IRON CONDOR OPTION TRADING STRATEGY

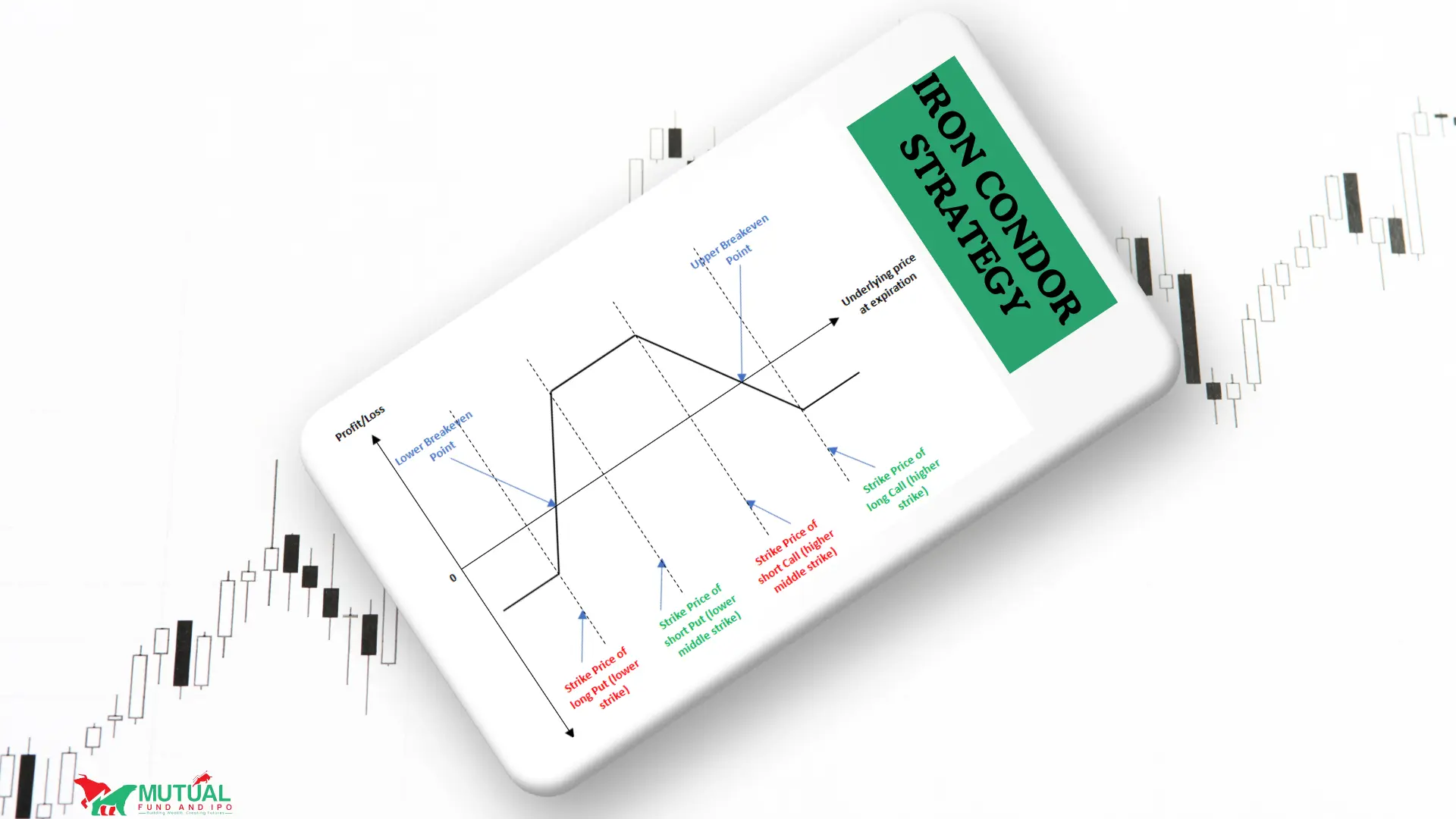

Iron Condor option trading Strategy, This strategy is used when the market is sideways, and neither a boom nor a recession is seen. This options trading strategy is a combination of “Short Straddle” and “Long Strangle”, which is a very safe options trading strategy. The profit is high, while the loss incurred is very low.

Iron Condor options trading strategy has the same expiry and the underlying value of two call options, and two put options are used. First, We have to buy the put “out the money” option and have to sell put closer to the “at the money” option, and second, We have to buy the call “out the money” option and have to sell the call closer to “at the money” option, position to be created. in which “out the money” call and put options are bought, so that if there is any kind of boom or recession, there will be a small loss, and the call and put options are sold, it has been done so that the required margin is kept to a minimum.

Some important things to remember before trading: -

For those who are going to use this strategy in the index or are going to use the strategy in any stock, there should not be much bullishness or recession in it.

All four options should have the same expiry.

All four options' quantity should be equal in all, no one should have more or no one should have less, only then will this strategy work equally.

To make a position: First, buy the “out the money” call and put option then sell closer to the “at the money” call and put option.

To square off position: First, square off the sold “at the money” call and put option, then square off the “out the money” call and put option.

