Introduction

Investing in the share market can be a lucrative way to build wealth, but it's essential to understand the tax implications associated with earnings from stocks. Whether you are a trader or a long-term investor, your gains are subject to income tax regulations . This article breaks down the different types of taxes on stock market income, how they are calculated, and strategies to optimize tax liability legally.

Types of Share Market Earnings

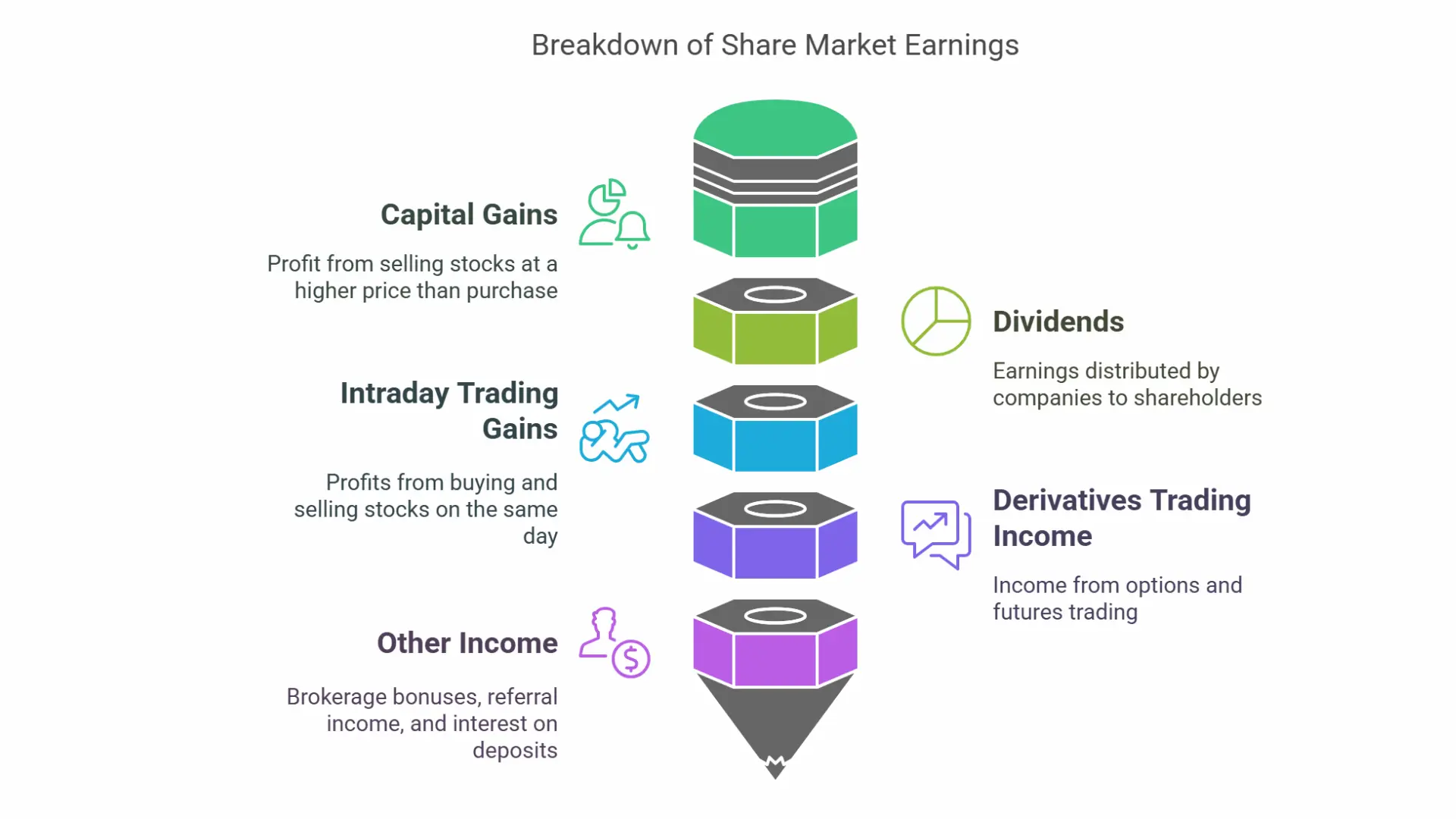

Before diving into tax calculations, it's important to distinguish between different types of income from the share market:

- Capital Gains – Profit from selling stocks at a higher price than the purchase price.

- Dividends – Earnings distributed by companies to their shareholders.

