📑 Table of Contents

- 📘 Introduction

- 🧠 What is a Bull Put Spread?

- 💡 When to Use a Bull Put Spread?

- 📈 Example: Bull Put Spread with Nifty

- 📊 Payoff Table

- 📌 Key Takeaways

- ✅ Benefits of Bull Put Spread

- ❌ Drawbacks of Bull Put Spread

- 🔚 How to Exit the Strategy?

- ❓ FAQ

📘 Introduction

The Bull Put Spread, also known as the Bull Put Credit Spread, is a strategic options trading method used when the trader expects the market to rise moderately or stay stable. It involves selling a higher premium In-the-Money (ITM) Put Option and buying a lower premium Out-of-the-Money (OTM) Put Option with the same expiry.

This is a limited-risk, limited-reward strategy that earns income through time decay and a neutral-to-bullish outlook.

🧠 What is a Bull Put Spread?

A Bull Put Spread is a credit spread strategy using Put Options. You earn a net premium upfront and profit when the underlying asset stays above the short put's strike price on expiry.

- Market View: Moderately bullish or range-bound

- Positions Involved: Sell ITM Put + Buy OTM Put

- Maximum Profit: Net premium received

- Maximum Loss: Difference in strike prices – net premium

- Breakeven Point: Strike price of short put – net premium received

- Risk Profile: Limited

- Reward Profile: Limited

💡 When to Use a Bull Put Spread?

- When you expect the price of a stock or index to rise slightly, stay sideways, or fall marginally

- Best suited for low-volatility or mildly bullish markets

📈 Example: Bull Put Spread with Nifty

Assume: Nifty is trading at ₹25,400.

