📑 Table of Contents

- What is a Bull Call Spread Strategy?

- Key Features

- How the Bull Call Spread Works

- Why Use a Bull Call Spread?

- Payoff Summary

- Bull Call Spread Formulae

- Max Profit and Max Loss Scenarios

- Pros and Cons

- How to Exit

🧠 What is a Bull Call Spread Strategy?

The Bull Call Spread, also known as the Bull Call Debit Spread, is a popular options trading strategy designed for traders who expect a moderate rise in the price of the underlying asset. It involves buying one In-the-Money (ITM) Call Option and selling one Out-of-the-Money (OTM) Call Option with the same expiry date.

This strategy is ideal for those who are moderately bullish and want to limit their risk and cost. Both risk and reward are capped, making it a safer bet compared to naked call buying.

✅ Key Features of Bull Call Spread

| Feature | Description |

|---|---|

| Strategy Type | Bullish (Moderate Rise Expected) |

| Instruments Used | Call Options |

| Number of Legs | 2 (Buy Call + Sell Call) |

| Risk | Limited (Net Premium Paid) |

| Reward | Limited (Strike Difference - Premium) |

| Best Time to Use | When expecting a moderate upward move |

📌 How the Bull Call Spread Works

A Bull Call Spread involves two positions:

- Buy a Call Option with a lower strike price (ITM)

- Sell a Call Option with a higher strike price (OTM)

Example:

Suppose NIFTY is trading at ₹25,500, and you expect it to rise slightly.

