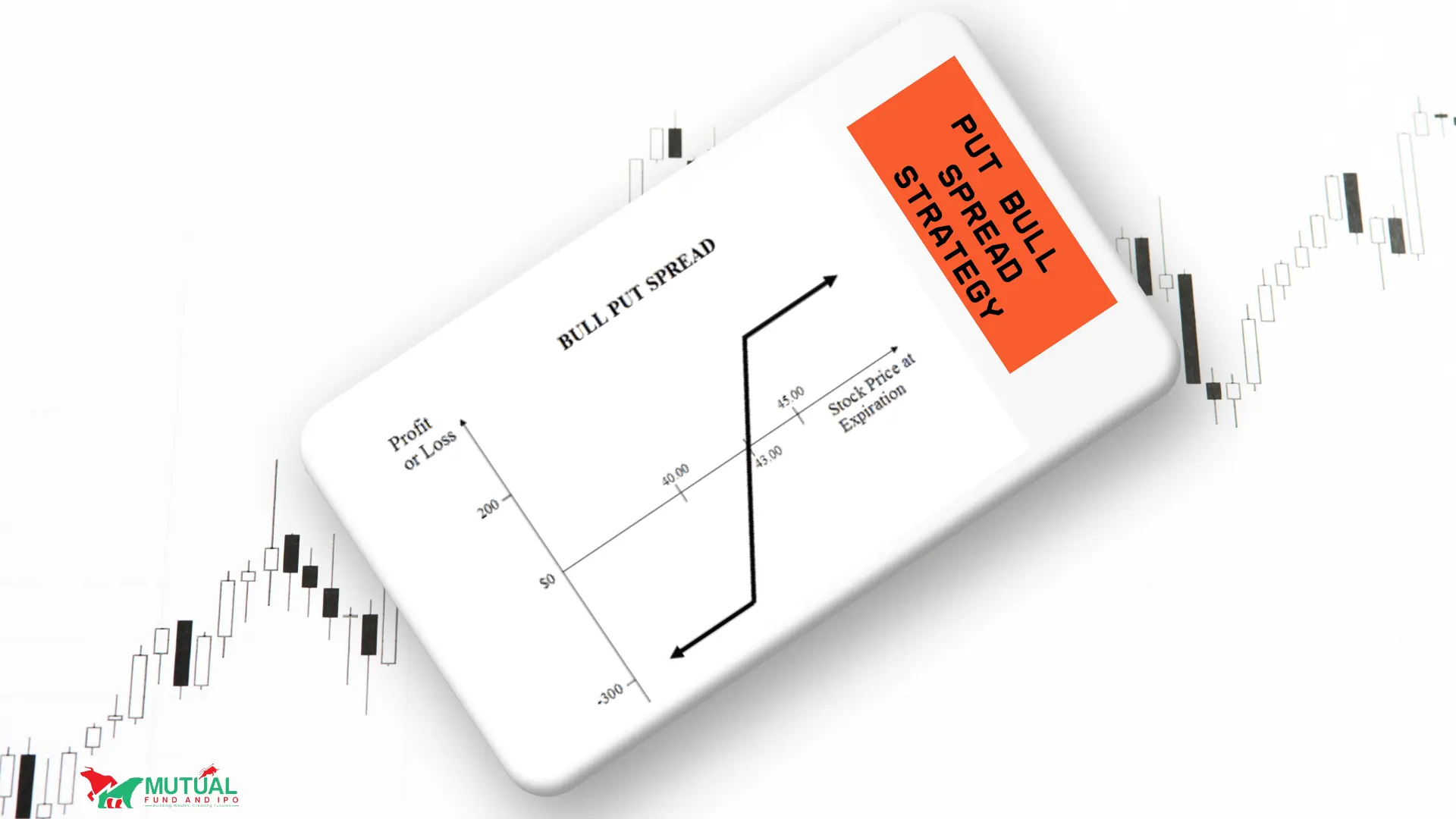

What is a Put Bull Spread?

A put bull spread is an options trading strategy where you buy one put option and sell another put option with a lower strike price, both with the same expiration date. It's called "bull" because you're betting the stock price will go up.

Important components

Buy one put option with a higher strike price.

Sell another put option with a lower strike price.

Both options have the same expiration date.

How to work Put Bull Spread?

Let's understand step by step:

You have to buy a put option at a higher strike price.

Then you have to sell a put option at a lower strike price.

As the stock price moves upside, both options lose value, but the one you sold loses more, where you will get a profit.

Your profit is the difference between what you paid and what you received.

