STRADDLE STRATEGY

A straddle option strategy involves buying both a call option and a put option with the same strike price and expiration date. It's like betting on both sides of a coin toss – you're not sure which way the market will move, but you're hoping for a big move in any direction.

How to work the straddle option strategy?

You buy a call option (the right to buy) at a specific strike price and the same expiry.

You also buy a put option (the right to sell) at the same strike price and same expiry.

Both options have the same expiration date.

Types of straddle option strategies

There are two main types of straddle strategies:

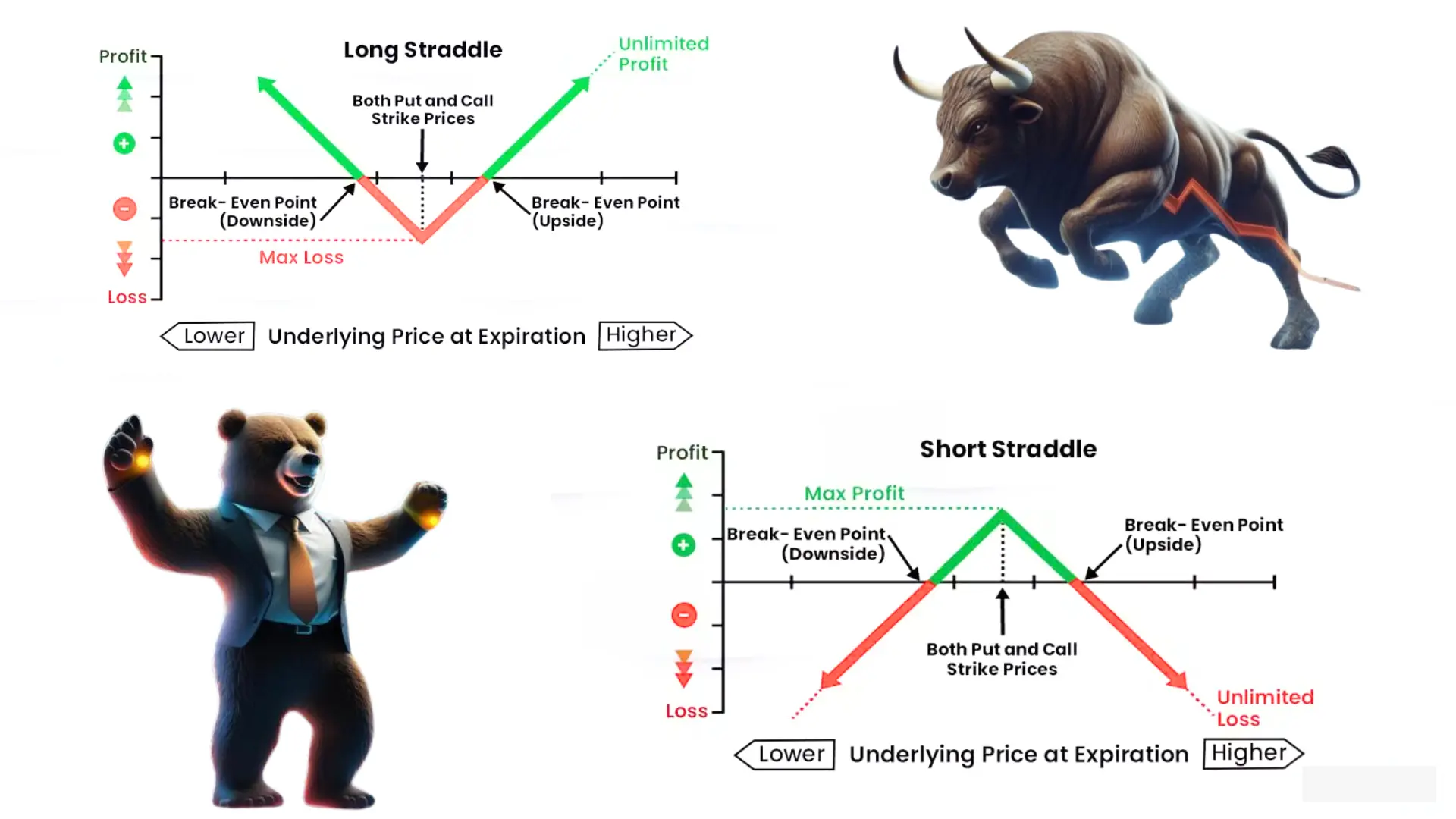

Long straddle option strategy

You buy both a call and a put option.

