An IPO, or initial public offering, is one method by which a business might raise capital to concentrate on corporate expansion. A company's shares can be bought by an individual investor.

IPO is one of the many investment alternatives available in the market; let's find out more. An IPO is a fantastic way for a corporation to raise money for rapid expansion. To reach significant milestones, the business raises money from the public. Holding a stake in a business entitles an investor to benefits like dividends and bonus shares.

What is Initial Public Offering (IPO)?

An initial public offering, or IPO, benefits both the firm issuing the shares and the investor. Let's first examine an initial public offering (IPO) from the viewpoint of an investor if you choose to begin putting your money in one:

How does IPO work for an investor?

The public is given the chance to purchase shares and become a part owner of the business through an initial public offering (IPO), which can help the business raise more money. For example, if you buy any number of shares in XYZ Company or an IPO, you will also own a portion of the business.

Reasons to invest in an IPO

Long-Term Objectives: IPOs are equivalent to equity investments and can help you reach your long-term goals while increasing your wealth.

Transparency: Because initial public offerings (IPOs) display the pricing of securities, the entire process is transparent. Share prices are erratic following the listing procedure because of market conditions.

Buy cheap and earn big: When a business goes public, share prices are lowered. Since the shares are rather pricey when the company goes public, it enables investors to invest at a reduced cost.

Things to consider: There are advantages and disadvantages to investing in an initial public offering (IPO), thus it is important to quickly weigh all the factors. Investing in an initial public offering (IPO) may have several drawbacks, such as:

It may compromise investor privacy since certain information must be disclosed.

It may take a lot of time because it is necessary to evaluate a company's performance before investing.

The pricing may be impacted by external interference.

Eligibility to apply for an IPO : An investor must have a PAN card, a valid DEMAT account, and the ability to enter into a legal contract.

How does an IPO work for the company?

A business can raise money in the primary market by selling securities to the general public through an IPO, or initial public offering. It is acknowledged as a crucial step in fostering a company's expansion. These two strategies can help a business raise money:

Fixed Price Issue

It is the price that the business sets for the first selling of its shares. The price at which the corporation issues its shares is available to investors.

Book Building Issue

The firm that is planning an initial public offering (IPO) offers a 20% price band on its equities. Investors can choose how many shares they want to purchase and how much they are willing to spend for each share. The bids of investors ultimately set the prices.

How can an IPO be beneficial for a company?

Capital Access: Through an IPO, the business can raise a significant amount of money. By helping the business with R&D, debt repayment, asset purchases, etc., it can provide financial stability.

Business Credibility: A company ready to raise capital from the public has to comply with many rules and regulations as per the regulatory bodies which increases the credibility of the investors towards the company and hence increases their investment. It also helps to increase the customer base, suppliers, and partners.

Debt Financing: Public companies have access to debt financing as compared to private companies.

Increased Liquidity: The shares of the company are more liquid because of the IPO which gives easy access to shareholders to execute buying and selling of shares.

Know its limitations:

Expensive Process: Because corporations must pay large fees to investment banks, attorneys, and accountants, the initial public offering (IPO) process is costly and complex.

Regulation Compliances: Before going public, a number of rules and procedures must be followed, which can be expensive and time-consuming.

Dilution of shares: As the corporation issues new shares, the value of the holdings held by current shareholders decreases, diluting the shares.

Terms related to initial public offerings

Stockbroker | Stockbrokers or broking firms allow investors to apply for an IPO. Investors can purchase and sell their shares with the help of stockbrokers. |

Bid Lot | Lots are pre determined by the companies and the investors are required to purchase the minimum number of shares which is called a Lot, as defined by the company. |

Floor Price | Minimum bidding price set by the company when applying to an IPO. |

Issue Price | It is the price at which the shares of a company are sold when they are first available to the public. |

Cut Off Price | The shares are allotted to the investors at cut off price. |

Abridged Prospectus | Abridged prospectus contains all the salient features of IPO issues. It is mandatory to attach an abridged prospectus for the companies while filling an application for an IPO. |

Anchor Investors | Qualified Institutional Buyers (QIB) includes investors such as banks, mutual funds, financial institutions, etc. Under this category, 60% of shares are reserved for the anchor investors who apply for shares worth Rs 10 crore or more in the IPO. |

Draft Red Herring Prospectus | An offer document containing complete financial and operational details about the company is called Red Herring Prospectus (RHP). It is issued by the company with SEBI and the Registrar of Companies before the commencement of IPO process. |

Listing Date | After the completion of the allotment process, trade can be executed in the secondary market when the shares are officially listed on the stock exchange. |