Example of a Put Bull Spread option strategy:-

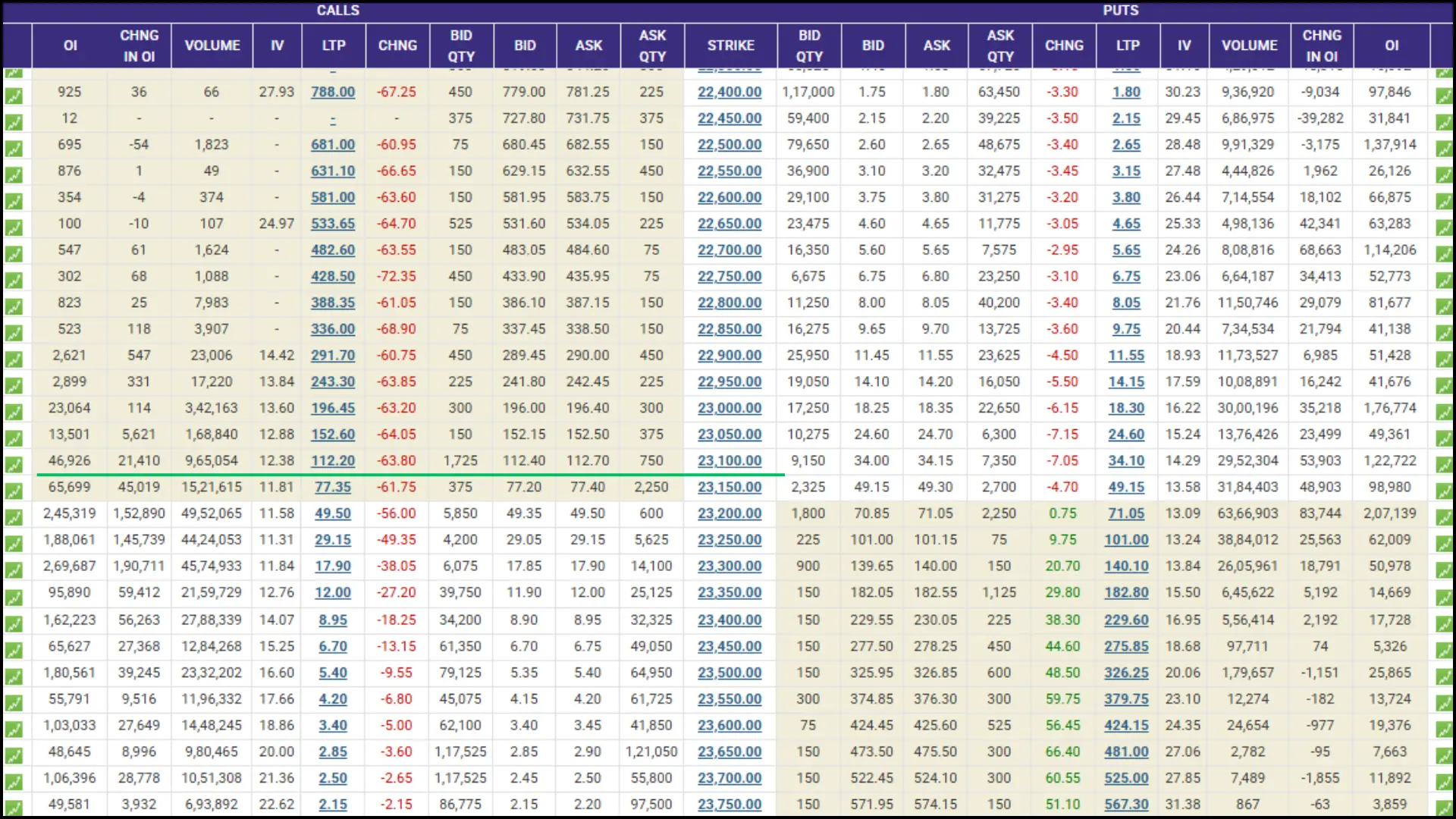

For Example:- The NIFTY Index is trading at 23212, where NIFTY 23200 is “At the money”, If I expect that market will not go down from here. But even, if the market does not go up much, then I will sell the NIFTY 23200PE option at ₹77 and buy “Out the money” put option NIFTY 23050PE at ₹25, so that if there is a decline in the market, I do not suffer much loss, by doing this. If there is a rise in the market then the price of NIFTY 23200PE will reduce. Even if there is not much momentum in the market and the market closes above 23200, the price of NIFTY 23200PE will remain very low, due to which we will only make a profit.

| NIFTY 23200PE price will be zero from ₹77, we will get profit full premium price and NIFTY 23050PE also will be zero that is buying and we will lose ₹25. |

Advantages of Put Bull Spreads option strategy:-

This strategy is more beneficial if used a day before the expiry, but if there are more days left before the expiry then it is not very beneficial. If we have left the call option to make a profit but require a fund margin, then the fund margin can be met by buying the “Out the money” put option, hence this strategy is also used.

There are some good reasons to consider this strategy for profitability:

Limited risk: You know the most you can lose upfront, loss is already fixed.

Cheaper than buying a call option outright or losing.

Can make money even if the stock price doesn't move much like a sideways market.

Disadvantages of Put Bull Spreads option strategy:-

There are also some disadvantages:

Limited profit potential, even the market will have huge upside movement.

You need to be right about the direction of the stock or index.

Requires more capital than just buying a call option with limited risk and reward.

When, you have to use the Put Bull Spread option strategy:-

You think a stock will go up moderately or the market will go sideways only.

You want to limit your risk, if any downfall.

You're satisfied with capping your potential profit.

| "Unlock Your Investment Journey – Open a Free Demat Account with Angel One Today" Leading brokers for Indian Stock Market |