📚 Table of Contents

- ✅ Overview

- 🛠 How It Works

- 💡 When to Use

- 📊 Real-World Example (NIFTY)

- 📘 Stock Example

- 🏦 Bank Nifty Example

- 📌 Summary

- ✅ Pros and Cons

- 🔚 Exit Strategy

- 🔄 Related Strategies

- 📌 Final Thoughts

✅ Overview

The Bear Put Spread—also called a Bear Put Debit Spread—is an advanced options trading strategy. It is used when a trader expects a moderate decline in the price of an underlying asset. The setup involves buying an In-the-Money (ITM) Put and selling an Out-of-the-Money (OTM) Put with the same expiry.

🧠 Key Features:

- Strategy Type: Bearish

- Skill Level: Advanced

- Positions: ITM Put Buy + OTM Put Sell

- Risk: Limited

- Reward: Limited

- Breakeven: Strike Price of Long Put – Net Premium Paid

🛠 How It Works

Unlike a Bear Call Spread, the Bear Put Spread involves a net debit because you're paying a higher premium for the long put than what you receive from selling the short put. This results in a capped risk and capped reward.

Traders implement this strategy when they expect the underlying asset to fall slightly to moderately before expiry.

💡 When to Use Bear Put Spread

- When you are moderately bearish on the underlying asset

- When you want to limit downside risk

- When you want to reduce the cost of a single long put

📊 Real-World Example (NIFTY)

Assume NIFTY is trading at ₹25,400. A trader sets up:

| Order | Option | Strike Price | Action |

|---|---|---|---|

| Buy | NIFTY18APR25600PE | ₹25,600 | ITM Put (Buy) |

| Sell | NIFTY18APR25200PE | ₹25,200 | OTM Put (Sell) |

- Profit: (Strike Difference – Net Premium Paid) × Lot Size

- Loss: Net Premium Paid

If NIFTY rises or stays flat:

Both options expire worthless, resulting in maximum loss, which is the net premium.

📘 Example: Stock at ₹38

Stock trading at ₹38 in June. You anticipate a decline.

| Option | Premium | Action |

|---|---|---|

| July ₹40 Put | ₹3 | Buy |

| July ₹35 Put | ₹1 | Sell |

Lot Size: 100 shares

Net Premium Paid: ₹200

🔍 Scenarios

- Stock stays at ₹38

- Long ₹40 Put has ₹2 intrinsic value → ₹200 gain

- Short ₹35 Put expires worthless

- Net gain = ₹0 (breakeven)

