What is Long Call Butterfly and How to Work?

What is a Long Call Butterfly?

A long call butterfly is an options trading strategy that involves three different call options with the same expiration date but different strike prices.

Here's step by step:-

You have to buy one call option at a lower strike price near the “At the Money” option.

You have to sell two call options at a middle-strike price the “Out the Money” option.

You have to buy one call option at a higher strike price full the “Out the Money” option.

The name "butterfly" comes from the graph of the profit/loss diagram, which looks a bit like a butterfly with spread wings.

How to work Long Call Butterfly?

To make long call butterfly strategy, follow these steps:

Choose an underlying stock or NIFTY, BANK NIFTY, or SENSEX index.

Select an expiration date for all your 3 different strike options.

Pick three strike prices: lower, middle, and higher strike.

Buy one call at the lower strike price near the “At the money” option.

Sell two calls at the middle strike price “Out the money” option.

Buy one call at the higher strike price full “Out the money” option.

Example for Long call butterfly strategy:-

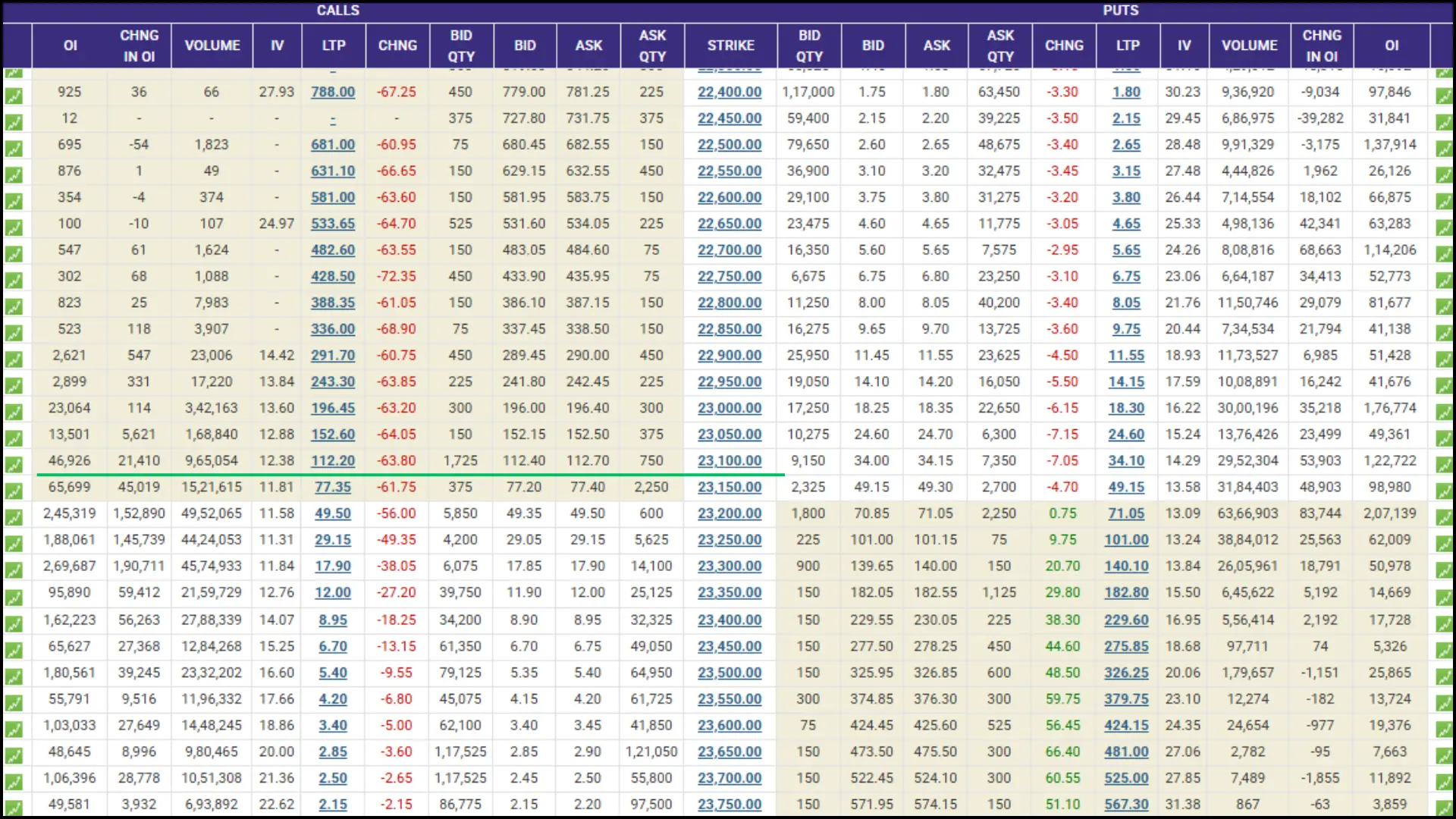

For example, NIFTY is trading at 23212 and 23200 is “At the money”, where we are thinking that NIFTY can go up to 23500 to 23600 levels, Where we have to make a Long Call Butterfly strategy.

To create 1st Position

To create 2nd Position

To create 3rd Position |

Now here we calculate the premium for all three positions.

1st Position (PAID PREMIUM) 2nd Position (RECEIVED PREMIUM) 3rd Position (PAID PREMIUM) |

| Total Buy Position =NIFTY 23000CE + NIFTY 23250CE =14700+2175= ₹16875 |

Total sell position = NIFTY 23150CE 2 LOT |

Total Premium Paid = Total Buy Positions – Total Sell Positions = ₹16875--₹11700 |

The total premium we have paid to create the position can result in a maximum loss of ₹5175 if the market falls or the market moves higher.

What should be the Risk and Reward for a long call butterfly strategy?

Maximum loss: The most you can lose is the net premium paid for the trade.

Maximum profit: Your best-case scenario is when the stock price is exactly at the middle strike price at expiration (2 lots sold at Middle strike price).

Break-even points: There are two slightly above the lower strike and slightly below the higher strike.

When do you have to use this Strategy?

- You think a stock will go up moderately or the market will go sideways only.

- You want to limit your risk to small losses only.

You're looking for a potentially high return on invested trading amount.

Advantages of Long Call Butterfly strategy:-

Limited risk of your deployed capital.

Potential for high percentage returns of your deployed capital.

Works well in low-volatility environments.

Can be adjusted as the market moves.

Disadvantages of Long Call Butterfly strategy:-

No strategy is 100% perfect, Here are some disadvantages to keep in mind:

Complex to set up and manage the position.

Requires precise price movement for maximum profit.

Brokerage can be expensive due to multiple-option contracts.

Time decay can work against you, if the stock doesn't move as expected.