Dr. Agarwal's Health Care Limited IPO will open for subscription on January 29, 2025, and the closing date for the IPO is January 31, 2025, according to the offer document filed by the company with the SEBI. After this, investors are expected to be updated about the allotment status on Monday, February 03, 2025.

Arisinfra Solutions Limited is combining cutting-edge technology with human knowledge to transform the building materials procurement sector. With a focus on digitizing and streamlining the procurement process, the organization provides contractors and building developers with a smooth, effective experience.

An IPO, or initial public offering, is one method by which a business might raise capital to concentrate on corporate expansion. A company's shares can be bought by an individual investor.

Large-cap mutual funds are investments that invest a bigger proportion of higher assets in a company with a higher market cap or part of the nifty 50 index and Sensex index or India's top 50 companies with higher market capitalization. These companies have an excellent track record for wealth creation over a time period. Large-cap mutual funds have lower risk compared to small and mid-cap funds.

Mid-cap mutual funds invest in stocks of medium-sized companies or as per exchange listed top 100 to 250 companies are mid-cap stocks. These are the stocks of companies that aren't quite as big as the giants you hear about every day, but they're not small companies. They're like the Goldilocks of stocks – not too big, not too small, but just right.

SWP stands for Systematic Withdrawal Plan is a facility extended to investors allowing them to withdraw fixed amounts from mutual fund schemes on a regular basis. You can select the withdrawal amount and frequency. Also, you can select a withdrawal plan from your profit on your investment and stay with the invested amount.

Foreign Institutional Investors (FIIs) are foreign investors in India's stock market, while Domestic Institutional Investors (DIIs) are domestic investors in the Indian stock market

Denta Water and Infra Solutions IPO will open for subscription on January 22, 2025, and the closing date for the IPO is January 24, 2025, according to the offer document filed by the company with SEBI. After this, investors are expected to be updated about the allotment status on Monday, January 27, 2025.

The offer document that the business submitted with SEBI states that Stallion India Fluorochemicals Limited's initial public offering (IPO) will go live on January 16, 2025, and close on January 20, 2025. On Tuesday, January 21, 2025, investors are anticipated to receive an update regarding the allocation status.

Laxmi Dental IPO: Investors can bid for a minimum of one lot, consisting of 33 equity shares. The minimum investment amount is ₹14,124

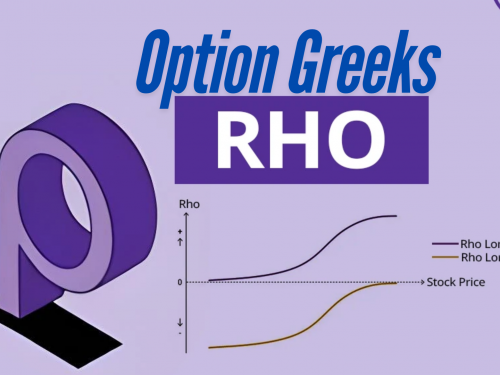

Rho is the part of option Greek that measures how sensitive an option's price is to changes in interest rates. In simpler terms, it tells us how much the price of an option might change if interest rates go up or down.

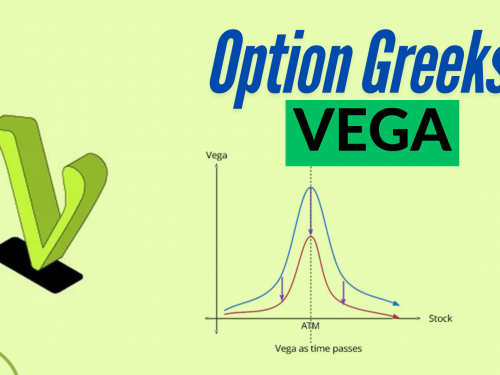

Volatility based on these, the work of showing the change in the option premium is done by Vega Greek. When the volatility is high in the market, there is a sharp fall or rise in the premium of the option, the increase in the premium of the option Vega indicates a decline.