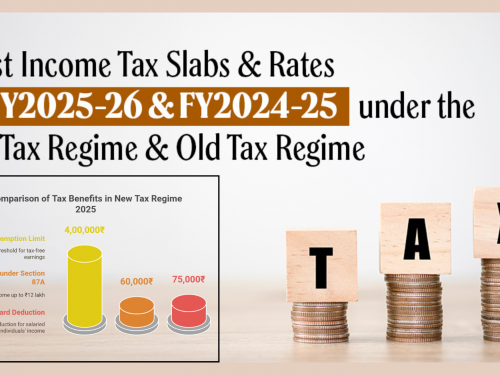

Updated! New Tax Regime for 2025 explained. Find out about rates, deductions, & if it's right for you. Don't overpay taxes – learn more here.

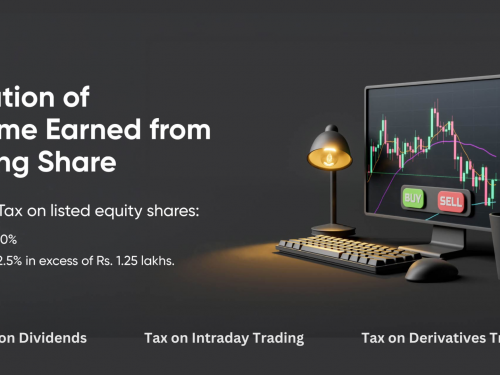

Understand the income tax on share market earnings. Explore capital gains, dividends, and effective strategies to minimize your tax burden legally.

SIP vs. STP: Know the key differences between Systematic Investment Plans & Systematic Transfer Plans. Learn which strategy fits your goals. Start investing smarter today

Secure your future with the NPS National Pension Scheme. Explore eligibility, account types, investment choices, and tax benefits for a stable retirement.

Discover the essential guide to trading tax in India. Learn about capital gains, intraday trading, and F&O taxation to optimize your financial strategy.

NSDL IPO is an offer of sale comprising 5,72,60,001 equity shares. The price band, lot size, and other details are yet to be announced.

Simplify your tax calculations with our Old and New Tax Rate Calculator. Understand your gross income, deductions, and potential savings for a stress-free filing.

As per the March 2024 report by CRISIL MI&A, Avanse Financial Services Limited is a prominent non-banking financial company (NBFC) in India focusing on education.

All index and stock derivatives contracts will now expire on Monday instead of Thursday, as stated by the National Stock Exchange (NSE) on Tuesday. This change will take effect on April 4, 2025.

New restrictions have been recommended by SEBI to address this issue. Let's examine these new regulations and their implications for investors.

Gold has long been a popular investment because its trend is opposite the stock market's. Gold's demand (and thus its price) typically rises in response to stock market declines or crashes.