In the world of investments, two popular systematic approaches often come into consideration: SIP (Systematic Investment Plan) and STP (Systematic Transfer Plan). SIP vs STP: Understanding Key Differences and Strategies is essential for investors looking to maximize their returns while minimizing risks. While both methods help investors manage their funds efficiently, they serve different purposes and suit different investment strategies. In this blog, we will explore the key differences between SIP and STP and help you determine which strategy works best for your financial goals.

What is SIP (Systematic Investment Plan)?

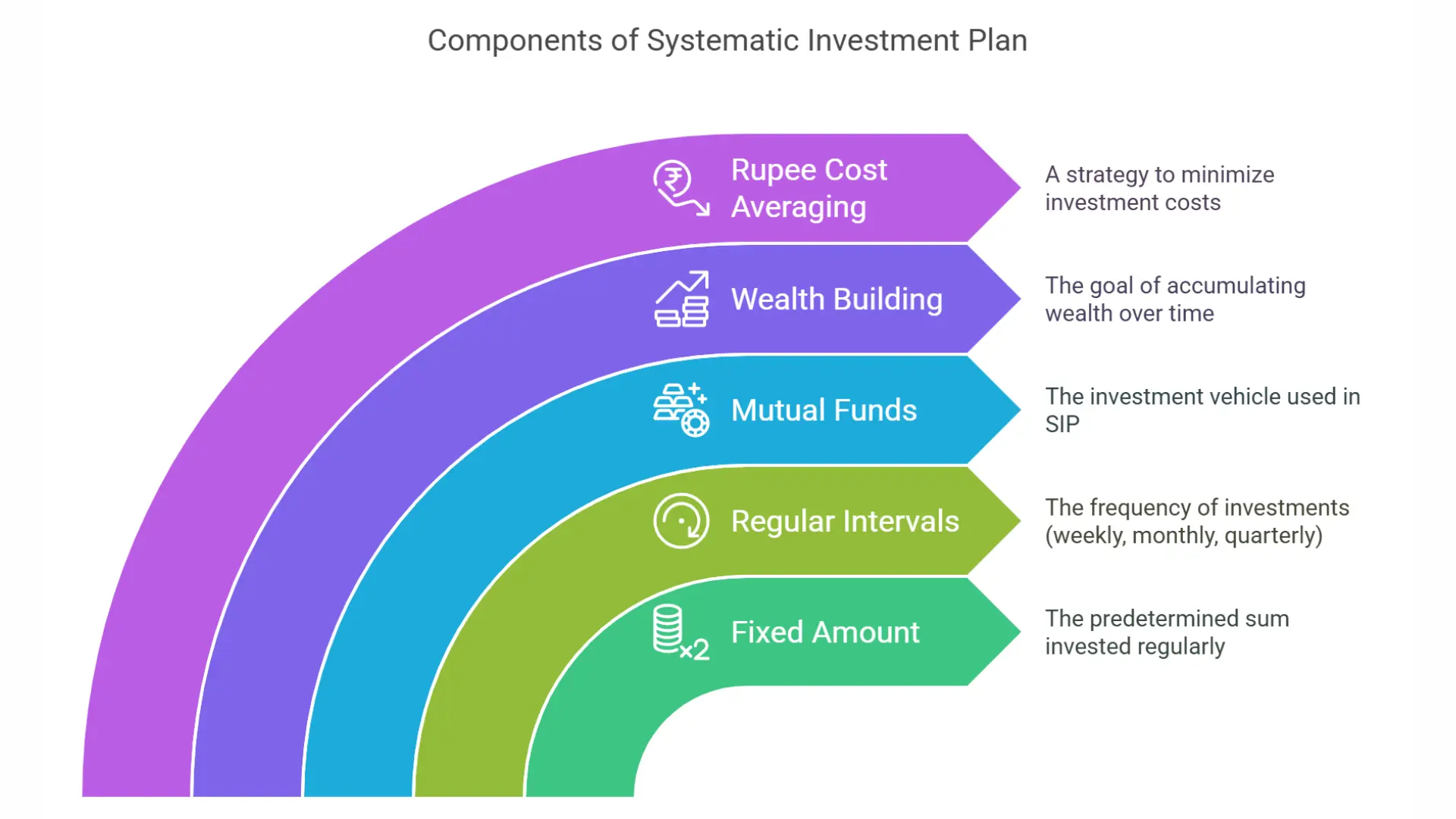

A Systematic Investment Plan (SIP) allows investors to invest a fixed amount of money in mutual funds at regular intervals—weekly, monthly, or quarterly. It is an excellent way to build wealth over time through disciplined investing and rupee cost averaging.

