What is Long Put and How to Work?

What is a Long Put?

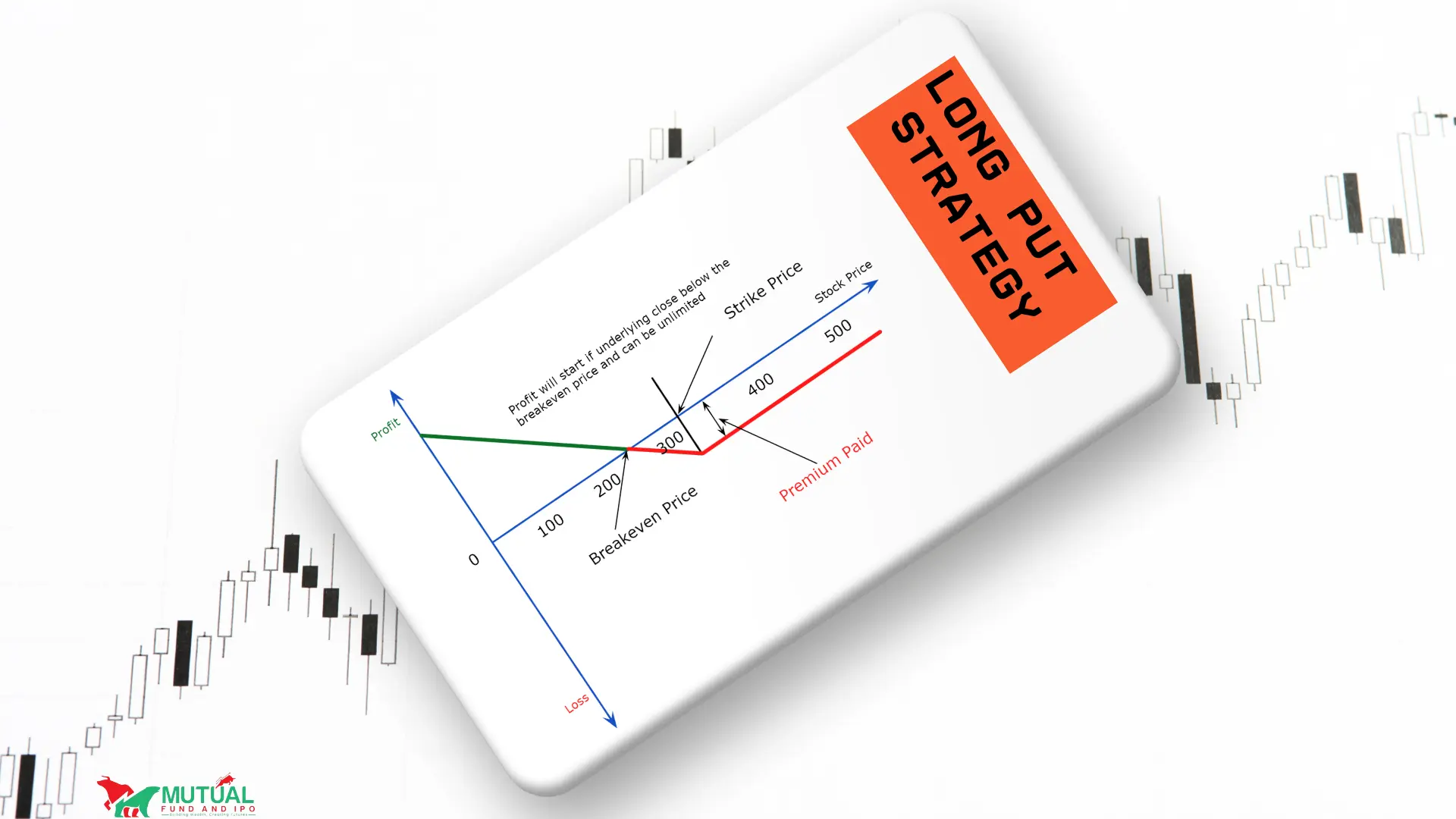

A long put is an options trading strategy where you buy a put option. It gives you the right, but not the obligation, to sell a specific stock at a predetermined price (called the strike price) before a certain date (the expiration date).

Long long-put option trading Strategy is a very simple and very basic Strategy. Mostly we use this strategy whenever the nifty or bank nifty is bearish in the market or any stock is bearish, then we can go for a big profit with small risk in the put option buying of that index or stock, just buy the put option. The position created in this way is called the long put option trading strategy.

Important components of a Long Put:

The underlying index option or Stocks.

The strike price of the index or stocks.

The expiration date of the weekly or monthly contract.

The premium price (the cost of buying the option)

How Does a Long Put Work?

Here's a simple breakdown step by step:

You choose a stock or index you think will fall from the current level.

You buy a put option for that stock or index.

If the stock price falls below the strike price, your put option will give you a profit.

You can then sell the option after getting a good profit or exercise it to sell the stock or index at the higher strike price.

