Delta

Delta is one of the most important options for Greeks. It measures how much an option's price is expected to change for every ₹1 move in the underlying asset's index or stock price. Think of it as the option's sensitivity to price changes in the stock or index whatever you're trading options on.

How to work Delta ?

Imagine you have a call option with a delta of 0.5. This means if the stock price goes up by ₹1, your option's price would theoretically increase by ₹0.50. It works the other way too – if the stock drops ₹1, your option would lose about ₹0.50 in value.

Note: Delta isn't set at fix. It changes as per market conditions movement, which is why we call it a "dynamic" measure.

Delta Range

Delta has a range, and it's pretty straightforward:

For CALL options: 0 to 1 (Always in positive )

For PUT options: -1 to 0 (Always in negative )

The thumb rule is At the money option delta range is 0.45 to 0.55

In the money option delta range is 0.55 to 1.00

Out of the money option delta range is 0.05 to 0.45

The closer the delta is to 1 (for a call option) or -1 (for a put option)

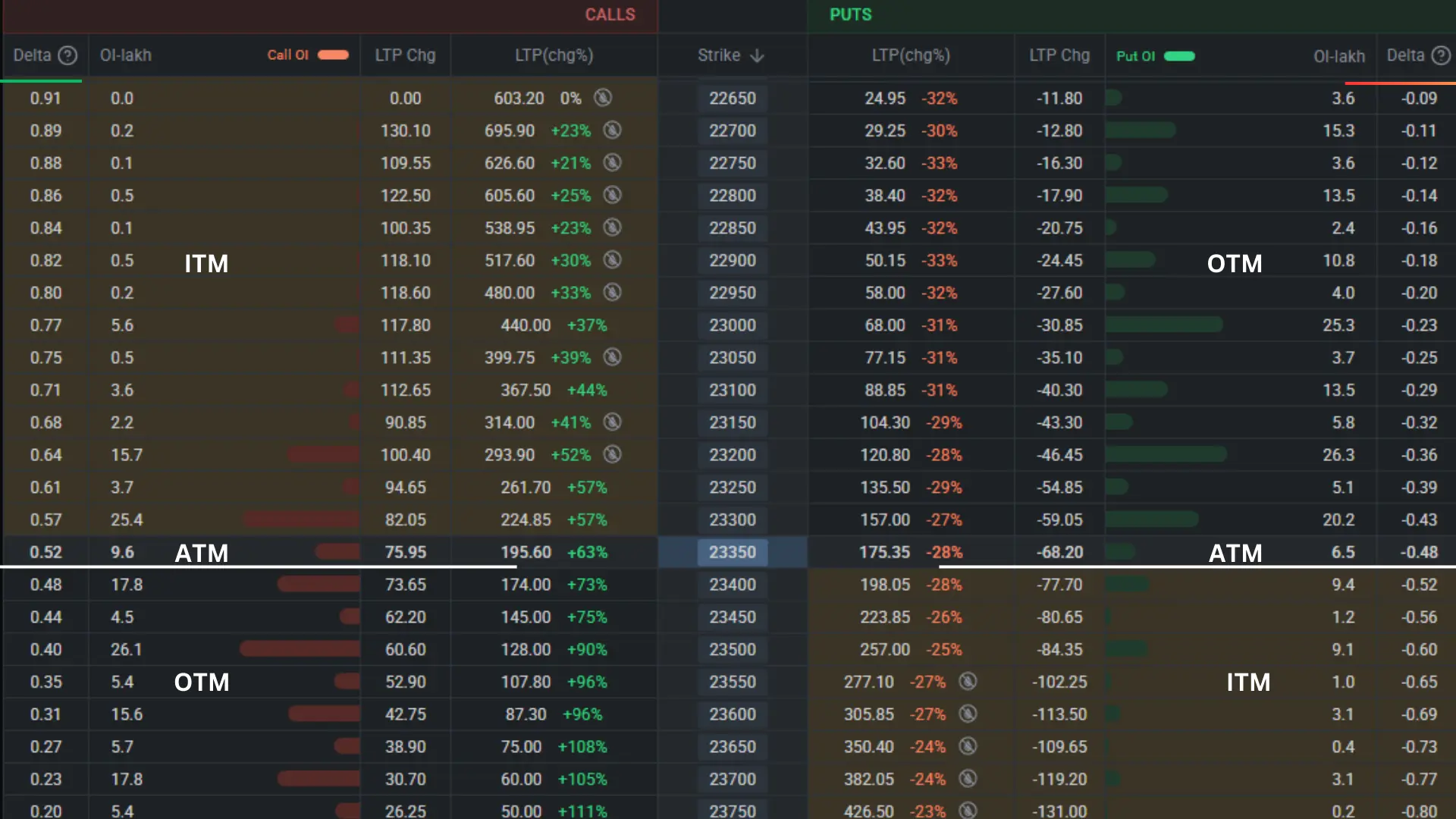

![]()

Screenshot attached for your reference:-

Importance of Delta in Options Trading

Price Movement Predictions:

Delta helps us predict how our options might move when the stock price changes.

Risk and reward Management:

Knowing your delta can help you manage risk. If you have a high delta position, you're more exposed to price changes in the underlying asset index or stock. This knowledge lets you adjust your strategy accordingly.

Balancing your Portfolio:-

Delta is super useful for balancing your portfolio. By looking at the total delta of all your positions, you can get a sense of your overall market exposure.

Practical Applications of Delta

Delta Hedging position:-

Some traders use a strategy called delta hedging. The idea is to balance positive and negative deltas in your portfolio to reduce risk.

Option price Selection:-

Delta can guide you in choosing the right strike options for your strategy. Want something that moves a lot with the stock or index?