- Intraday Trading Gains – Profits from buying and selling stocks on the same day.

- Derivatives Trading Income – Income from options and futures trading.

- Other Income – Brokerage bonuses, referral income, and interest on stock-related deposits.

Capital Gains Tax on Share Market Earnings

Short-Term Capital Gains (STCG)

Short-term capital gains apply when you sell stocks within one year of purchase. The tax rate varies based on the country, but in many places:

- The rate is 15% for listed securities.

- Gains from unlisted securities might be taxed at the individual’s slab rate .

Example Calculation:

- You purchase 100 shares of Company A at ₹50 per share.

- After 6 months, you sell them at ₹70 per share.

- Your total short-term capital gain = (100 × ₹70) - (100 × ₹50) = ₹2,000 .

- Tax at 15% = ₹300 .

Long-Term Capital Gains (LTCG)

If you hold stocks for more than one year , they qualify as long-term capital gains. Tax rates usually differ:

- In many countries, LTCG on listed shares beyond a certain exemption limit (e.g., ₹1,000 or equivalent) is taxed at 10% or 20% .

- Some jurisdictions offer indexation benefits to adjust for inflation.

Example Calculation:

- You buy 200 shares of Company B at ₹30 per share.

- After 2 years, you sell them at ₹60 per share.

- Your total long-term capital gain = (200 × ₹60) - (200 × ₹30) = ₹6,000 .

- Assuming an exemption of ₹1,000, the taxable amount = ₹5,000 .

- Tax at 10% = ₹500 .

Taxation on Dividends

Dividends received from companies are another form of income. The taxation depends on the country’s tax laws:

- Tax-Free Dividend – Some countries allow tax-free dividends up to a certain limit.

- Dividend Distribution Tax (DDT) – Some governments impose a tax on the company distributing dividends.

- Tax on Dividend Income – Many tax systems now tax dividends as per the investor’s applicable slab rate.

Example Calculation:

- You receive a dividend of ₹2,000 from Company C.

- If dividends are taxed at 10%, the tax payable = ₹200 .

Tax on Intraday Trading Earnings

Intraday Trading as Speculative Business Income

Intraday trading is considered speculative business income rather than capital gains. Hence, profits from intraday trading are added to your total taxable income and taxed according to your tax slab.

Example Calculation:

- You make a profit of ₹5,000 from intraday trading.

- If your tax slab rate is 30% , tax payable = ₹1,500 .

Expenses Deduction

Since intraday trading is considered a business, traders can deduct:

- Brokerage fees

- Internet charges

- Advisory fees

- Other trading-related expenses

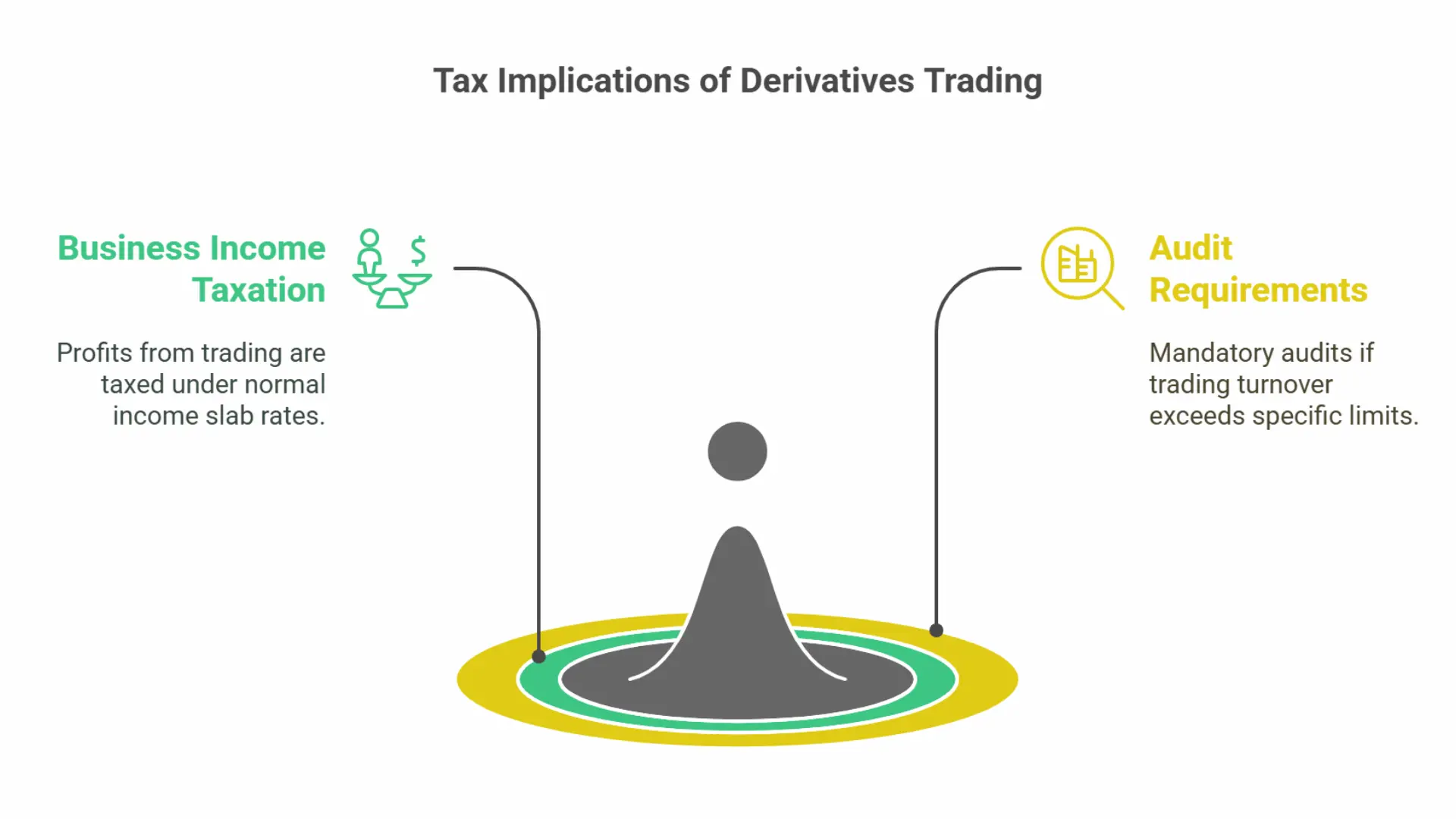

Tax on Derivatives Trading (Futures & Options)

Futures and Options as Business Income

Profits from Futures & Options (F&O) trading are treated as business income and taxed under normal slab rates.

Audit Requirements

If F&O turnover exceeds a prescribed limit (varies by country), a tax audit might be mandatory.

Example Calculation:

- You earn ₹8,000 from options trading and ₹3,000 from futures trading.

- Your total derivatives income = ₹11,000 .

- If your tax slab rate is 25% , tax payable = ₹2,750 .

How to Calculate Taxes on Share Market Earnings?

Here’s a simple breakdown of how taxes are calculated:

- Classify Income – Determine whether income falls under capital gains or business income .

- Calculate Taxable Amount – Deduct expenses and apply the appropriate tax rate.

- Consider Exemptions – Some countries offer tax exemptions or deductions.

- Pay Advance Tax – If tax liability exceeds a threshold, an advance tax payment may be required.

How to Reduce Tax on Share Market Earnings?

1. Use Tax Exemptions Wisely

Many governments provide exemptions on LTCG up to a certain amount. Utilize these exemptions by timing your stock sales accordingly.

2. Offset Losses Against Gains

Most tax authorities allow investors to offset capital losses against gains. You can:

- Adjust short-term losses against short-term and long-term gains .

- Carry forward losses for a few years to reduce future tax liability.

Example:

- Short-term loss = ₹3,000

- Short-term gain = ₹5,000

- Net taxable gain = ₹2,000 (instead of paying tax on ₹5,000)

3. Invest in Tax-Free Securities

Consider investing in tax-free bonds or securities that provide returns without tax implications.

4. Utilize Tax-Advantaged Accounts

Certain investment accounts offer tax benefits. Examples include:

- Retirement accounts with tax-deferral options.

- Tax-saving mutual funds or index funds with favorable tax treatment.

5. Keep Accurate Records

Maintaining a record of all transactions ensures correct tax filing and reduces errors.

