Theta

Theta tries to tell us how much time is left for the option to expire on any stock or index.

Theta refers to the time decay (Time decay) of the options. The value of theta is always negative for both the call option and the put option, as the time given to the option expires gradually.

Theta is the “enemy” of option buyers because the value of theta decreases with time. After buying the option, the buyer of the option can earn profits if the market moves accordingly. If the direction of the market is reversed or if there is no change in the market, then in both cases losses have to be incurred.

Theta is a friend for option sellers, where the value of theta decreases over time, and the seller benefits, even if the index or stock does not change. After selling the option to the option seller, profit can be made if the market moves according to them, but if the value of theta is low, even if the market does not change, profit can be made. Only if the market moves against the position created according to it, there can be a loss.

Now, let's focus on the star of the show: Theta. Theta is often called the "time decay" Greek, and for good reason. It measures how much an option's value decreases as time passes, assuming everything else stays the same.

Theta tells us how much money an option loses each day just because time is ticking away.

Think of it like this: options are a bit like cartons of milk. The closer they get to their expiration date, the less valuable they become. Theta helps us understand just how quickly that value is dropping.

![]()

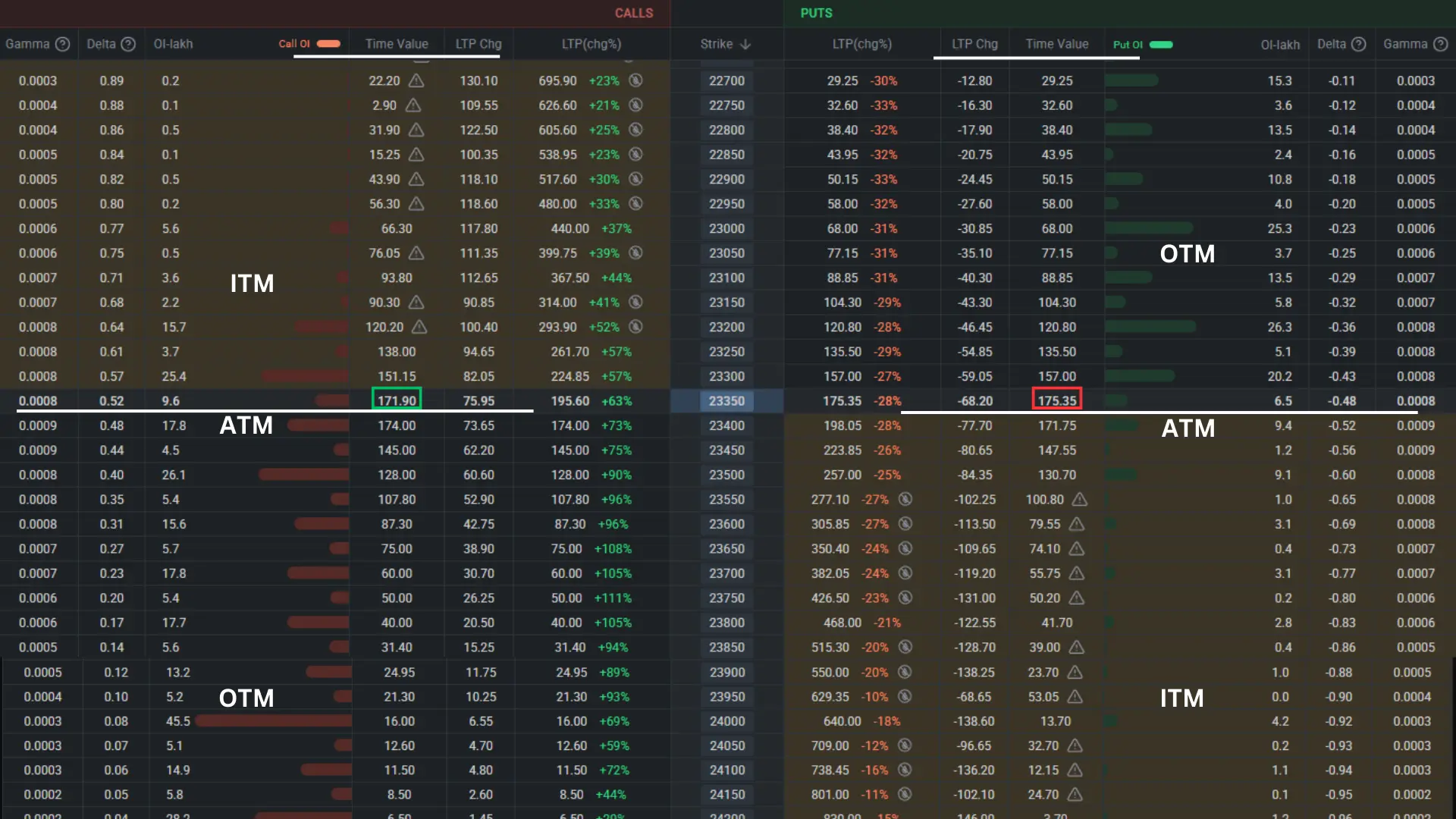

Theta and Different Option Types

Theta affects different types of options in different ways:

At the money Options:

These options typically have the highest Theta. They're the ones that stand to lose the most value as time passes.

In the money Options:

These options usually have lower Theta because a good chunk of their value comes from their intrinsic value, which isn't as affected by time decay.

Out The money Options:

These options also tend to have lower Theta, but that's because they don't have much value to lose in the first place! They have only theta value, no intrinsic value.

Why Theta matters for Options Traders?

Understanding Theta is super important for options traders because it helps us:

Plan our trades better: Knowing how quickly our options might lose value can help us decide when to enter or exit a trade.

Choose the right strategies: Some options strategies are more sensitive to Theta than others. Knowing this can help us pick the right approach for our goals.

Manage our risk: Theta reminds us that holding onto options too long can be risky, especially as expiration approaches.

Theta Strategies for Option Seller

Some traders actually try to use Theta to their advantage. They might sell options to benefit from time decay, a strategy often called "collecting Theta." It's like being the house in a casino - time is working in your favor.

On the flip side, if you're buying options, you might want to be extra careful about Theta. You don't want to hold onto an option for too long and watch its value melt away like an ice cream cone on a hot day.