📌 Table of Contents

🧠 Introduction

The Bear Call Spread—also known as the Bear Call Credit Spread—is an options trading strategy designed for bearish or range-bound market conditions. This strategy involves selling an in-the-money (ITM) call option and buying an out-of-the-money (OTM) call option with the same underlying asset and expiry date. It’s a low-risk, limited-reward strategy ideal for traders who expect a moderate decline or stability in the market.

📌 Key Highlights

| Feature | Details |

|---|---|

| Strategy Type | Bearish (Credit Spread) |

| Instruments Traded | Call Options |

| Positions Involved | 2 (1 Short Call, 1 Long Call) |

| Risk Profile | Limited |

| Reward Profile | Limited |

| Breakeven Point | Strike Price of Short Call + Net Premium |

🛠 How the Bear Call Spread Strategy Works

The Bear Call Spread is implemented as follows:

- Sell a Call Option with a lower strike price (ITM)

- Buy a Call Option with a higher strike price (OTM)

💰 Net Credit = Premium Received – Premium Paid

You earn a net credit at the time of initiating the trade. The goal is for both options to expire worthless, allowing you to keep the net premium as profit.

📊 Bear Call Spread Example – NIFTY

Assume NIFTY Spot Price = ₹25,400

| Order Type | Strike Price |

|---|---|

| Buy 1 OTM Call | NIFTY 25600 CE |

| Sell 1 ITM Call | NIFTY 25200 CE |

If NIFTY stays below 25,200, both options expire worthless. You retain the net premium as your maximum profit.

🧾 Bear Call Spread Example – Stock Options

Stock Spot Price = TCS ₹3330

| Option Type | Strike Price | Premium (₹) | Lot Size |

| Buy July 3400 Call | ₹3400 | ₹20 | 175 shares |

| Sell July 3300 Call | ₹3300 | ₹60 | 175 shares |

- Total Premium Paid = ₹3500

- Total Premium Received = ₹10500

- Net Credit = ₹7000

✅ Scenario 1: Stock remains at ₹3330

Both options expire worthless.

Profit = ₹7000 (Maximum Profit)

❌ Scenario 2: Stock rises to ₹3450

- Loss on Short Call = ₹26250

- Gain on Long Call = ₹8750

- Net Loss = ₹17500(Maximum Loss)

✅ Scenario 3: Stock drops to ₹3250

Both options expire worthless.

Profit = ₹7000 (Maximum Profit)

