Options Strangle Strategy A Complete Guide for Beginners

Strangle strategy is an option trading strategy, where you buy both a call option and a put option with the same expiration date but a different strike price. The main importance is that the both option is that both options are “Out the money” when you buy or sell both options.

For example:- NIFTY is trading at 23200 and the expiry is the next day and you are buying or selling fully “Out the money” option above 23400CE and below 23000PE.

There are 2 types of strangle strategy.

There are actually two main types of strangle strategies. Let's understand in brief:

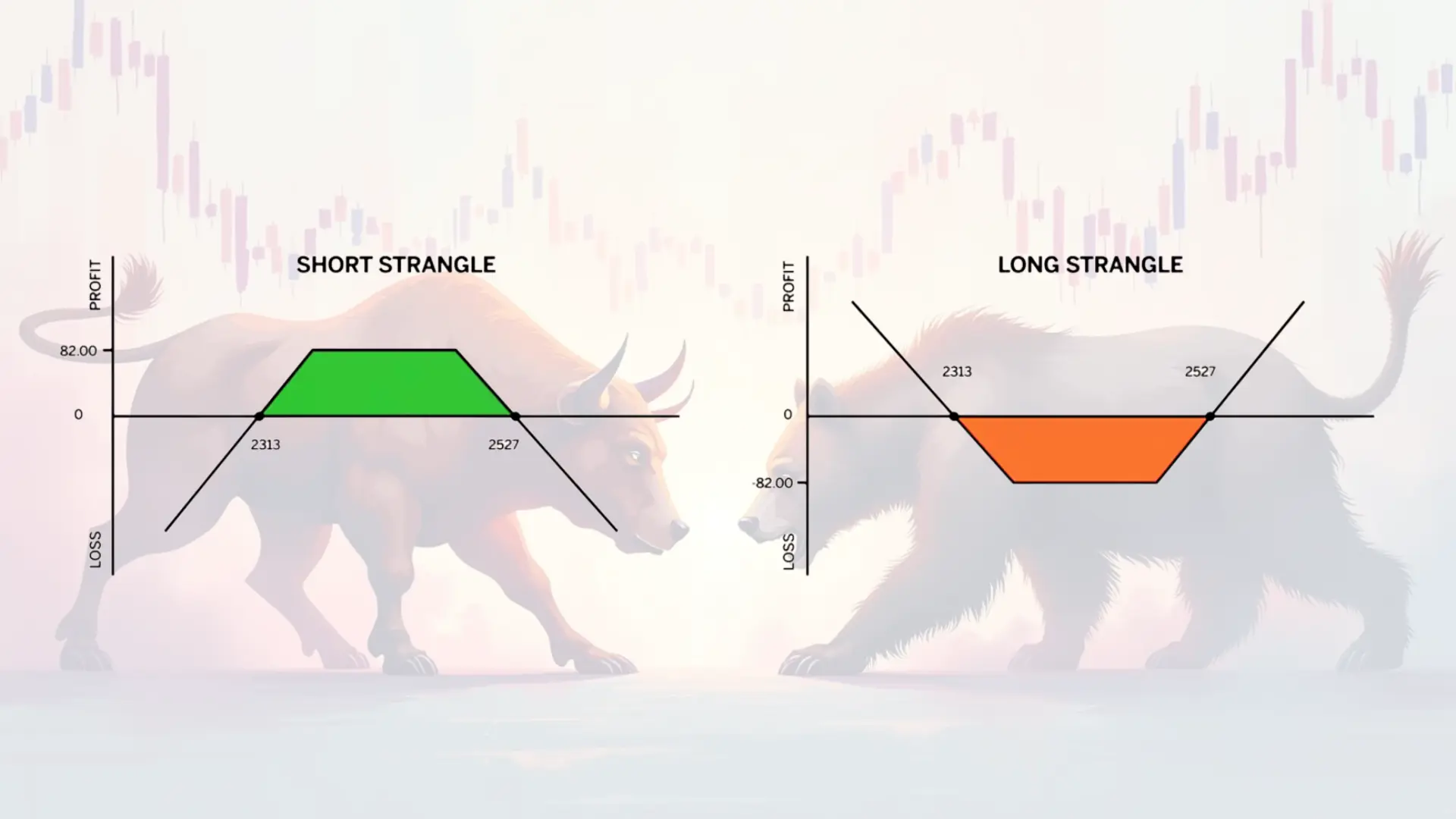

Long strangle

Buy both "Out the money” a call and a put option.

