In FY 2024, Ajax Engineering made 1,741 crores, for a total income of 17,800.74. The company also has 9,690.48 million in total current assets and 2,670.94 million in total non-current assets. Additionally, in FY 2024, total equity and liabilities are 12,361.42.

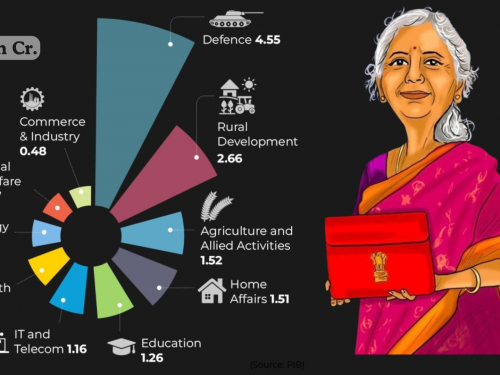

In Budget 2025-26, the Ministry of Finance was allocated Rs 19.39 lakh crore, followed closely by the Ministry of Defence with a significant share of funds.

UNION MINISTER OF FINANCE AND CORPORATE AFFAIRS SMT. NIRMALA SITHARAMAN PRESENTED THE UNION BUDGET 2025-26 IN PARLIAMENT TODAY. HERE IS THE SUMMARY OF HER BUDGET SPEECH

A 1:1 bonus issue has been announced by Indraprastha Gas Limited, a company that provides natural gas to homes and businesses. The record date for this issue is January 31, 2025. This action demonstrates the company's dedication to increasing shareholder value and shows its faith in future expansion.

One time, Ritesh Agarwal, the creator of OYO, went traveling in India. He learned from his experience that when it comes to choosing inexpensive hotels in India, tourists have no notion of what to anticipate. In an attempt to address this void in the hotel sector, the 19-year-old established OYO in 2013.

Despite the concerns of his family, Aman Gupta partnered with Sameer Mehta to develop the boAt brand back in 2013. And boAt became one of the most well-known domestic audio brands in India as a result of Gupta's strategy.

Once Go Airlines has recovered from the tumultuous period of travel limitations brought on by the pandemic, it intends to relaunch its initial public offering (IPO). Previously known as Go Air, the ultra-low-cost airline owned by the Wadia Group has changed its name to Go First as part of its turnaround strategy

Trading stock futures and options offer a number of advantages. All securities do not, however, have access to these derivatives. They are only available on stocks that are listed on the F&O stock exchange.

Equity Mutual Funds, Hybrid Mutual Funds, Debt Mutual Funds,Solution Oriented Funds,Other Mutual Funds

Due to the introduction of the Union Budget, the National Stock Exchange (NSE) will hold a special trading session on Saturday, February 1, 2025.

People from all industries are experiencing more fear than ever before due to the impending Union Budget 2025. It is the second comprehensive financial blueprint of the Modi government's third term and will be presented by Nirmala Sitharaman on February 1, 2025, during her eighth year in office.