Introduction

The NPS National Pension Scheme is one of India's most trusted and beneficial retirement savings plans. Launched by the Government of India and regulated by the Pension Fund Regulatory and Development Authority (PFRDA) , NPS offers individuals a structured approach to retirement planning. Whether you are a salaried employee, an self-employed professional, or an NRI , NPS is a tax-efficient and flexible pension scheme that ensures financial stability post-retirement.

What is NPS?

NPS is a voluntary, long-term retirement savings scheme that provides financial security after retirement. It allows individuals to contribute regularly to their pension accounts and, upon maturity, withdraw a part of the corpus while using the rest for an annuity plan to get a steady pension.

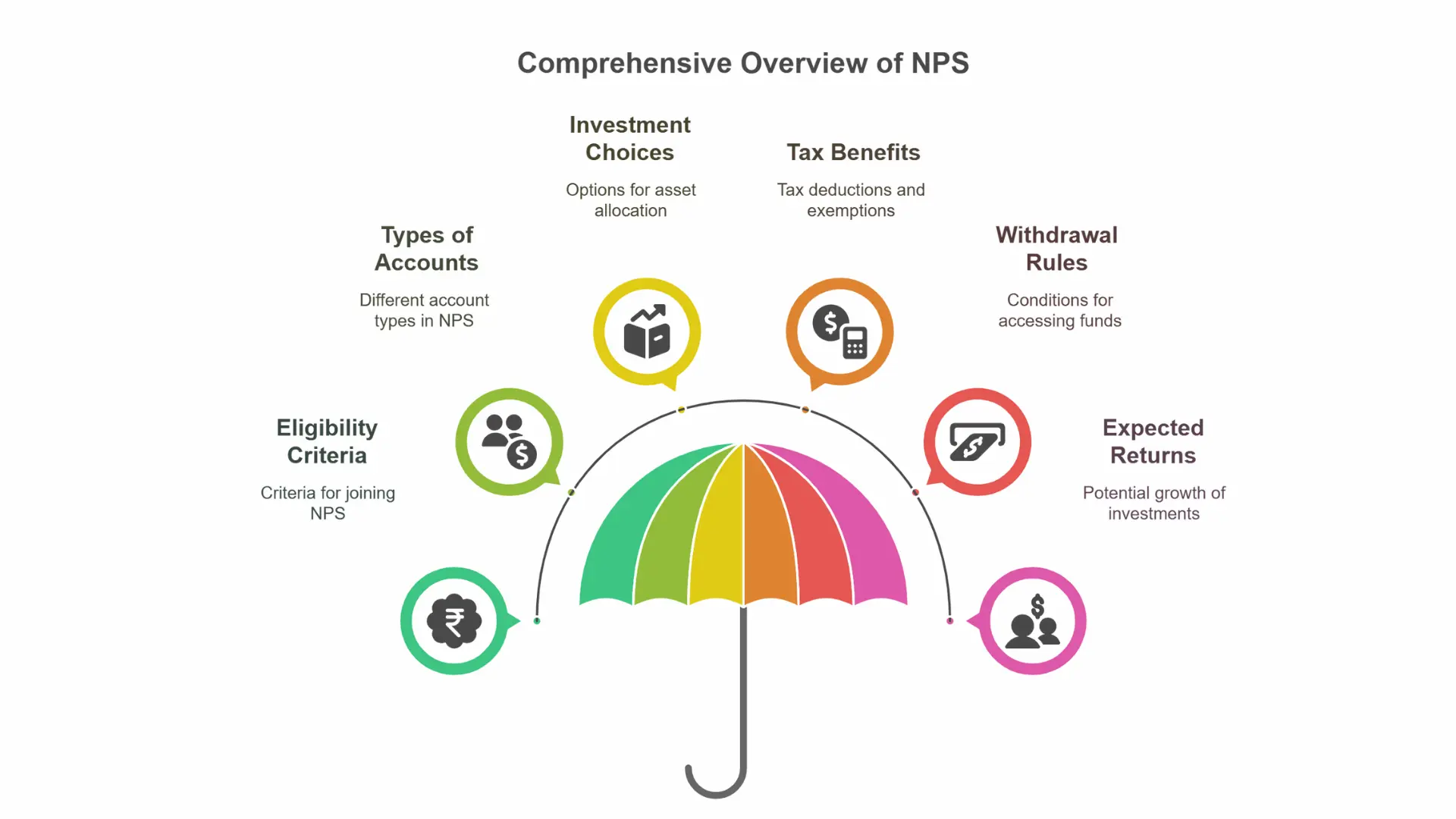

Key Features of NPS

1. Eligibility Criteria

- Open to Indian citizens (residents and non-residents) .

- Available for individuals aged 18 to 70 years .

- KYC (Know Your Customer) compliance is mandatory.

2. Types of NPS Accounts

NPS offers two types of accounts:

- Tier-I Account (Mandatory) : A retirement savings account with restrictions on withdrawals.

- Tier-II Account (Voluntary) : A flexible savings account allowing withdrawals at any time (only available for Tier-I account holders).

3. Investment Choices

Subscribers can invest in different asset classes:

- Equities (E) – High-risk, high-return investments.