When do we have to use an Iron Condor strategy?

This strategy works best when:

You think a stock won't move much upside or downside.

Market volatility is high and option premium is high (because you get more money for selling options).

You want to make a bit of cash without predicting which way the market will go.

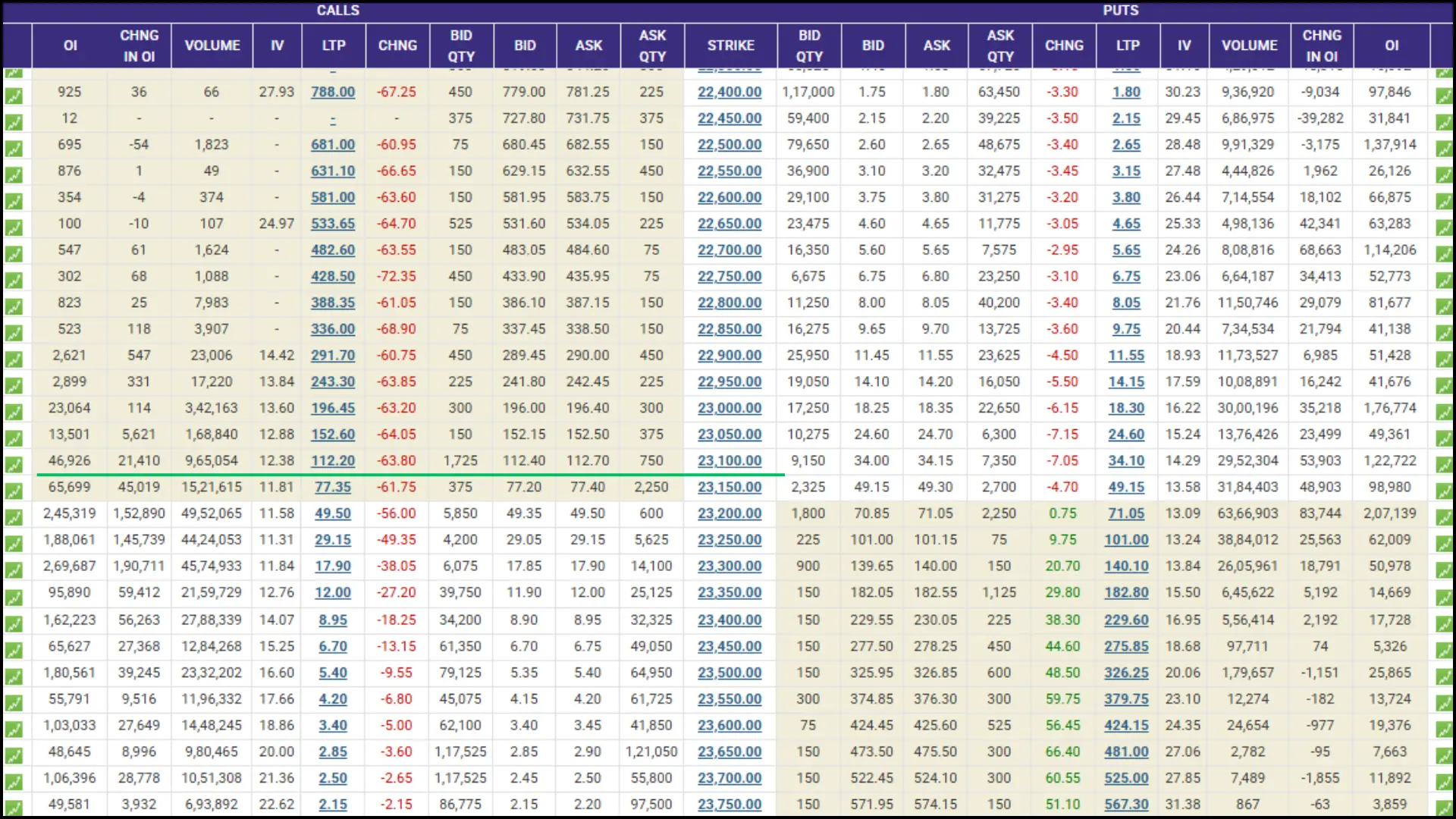

As mentioned above, as shown in the screenshot, the NIFTY 23200 call option and NIFTY 23200 put option are both at the money option. In which we have to sell the “at the money” call and put option, the price is also almost the same . There is price of the NIFTY 23200CE option is ₹49 and the NIFTY 23200PE is ₹71. We have to buy the “out the money” call and put an option for hedge. There is price of the NIFTY 23400CE option is ₹8 and the NIFTY 23000 PE is ₹18.

CALCULATION

(PAID PREMIUM) BUY POSITION = PREMIUM PRICE OF NIFTY 23400CE ₹8 (PAID PREMIUM) BUY POSITION = PREMIUM PRICE OF NIFTY 23000 PE ₹18 |

(RECEIVED PREMIUM) SELL POSITION = PREMIUM PRICE OF NIFTY 23200 CE ₹49 (RECEIVED PREMIUM) SELL POSITION = PREMIUM PRICE OF NIFTY 23200PE ₹71 |

TOTAL (RECEIVED PREMIUM) SELL POSITION= 49+71=120(multiply current lot size 75)=₹9000 TOTAL (PAID PREMIUM) BUY POSITION= 8+18=26(multiply current lot size 75)=₹1950 |

How much profit and loss, we will see in Sensibull or Opestra, sensibull is free for all Angel One users. You can open a demat account in Angel One .

