Gamma

Gamma measures the change in delta, when there is a change in any stock or index, gamma also changes continuously, which also works to measure the change in delta due to that change in the stock or index. Gamma How much the value of delta will change in the premium of the strike of an index can also be ascertained by Gamma. When Gamma is high, it means the option's Delta can change quickly, which can be exciting but also risky.

Gamma is like the speedometer for your option's delta. It tells you how fast the delta is changing.

Remember, Delta tells us how much an option's price will change when the stock price moves. Gamma takes this a step further by telling us how quickly that delta is changing.

How Gamma Works

Let's understand with a simple example:

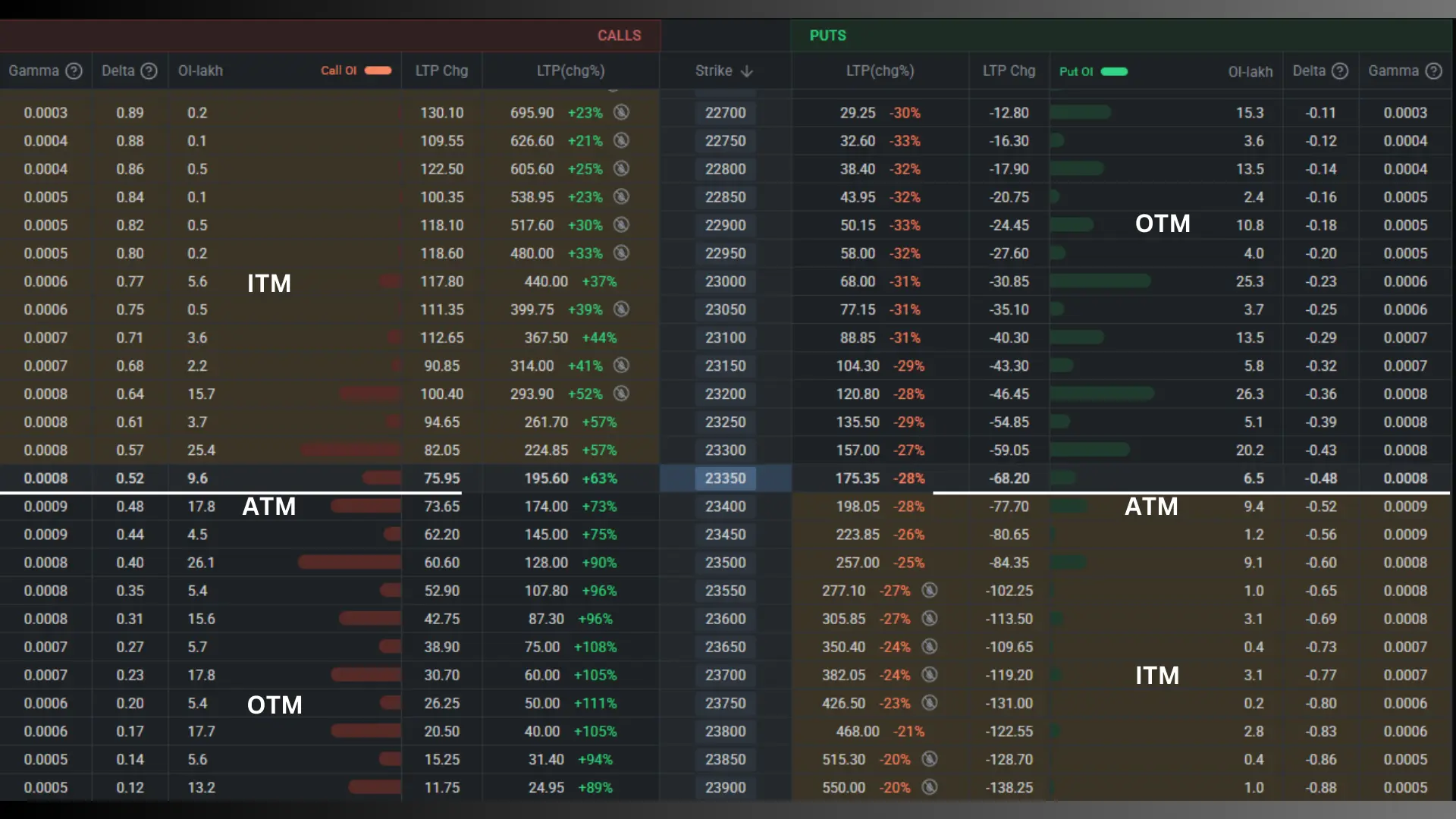

Imagine you have a call option with a delta of 0.55 and a gamma of 0.0019. If the stock price goes up by ₹1:

The option's price will increase by ₹50 (that's the delta at work)

The delta will increase to 0.645 (that's gamma doing its thing)

So, gamma is constantly adjusting the delta as the stock price moves. It's like a little helper making sure your delta stays up-to-date.

![]()

Calculating Gamma:-

The value of GAMMA is 0.0019, for a 50-point change in Nifty, the changed point will be multiplied by the value of Gamma.

New gamma value = old gamma value (0.0019) × (50) NIFTY CHANGE POINTS= 0.095

So, for a 50-point change in Nifty, the new Gamma value will be 0.095, which will be used to add the old value of Delta.

So, we can say that before the 50-point change in Nifty, the value of the delta was 0.55, now

That new value of data = old data value (0.55) + New value of gamma after the 50-point change (0.095) = 0.645 thus the new value of delta has become.

0.645 is the new delta value, from here on the Nifty will change by 0.645 per point.

So, this way gamma measures the change in delta, where a 50-point change is a 0.05 change in delta.

Why Gamma matters for option traders:

Risk management: High gamma means your position can change quickly, which might be good or bad depending on your strategy.

Predicting profit/loss: Gamma helps you estimate how your profits or losses might accelerate as the stock price moves.

Understanding option behavior: Gamma is highest for the money options and increases as expiration approaches, giving you insights into how different options might behave.

Trading Strategies Involving Gamma:

Gamma scalping: This involves trying to profit from small price movements by adjusting your position frequently.

Gamma hedging: This is about trying to keep your overall gamma close to zero to minimize risk.

Long gamma strategies: These aim to profit from large price movements in either direction.