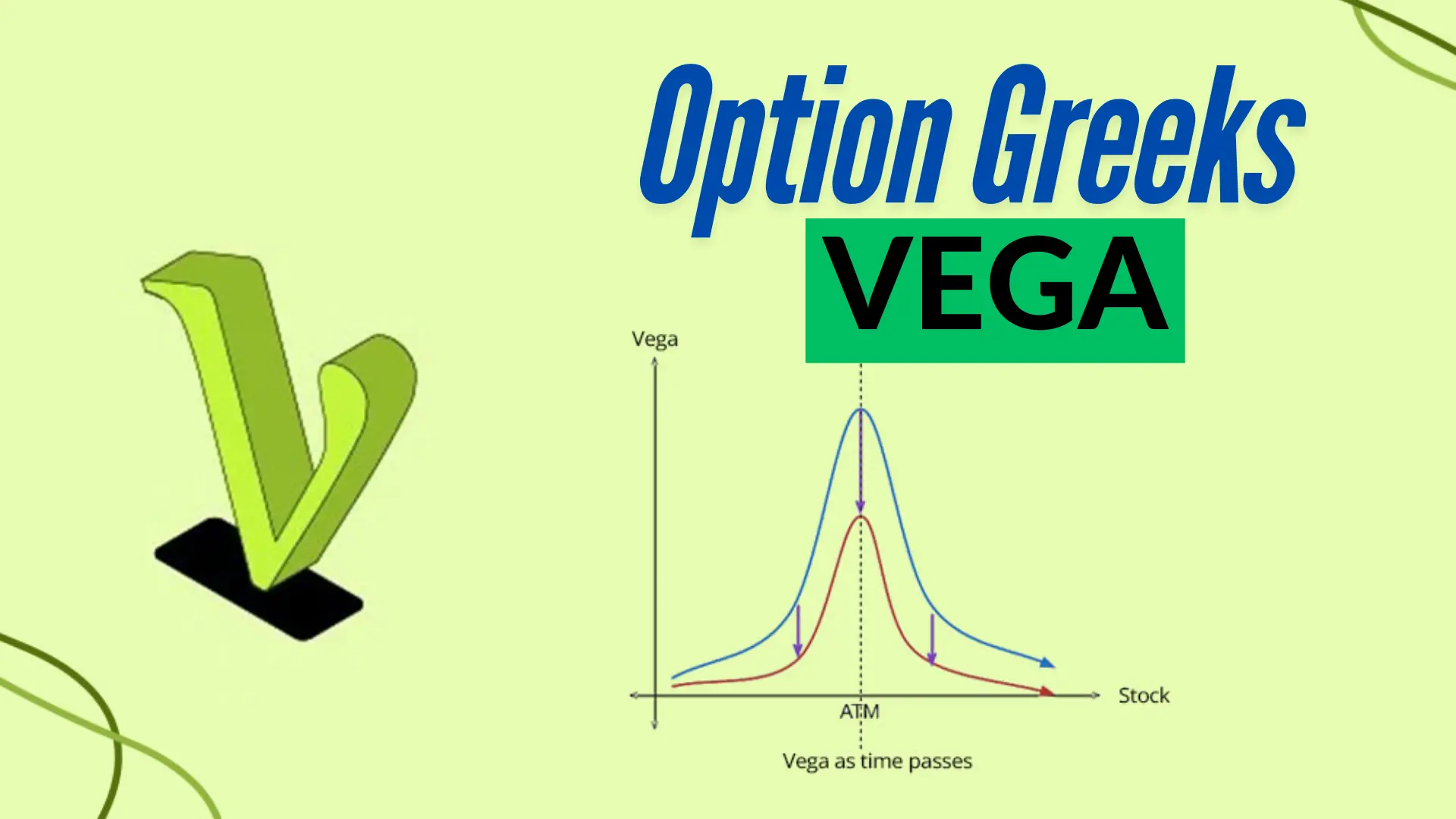

Vega

Volatility based on these, the work of showing the change in the option premium is done by Vega Greek. When the volatility is high in the market, there is a sharp fall or rise in the premium of the option, the increase in the premium of the option Vega indicates a decline. It is worth noting that high volatility makes the option premium more expensive. Since the strike premium changes very quickly due to volatility, usually when the volatility is low, the option writer makes more profit and vice-versa for the option buyer. Since long options position traders to profit when prices rise, and short options position traders to profit when prices fall, this is why long options have positive Vega while short options have negative Vega.

Calculating Vega

Now, I'm not going to bore you with complex math, but it's good to know that Vega is usually expressed as the amount an option's price changes for a 1% change in implied volatility.

For example, if an option has a Vega of 0.10, its price would increase by ₹0.10 if implied volatility went up by 1%.

Risk Management

Knowing your Vega helps you manage your risk better. If you're worried about big swings in volatility, you might want to keep an eye on options with lower Vega values.

Trading Strategies

Some traders actually use Vega to their advantage. They might look for options with high Vega when they think volatility is going to increase, or low Vega when they expect things to calm down.