If the market is neither bullish nor bearish, the total sold position will result in a profit of 120 points. But in the case in which buying has been made, there will be a loss of 26 points and the total profit will be around 120-26 =94 points (multiply current lot size 75). But it rarely happens in the market that the market closes near “at the money”, in such a situation we can assume that profit can be around 60-70 points. But if there is a boom or recession in the market, we will not see this profit but will suffer a loss and the loss will also be very less. Because we have bought “out the money” call and put option.

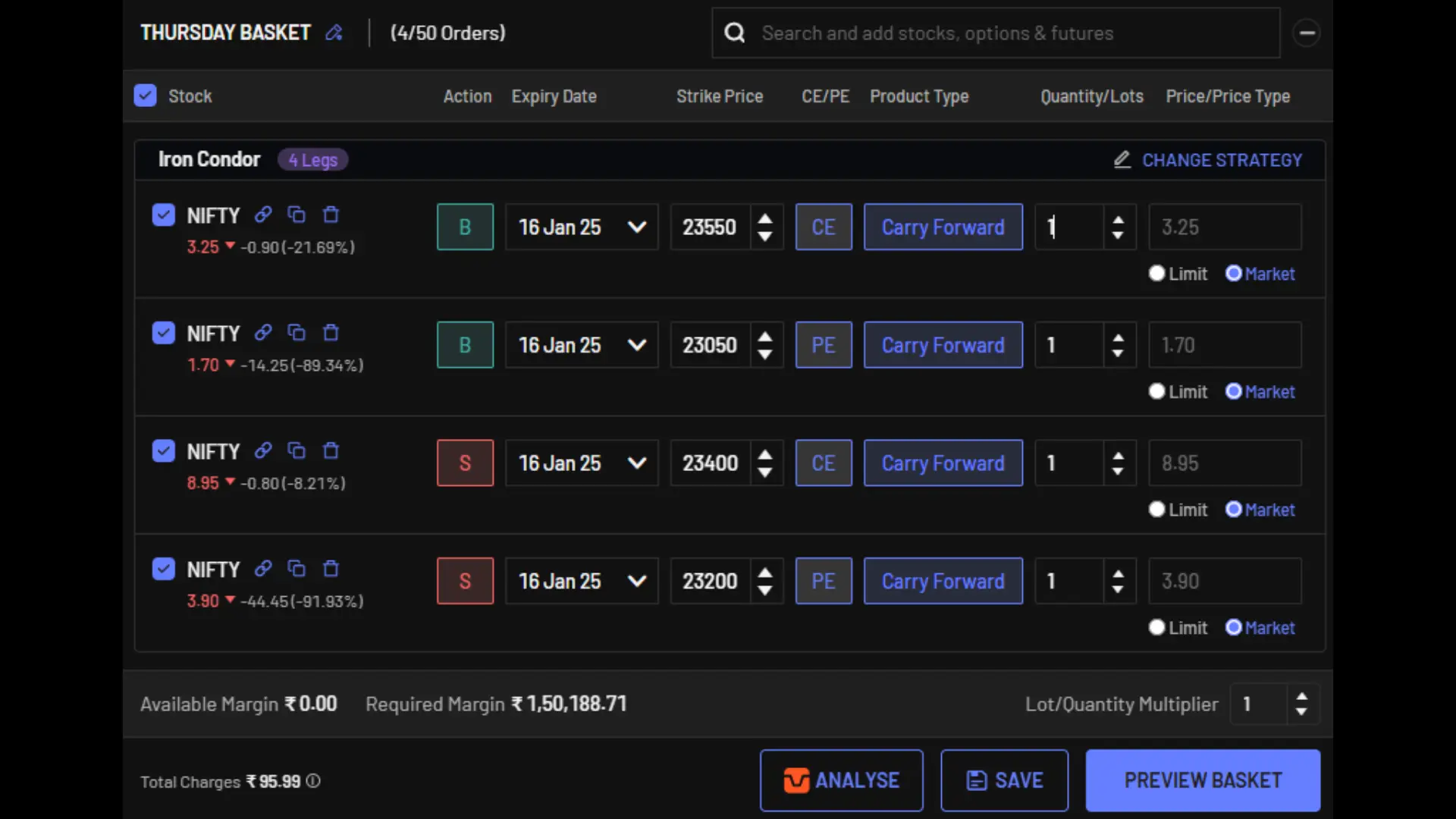

How much capital will be required to build it?

As shown in the screenshot above, this entire combination of IRON CONDOR . In which at least ₹150000 will be required in Nifty Option and at least ₹110000 in Bank Nifty Option. Also depends on market conditions like: how many days remain for expiration and lot size Nifty has lot 75 bank Nifty has lot size 30 and Sensex has lot size 20.