Overview

Once in a lifetime, you must have seen the sentence, "Mutual Funds Sahi Hai paisa invest karne ke liye" and made the decision to put money into it. That's fantastic. However, are you aware of exactly how mutual funds operate? And why should you pay attention to it?

Let's attempt to comprehend this subject. FDs were the most reputable form of investment for consumers for a very long time. However, their funds are little impacted by the low interest rate. Nonetheless, a good return on investment (ROI) can be obtained by investing in other financial instruments, such as stocks, bonds, and gold. However, are all of us aware of it?

What is A Mutual Fund?

Let's go back to the beginning and attempt to define a mutual fund.The number of investors that wish to invest is "n." However, they lack the skills necessary to handle their money, let alone invest, due to their lack of understanding of financial markets and investment tools. A mutual fund can be useful in this situation.

Imagine wanting to go somewhere and knowing the route to get there. You take the bus since you don't know how to drive, and the bus driver helps you get where you're going. The same is true for mutual funds, where investors are the passengers and fund managers are the drivers who invest your money on your behalf to help you achieve your financial objectives.

It gathers funds from all investors and makes the appropriate investments to support the growth of their finances. A qualified manager who oversees the fund and has substantial financial market knowledge is in charge of these investments.

Mutual funds should be considered as the investment basket that contains all of the tools for investing.

