Table of Contents

- Introduction

- Revised Income Tax Slabs for FY 2025-26

- Key Updates in the New Tax Regime

- Example Calculation for a Salaried Individual (New Tax Regime)

- Example Calculation for a Salaried Individual (Old Tax Regime)

- Who Should Opt for the New Tax Regime?

- Comparison: Old Tax Regime vs. New Tax Regime

Introduction

The introduction of the New Tax Regime has significantly changed how taxpayers approach income taxation. With revised tax slabs, reduced exemptions, and a simplified structure, this system aims to make tax compliance easier and more transparent. However, many individuals and businesses are still unclear about whether they should opt for the new regime or stick with the old one.

In this detailed guide, we will break down the new tax regime, compare it with the old tax system, and help you understand its pros and cons. By the end of this article, you will have a clear idea of whether the new regime is beneficial for you.

Revised Income Tax Slabs for FY 2025-26

Effective from April 1, 2025, the income tax slabs under the new regime have been restructured as follows:

| Income Slab (INR) | Tax Rate (%) |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 - 8,00,000 | 5% |

| 8,00,001 - 12,00,000 | 10% |

| 12,00,001 - 16,00,000 | 15% |

| 16,00,001 - 20,00,000 | 20% |

| 20,00,001 - 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Key Updates in the New Tax Regime