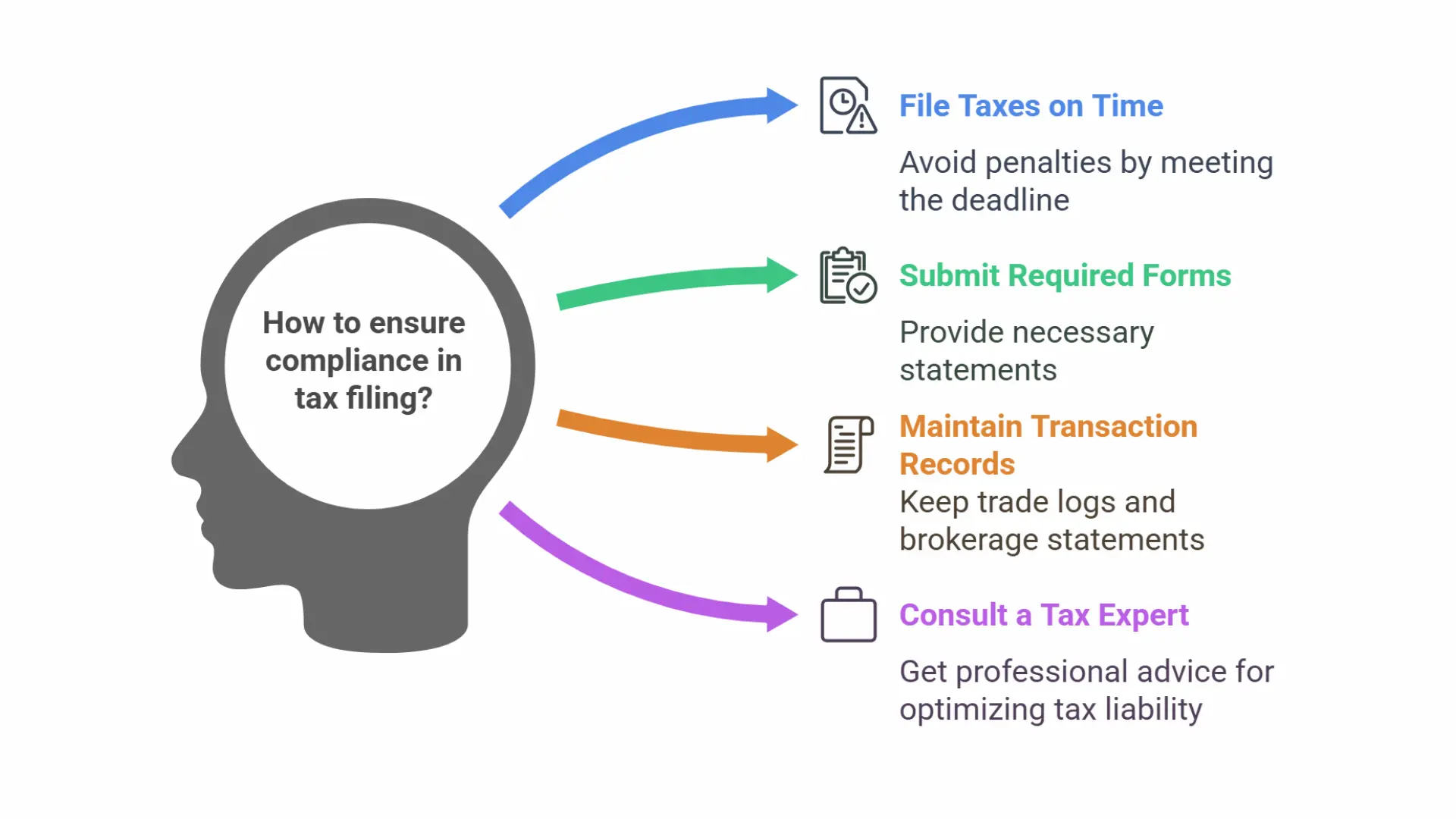

Tax Filing and Compliance

To ensure compliance, follow these steps:

- File Taxes on Time – Avoid penalties by meeting the deadline.

- Submit Required Forms – Provide necessary statements, such as an equivalent.

- Maintain Transaction Records – Keep trade logs and brokerage statements.

- Consult a Tax Expert – Get professional advice for optimizing tax liability.

Common Tax Mistakes to Avoid

- Ignoring Tax Deductions – Failing to claim trading expenses.

- Not Reporting All Income – Omitting dividend or bonus income.

- Incorrectly Classifying Income – Treating business income as capital gains.

- Missing Tax Filing Deadline – Resulting in penalties.

Conclusion

Understanding income tax on share market earnings is crucial to avoid unnecessary tax burdens. Whether you are a trader or a long-term investor, knowing how to classify your income, apply deductions, and optimize your tax liability can significantly impact your financial growth. Always stay updated with the latest tax laws, and when in doubt, consult a tax professional to ensure compliance and maximize returns.