What is a Long Call Strategy? And How to Work?

Long-call option trading strategy

Long Call Option Trading Strategy is a very simple and very basic Strategy, which is the most used. Whenever a trader, If any index is bullish in the market or any stock is bullish, then buys the option of that index or calls the option of that stock for big profits by taking a small risk. The position created in this way is called LONG CALL.

For example, If the Nifty index is going to rise then the Nifty call option can be bought in “ at the money” or “in the money” call option, and the call option can be sold after getting good profits.

What is a Long Call Strategy?

A long-call strategy is when you buy a call option, giving you the right to buy (but not the obligation) a stock at a specific price within a set timeframe.

Important components of a Long Call

Call Option: The contract you're buying for a long position.

Strike Price: The price at which you can buy the Index or stock call option.

Expiration Date: When your "option contract" expires.

How to Work a Long Call Strategy?

Choose an index or stock, you think will increase in value.

Buy a call option for that stock or index near the “At the money” or “Out the money” option.

Wait and watch the stock price movement.

If the stock price goes above your strike price, you will be in profit.

After getting a good profit, you can sell or if the market is in your favor you can trail your profit.

Example of Long call option trading strategy:-

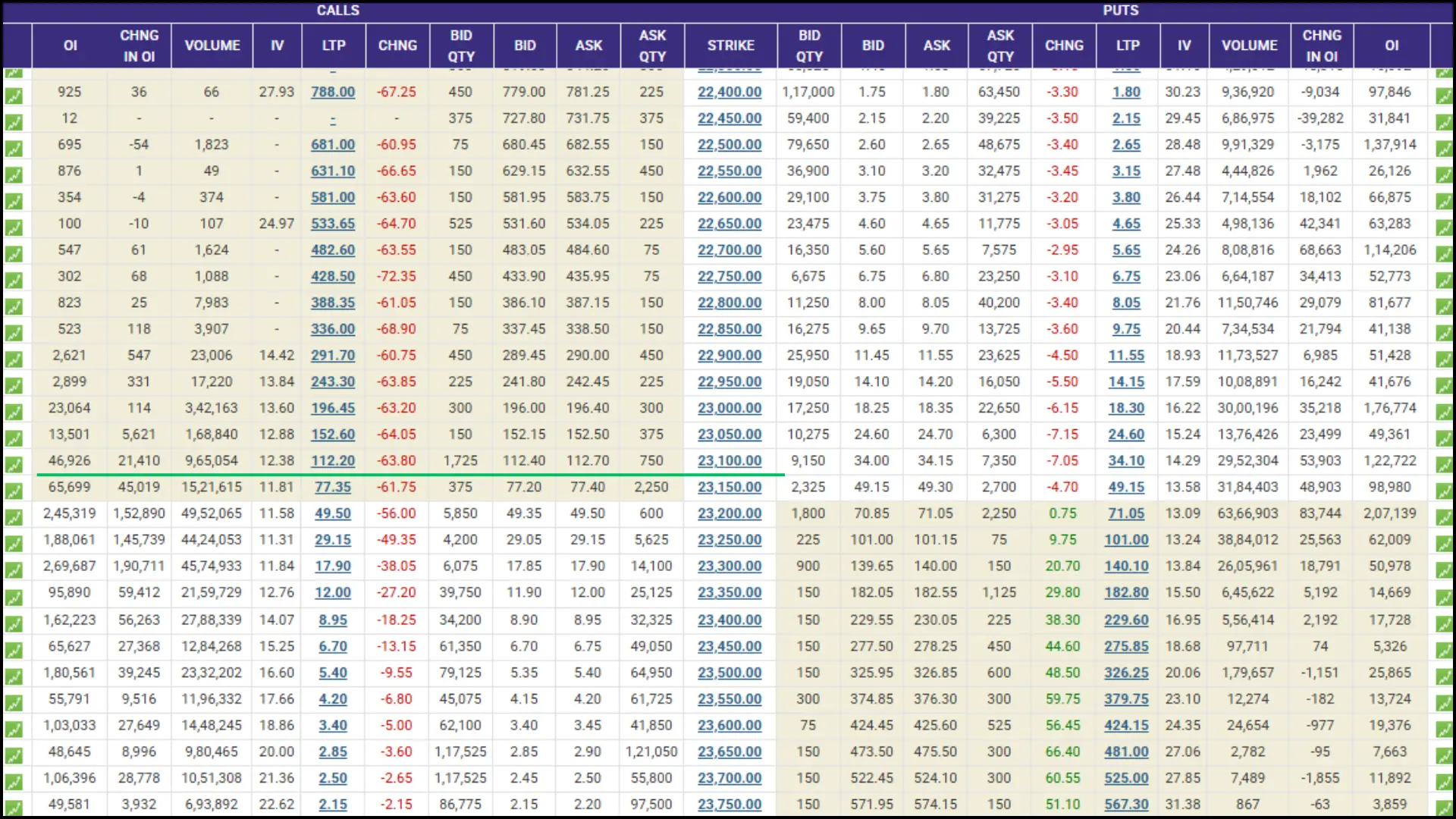

Suppose, you buy a call option of the nifty index NIFTY 23100CE and currently NIFTY INDEX is trading 23100 level, and the strike price of 100, expiring in 3 days.

If the Nifty rises to 100 Points, you'll be in a good profit.

You could buy the Index or stock option at market price for example ₹100 Nifty (lot size 75) and immediately sell it at ₹120, making a ₹20*75=1500 profit

Advantages of Long Call Strategy:

- Limited Risk: You can't lose more than what you paid for the option contract.

- High Potential Returns: If the stock price moves fast and high, then your profits are higher than expected.

- Leverage: Control more shares with less capital.

Disadvantages of the Long Call Strategy:

- Time Decay: Options lose value as they approach expiration.

- Volatility: Stock price needs to move enough to offset the option cost.

- Total Loss: If the stock price doesn't reach the strike price, you could lose your entire investment.

The right time to use a Long Call Strategy:

- You're bullish on a stock or index.

- You want to limit your risk and unlimited profit.

- You're looking for leveraged returns like option trading.

Tips for Successful Long Call Trading

- Do your homework on the underlying stock or index or do paper trade for few times.

- Pay attention to implied volatility.

- Consider the time until expiration carefully.

- Have a clear exit and entry point.

- don't do average, if loss is running.