How Does SIP Work?

- Choose a Mutual Fund – Select a mutual fund based on your financial goals and risk appetite.

- Decide Investment Amount & Frequency – Determine how much you want to invest and at what intervals (monthly, quarterly, etc.).

- Auto-Debit Setup – The amount gets auto-debited from your bank account on the chosen date.

- Buying Fund Units – Based on the NAV (Net Asset Value) on the date of investment, units are allotted to you.

- Long-Term Growth – Over time, your investments grow due to market appreciation and the power of compounding.

Benefits of SIP:

- Rupee Cost Averaging – Buying units at different prices helps mitigate market volatility.

- Compounding Benefits – Long-term investments grow exponentially due to compound interest.

- Budget-Friendly – Allows small investments over time, making it accessible to all investors.

- Disciplined Investing – Encourages regular investments, reducing the impact of emotional decision-making.

- Low-Risk Exposure – Ideal for risk-averse investors as it spreads investments over time.

Example of SIP:

Rahul, a young professional, decides to invest ₹5,000 per month in an equity mutual fund via SIP. Over the years, his investments benefit from rupee cost averaging and compounding, helping him build a significant corpus for his long-term goals, such as buying a house or retirement planning.

What is STP (Systematic Transfer Plan)?

A Systematic Transfer Plan (STP) enables investors to transfer a fixed amount of money from one mutual fund scheme (typically a debt fund) to another mutual fund scheme (typically an equity fund) at regular intervals.

