What is Bear Put Spread and How Does It Work?

Bear Put Spread?

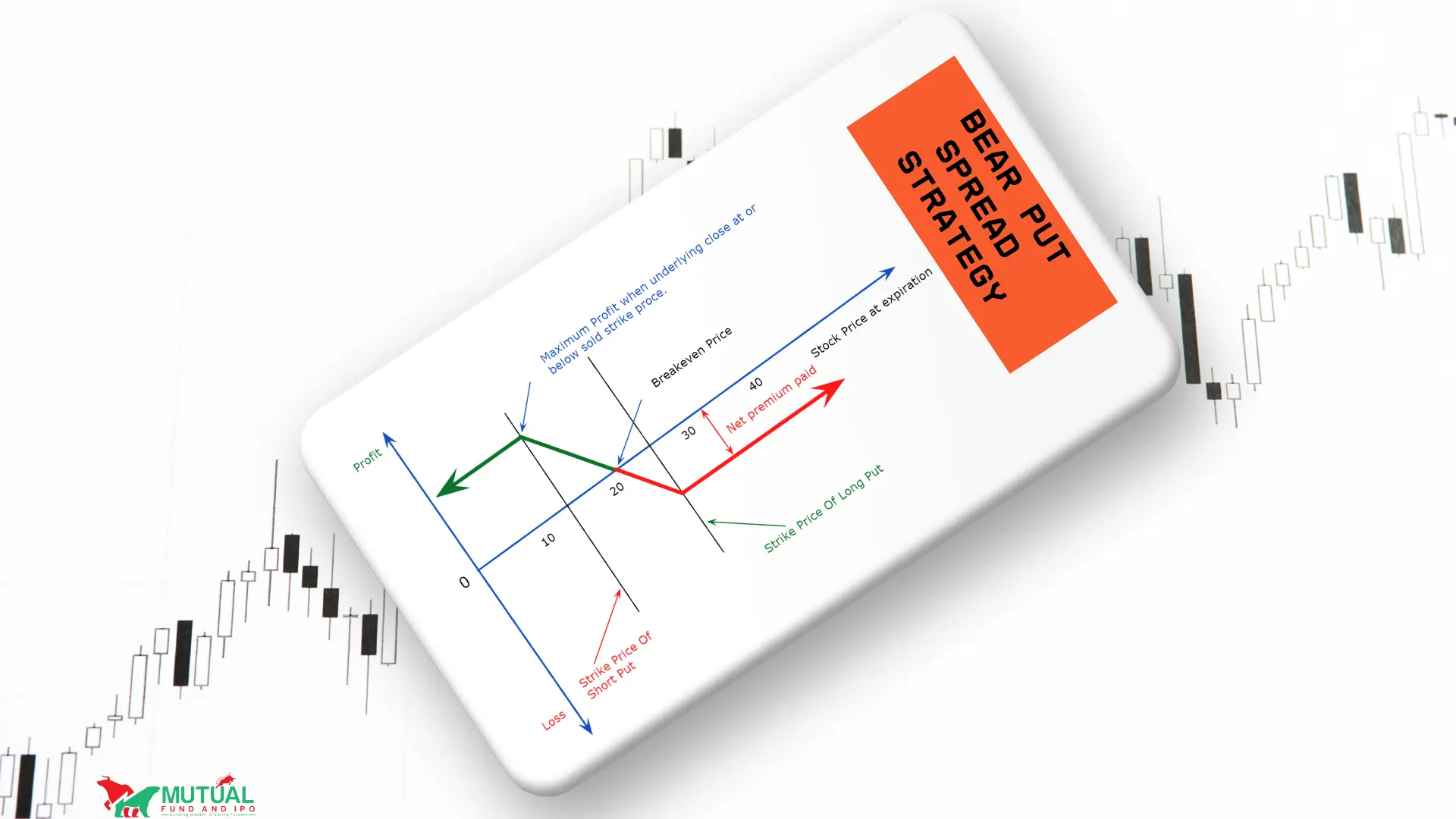

“Bear put spread”, as the name suggests, bear means the bearish environment in the Share market, and put spread meaning, it has been created by combining two put options. Whenever there is a bearish situation in the market. It involves buying one put option and selling another put option on the same stock or index, but at different strike prices. The “In the money” or “at the money” put option is buying and the “out the money” option is selling. The position created in this way is called a “Bear put spread” Option trading strategy.

The main idea here is to limit your risk while still having a chance to make some money when you think a stock's price might go down.

Important components of a Put Spread option strategy:

Buying a put option at one strike price in stock or index.

Selling a put option at a lower strike price in the same stock or index.

Both options have the same expiration date.

How do work bear put spread option strategy?

let's understand this step-by-step:

First, you buy a put option at a certain strike price in stock or index. This gives you the right to sell the stock or index at that price.

Then, you sell another put option at a lower strike price in stock or index. This creates an obligation to buy the stock or index at that lower price, if the option is exercised.

The difference between these two strike prices is your maximum and maximum potential profit.

Your maximum loss is limited to the difference between the strike prices minus the net premium you received or paid for setting up the put spread.

What advantages of the “Bear Put Spread” strategy?

There are several reasons why traders like using the bear put spread option strategy:

Limited risk: Your maximum loss is capped at the net premium paid only.

Lower cost: Selling the lower strike put helps offset the cost of buying the higher strike put option.

Defined profit potential: You know your maximum profit upfront.

Flexibility: You can adjust the strike prices based on your market sentiment.

Disadvantages of “Bear Put Spread” strategy?

