What is a mid-cap mutual fund?

What are mid-cap stocks?

Mid-cap mutual funds invest in stocks of medium-sized companies or as per exchange listed top 100 to 250 companies are mid-cap stocks. These are the stocks of companies that aren't quite as big as the giants you hear about every day, but they're not small companies. They're like the Goldilocks of stocks – not too big, not too small, but just right.

Characteristics of mid-cap stocks:

Usually have a market capitalization between 5000 Cr to 20000 Cr.

Often growing companies with potential for expansion.

Can be more volatile than large-cap stocks, but potentially offer higher returns.

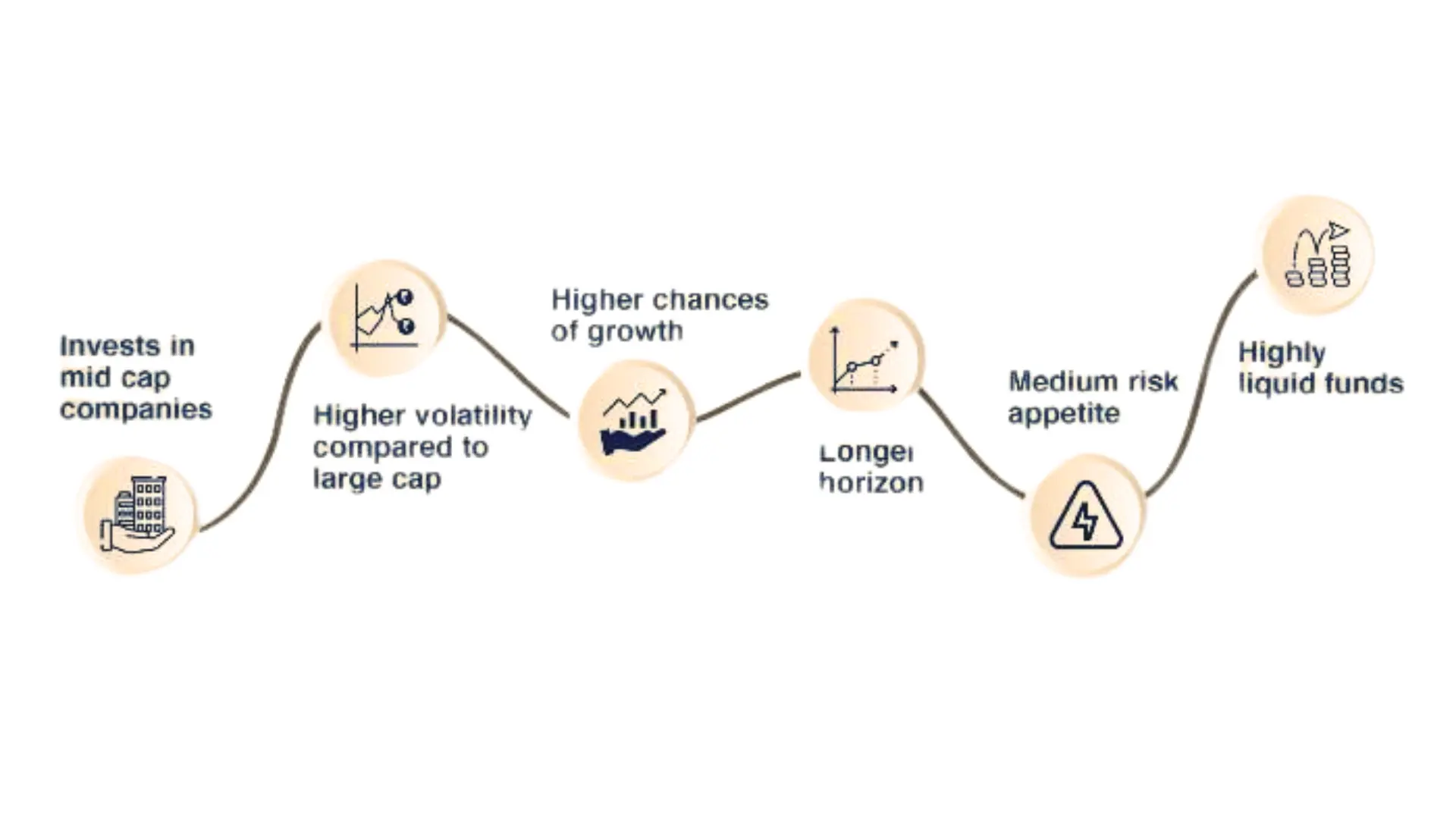

Key features of mid-cap mutual funds:

Invest primarily in mid-cap stocks.

Managed by professional fund managers.

Offer diversification within the mid-cap segment.

What are the benefits of investing in mid-cap mutual funds?

Potential for high returns:

Mid-cap companies often have more room to grow compared to their larger counterparts. It's like backing a talented up-and-coming athlete – they might not be a superstar yet, but they have the potential to become one!

Diversification:

By investing in a mid-cap mutual fund, you're not putting all your eggs in one basket. It's like going to a potluck dinner – you get to enjoy a variety of dishes without having to cook them all yourself!

Professional management:

Fund managers do all the heavy lifting for you. They research companies, analyze market trends, and make investment decisions. It's like having a personal chef who plans and prepares your meals – you just get to enjoy the results!

Risks associated with mid-cap mutual funds:

Now, I wouldn't be a good friend if I didn't tell you about the risks too. Like anything in life, mid-cap mutual funds come with their own set of challenges. It's risky compared to large-cap mutual funds.

Market volatility:

Mid-cap stocks can be more sensitive to market ups and downs. It's like riding a roller coaster – there might be some thrilling highs and stomach-dropping lows!

Liquidity risk:

Sometimes, it might be harder to buy or sell mid-cap stocks quickly without affecting their price. It's like trying to sell a unique piece of art – you might need to wait for the right buyer to come along.

Company-specific risks:

Mid-cap companies might face challenges as they grow. It's like watching a teenager navigate high school – there might be some awkward growth spurts and unexpected challenges along the way!

How to invest in mid-cap mutual funds?

Here is step by step mentioned below

- Research different mid-cap mutual funds.

- Compare their performance, expense ratios, and fund managers.

- Decide how much you want to invest in a mutual fund.

- Choose between a lump sum investment or a systematic investment plan (SIP).

- Open an account with a mutual fund company or use a brokerage platform (Investing in a mutual fund is ZERO, Click here for Account opening in Angel One)

- Start investing and monitor your investment regularly.