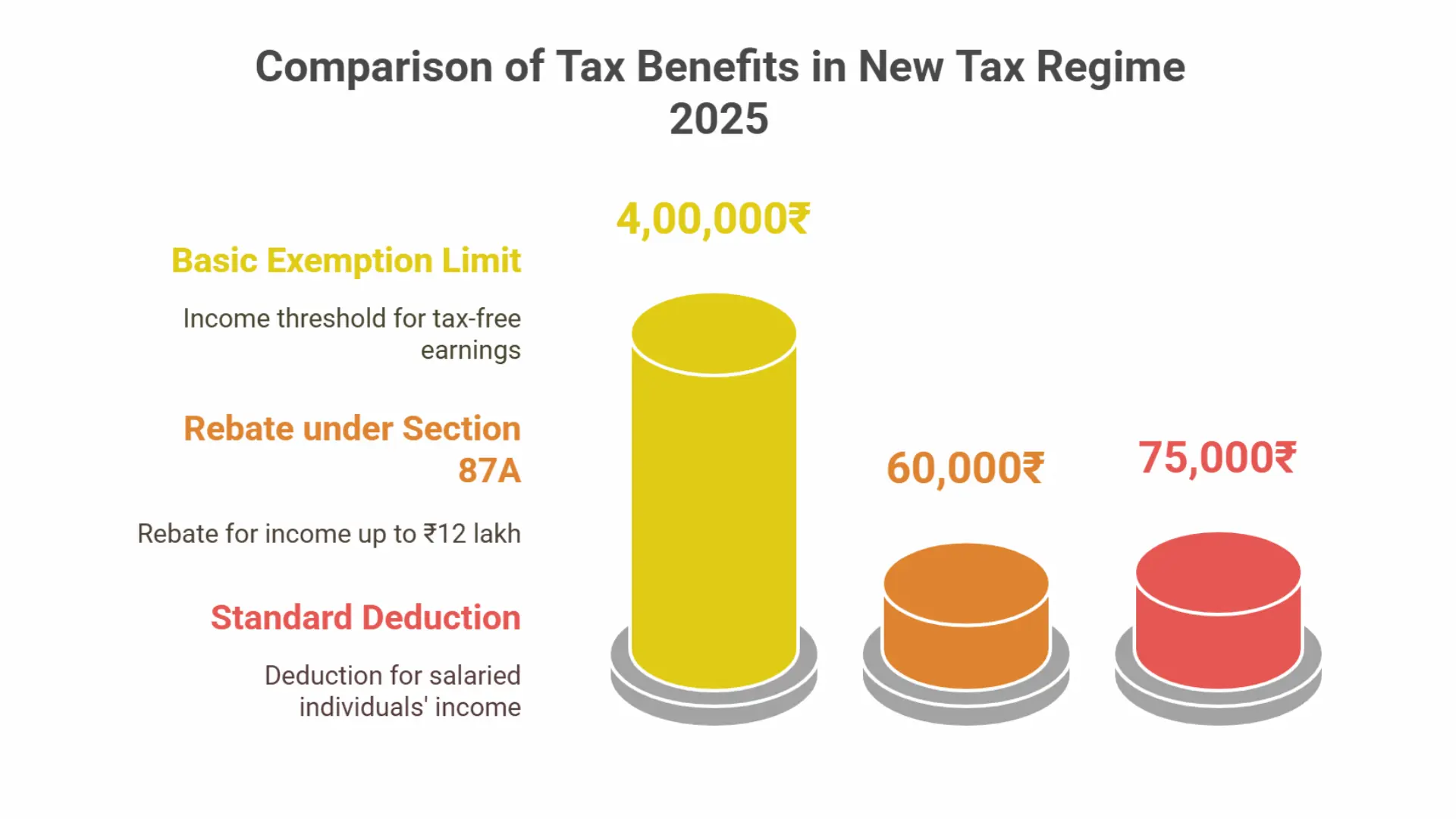

- Increased Basic Exemption Limit: The basic exemption limit has been raised from ₹3 lakh to ₹4 lakh, meaning individuals earning up to ₹4 lakh annually are not required to pay any income tax.

- Enhanced Rebate under Section 87A: The rebate under Section 87A has been increased from ₹25,000 to ₹60,000. Consequently, individuals with a total income up to ₹12 lakh will have zero tax liability after claiming this rebate.

- Standard Deduction for Salaried Individuals: A standard deduction of ₹75,000 has been introduced for salaried taxpayers.

Example Calculation for a Salaried Individual (New Tax Regime)

Example:

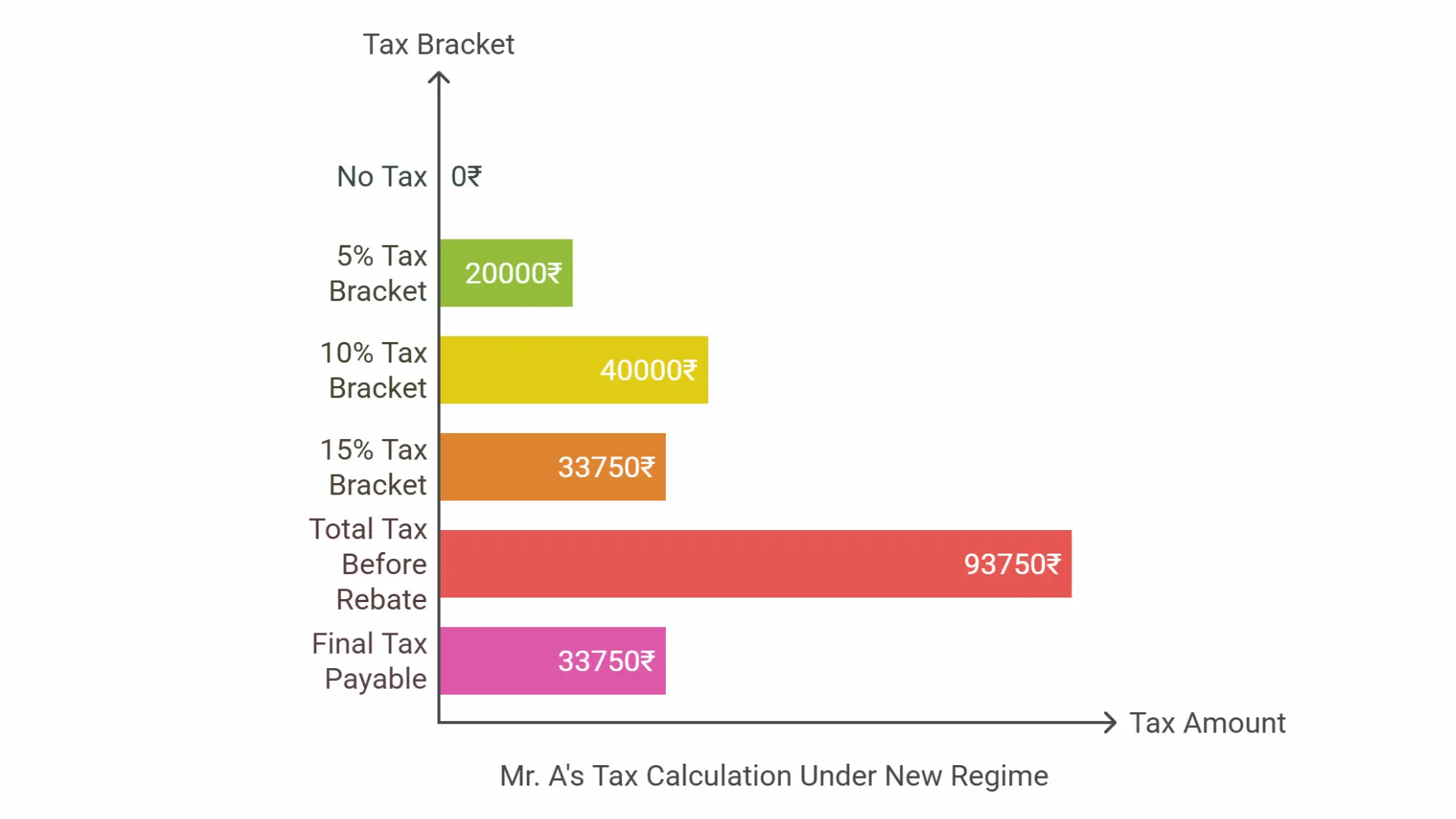

Mr. A is a salaried individual earning ₹15,00,000 annually. Let’s calculate his tax liability under the new regime:

- Gross Income = ₹15,00,000

- Standard Deduction = ₹75,000

- Taxable Income = ₹15,00,000 - ₹75,000 = ₹14,25,000

Now, applying the new tax slabs:

- ₹4,00,000 – No tax

- ₹4,00,001 - ₹8,00,000 (5%) = ₹4,00,000 × 5% = ₹20,000

- ₹8,00,001 - ₹12,00,000 (10%) = ₹4,00,000 × 10% = ₹40,000

- ₹12,00,001 - ₹14,25,000 (15%) = ₹2,25,000 × 15% = ₹33,750

| Total Tax Payable = ₹20,000 + ₹40,000 + ₹33,750 = ₹93,750 |

After applying Section 87A rebate (₹60,000 for income up to ₹12 lakh), Mr. A’s final tax payable = ₹93,750 - ₹60,000 = ₹33,750 .

Thus, under the New Tax Regime , Mr. A will pay ₹33,750 as income tax.

Example Calculation for a Salaried Individual (Old Tax Regime)