No strategy is 100% sureshot. Here are some drawbacks to consider:

Limited profit potential: Your gains are capped, unlike a straight-put purchase.

Requires higher capital for trade: You'll need to have enough money to buy the higher-priced put option.

Time decay: Both options lose value as expiration approaches.

Complexity: It's more complicated than simply buying or selling a single option.

When do you have to use the “Bear Put Spread” option strategy?

When you expect a moderate decline in the stock price.

If you want to limit your potential losses.

When you're looking for a less expensive alternative to buying puts outright.

If you're comfortable with capped profit potential in exchange for lower risk.

Example of Bear put spread:-

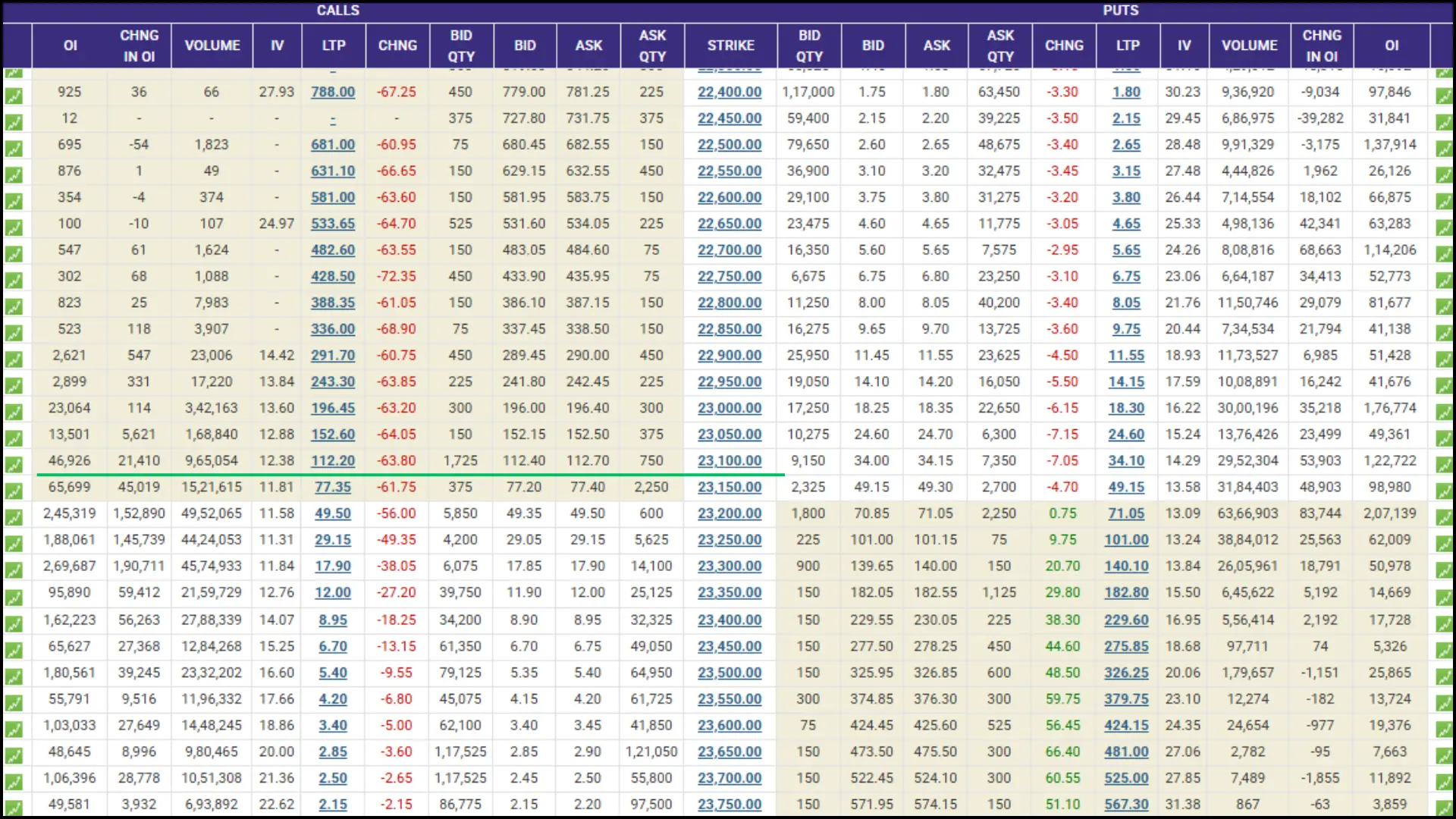

In the Live market: NIFTY is trading at 23212 and I think the market may turn bearish from here, so I will buy the NIFTY 23200 PE option. If NIFTY closes below 23000 before expiry, I will not suffer loss. But the price of 23200PE is ₹71, due to which I will make a profit if NIFTY closes below 23000, but if NIFTY closes around 23000-23050, I may lose ₹71. So to save the loss caused by this, I will sell the “out the money” put option. So here the price of the put option of 23100PE is ₹34 and if NIFTY does not go below 23200, then I will make a profit of ₹34 from the 23100PE option & loss from 23200PE. Finally, my total loss will be 71-34=37 points.

Fund required: In the “Bear put spread” to make in Nifty option and Fin Nifty option around 75-80k funds are required, Whereas in the Bank Nifty option, the fund utilization is around ₹75-85K and also depending on the lot size, strike price and days left to expiry, the fund utilization varies more or less.

NOTE:- To make a “Bear put spread” option strategy, you have to first create a buying position, then create a selling position, but during profit booking, you have to square off the selling position first, then square off the buying position.