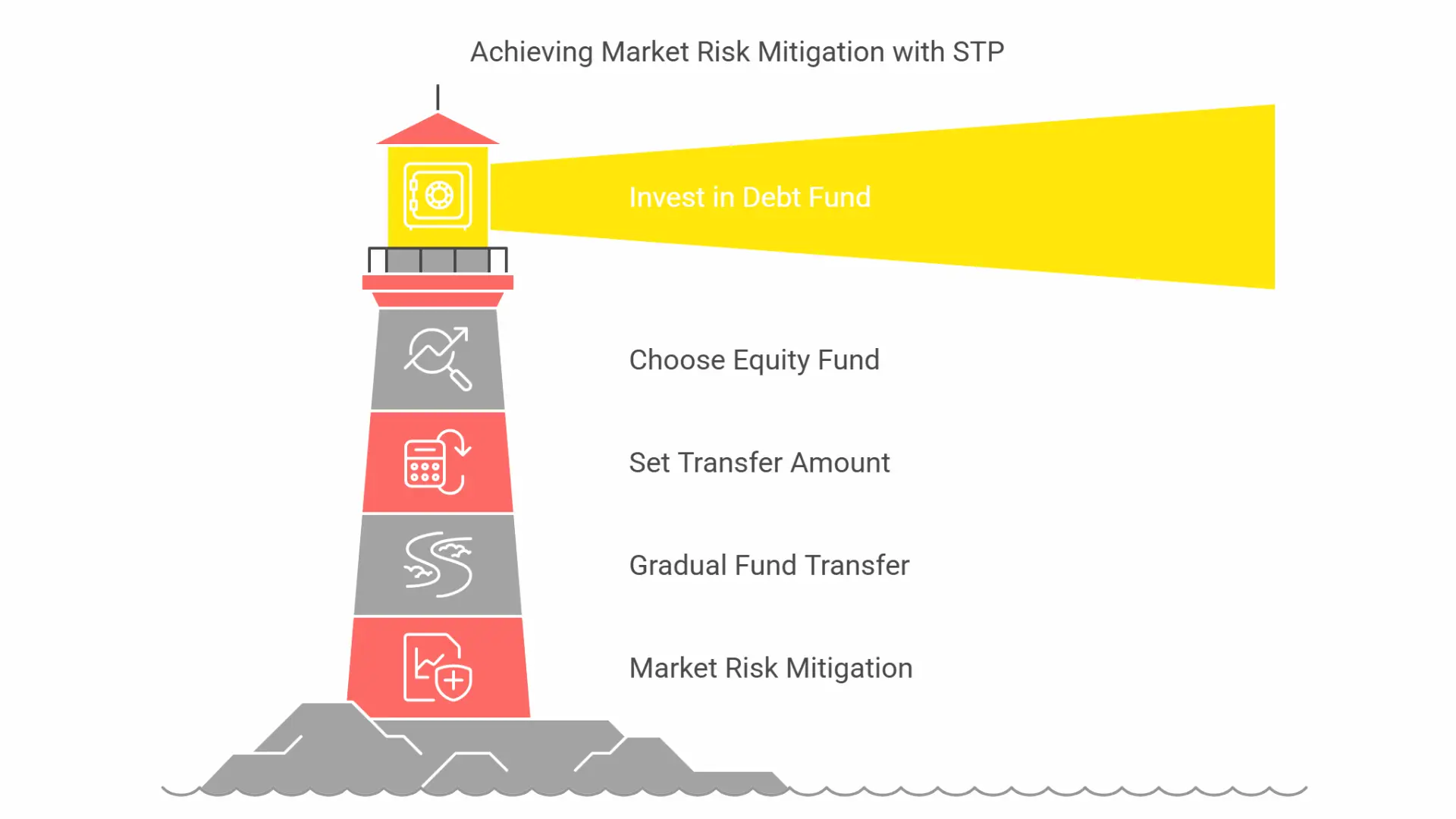

How Does STP Work?

- Invest in a Debt Fund – Start by investing a lump sum amount in a debt mutual fund.

- Choose Target Equity Fund – Select an equity mutual fund where you want to transfer your money.

- Set Transfer Amount & Frequency – Decide how much you want to transfer periodically (weekly, monthly, etc.).

- Gradual Transfer of Funds – The chosen amount is automatically moved from the debt fund to the equity fund at set intervals.

- Market Risk Mitigation – The systematic transfer helps reduce the impact of market volatility while ensuring capital appreciation.

Benefits of STP:

