What’s a Bull Spread Options Strategy and How Does It Work?

What is a Bull Spread?

Bull Call Spread as the name suggests, is made by combining, Bull i.e. market is bullish and Call Spread made by combining two call options, with the same expiration date, but at different strike prices. In which the “In the money” call option or “At the money” call option is bought and the “Out the money” call option is sold. Which is called the “ Bull call spread” option trading strategy.

When to use Bull Call Spread strategy?

A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future.

Important Components of a Bull Spread:-

Buying a call option at a specific in-the-money or at-the-money strike price.

Selling another call option at a higher strike price (Out the money) option.

Both options have the same expiration date.

How to work Bull Spread?

let's understand this step by step:

First, we buy a call option at a lower strike price (In the money or at the money option) This gives us the right to buy the stock at that price.

Then, we sell another call option at a higher strike price (Out the money option). This creates an obligation to sell the stock at that higher price, if the option is exercised.

The difference between these strike prices is our maximum potential profit.

Advantages of Bull Call Spread:

Limited Risk: Your maximum loss is capped at the net premium paid.

Lower Cost: It's cheaper than just buying a call option out of the money option.

Flexibility: You can adjust the strike prices to match your risk tolerance.

Disadvantages of Bull Call Spread:

Limited Profit: Your gains are capped at the difference between strike prices minus the net premium paid.

Requires More Capital: You need enough money to buy the lower strike call option.

Time Decay: Both options lose value as the expiration date.

When do you have to use a Bull Spread option trading strategy?

You're moderately bullish on a stock or sideways.

You want to limit your potential losses.

The market is somewhat volatile, and you want to reduce the cost of buying options.

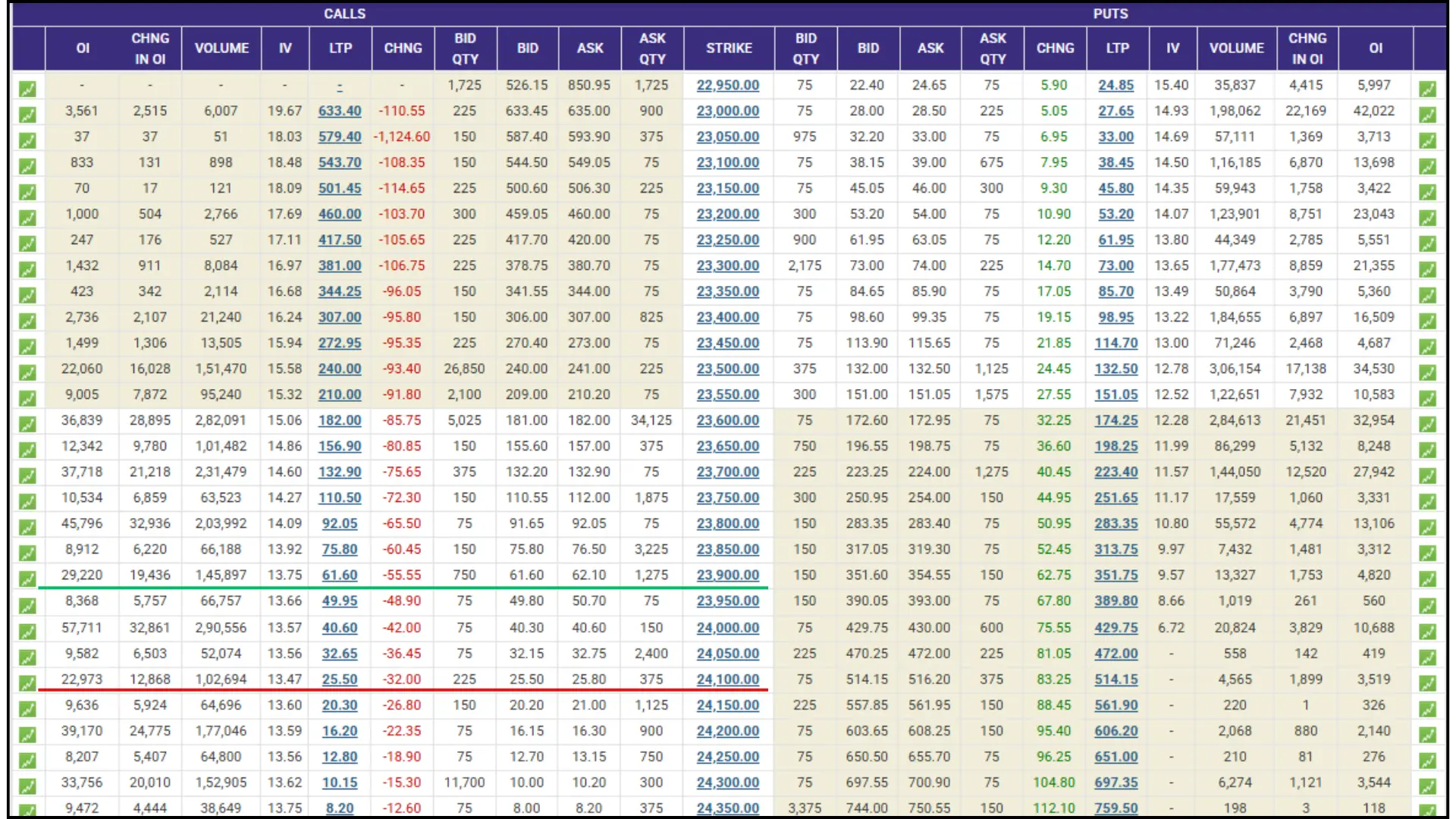

Example of a Bull Call Spread:-

In the Live market: If I feel the market is going to go up from here or may go up, if not today then tomorrow, I will buy the NIFTY 23350CE option at ₹344, and if I feel there is a slight fall in the market, It is possible that there may not be much rise in the market tomorrow due to which NIFTY 23350CE call option may not get that much profit or there may be a slight loss, then to save the loss due to this, I will go for option selling “Out the money” call option. We have to sell the NIFTY23750CE option at ₹110. Even if I suffer a small loss, I will benefit from NIFTY 23550CE.

If there is more growth in the Nifty, then the NIFTY 23350CE option will see more profit, due to which I will remain in profit, but if there is a loss, then the NIFTY 23750 CE option will save me from the loss.

Current Nifty | 23550 |

Option Lot Size | 75 |

Strike Price of Call Option | 23350 |

Premium Paid | 344 |

Strike Price of short Call Option | 23750 |

Premium Received | 110 |

Net Premium Paid | 234 |

Break Even Point | 23984 |

Fund required: In the “Bull call spread” to make in Nifty option and Fin Nifty option around 75-80k funds are required, Whereas in the Bank Nifty option, the fund utilization is around ₹75-85K and also depending on the lot size, strike price and days left to expiry, the fund utilization varies more or less.

NOTE:- To make a “Bull call spread” option strategy, you have to first create a buying position, then create a selling position, but during profit booking, you have to square off the selling position first, then square off the buying position.

"Unlock Your Investment Journey – Open a Free Demat Account with Angel One Today" |