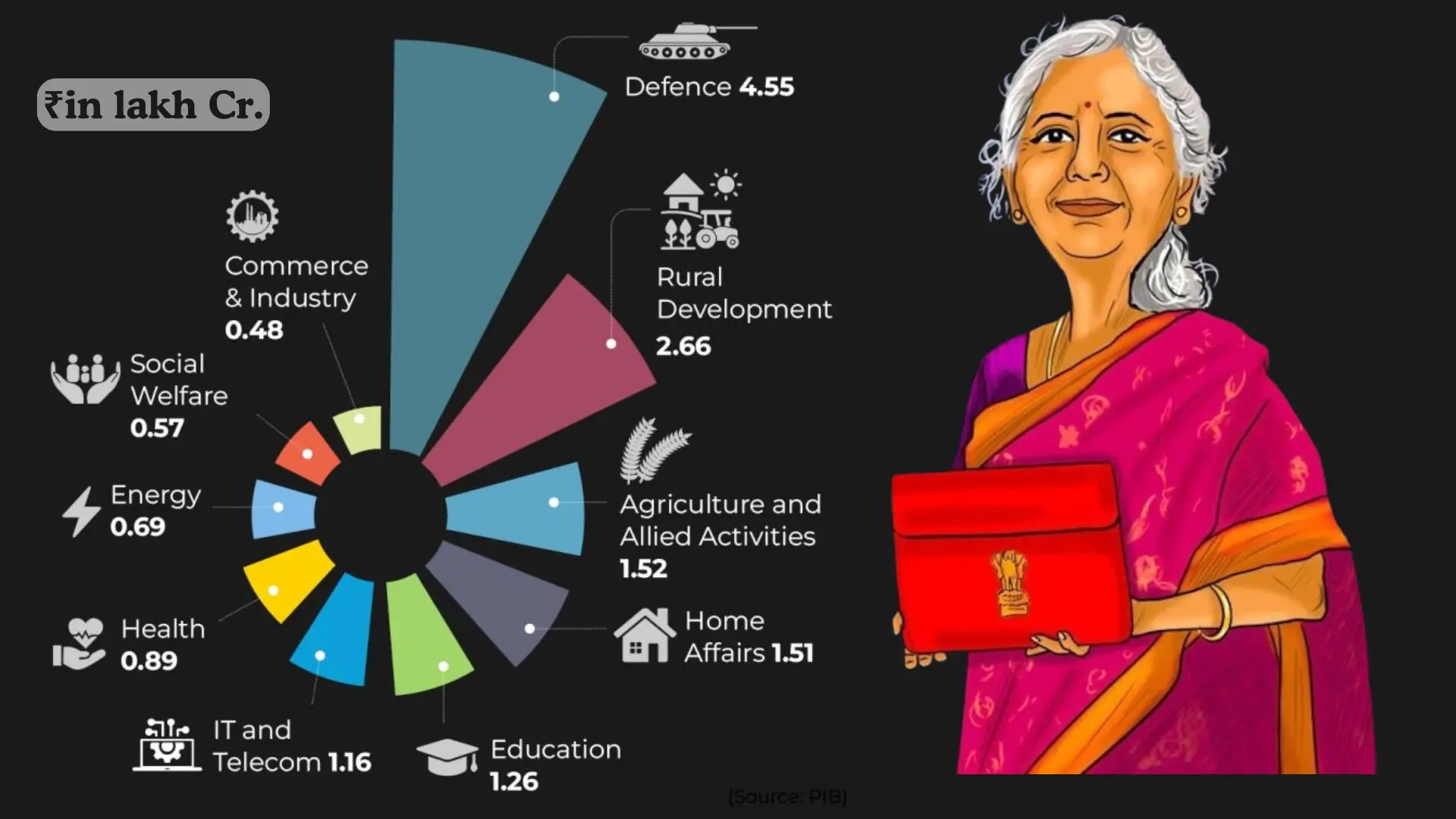

In Budget 2025-26, the Ministry of Finance was allocated Rs 19.39 lakh crore, followed closely by the Ministry of Defence with a significant share of funds. Other key sectors, such as the Ministry of Road Transport and Highways, Ministry of Railways, and Ministry of Home Affairs, also received substantial allocations. Here, we highlight the major ministry fund allocations in the Union Budget 2025.

| Sr.No. | Ministry | Funds Allocated |

| 1. |  | The Ministry of Defence received Rs 6.81 lakh crore. |

| 2. |  | The Ministry of Road Transport and Highways was allocated Rs 2.87 lakh crore. |

| 3. |  | The Ministry of Railways received Rs 2.55 lakh crore. |

| 4. |  | The Ministry of Home Affairs was allocated Rs 2.33 lakh crore. |

| 5. |  | The Ministry of Consumer Affairs, Food, and Public Distribution received Rs 2.16 lakh crore. |

| 6. |  | The Ministry of Rural Development was allocated Rs 1.90 lakh crore. |

| 7. |  | The Ministry of Chemicals and Fertilizers received Rs 1.62 lakh crore. |

| 8. |  | The Ministry of Agriculture and Farmers Welfare was allocated Rs 1.38 lakh crore. |

| 9. |  | The Ministry of Health and Family Welfare received Rs 1.00 lakh crore. |

The stock market's reaction to the budget for 2025: Which Stock stands to gain or lose?

