Learn how the Bear Put Spread strategy works for bearish market conditions. Discover its setup, payoff scenarios, risks, rewards, and real-world examples with NIFTY & Bank Nifty. Ideal for advanced traders seeking limited-risk, limited-reward options strategies.

Learn how to trade the Bear Call Spread options strategy—ideal for bearish or range-bound markets. Discover setup, payoff, advantages, and real-world examples.

Learn how to trade the Bull Put Spread strategy for stable profits in moderately bullish markets. Discover its setup, breakeven point, max profit/loss, payoff chart & real examples.

Learn how the Bull Call Spread options strategy works with real examples. Understand payoff, risk, profit potential, and how to apply this bullish strategy in the Indian stock market.

Learn everything about the Short Put Option Strategy — a bullish options trading approach to earn premium income with limited profit and unlimited risk. Includes real-world NIFTY and Bank Nifty examples, payoff charts, and risk-reward analysis.

Learn how the Long Put Option Strategy works, with real examples, payoff charts, and risk-reward insights. Ideal for bearish traders seeking limited-risk trades.

Learn everything about the Short Call (Naked Call) Options Strategy. Understand how it works, risks, rewards, breakeven point, and real-world examples in stock and index trading. Ideal for experienced options traders.

Learn the Long Call Option trading strategy—ideal for bullish traders. Discover risk, reward, breakeven, and real examples with Nifty & Bank Nifty.

Before beginning to trade options, it is essential to thoroughly understand options pricing and the different aspects that determine an option's value. Several option pricing methods are also employed to determine the value of a call or put option.

Trading stock futures and options offer a number of advantages. All securities do not, however, have access to these derivatives. They are only available on stocks that are listed on the F&O stock exchange.

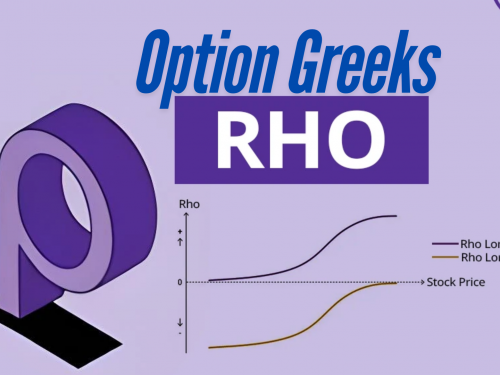

Rho is the part of option Greek that measures how sensitive an option's price is to changes in interest rates. In simpler terms, it tells us how much the price of an option might change if interest rates go up or down.

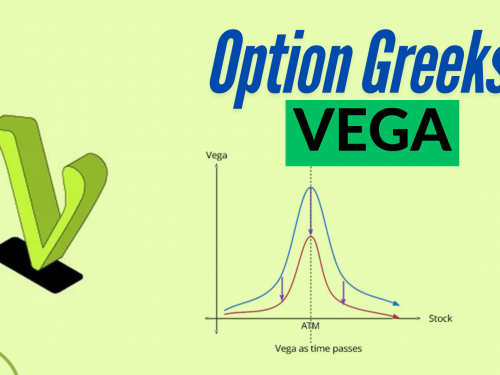

Volatility based on these, the work of showing the change in the option premium is done by Vega Greek. When the volatility is high in the market, there is a sharp fall or rise in the premium of the option, the increase in the premium of the option Vega indicates a decline.