| Trade Leg | Strike Price | Premium |

|---|---|---|

| Buy NIFTY Call (ITM) | ₹25,300 | ₹170 |

| Sell NIFTY Call (OTM) | ₹25,700 | ₹60 |

- Net Premium Paid = ₹170 - ₹60 = ₹110

- Lot Size = 75

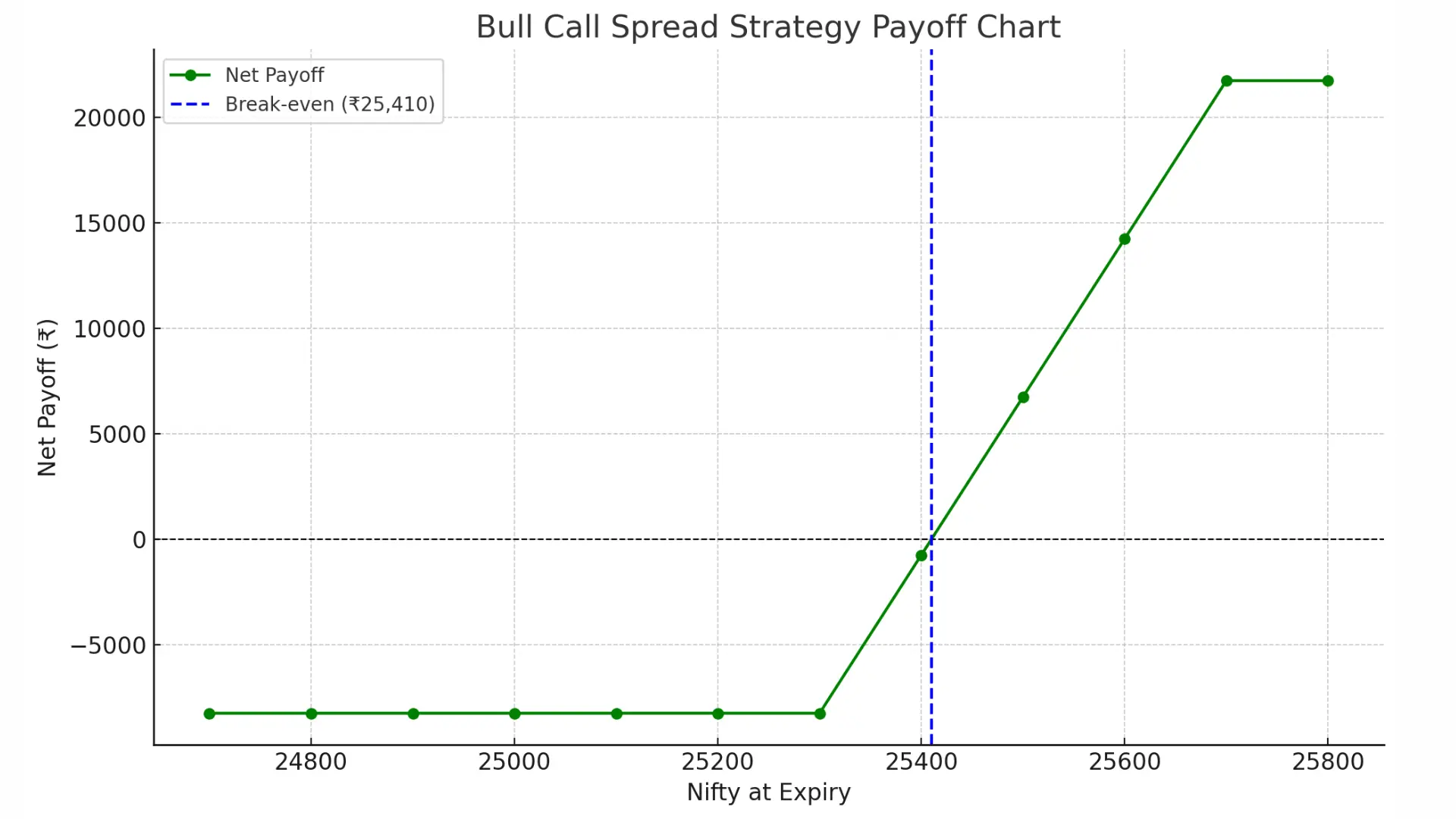

- Break-even Point = ₹25,300 + ₹110 = ₹25,410

💡 Why Use a Bull Call Spread?

- 🔽 Lower Cost: Selling the higher strike Call offsets the premium of the bought Call.

- 🔐 Limited Risk: The maximum loss is limited to the net premium paid.

- 🎯 Limited but Predictable Profit: Maximum profit is capped at the difference between the strike prices minus the premium.

📊 Payoff Summary

| Nifty at Expiry | Long Call P/L | Short Call P/L | Net Payoff (₹) |

|---|---|---|---|

| 24,700 | -12,750 | 4,500 | -8,250 |

| 24,900 | -12,750 | 4,500 | -8,250 |

| 25,200 | -12,750 | 4,500 | -8,250 |

| 25,410 (BEP) | -4,500 | 4,500 | 0 |

| 25,600 | 9,750 | 4,500 | 14,250 |

| 25,800 | 24,750 | -3,000 | 21,750 |

🧾 Bull Call Spread Formula

- Break-even Point: Lower Strike + Net Premium Paid

- Max Profit: (Higher Strike - Lower Strike) – Net Premium

- Max Loss: Net Premium Paid

📈 Max Profit Scenario

- Happens when both options are exercised.

- The underlying price closes above the higher strike price on expiry.

📉 Max Loss Scenario

- Happens when both options expire worthless.

- Underlying closes below the lower strike price.

✅ Pros of Bull Call Spread

- ✔️ Controlled risk with limited loss

- ✔️ Lower upfront cost compared to buying only a Call

- ✔️ Ideal for a moderately bullish outlook

❌ Cons of Bull Call Spread

- ❌ Limited profit potential

- ❌ Not suitable for strong bullish trends

🔚 How to Exit a Bull Call Spread

You can exit before or on expiry by:

- Selling the bought Call Option

- Buying back the sold Call Option

📘 Final Thoughts

The Bull Call Spread is an excellent strategy for beginners and intermediate traders who anticipate a gradual rise in prices. It allows you to balance risk and reward, especially in a sideways or slow-moving bullish market. By spreading out your position, you reduce costs while still maintaining upside potential.

❓ Frequently Asked Questions (FAQs)

What is the Bull Call Spread strategy?

The Bull Call Spread is a limited-risk, limited-reward options trading strategy where a trader buys a lower strike Call (ITM) and sells a higher strike Call (OTM) with the same expiry. It’s used when expecting a moderate rise in the underlying asset.

When should I use a Bull Call Spread?

This strategy is best used when you expect the stock or index to rise moderately but not exceed a certain level. It is ideal during low volatility, sideways, or mildly bullish markets.

What is the maximum profit in a Bull Call Spread?

The maximum profit is the difference between the strike prices minus the net premium paid. It occurs when the underlying closes above the higher strike price on expiry.

What is the maximum loss in a Bull Call Spread?

The maximum loss is limited to the net premium paid for initiating the trade. This occurs if the underlying closes below the lower strike price at expiry.

Is the Bull Call Spread suitable for beginners?

Yes, it’s considered a beginner-friendly options strategy due to its defined risk and reward. It helps new traders gain exposure to options without excessive risk.

Can I exit a Bull Call Spread before expiry?

Yes, you can exit anytime before expiry by squaring off both legs (sell the bought Call and buy back the sold Call). This may lock in profits or reduce losses early.

What happens if the underlying price is between the two strike prices at expiry?

In this case, the long Call is exercised while the short Call expires worthless. You make partial profit depending on how close the price is to the higher strike.