You're hoping for a big price move in either direction.

Your potential profit is unlimited, but your loss is limited to the premium paid.

2. Short straddle option strategy:

You sell both a call and a put option.

You're betting that the price won't move much from the range.

Your potential profit is limited to the premium received, but your loss could be unlimited.

What are the advantages of the straddle option strategy?

Potential for profit in both bullish and bearish markets.

Can be a good strategy during times of expected high volatility.

Limits your risk to the premium paid (for long straddles).

What are the disadvantages of the straddle option strategy?

Can be expensive due to buying two options.

Requires a significant price move to be profitable.

Time decay can work against you if the price doesn't move much.

When to use the straddle option strategy

Straddles can be particularly useful in these situations:

Before major events like election events or major events, Fed policy, RBI Policy budget day, or any big news.

During periods of market uncertainty or volatility.

When you expect volatility but are unsure of the direction.

Before a company announces news that could impact the market.

Let us understand both strategies in brief.

1. LONG STRADDLE STRATEGY

“Long straddle option trading strategy” the direction of the market is not fixed or non-directional market, that market above is going to go up or the market is going to go down, and because of any news the market can go up a lot or go down a lot, then in such a situation long straddle Option trading strategy is used.

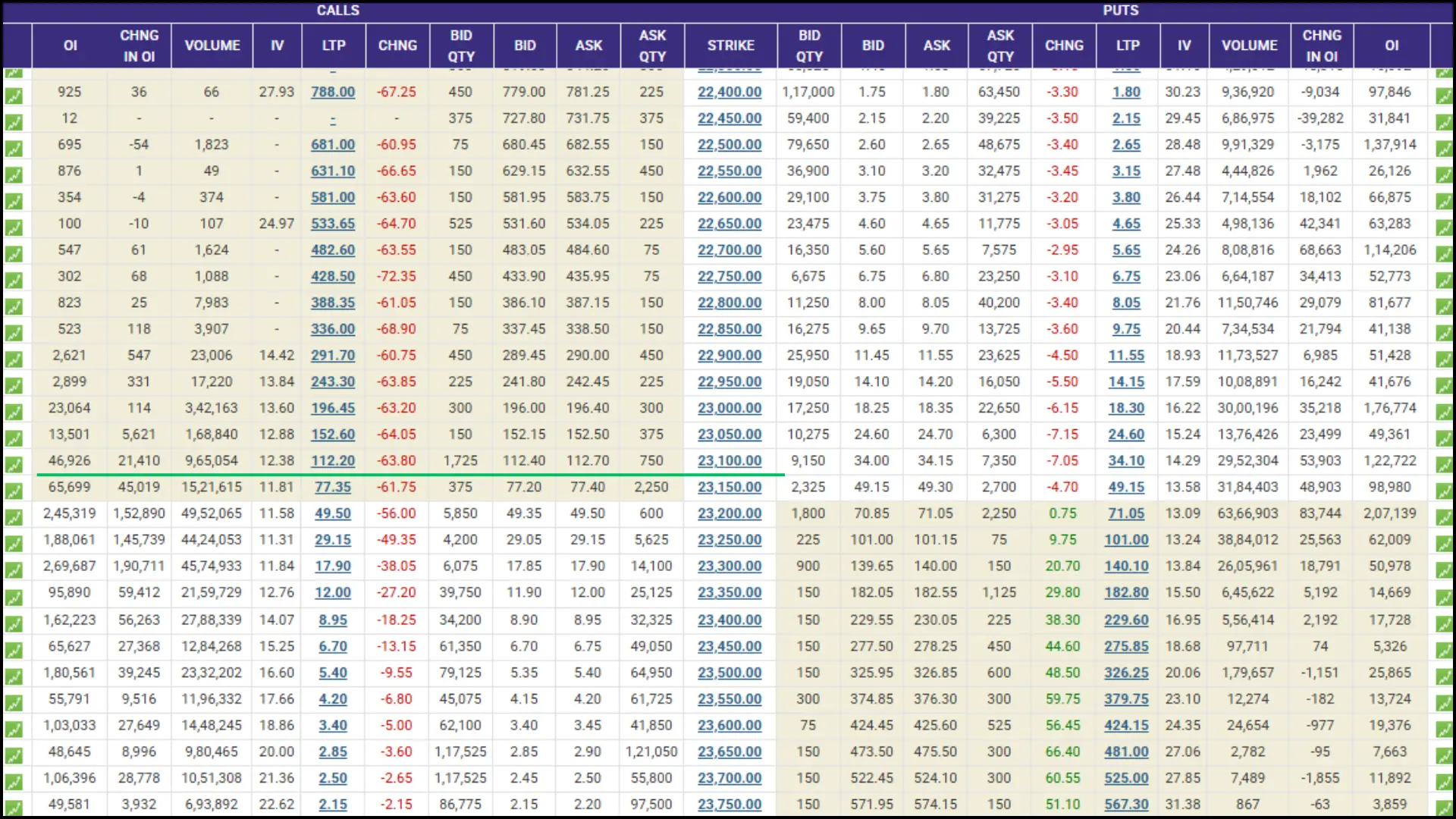

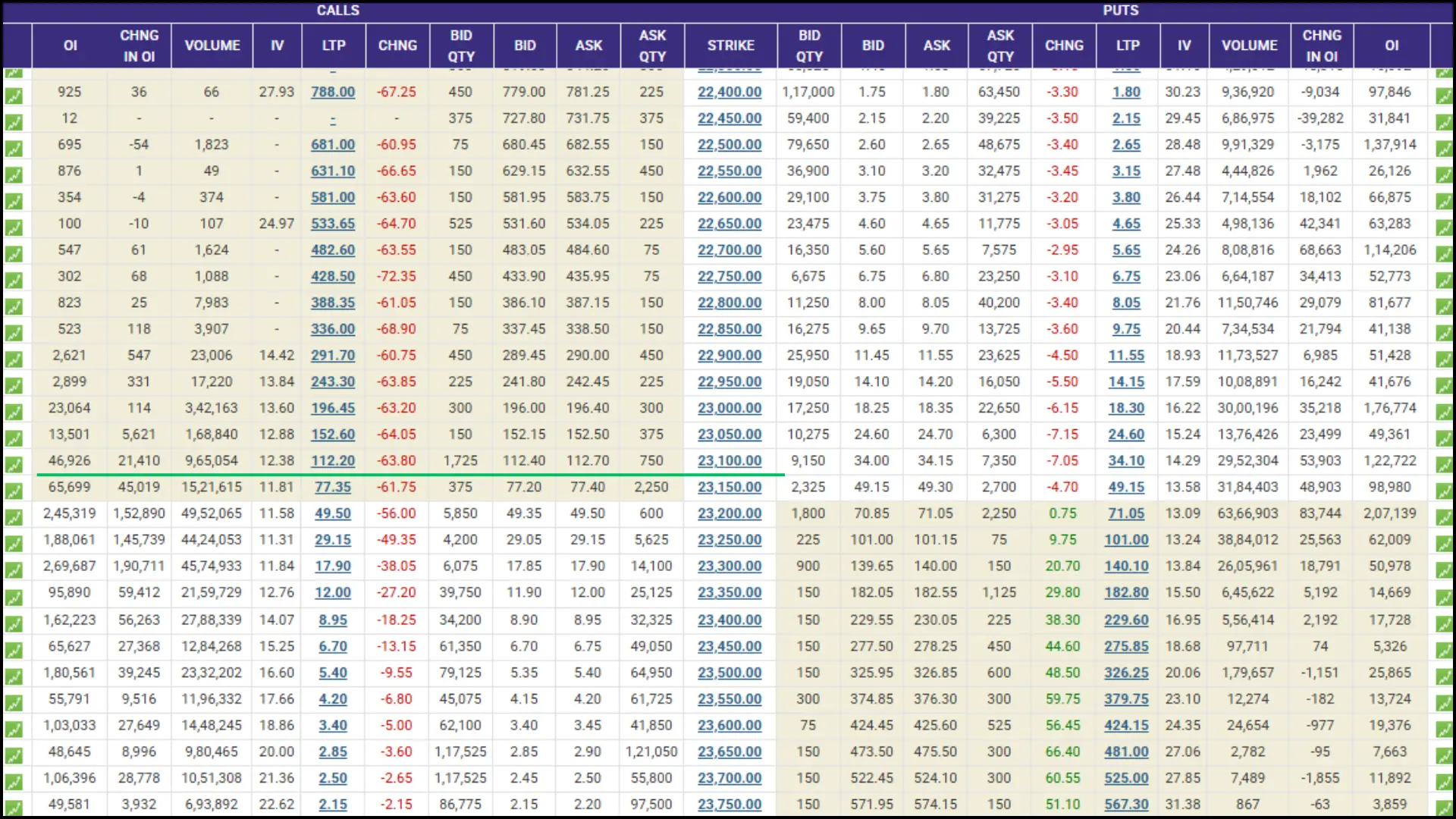

As shown in the option chain above, there is a strike of the NIFTY index in which NIFTY is trading around 23212, which we will call 23200 as an “At the money” option, in which the price of 23200CE is ₹49, and put option 23200PE is ₹71 and the expiry of both is also 16th Jan 2025. We have to buy both calls and put options simultaneously to create a position.

Now here, if there is a bullish or bearish trend in the market, then the market movement should be higher, so that there is one option, call or put option. In this, we will get to see profits quickly, if the market easily moves 100 to 200 points up or down in any direction, then we will get to see more profits in any one option and losses will be less. But if there is a movement of 300 to 400 points in the market, then we will see more profits. In long straddle option trading, our maximum loss will be the money we have paid to buy the option, but there is no limit to the profit.

(PAID PREMIUM) BUY POSITION = PREMIUM PRICE OF NIFTY 23200CE ₹49 (PAID PREMIUM) BUY POSITION = PREMIUM PRICE OF NIFTY 23200PE ₹71 |

TOTAL PREMIUM = 49+71= 120 (MAXIMUM LOSS POINT) |

2. SHORT STRADDLE STRATEGY

