Table of Contents

What is IPO in Stock Market?

In This Blog, we discover what is ipo and how does it work, including their meaning, benefits, and regulations. Learn how companies transition from private to public.

What is IPO >>>IPO is a process by which a company offers its shares to the general public for the first time via the stock market. Learn IPO's meaning, benefits, and regulations.

IPO Basics

IPO, or Initial Public Offering, marks a significant milestone in a company’s journey from private to public...

Top Reasons for Taking a Company Public

1. Capital Generation for Growth

Raising capital is the most important driver behind a public offering. Companies require funds to:

- Scale operations

- Enter new markets

- Invest in R&D and infrastructure

- Acquire new assets or businesses

2. Exit for Initial Investors

Founders, venture capitalists, and private equity players often look to exit or partially monetize their investments via IPOs. This exit strategy can be achieved through an Offer for Sale (OFS) , where existing shareholders sell their shares to the public.

3. Reduction of Debt

Some companies carry substantial liabilities and use IPO proceeds to repay loans , thereby improving their financial health and deleveraging their balance sheets .

4. Enhanced Market Visibility and Credibility

An IPO generates extensive media coverage , improves brand recognition , and boosts investor confidence . Being a listed company also implies better governance and transparency, fostering trust among stakeholders.

Why Do Companies Issue IPO Shares?

Companies navigate through different financing phases before considering an IPO:

- Self-funding & support from family/friends

- Angel investors

- Venture Capital (VC) firms

- Private Equity (PE) investors

- Bank loans

When these avenues are exhausted or no longer ideal, IPO becomes a strategic move for several reasons:

- Avoid dilution of control (compared to VC/PE funding)

- Prevent interest burden (unlike loans)

- Provide liquidity for existing stakeholders

Advantages of an IPO

Benefits to the Company

- Access to Capital: IPOs unlock large-scale funding without the need to repay or service interest.

- Exit Opportunity: Founders and early-stage investors can cash out by selling their stake.

- Valuation Discovery: Listing on a public exchange helps the company discover its market-driven valuation.

- Brand Prestige: Publicly listed companies enjoy higher reputation and trust.

- Attracting Talent: With Employee Stock Options (ESOPs) and visibility, companies can retain and attract top talent.

- Lower Cost of Capital: Compared to debt, equity funding is cost-effective.

- Market Discipline: Public scrutiny ensures efficient management practices and transparency.

Benefits to Investors

- No Entry Costs: IPO applications are free of brokerage or transaction charges.

- High Growth Potential: Investors can get in on the ground floor of rapidly growing companies.

- Long-term Wealth Creation: Strategic investments in IPOs can yield significant returns over time.

- Participation Rights: Shareholders gain voting rights and dividend eligibility.

- Transparent Information: Details in the Red Herring Prospectus (RHP) provide insights into financials and operations.

- Fair Opportunity: Equal access to both retail and institutional investors during IPO bidding.

Disadvantages of an IPO

Drawbacks for the Company

- High Costs: Legal, underwriting, compliance, and listing expenses can run into crores.

- Regulatory Burden: Listed companies must file quarterly reports, comply with SEBI rules, and maintain transparency.

- Loss of Control: Public investors gain voting rights, potentially impacting strategic decisions.

- Time-Intensive Process: Management must invest significant time in roadshows, filings, and disclosures.

- Market Pressure: Share price movements can affect business decisions due to short-term investor sentiment.

Drawbacks for Investors

- Lack of History: New IPO companies may lack a performance track record.

- Volatility Risk: Shares may underperform post-listing, especially if overvalued.

- Oversubscription Woes: There's no guarantee of allotment in oversubscribed IPOs.

- Limited Exit in SME IPOs: Liquidity may be limited for smaller IPOs, affecting exit opportunities.