- Corporate Bonds (C) – Moderate-risk investments.

- Government Securities (G) – Low-risk, stable returns.

- Alternative Assets (A) – Includes REITs and infrastructure projects.

You can choose between:

- Auto Choice : Age-based asset allocation.

- Active Choice : Self-decided allocation.

4. Tax Benefits of NPS

NPS is one of the most tax-efficient investment options:

- Under Section 80CCD(1) : Up to ₹1.5 lakh deduction (part of Section 80C limit).

- Under Section 80CCD(1B) : Additional ₹50,000 deduction (beyond Section 80C limit).

- Under Section 80CCD(2) : Employer contributions up to 10% of salary (Basic + DA) are tax-exempt (no upper limit for private-sector employees).

5. Withdrawal & Exit Rules

- Before 60 years : Partial withdrawal allowed for specified reasons (education, marriage, medical treatment, home purchase).

- After 60 years : At least 40% of the corpus must be used for an annuity plan , while the remaining 60% is tax-free and can be withdrawn as a lump sum.

- Premature Exit : If exiting before 60 years, 80% of the corpus must be invested in an annuity plan .

6. Expected Returns on NPS

NPS returns are market-linked and depend on the performance of selected fund managers. Historically, returns range from 8-12% per annum , making NPS an attractive option for long-term growth.

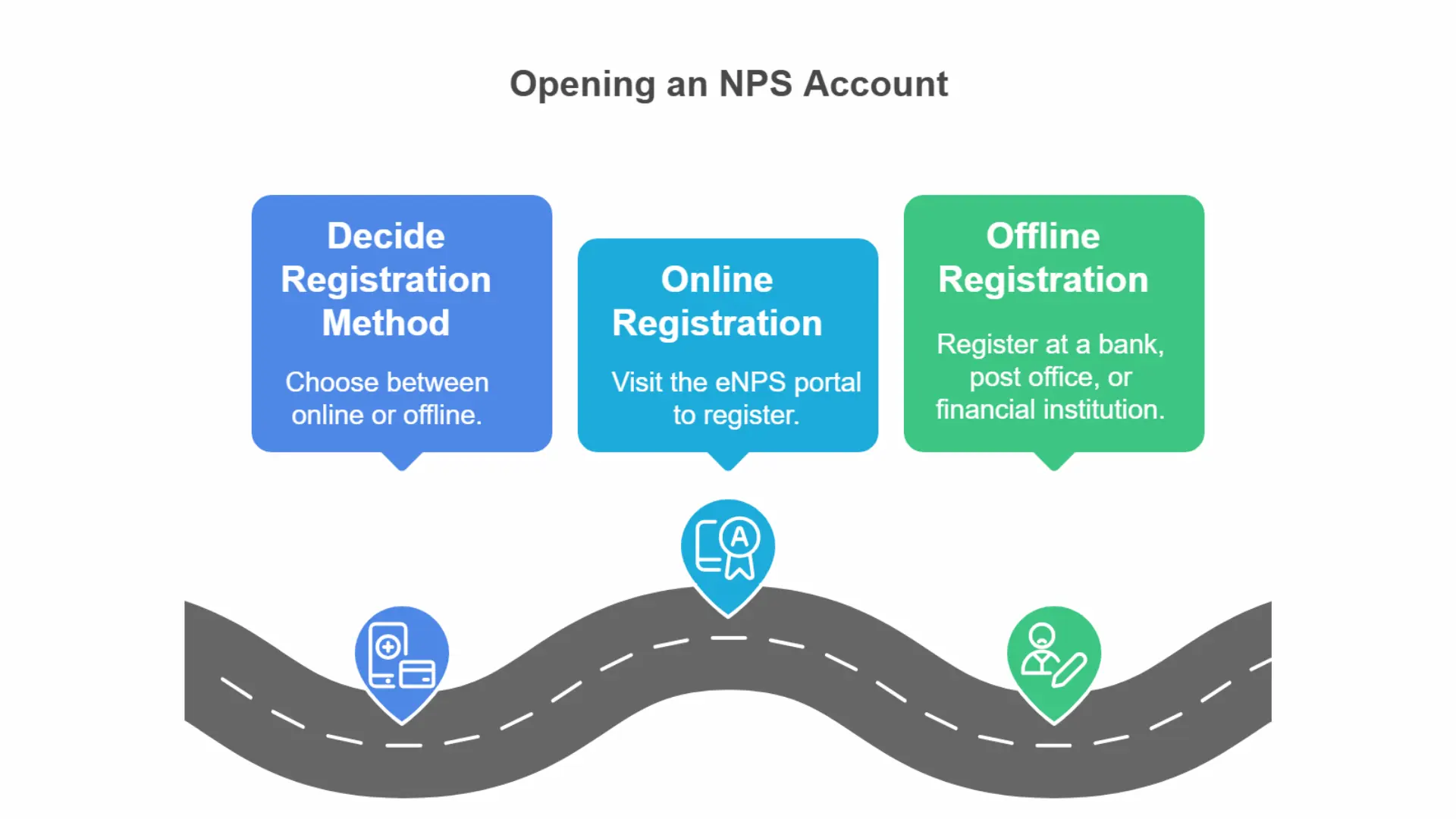

7. How to Open an NPS Account?

You can open an NPS account through:

- Online (eNPS Portal) : Register via https://enps.nsdl.com/ or https://npscra.nsdl.co.in/ .