Profit potential is unlimited.

Maximum loss is limited to the premium paid for both options.

Used when you expect a big price move but aren't sure of the direction

Short strangle

Sell both "Out the money” a call and a put option.

Profit is limited to the premium received for selling the options.

Potential loss is unlimited, if the market is rapidly moving in any direction.

Used when you expect the price to remain relatively stable or sideways.

LONG STRANGLE STRATEGY:

When the fluctuations in the market are more rapid i.e. the speed of the market is more fast, as RBI policy is about to come, either there is a meeting of the Fed Reserve of America or some event. going to happen, yes. In such a situation, the ups and downs in the market happen more rapidly, and then we go for a strangle strategy. You can earn money in options trading by using this strategy, but if the market is not bullish or bearish, then it will not work. The strategy is very unprofitable and there is no profit to be seen. Use this strategy at the last moment on the day of expiry for HERO ZERO trade. Where it is assumed that if there is a loss, it will be completely zero but if there is a profit, it will be 3 to 4 times.

How does a strangle strategy work?

Let’s see understand, how a strangle strategy actually works.

Buying two options: With a strangle, you're essentially buying two option contracts for the same underlying index or stock and expiration date.

One call option: The first contract is a call option with an "Out the money” strike price.

One put option: The second contract is a put option with an "Out the money” strike price.

"Out the money” options: Both options are typically "Out the money” when you buy them, which means they have no intrinsic value at the time of purchase.

Profiting from price movements: The goal is to make money, if the underlying index or stock price moves significantly in either direction.

SHORT STRANGLE STRATEGY:

In the Short Strangle strategy money is earned by selling “Out the money” Call and put options. This strategy makes about 70 to 80% profit, if the strategy is traded on normal days by removing some event days, then it makes very good profits. If ever the stop loss is hit, it is necessary to follow the stop loss. By using this strategy, we can make 30 to 50% profit in option trading within 1 year. In this way, the strategy to earn profit by selling “Out the money” call and put options can be shorted.

Advantages of using a strangle strategy

Flexibility: You can profit from price movements in either direction, which gives you more flexibility than betting on just one direction.

Limited risk (for long strangles): Your maximum loss is capped at the amount you paid for the options.

Potential for high returns: If there's a significant price movement, your returns can be substantial.

Lower cost than a straddle: Strangles are typically cheaper than straddles because both options are "Out the money”.

Disadvantages of using a strangle strategy

Requires significant price movement: To be profitable, the underlying index or stock price needs to move more than the combined cost of both options.

Time decay: If the price doesn't move enough, the value of your options will decrease as expiration approaches.

Potentially high costs: While cheaper than straddles, strangles still involve buying two options, which can be costly.

Complexity: Strangles are more complex than simple buy or sell strategies, which can be challenging for beginners.

When to use a strangle strategy?

Ahead of major events: If you expect a big announcement or event that could significantly impact the price of an asset, but you're not sure which direction it will go.

During periods of expected volatility: When you anticipate increased market volatility but aren't certain about the direction.

In range-bound markets: Short strangles can be useful when you expect the price to stay within a certain range or fully sideways.

Recommendation for beginners for more success:

Do your homework: Make sure you understand the underlying asset and the factors that could influence its price.

Choose your expiration dates wisely: Consider how much time you think it will take for the price movement to occur.

Monitor your position: Keep an eye on how the underlying index or stock price is moving and be prepared to adjust your strategy, if needed.

Manage your risk: Always use proper risk management techniques and never risk more than you can afford to lose.

Practice with paper trading: Before risking real money, try out the strategy with paper trading or practice with a small quantity to get a feel for how it works.