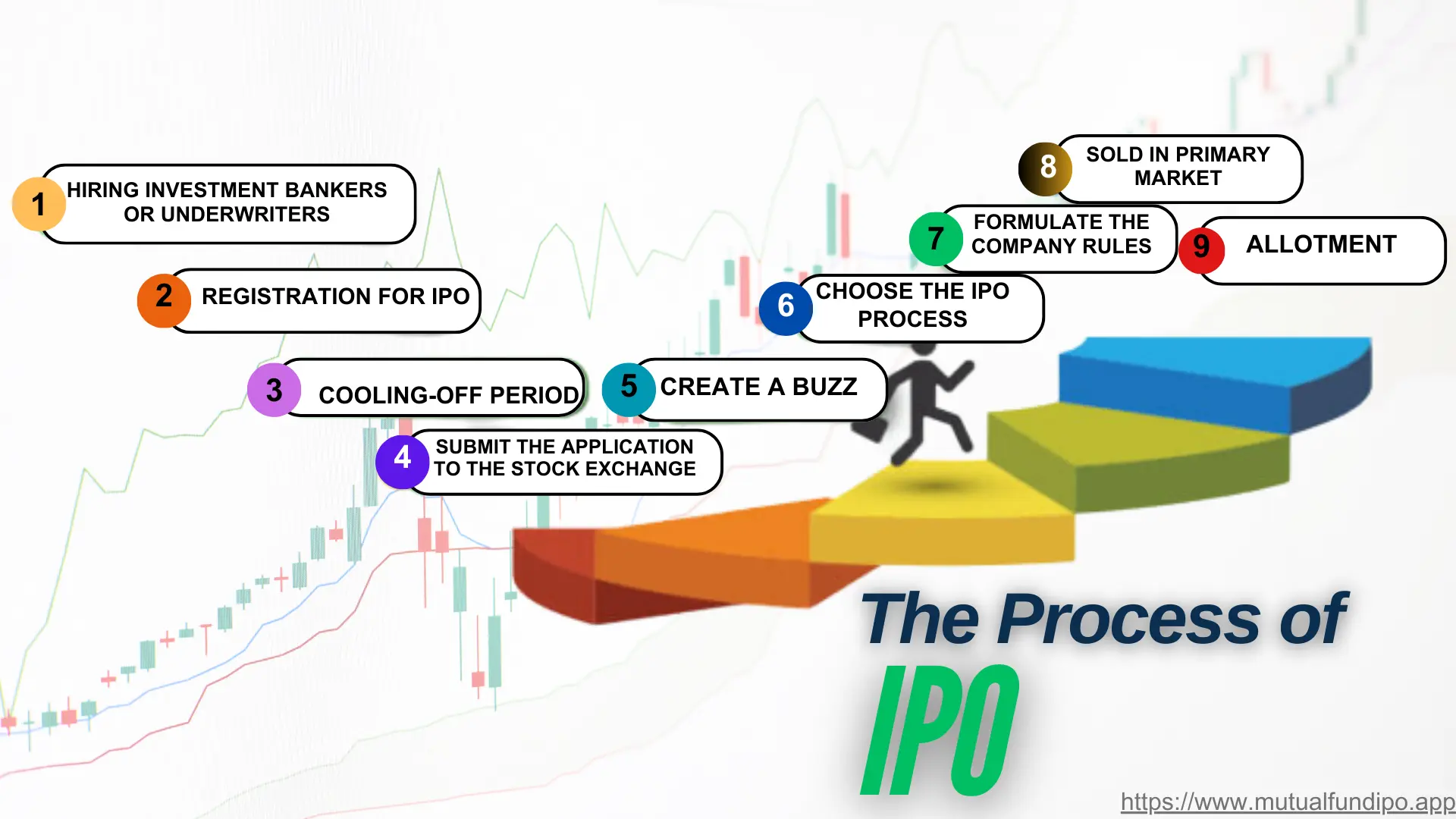

What is the process of IPO?

For any company that has chosen to go public, the procedure is extremely complicated. The duration of this process could range from six to nine months. A business must do the following actions:

Step1: Hiring investment bankers or underwriters:

The company is guided through the entire IPO process by financial experts.

Step 2: Registration for IPO:

A document known as a red herring prospectus is used by the companies to register. According to SEBI's guidelines, the company must complete this official process and disclose all of its important information.

Step 3: Cooling-off period

SEBI confirms the date for an IPO after conducting the verification process and searching for mistakes and inconsistencies.

Step 4: Submit the application to the stock exchange

To conduct the initial issue, the company should file an application with the stock exchange.

Step 5: Create a buzz

People should be aware of a company's initial public offering (IPO), thus the business must make sure they persuade the investors. To do this, a number of activities are planned, raising anticipation for the company's initial public offering.

Step 6: Choose the IPO process

The company has to make a choice between fixed-price issues and book-building issues.

Step 7: Formulate the company rules

Before launching an IPO, a business must make sure that no insiders trade in the IPO to maintain its efficacy.

Step 8: Sold in the primary market

The issued shares are sold in the primary market, and investor funds are gathered in order to carry out the last phase. About 5 working days are allotted for the bidding process. Within 10 business days following the conclusion of the bidding, investors receive their IPO shares.

Step 9: Allotment

The allotment process, in which the bidders receive their shares, is the final stage. The business determines the total number of shares allocated to each investor in this final phase. If there is an instance of oversubscription, partial allocations are made.

Conclusion

As far as we know, firms use initial public offerings (IPOs) to raise money from the general public by listing on the National Stock Exchange or other platforms. It shows a company's initial stage of entering the stock market.