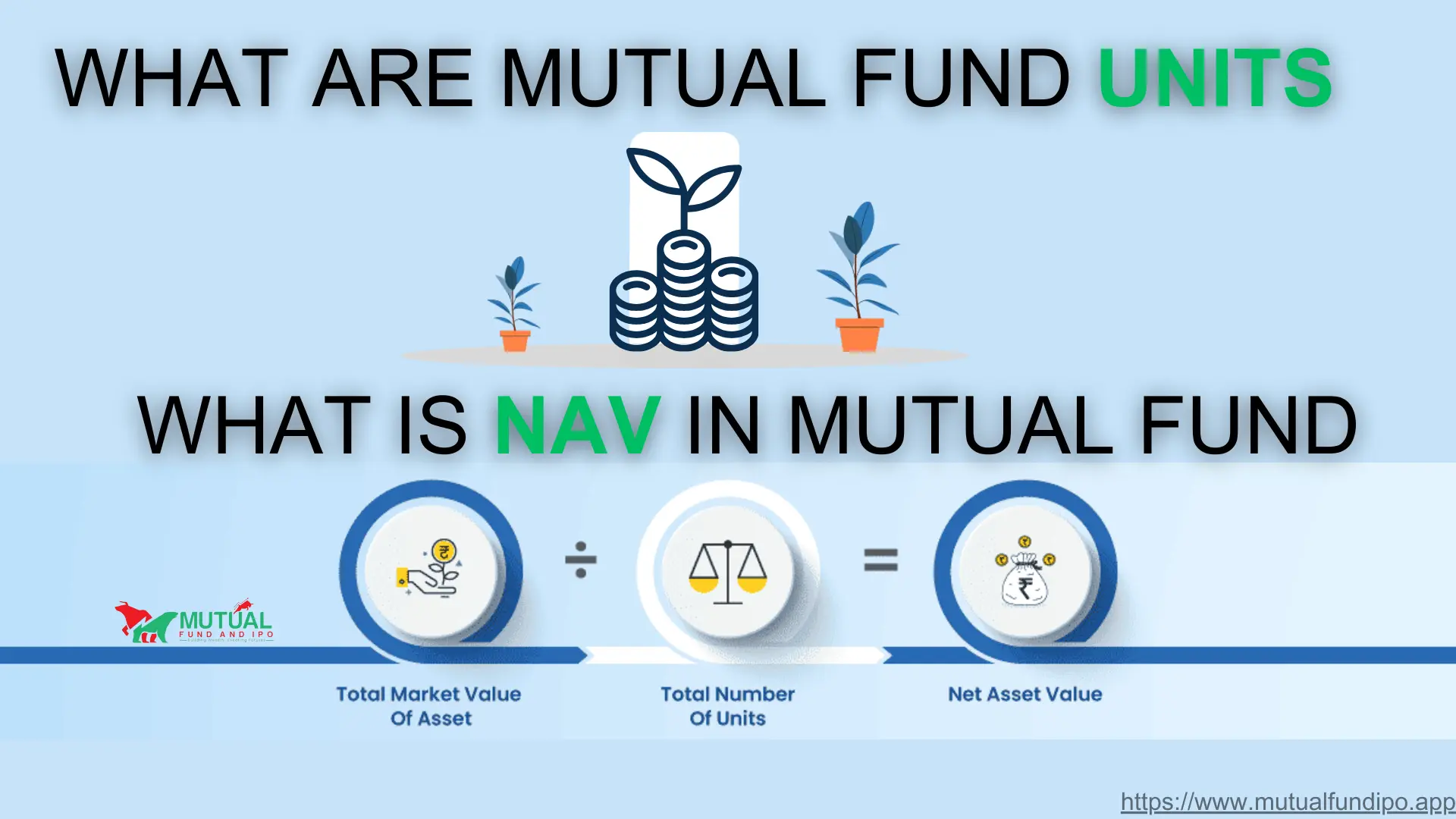

What Are Net Asset Value (NAV) and Mutual Fund Units?

Mutual fund units and net asset value (NAV) are two fundamental ideas to understand before beginning the mutual fund investment process.

Through fund management, investors make their investments and receive mutual fund units in exchange. An ownership stake in the stocks, bonds, and other securities that the mutual fund owns is represented by a mutual fund unit. The second is NAV, or net asset value, which determines the worth of a single unit of a mutual fund. To put it simply, NAV is comparable to the cost of a single unit of a mutual fund. The fund unit tends to increase in value when the NAV rises, which is how investors profit from it.

NAV is calculated using the following formula: (total assets - total liabilities)/total number of units issued.

However, investors don't have to figure it out. Because determining the value of NAV is not the responsibility of an investor. It assists you in determining the value of the fund, including how much to invest when you first start investing or when you withdraw your money, among many other things.

Let us make it easy for you to understand through an example:

Let’s see a guy named Suraj wants to invest 20,000 in mutual funds so he decided to invest in it on April 10, 2024.

On 10 April 2024, the NAV of XYZ Blue Chip fund company was Rs.40, that is one unit of XYZ fund cost Rs.40.

Now, Suraj invested the whole 20,000 in this fund on 10 April 2024. Therefore, he was given 500 units.

20000/40= 500 units

Now fast forward to 6 years later, on 10 April 2030, Suraj needed this fund to make his home, so he decided to withdraw it. The fund’s NAV on 8 April 2030 was Rs.60.

For Suraj, 500 units will be worth 30,000

(500*60)= 30,000 Rs

The fund has given a profit of 10,000 Rs to Suraj in six years.

So let’s conclude it with the fact that any return given to investors would be distributed in proportion to the number of unit investors hold. If an investor wants to exit the investment, the redemption value of each unit will depend upon the NAV on that day of security.

Purchasing mutual funds: Low versus high net asset value

Investors frequently believe that funds with a low net asset value (NAV) will perform better. Let's dispel this myth, then. The return of the fund is mostly dependent on two factors. The first is the market, and the second is the fund manager's abilities. Therefore, make sure to properly analyze the fund rather than focusing just on the price increase from low NAV funds.

Additionally, bear in mind that a mutual fund with a high net asset value (NAV) may be a sign of a well-managed fund. A rising trend in the NAV of a mutual fund indicates persistent high performance. A high NAV is the outcome of steady increases over time.

When it comes to investing in mutual funds, how do they operate for novices?

An Asset Management Company (AMC) oversees the management of a mutual fund, which is a type of trust. The AMC collects investor funds and uses them to invest in a variety of investment instruments, including stocks, bonds, commodities, and many more. A qualified fund manager and his staff oversee the entire fund.

In exchange, managers build a portfolio of stocks, bonds, and commodities by closely examining market dynamics, company performance prospects, and mutual fund investing guidelines.

However, over time, the fund manager continues to realign the portfolio in accordance with his market expertise and judgment. To make more money, they might be able to sell the old tools and purchase some new ones.

If the market advances in their favor, investors will profit from the fund's growth, which is directly proportional to the market, and vice versa.

What are the different types of mutual funds?

You must already understand how a mutual fund operates by now, so let's talk about which mutual funds have been assigned to certain categories:

Investors used to struggle to determine exactly where they should and shouldn't put their money. Therefore, SEBI, which oversees mutual funds, informed businesses that they could only have the most common kinds of mutual funds going forward.

Equity fund.

