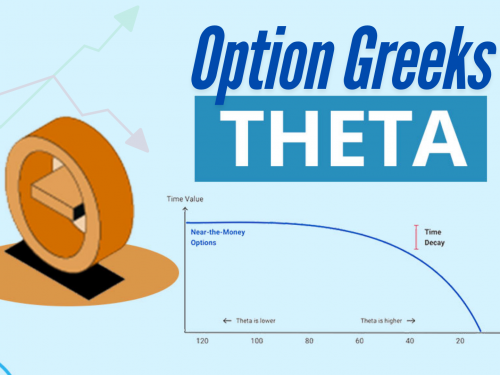

Theta is the “enemy” of option buyers because the value of theta decreases with time. After buying the option, the buyer of the option can earn profits if the market moves accordingly. If the direction of the market is reversed or if there is no change in the market, then in both cases losses have to be incurred.

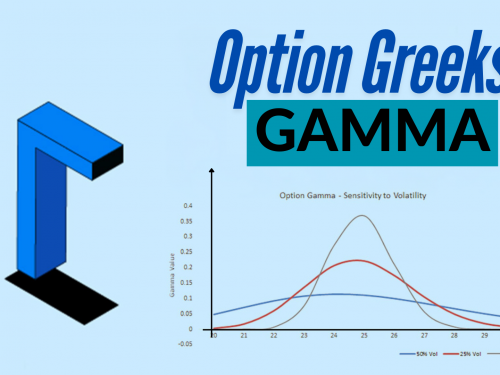

Gamma measures the change in delta, when there is a change in any stock or index, gamma also changes continuously, which also works to measure the change in delta due to that change in the stock or index. Gamma How much the value of delta will change in the premium of the strike of an index can also be ascertained by Gamma. When Gamma is high, it means the option's Delta can change quickly, which

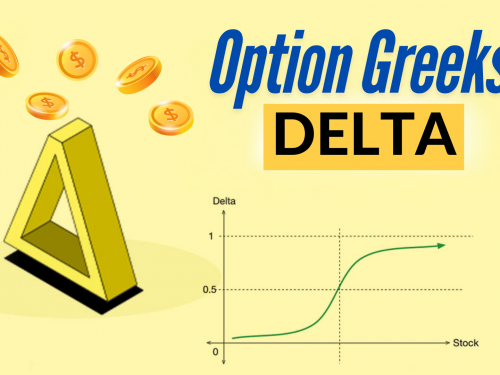

Delta is one of the most important options for Greeks. It measures how much an option's price is expected to change for every ₹1 move in the underlying asset's index or stock price. Think of it as the option's sensitivity to price changes in the stock or index whatever you're trading options on.

Foreign Institutional Investors (FIIs) are foreign investors in India's stock market, while Domestic Institutional Investors (DIIs) are domestic investors in the Indian stock market

Option Greeks are a set of measurements that help us understand how different factors affect the price of an option. Option Greeks are super important because they give traders a way to measure and manage risk and make a new position for trading. We can hedge our position with the help of option Greeks.

Daily Market Update Top Gainers, Top Losers,52 Week High,52 Week Low

Daily Market Update Top Gainers, Top Losers,52 Week High,52 Week Low

A straddle option strategy involves buying both a call option and a put option with the same strike price and expiration date. It's like betting on both sides of a coin toss – you're not sure which way the market will move, but you're hoping for a big move in any direction.

Strangle strategy is an option trading strategy, where you buy both a call option and a put option with the same expiration date but a different strike price. The main importance is that the both option is that both options are “Out the money” when you buy or sell both options.

Iron Condor option trading Strategy, This strategy is used when the market is sideways, and neither a boom nor a recession is seen. This options trading strategy is a combination of “Short Straddle” and “Long Strangle”, which is a very safe options trading strategy. The profit is high, while the loss incurred is very low.

Long long-put option trading Strategy is a very simple and very basic Strategy. Mostly we use this strategy whenever the nifty or bank nifty is bearish in the market or any stock is bearish, then we can go for a big profit with small risk in the put option buying of that index or stock, just buy the put option. The position created in this way is called the long put option trading strategy.

“Bear put spread”, as the name suggests, bear means the bearish environment in the Share market, and put spread meaning, it has been created by combining two put options. Whenever there is a bearish situation in the market. It involves buying one put option and selling another put option on the same stock or index but at different strike prices. The “In the money” or “at the money” put option is