Discover the best implied volatility strategy for options traders. Learn when to buy or sell options with real examples and pro trading tips.

Before beginning to trade options, it is essential to thoroughly understand options pricing and the different aspects that determine an option's value. Several option pricing methods are also employed to determine the value of a call or put option.

Trading stock futures and options offer a number of advantages. All securities do not, however, have access to these derivatives. They are only available on stocks that are listed on the F&O stock exchange.

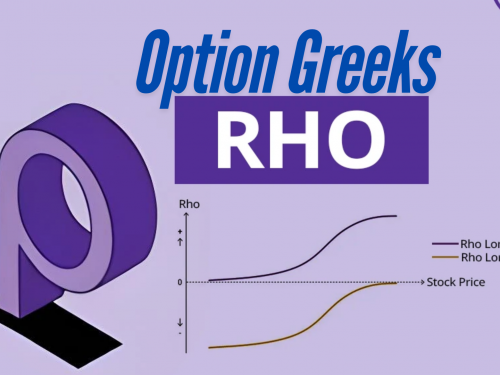

Rho is the part of option Greek that measures how sensitive an option's price is to changes in interest rates. In simpler terms, it tells us how much the price of an option might change if interest rates go up or down.

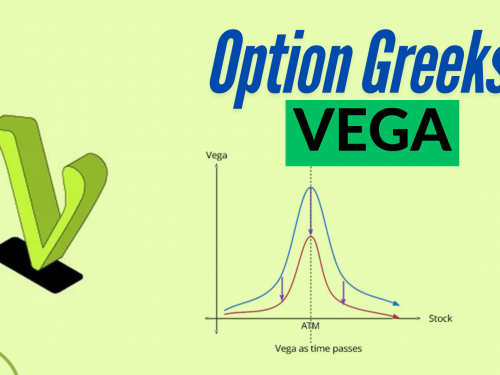

Volatility based on these, the work of showing the change in the option premium is done by Vega Greek. When the volatility is high in the market, there is a sharp fall or rise in the premium of the option, the increase in the premium of the option Vega indicates a decline.

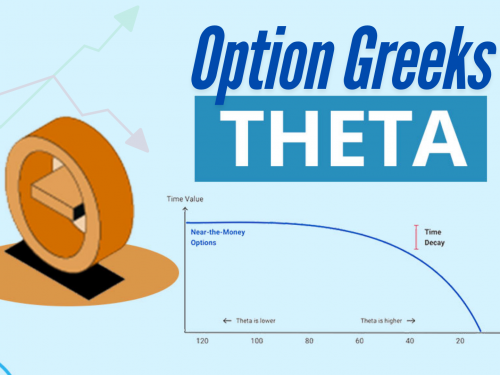

Theta is the “enemy” of option buyers because the value of theta decreases with time. After buying the option, the buyer of the option can earn profits if the market moves accordingly. If the direction of the market is reversed or if there is no change in the market, then in both cases losses have to be incurred.

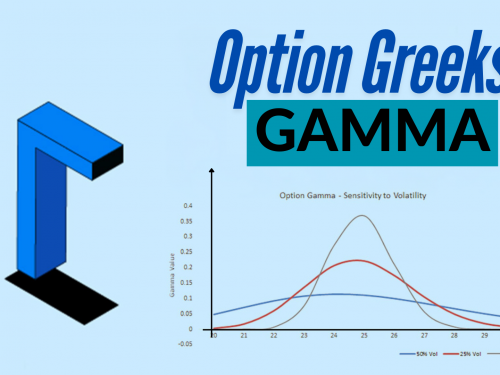

Gamma measures the change in delta, when there is a change in any stock or index, gamma also changes continuously, which also works to measure the change in delta due to that change in the stock or index. Gamma How much the value of delta will change in the premium of the strike of an index can also be ascertained by Gamma. When Gamma is high, it means the option's Delta can change quickly, which

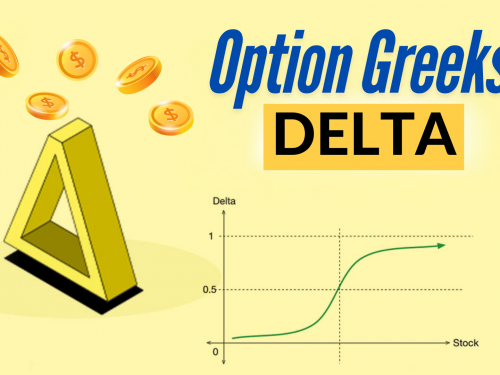

Delta is one of the most important options for Greeks. It measures how much an option's price is expected to change for every ₹1 move in the underlying asset's index or stock price. Think of it as the option's sensitivity to price changes in the stock or index whatever you're trading options on.

Option Greeks are a set of measurements that help us understand how different factors affect the price of an option. Option Greeks are super important because they give traders a way to measure and manage risk and make a new position for trading. We can hedge our position with the help of option Greeks.

Options trading is a type of financial trading that allows traders to buy or sell the right to buy or sell an underlying asset or sell shares at a set price within a specific time frame. A Call option is used when you expect the prices to increase/rise. A Put option is used when you expect the prices to decrease/fall.