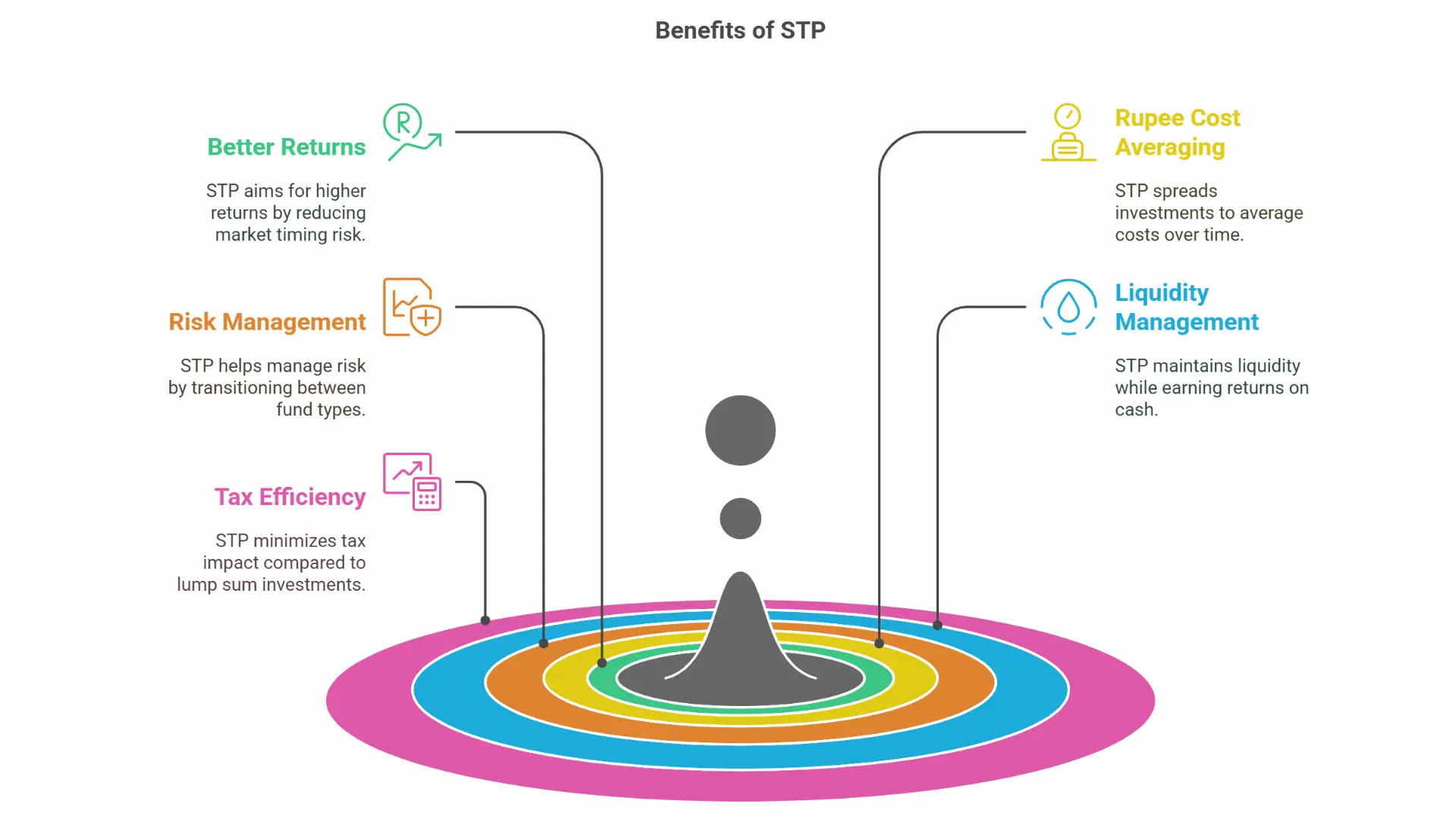

- Better Returns than Lump Sum – Helps mitigate market timing risk by gradually moving funds into equity.

- Rupee Cost Averaging – Similar to SIP, STP ensures investments are spread over different market conditions.

- Risk Management – Ideal for investors looking to shift from low-risk debt funds to high-return equity funds.

- Liquidity Management – Ensures funds are available while still earning returns on idle cash.

- Tax Efficiency – Reduces the tax burden compared to lump sum investments.

Example of STP:

Neha receives a bonus of ₹5,00,000 and wants to invest in equity mutual funds. Instead of investing the lump sum amount directly, she parks it in a low-risk debt fund and sets up an STP of ₹50,000 per month into an equity mutual fund. This strategy helps her mitigate the risk of market volatility and ensures better returns over time.

Key Differences Between SIP and STP

Feature | SIP (Systematic Investment Plan) | STP (Systematic Transfer Plan) |

Source of Funds | External income (salary, savings) | Existing investment in a mutual fund |

Objective | Invest regularly over time | Transfer money systematically from debt to equity |

Market Timing | Reduces risk by averaging purchase price | Reduces risk by spreading investments |

Investment Type | Fresh investment in mutual funds | Switching between mutual fund schemes |

Risk Exposure | Lower, as investments are spaced out | Moderate, depends on the fund types |

Ideal for | New investors, salaried individuals | Investors with a lump sum amount looking for phased equity exposure |

Which Strategy is Right for You?

- Choose SIP if:

- You have a regular income and want to invest systematically.

- You are a beginner and want to build wealth gradually.

- You want to reduce risk through long-term investing.

- Choose STP if:

- You have a lump sum amount but want to invest gradually.

- You want to shift from debt to equity systematically.

- You aim to maximize returns while reducing market timing risks.

Conclusion

Both SIP and STP are excellent investment strategies that cater to different financial needs. SIP is best for investors looking for disciplined, long-term investing, while STP is ideal for those with a lump sum who want to reduce market risk. Understanding your financial goals and risk tolerance will help you decide which strategy suits you best.

By leveraging the power of SIP and STP effectively, investors can optimize their investment portfolio and achieve financial growth with minimized risks.