The Union Budget 2025 keeps capital expenditures modest while providing a significant boost to consumption through personal income tax relief. The pronouncements of the Finance Minister's budget have caused stocks in a number of industries, including FMCG, autos, consumer durables, insurance, and green energy, to rise. In the meantime, the lack of a significant capital expenditure boost caused railway, defense, and infrastructure stocks to decline.

Here is a look at the Budget's impact per sector.

FMCG and consumer stocks

| It is anticipated that an increased standard deduction of Rs 75,000 and an expansion of the income tax exemption up to Rs 12 lakh will increase disposable income. This move is expected to increase spending on everyday necessities, which will help companies like HUL, ITC, Dabur, Marico, and Nestle, as urban demand has previously shown signs of tiredness. Indirect benefits could also benefit suppliers like Polyplex and Uflex. |

Stocks of consumer and automotive durables

| Maruti Suzuki, Tata Motors, and Hero MotoCorp stand to gain from increased demand for entry-level cars due to more disposable income brought about by tax incentives. As customers increase their spending on home appliances and electronics, consumer durable brands like Dixon Technologies, Voltas, Whirlpool, Blue Star, Crompton Greaves, Havells, Titan, and V Guard Industries are also anticipated to enjoy growth. |

Stocks of insurance

| Private insurers will benefit greatly from the government's decision to raise the FDI cap in the insurance industry from 74% to 100%. As more foreign investment could improve capital availability and company expansion, companies including HDFC Life, SBI Life, ICICI Prudential Life, and Star Health saw a sharp gain in response to the announcement. |

Stocks of fisheries

| The Andaman & Nicobar and Lakshadweep fishing industry would be strengthened by government support as well as fishermen's continuous access to Kisan Credit Cards (KCC). This program is probably going to help businesses like Godrej Agrovet, Apex Frozen Foods, and Avanti Feeds. |

Medical stocks

| Under the "Heal in India" campaign, the Budget outlined plans to improve healthcare facilities and encourage medical tourism. Along with diagnostic service companies like Lal PathLabs, Metropolis, and Vijaya Diagnostics, hospitals like Max Healthcare, Medanta, and Apollo Hospitals are expected to benefit. |

Stocks in agriculture

| Businesses involved in agriculture are anticipated to gain from a number of initiatives targeted at boosting the production of pulses and initiating a nationwide campaign on high-yield seeds. These measures are expected to benefit stocks such as Kaveri Seed Company, Mangalam Seed, Godrej Agrovet, and Dhanuka Agritech. |

Green energy resources

| The government's emphasis on developing a clean power technology ecosystem, which includes grid-scale batteries, solar PV cells, and electrolyzers, will help renewable energy companies. The stocks under consideration are Inox Wind, Adani Green, Waaree Energies, and Suzlon Energy. |

Textile stocks

| Textile businesses will benefit from a five-year initiative to increase cotton productivity. Following the announcement, stocks such as Ambika Cotton Mill, KPR Mills, Vardhman Textiles, and Arvind saw increases of up to 9%. |

Defence Stock

| Stocks in the defense industry dropped as much as 9% after the government's FY26 defense budget allocation of Rs 4.92 lakh crore fell short of market forecasts. Investors were also let down by the little increase in capital expenditure from Rs 11.11 lakh crore to Rs 11.2 lakh crore. Hindustan Aeronautics Ltd. (HAL), Bharat Dynamics, Bharat Electronics (BEL), and Bharat Heavy Electricals (BHEL) are among the affected PSU stocks in this sector, which saw a 6% decline. On the other hand, private equities such as Data Patterns, MTAR Technologies, and Paras Defence and Space Technologies experienced a 9% decline. |

Railway Stock

| The absence of a capital expenditure increase in the budget caused a decline in rail stocks. Expectations of a double-digit increase were disappointing as the total railway capital expenditure stayed close to the same at Rs 2.5 lakh crore as the previous year. Following the release of the budget, shares of Jupiter Waggons, Titagarh Rail, IRFC, Texmaco, Ircon, and Rail Vikas Nigam dropped as much as 9%. |

DISCLAIMER: No financial information presented here should be interpreted as advice of any kind or as an offer to purchase or sell securities. Under no circumstances should any of the material presented here be used as a basis for making investment decisions; rather, it is intended solely for educational and informational reasons. Readers should speak with a certified financial advisor before making any real investing decisions based on the information presented here. Any reader who decides based on the information presented here does so at their own risk. Investors should understand that there are unpredictably high risks associated with any equity market investment. This offering is not something the author plans to invest in.