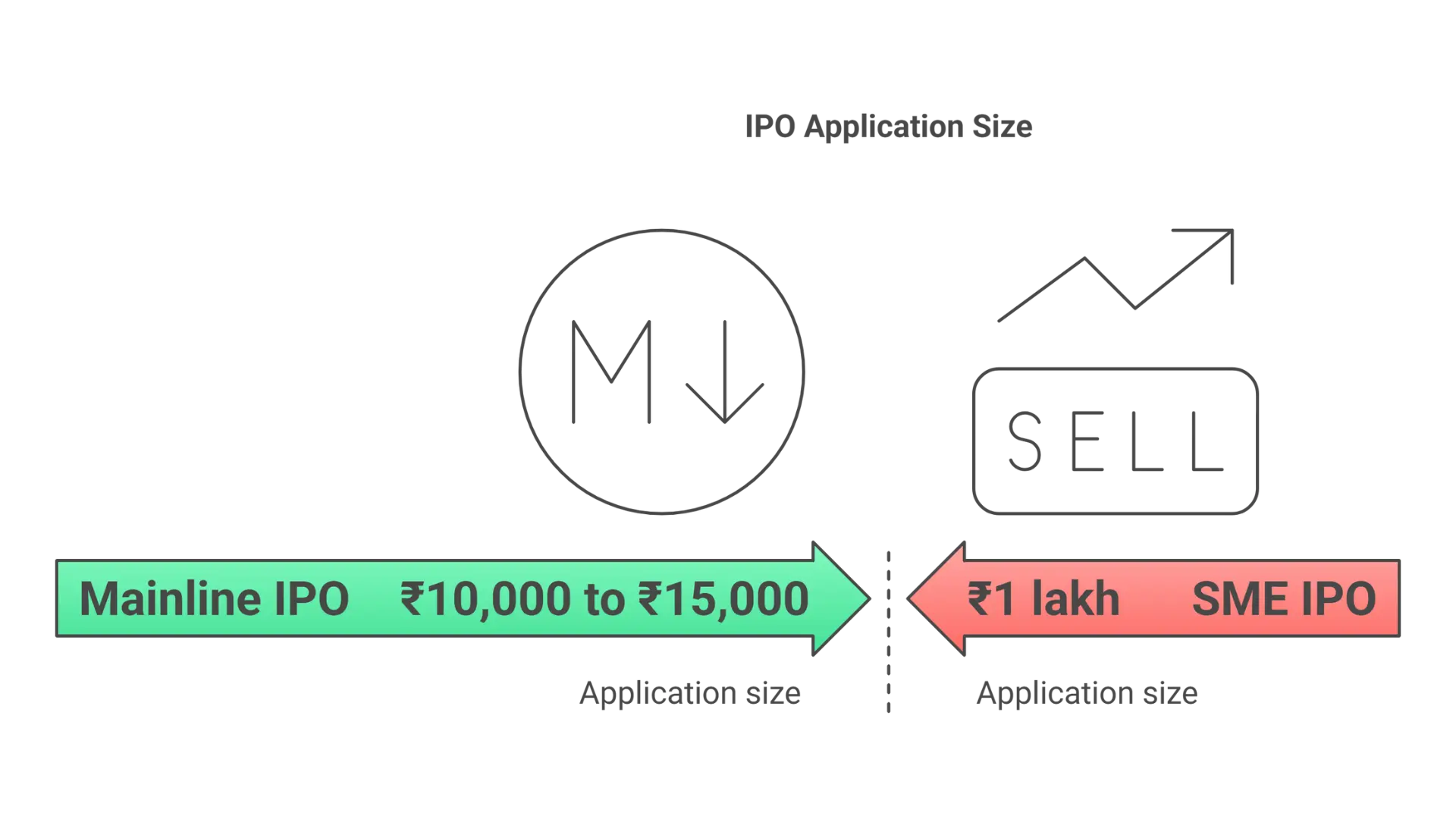

Types of IPOs: Mainline IPO vs SME IPO

1. Mainline IPO

Mainline IPOs are issued by large companies that meet SEBI’s strict eligibility criteria. They are listed on the NSE or BSE Mainboard.

- Minimum post-issue paid-up capital: ₹10 crores

- Vetted by: SEBI

- Market making: Not mandatory

- IPO Application Size: ₹10,000 to ₹15,000

- Financial Disclosures: Quarterly audited financials

- Underwriting: Optional

2. SME IPO

SME IPOs are issued by smaller or newer companies and listed on platforms like NSE Emerge or BSE SME.

- Post-issue paid-up capital: Should not exceed ₹25 crores

- Vetted by: Stock Exchanges

- Market Making: Mandatory for 3 years

- IPO Application Size: Minimum ₹1 lakh

- Financial Disclosures: Half-yearly

- Underwriting: Compulsory, with 15% by Merchant Banker

Mainboard IPO vs SME IPO – Detailed Comparison

| Feature | Mainboard IPO | SME IPO |

|---|---|---|

| Eligibility | Strict SEBI norms | Relaxed requirements |

| Paid-up Capital | ₹10 crore minimum | ≤ ₹25 crore |

| Vetting Authority | SEBI | Stock Exchanges |

| Market Making | Not required | Mandatory for 3 years |

| Financial Filing | Quarterly | Half-yearly |

| Underwriting | Optional | Mandatory (15% by MB) |

| Application Size | ₹10,000 - ₹15,000 | ₹1,00,000 minimum |

| Trading Platform | NSE/BSE Mainboard | NSE Emerge/BSE SME |

Conclusion

An Initial Public Offering is a powerful financial tool that fuels a company’s next growth phase while offering the public a chance to participate in its success story. However, it's vital for both companies and investors to understand the advantages and disadvantages of IPOs and choose the right type—Mainboard or SME—based on their goals and investment profiles.

If you want to read more information, visit the Next Chapter -- > The Insider's Views