Debt funds

Hybrid fund

ETF

Tax saving Fund

Equity funds

Equity funds make investments in the stock of various businesses. when the fund manager diversifies the portfolio with different market capitalizations in an attempt to provide high returns. In general, equity funds are thought to yield higher returns than debt-based funds.

Debt fund

A debt fund is a type of mutual fund scheme that makes investments in fixed-income securities or tools having maturity dates, such as government and corporate bonds, money market instruments, corporate debt securities, etc., that provide capital gains.

Creating income for investors through interest and capital growth is a debt fund's primary goal. while reducing the danger of debt securities. Investors who choose a steady and predictable income stream over the possibly greater but less consistent and more unpredictable returns of equities funds frequently select these funds.

Hybrid funds / Balanced Funds

Mutual funds that invest in a variety of asset classes are known as hybrid funds. Typically, it consists of stocks and bonds, although occasionally gold assets may be included as well. It gains balance as a result of diversification, which is why it is sometimes referred to as balanced funds.

Exchange-Traded Funds

As the name implies, exchange-traded funds, or ETFs, are funds that are traded on exchanges by, specifically, following a particular index. Simply said, one benefit of investing in ETFs is that you can buy and sell money straight from your Demat account.

For instance, ETFs offer a solution if you wish to invest in the IT industry but are unsure which companies to choose because there are so many alternatives. You are essentially investing in the whole IT industry when you buy an ETF tailored to that industry. which results in spreading your investment over a variety of stocks in that industry.

Tax-Saving Funds (ELSS)

Equity Linked Savings Plans, or ELSSs, are mutual fund investment plans that help you save money by reducing your income tax; this is why they are also known as tax-saving funds. Section 80c of the Income Tax Act permits taxpayers to invest up to INR 1.5 lakh in certain securities and deduct that amount from their taxable income.

Some more Mutual Funds are listed below:

Bond Funds:

A bond fund's main focus is on investments having a set rate of return, like government bonds, corporate bonds, and other debt instruments. The fund's portfolio generates interest income for the shareholders. These funds are regularly and aggressively managed to buy relatively cheap bonds so they can sell them for a profit.

Dividend Funds:

These funds are made up of stocks that pay out large, consistent dividends.

Index Funds:

These funds are the kind that make investments in the main market index, like the Bank Nifty or the Nifty.

Income Funds:

Usually, the purpose of these funds is to provide cash flow to investors. Most investors are retirees seeking a steady income. We only invest in government and high-quality debt with income funds.

Money Market Funds:

Treasury notes are another name for money market funds. These are risk-free funds that give investors a respectable return over a brief period of time.

How should a mutual fund be chosen?

You must shortlist the mutual fund category before choosing a mutual fund. Establishing the financial objective, along with the time frame and anticipated amount of the target, is the first step. We have no idea if the market will rise or decline in the near future. It is preferable to invest in short-term debt funds for any short-term financial objective.

To cover unforeseen costs, always invest in liquid assets to increase your emergency fund. It is necessary to keep abreast of both domestic and global economic developments. Your level of investment confidence increases as you get more knowledge and comprehension of mutual funds.

What are the advantages of mutual funds?

Mutual funds provide several benefits, some of which are as follows:

1. Low cost

Due to the economic scale, mutual funds are favored for their cheap costs, which makes investing in them somewhat simple and advantageous for those with somewhat lower capital.

2. Easy to invest

Through a systematic investment plan (SIP), investments can be made in one lump sum or in smaller, more manageable installments. A SIP can be started for as little as 500 rupees. Buying and selling mutual funds is simple. It is therefore seen to be easily accessible to all investors.

3. Highly regulated and transparent

India's mutual fund market is highly transparent and well-regulated. The Securities Exchange Board of India (SEBI) keeps a close eye on it and regulates it.

4. Professional management:- saves time, and costs and reduces risk

You don't have to keep an eye on the market while investing in mutual funds because AMCs do it for you, giving you a time and cost advantage.

5. Diversification:- to protect from downside risk

One is always at low risk because mutual funds are always diversified (invested in many sectors). Because of its diversification, your portfolio poses little danger to your investments.

6. Tax saving

Under ELSS, there exist tax-saving funds. You can deduct up to Rupees 1,50,000 annually under section 80C of the Income Tax Act.

7. Liquidity

Unlike other investment plans, mutual funds are highly liquid and can be traded at any moment during business hours.