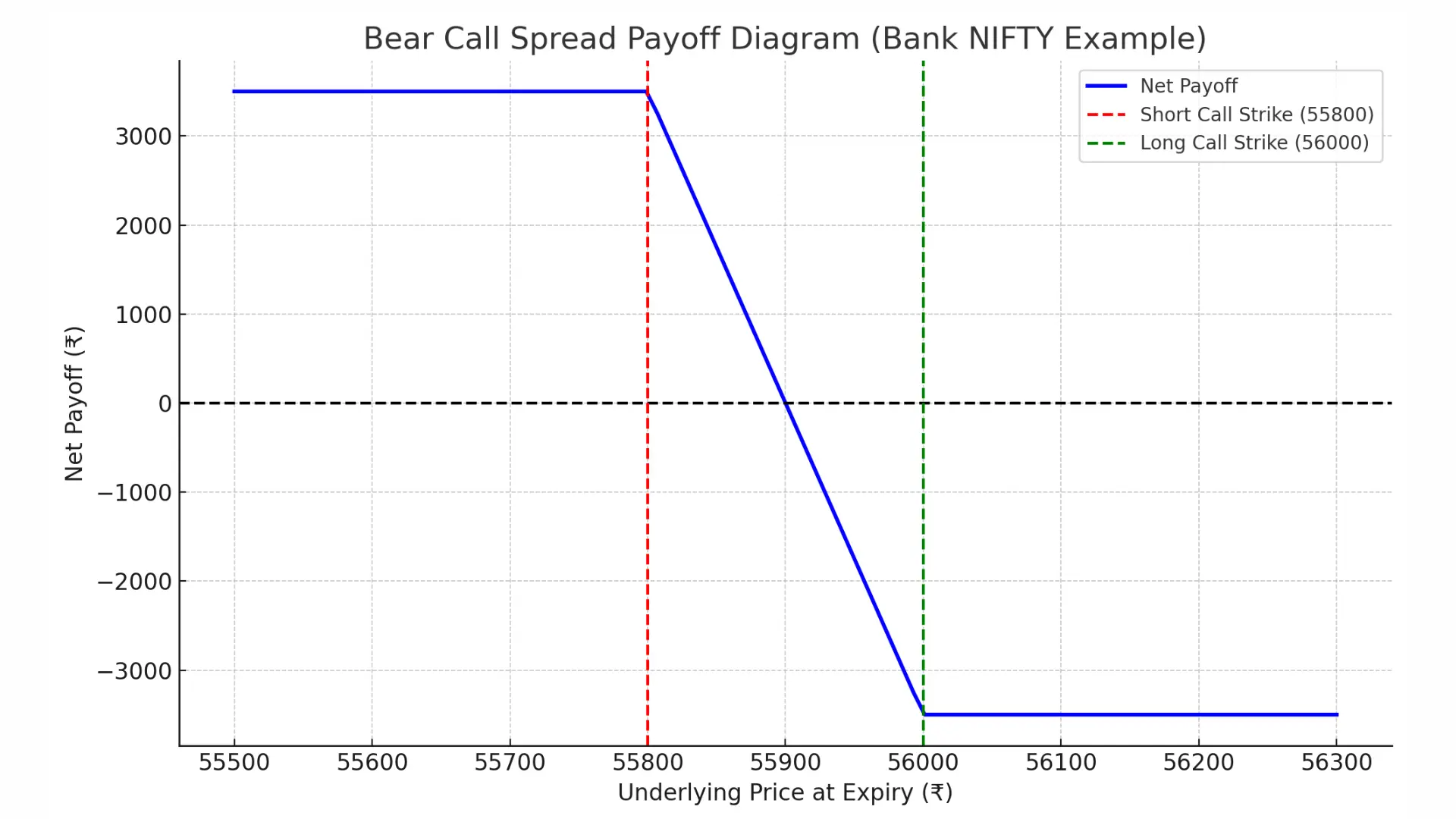

🏦 Bear Call Spread Example – Bank NIFTY

| Details | Values |

|---|---|

| Spot Price | ₹55,900 |

| Lot Size | 35 |

| Buy OTM Call (56000 CE) | ₹400 (₹14,000 total) |

| Sell ITM Call (55800 CE) | ₹500 (₹17,500 total) |

| Net Premium | ₹100 (₹3,500 total) |

| Breakeven Point | ₹55,900 |

| Max Profit | ₹3,500 |

| Max Loss | ₹3,500 |

📈 Payoff Table

| Expiry Price | Profit/Loss (₹) |

|---|---|

| 55500 | +3,500 |

| 55700 | +3,500 |

| 55900 | 0 (Breakeven) |

| 56100 | –3,500 |

| 56300 | –3,500 |

⚖️ Profit & Loss Overview

- Max Profit = Net Premium Received

- Max Loss = Difference in Strike Prices – Net Premium

- Breakeven = Short Call Strike + Net Premium

✅ Advantages of Bear Call Spread

- Profitable in flat or mildly bearish markets

- Lower margin requirement than naked calls

- Predefined risk and reward

- Easy to execute and manage

❌ Disadvantages of Bear Call Spread

- Limited profit potential

- Requires correct market direction

- Profitability depends on the price staying below the short call strike

🔄 How to Exit the Strategy?

- Let options expire worthless to retain the full premium

- Close position early by reversing both legs if the price reverses

📌 Best Use Case

When you're moderately bearish or expect range-bound movement in the underlying asset.

📋 Frequently Asked Questions (FAQs)

❓ What is a Bear Call Spread strategy?

It's an options strategy where you sell an ITM call and buy an OTM call to earn a net credit.

❓ Is the Bear Call Spread strategy safe?

Yes, it's low-risk with defined loss and profit.

❓ What happens at expiry?

If the asset closes below the short call strike, both options expire worthless, and you keep the net premium.

❓ Can I exit early?

Yes, reverse the trade anytime before expiry.

❓ Which is better: Bear Call Spread or Naked Call?

Bear Call Spread is safer due to defined risk; naked calls have unlimited loss potential.