2. Stock rises to ₹42

Both options expire worthless

Maximum loss = ₹200

3. Stock falls to ₹34

Long Put gains ₹600

Short Put loses ₹100

Net Profit = ₹300 → Maximum Profit

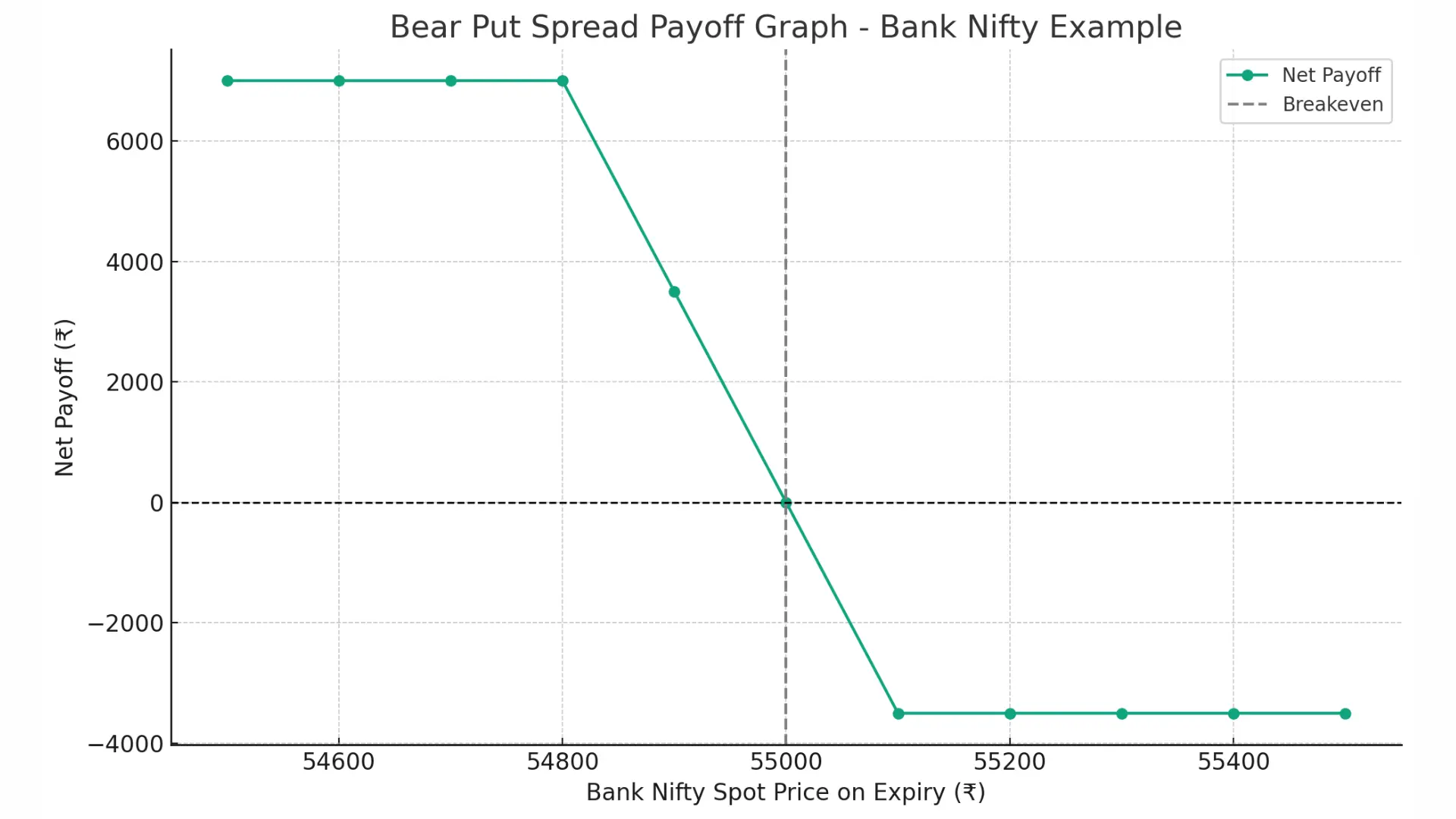

🏦 Example: Bank Nifty

| Spot Price | ₹54,900 |

| Lot Size | 35 |

| Buy ₹55,100 Put | Premium ₹500 |

| Sell ₹54,800 Put | Premium ₹400 |

| Net Premium | ₹100 × 35 = ₹3,500 |

| Breakeven | ₹55,000 |

| Max Profit | ₹7,000 |

| Max Loss | ₹3,500 |

📈 Payoff Scenarios

| Expiry Price | Net Profit/Loss |

|---|---|

| ₹54,600 | ₹7,000 (Max Profit) |

| ₹54,800 | ₹7,000 |

| ₹55,000 | ₹0 (Breakeven) |

| ₹55,200 | -₹2,500 (Max Loss) |

📌 Summary

| Market Outlook | Bearish |

| Strategy Type | Net Debit |

| Risk | Limited |

| Reward | Limited |

| Breakeven | Long Put Strike – Net Premium |

✅ Pros and Cons

✅ Advantages:

- Risk is capped

- Lower cost than buying a standalone put

- Ideal for moderately bearish forecasts

❌ Disadvantages:

- Profit potential is limited

- Requires price to move moderately lower

🔚 Exit Strategy

Close the strategy by:

- Buying back the sold Put

- Selling the bought Put

🔄 Related Strategies

📌 Final Thoughts

The Bear Put Spread is an efficient bearish strategy for traders expecting moderate price declines. With clearly defined risk and reward, it offers a strategic way to profit in a falling market.