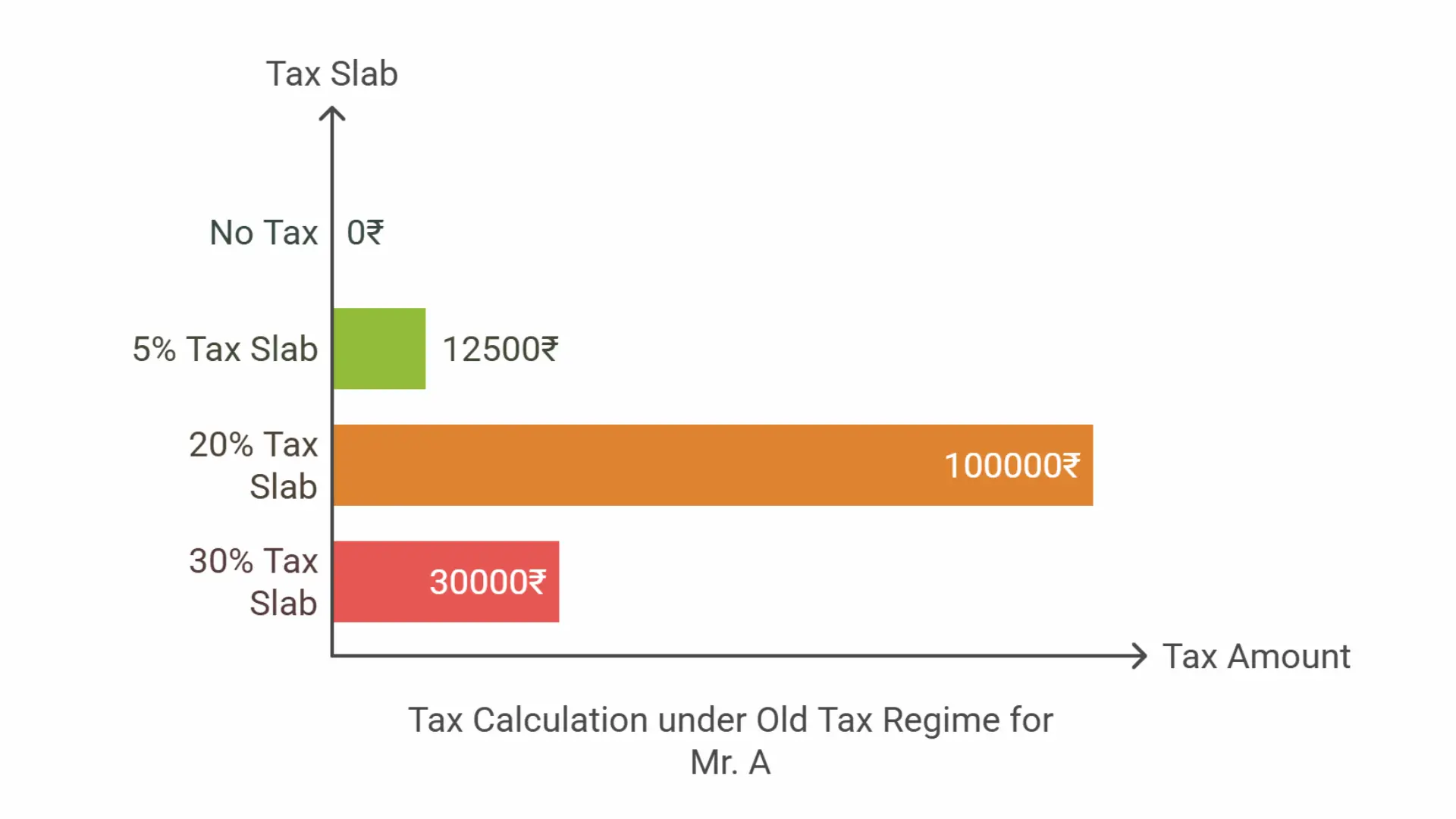

Now, let’s calculate the tax liability under the Old Tax Regime for the same income.

Example:

Mr. A earns ₹15,00,000 annually and claims the following deductions:

- Standard Deduction = ₹50,000

- Section 80C Deduction (EPF, PPF, LIC, ELSS) = ₹1,50,000

- Section 24 (Home Loan Interest Deduction) = ₹2,00,000

- Gross Income = ₹15,00,000

- Total Deductions = ₹50,000 + ₹1,50,000 + ₹2,00,000 = ₹4,00,000

- Taxable Income = ₹15,00,000 - ₹4,00,000 = ₹11,00,000

Now, applying the old tax slabs:

- ₹2,50,000 – No tax

- ₹2,50,001 - ₹5,00,000 (5%) = ₹2,50,000 × 5% = ₹12,500

- ₹5,00,001 - ₹10,00,000 (20%) = ₹5,00,000 × 20% = ₹1,00,000

- ₹10,00,001 - ₹11,00,000 (30%) = ₹1,00,000 × 30% = ₹30,000

| Total Tax Payable = ₹12,500 + ₹1,00,000 + ₹30,000 = ₹1,42,500 |

Thus, under the Old Tax Regime , Mr. A will pay ₹1,42,500 as income tax.

Who Should Opt for the New Tax Regime?

The new tax regime benefits taxpayers who:

- Do not claim multiple exemptions and deductions.

- Prefer a simpler tax calculation method.

- Have lower tax-saving investments.

- Want lower upfront tax rates without documentation hassles.

Comparison: Old Tax Regime vs. New Tax Regime

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Rates | Higher | Lower |

| Exemptions/Deductions | Multiple available | Mostly removed |

Standard Deduction | Available (₹50,000) | ₹75,000 |

Section 80C Benefits | Available (up to ₹1.5L) | Not available |

HRA & LTA | Available | Not available |

Best for | Those with high deductions | Those with fewer deductions |

Conclusion

The new tax regime presents a simplified structure with lower tax rates but removes most deductions and exemptions. While it benefits taxpayers who prefer a hassle-free system, those who invest in tax-saving instruments may still find the old tax regime more advantageous. The choice between the two should be based on individual financial goals, tax-saving habits, and overall income structure.

Understanding these tax regimes will help you maximize savings while staying compliant with tax laws. Whether you choose the old or new system, planning your taxes efficiently is key to financial stability and wealth creation.