- Offline (PoP Centers) : Banks, post offices, and financial institutions act as Points of Presence (PoP).

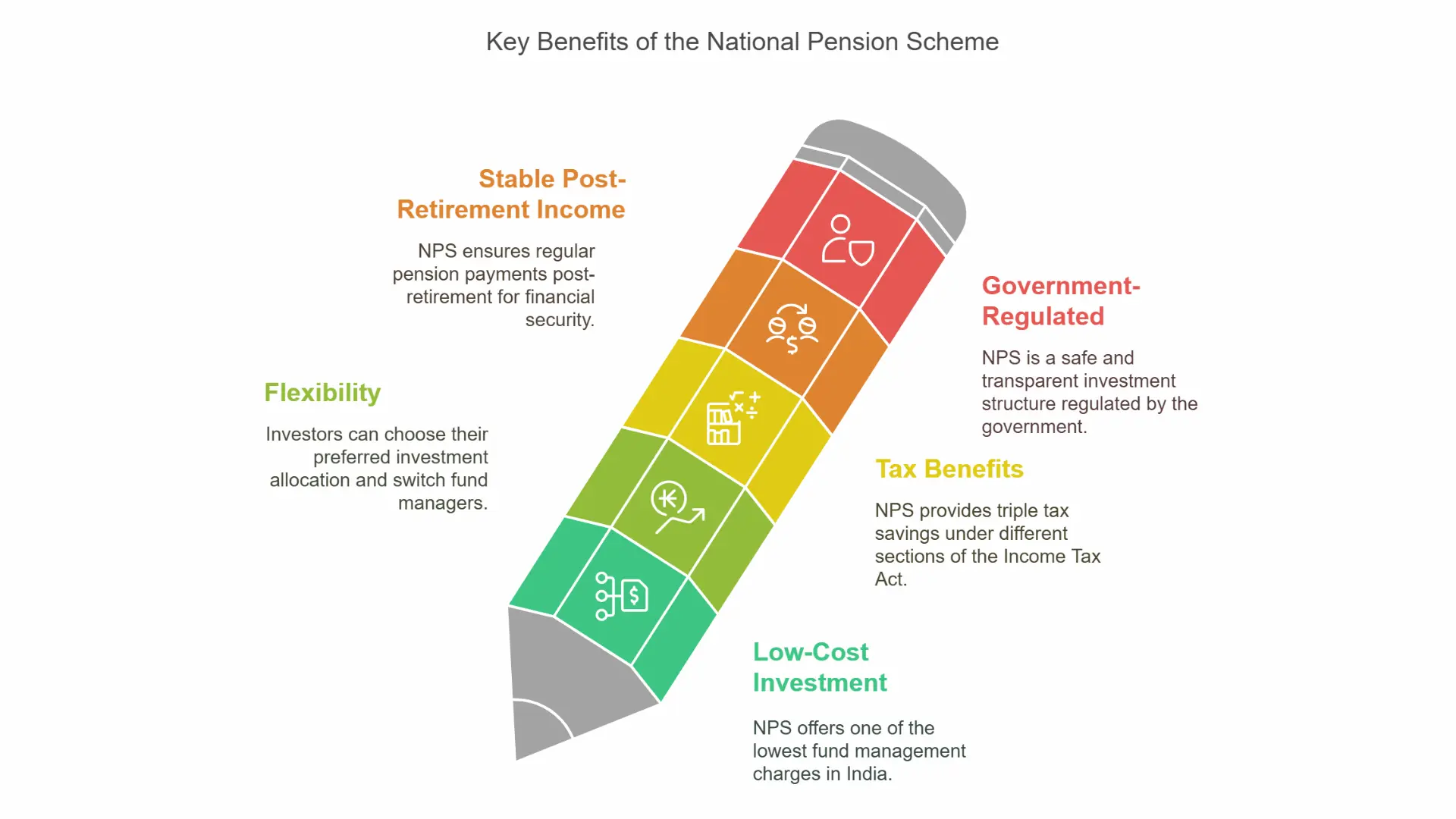

Why Should You Invest in NPS?

- Low-Cost Investment : NPS has one of the lowest fund management charges in India.

- Flexibility : Choose your preferred investment allocation and switch fund managers.

- Tax Benefits : Triple tax savings under different sections of the Income Tax Act.

- Stable Post-Retirement Income : Regular pension post-retirement ensures financial security.

- Government-Regulated : Safe and transparent investment structure.

Conclusion

The National Pension Scheme (NPS) is an excellent retirement planning tool for individuals seeking financial security and tax efficiency. With low costs, diversified investments, and high returns , NPS is an ideal choice for long-term wealth accumulation. If you haven't invested in NPS yet, now is the time to start securing your future !

Have Questions About NPS?

Drop your queries in the comments, and we’ll be happy to assist you!