| Position | Strike Price | Premium |

|---|---|---|

| Sell Put | ₹25,200 | ₹25 |

| Buy Put | ₹25,000 | ₹10 |

Lot Size: 75

- Net Premium Received: ₹15

- Breakeven Point: ₹25,200 – ₹15 = ₹25,185

- Maximum Profit: ₹15 × 75 = ₹1,125

- Maximum Loss: (₹25,200 – ₹25,000 – ₹15) × 75 = ₹13,875

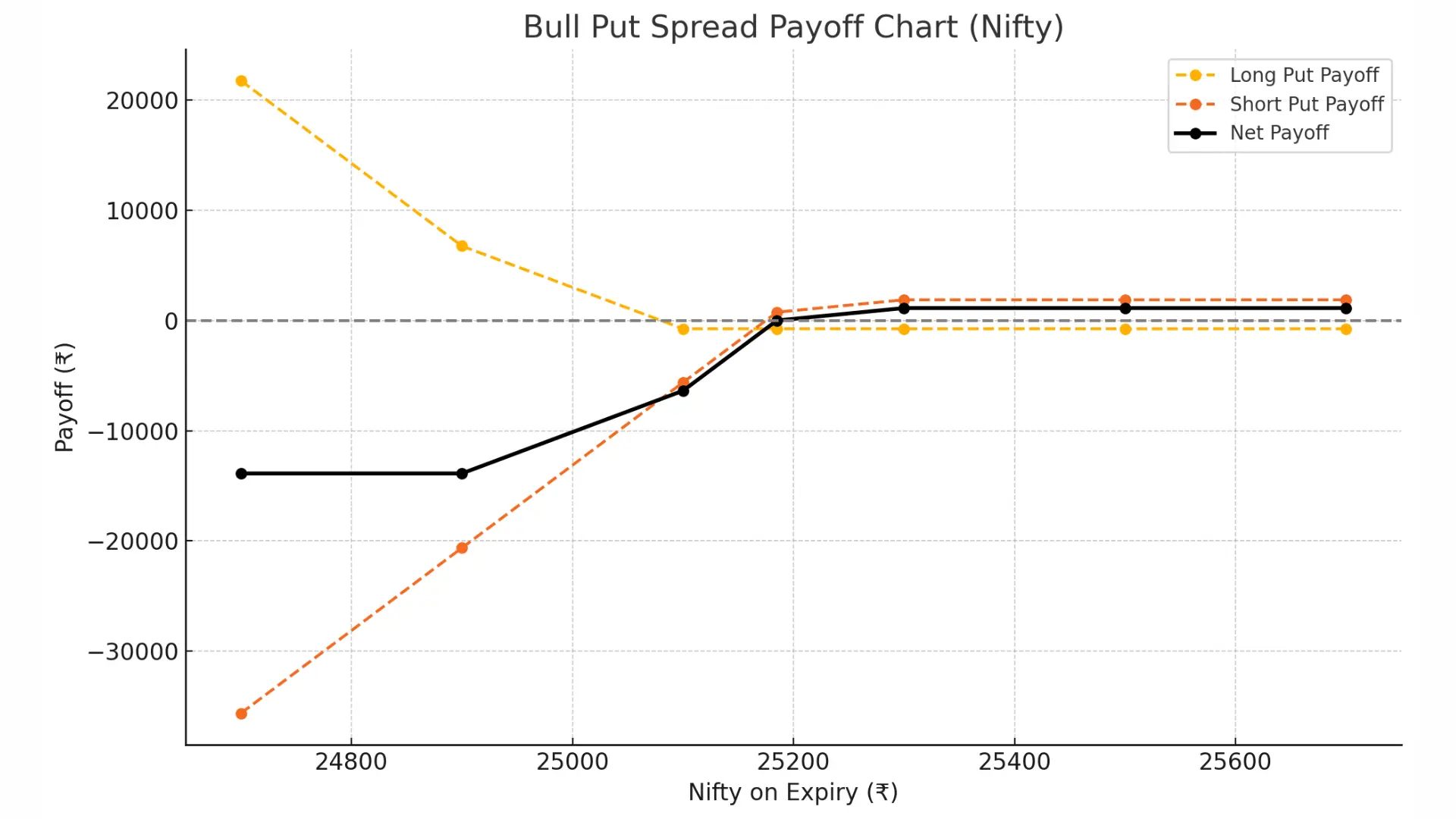

📊 Payoff Table

| Nifty on Expiry (CP) | Long Put Payoff | Short Put Payoff | Net Payoff (₹) |

|---|---|---|---|

| 24,700 | 21750 | -35625 | -13875 |

| 24,900 | 6750 | -20625 | -13875 |

| 25,100 | -750 | -5625 | -6375 |

| 25,185 | -750 | 750 | 0 |

| 25,300 | -750 | 1875 | 1125 |

| 25,500 | -750 | 1875 | 1125 |

| 25,700 | -750 | 1875 | 1125 |

📌 Key Takeaways

- Max Profit: When the price stays above the short put strike price

- Max Loss: When the price falls below the long put strike price

- Breakeven: Short Put Strike – Net Premium Received

✅ Benefits of Bull Put Spread

- Earn income through time decay

- Lower risk than naked put selling

- Profits from a rise, sideways, or mild decline in price

- Defined risk and reward

❌ Drawbacks of Bull Put Spread

- Limited upside potential

- Loss of underlying moves sharply down

- Time decay may work against you if the direction is wrong

🔚 How to Exit the Strategy?

- Let both options expire to retain the net premium

- Or close both legs before expiry (buy short put and sell long put)

❓ Frequently Asked Questions (FAQ)

1. Is Bull Put Spread profitable in sideways markets?

Yes, as long as the underlying stays above the short put strike price, the strategy can yield profits even in a sideways market.

2. What is the best expiry to choose for Bull Put Spreads?

Weekly or monthly options are both used. Shorter expiry options yield faster time decay, but monthly options offer more stability.

3. Can I use this strategy for Bank Nifty or stocks?

Yes, Bull Put Spreads can be used on any liquid options, including indices like Bank Nifty or large-cap stocks.

4. Is a margin required for this strategy?

Yes, since you are selling a put, margin is required, but it is lower than selling a naked put due to the hedging of an OTM put.

5. Is the risk-reward ratio favorable?

It depends on the strike prices chosen. Typically, the reward is smaller compared to the risk, but the probability of profit is high.