When there is no movement in the market at all and the market movement is very slow, then in such a situation short straddle option strategy is used where both a call option and a put option (At the money) with the same strike price are sold simultaneously. Due to a lack of movement in the market, one gets the benefit of “TIME DECAY", due to which the price of both the options gradually decreases, and the lower it is, the more profit the seller of the option. Short the position created in this way Short Straddle Option Strategy.

As shown in the option chain above, the strike of the NIFTY index is. Where NIFTY has closed around 23212, in which the level of 23200 is “At the money”, whose call and put option prices are almost the same, in which we have to sell.

The price of the NIFTY 23200CE option is ₹49 and the price of the NIFTY 23200PE option is ₹71.

If both the call options are sold together, the profit made here is limited. The maximum profit we can make by selling the NIFTY option at a premium is the same. But if there is a sudden movement or recession in the market, then our loss can be much more than that, meaning the loss is unlimited, if we do not set a stop loss.

(RECEIVED PREMIUM) SELL POSITION = PREMIUM PRICE OF NIFTY 23200CE ₹49 (RECEIVED PREMIUM) SELL POSITION = PREMIUM PRICE OF NIFTY 23200PE ₹71 |

TOTAL RECEIVED PREMIUM = 49+71=120 TOTAL LOSS = UNLIMITED (if stop loss is not applied) |