Example:-

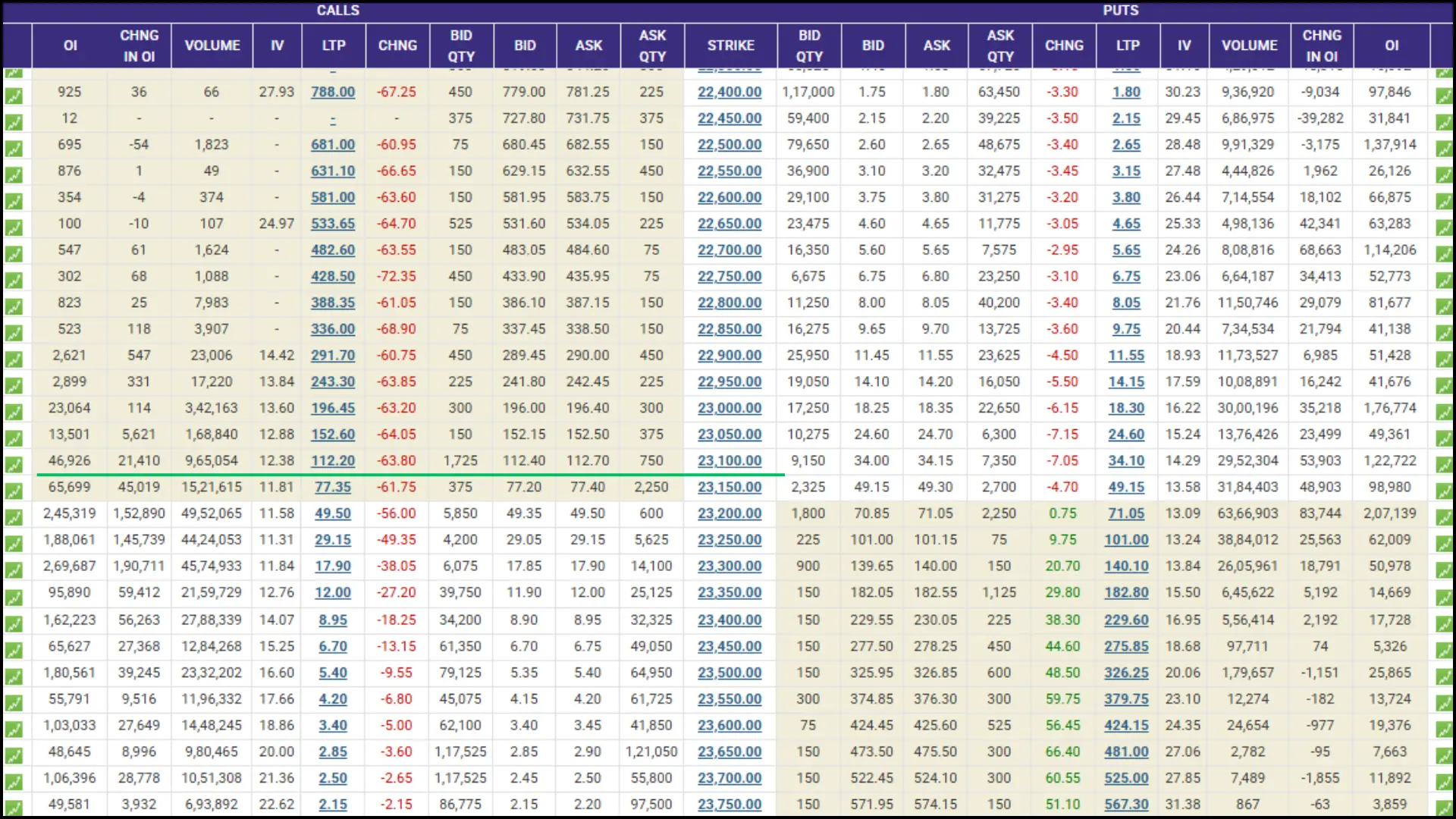

As shown in the option chain above, Nifty is trading at 23212, and the 23200 put option is the “At the money” Option, the price of NIFTY 23200 put option is ₹71, today's date is 15th Jan 2025 and the expiry of NIFTY index is the date is 16th Jan 2025, so this option has 1 day to expire. Here we have plenty of time as well as the option price of ₹71.

The NIFTY lot size is 75 & price NIFTY 23200PE ₹71

TOTAL PREMIUM PAID (BUY POSITION)= 71 ×75= ₹ 5325 Maximum loss = ₹ 5325 (if a stop loss is not applied) Maximum Profit = Countless profits can be earned, if the market continues to be bearish, or even if the target we have set before is achieved, we can earn profit. |

Advantages of Long Put Strategy:

Limited Risk: You can't lose more than what you paid for the option contract.

High Potential Returns: If the stock price moves fast and high, then your profits are higher than expected.

Leverage: Control more shares with less capital.

Disadvantages of the Long Put Strategy:

Time Decay: Options lose value as they approach expiration.

Volatility: Stock price needs to move enough to offset the option cost.

Total Loss: If the stock price doesn't reach the strike price, you could lose your entire investment.

When to Use Long Puts

Here are a few scenarios:

When you're bearish about a particular stock or index or the overall market.

To protect your existing stock holdings against potential losses.

If you want to speculate on a stock's downward movement without actually shorting the stock or index.

Risks and Considerations

While long puts can be useful, risks are also involved:

Time Decay: Options lose value as they approach expiration.

Volatility Changes: A decrease in volatility can negatively impact option prices.

Limited Upside: If the stock price doesn't move as expected, you could lose the entire premium.