What are Option Greeks?

Option Greeks are a set of measurements that help us understand how different factors affect the price of an option. Option Greeks are super important because they give traders a way to measure and manage risk and make a new position for trading. We can hedge our position with the help of option Greeks.

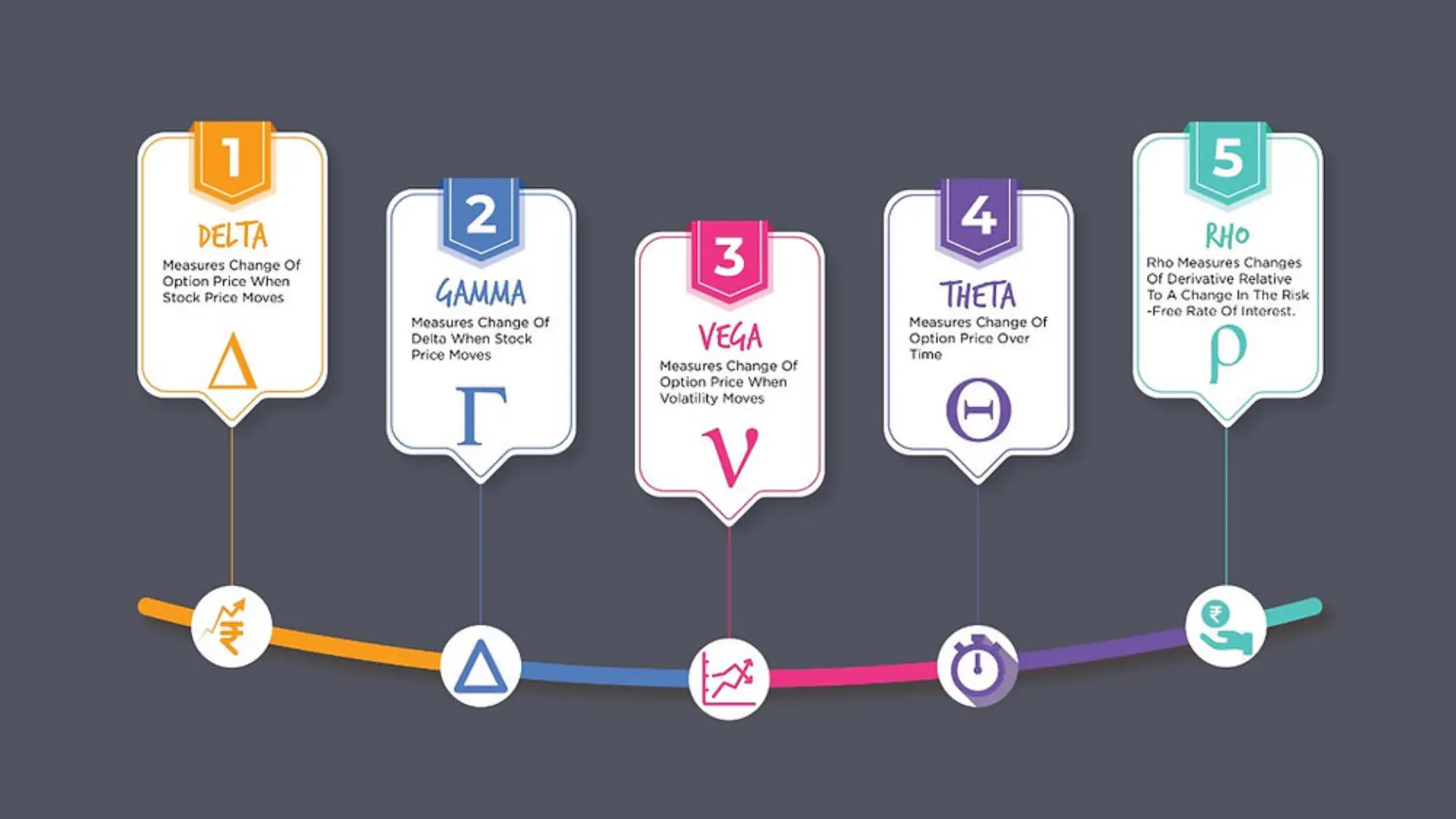

There are 5 types of Option Greeks

Delta (Δ)

Delta is one of the most important options for Greeks. It measures how much an option's price is expected to change for every ₹1 move in the underlying asset's index or stock price. Think of it as the option's sensitivity to price changes in the stock or index whatever you're trading options on.

For full details about Delta Greek Click here

Gamma ( Γ )

Gamma measures the change in delta, when there is a change in any stock or index, gamma also changes continuously, which also works to measure the change in delta due to that change in the stock or index. Gamma How much the value of delta will change in the premium of the strike of an index can also be ascertained by Gamma. When Gamma is high, it means the option's Delta can change quickly, which can be exciting but also risky.

For full details about Gamma Greek Click here

Theta ( θ )

Theta tries to tell us how much time is left for the option to expire on any stock or index.

Theta refers to the time decay (Time decay) of the options. The value of theta is always negative for both the call option and the put option, as the time given to the option expires gradually.

For full details about Theta Greek Click here

Vega ( ν )

Volatility based on these, the work of showing the change in the option premium is done by Vega Greek. When the volatility is high in the market, there is a sharp fall or rise in the premium of the option, the increase in the premium of the option Vega indicates a decline. It is worth noting that high volatility makes the option premium more expensive. Since the strike premium changes very quickly due to volatility, usually when the volatility is low, the option writer makes more profit and vice-versa for the option buyer. Since long options position traders to profit when prices rise, and short options position traders to profit when prices fall, this is why long options have positive Vega while short options have negative Vega.

For full details about Vega Greek Click here

Rho ( ρ )

Rho is the part of option Greek that measures how sensitive an option's price is to changes in interest rates. In simpler terms, it tells us how much the price of an option might change if interest rates go up or down.

For full details about Rho Greek Click here

Option Greeks Effects