📚 Table of Contents

- What is an SME IPO?

- Brief History of SME IPO in India

- SME Business Classification

- Objectives of Issuing an SME IPO

- Fresh Issue vs Offer for Sale (OFS)

- Advantages of SME IPO

- Disadvantages and Risks of SME IPO

- SME IPO vs Mainline IPO

- SME IPO Limits Imposed by SEBI

- Post-Issue Capital Restructuring

- Real-Life Example

- Conclusion: Is SME IPO Right for You?

In this Topic, we are discussing SME IPO: Complete Guide on Meaning Small and Medium Enterprises (SMEs) are the backbone of India's growing economy. From creating jobs to promoting entrepreneurship, SMEs play a vital role in economic development. But as these businesses grow, raising funds for expansion becomes critical, and one of the most efficient ways to do so is through an SME IPO.

In this comprehensive guide, we will explore the meaning, benefits, limitations, and key differences between SME IPOs and Mainline IPOs, along with insights into capital restructuring and regulatory requirements. This article is written to help new investors and entrepreneurs understand every aspect of SME IPOs in a clear, conversational, and SEO-optimized manner.

✅ What is an SME IPO?

An SME IPO (Small and Medium Enterprises Initial Public Offering) refers to the process where a small or medium-sized business issues shares to the public for the first time through a stock exchange. The main goal is to raise capital to fund business growth, innovation, or to reduce debt.

Unlike large corporations, SMEs use a dedicated SME platform on the BSE (BSE SME) or NSE (NSE Emerge) to get listed. These platforms are specially designed to cater to the unique needs and scale of small businesses.

📜 Brief History of SME IPO in India

The journey of SME IPOs began in 2012, when SEBI recognized the need for a separate listing platform for SMEs. This led to the launch of BSE SME and NSE Emerge.

First BSE SME Listing: BCB Finance Ltd.

First NSE Emerge Listing: Thejo Engineering Ltd.

Since then, hundreds of SMEs have raised funds and expanded successfully through these platforms, contributing significantly to India’s economic engine.

📊 SME Business Classification

SMEs are classified based on their investment in equipment and annual turnover. Categories include Micro, Small, and Medium Enterprises.

SMEs are classified into three categories based on investment and turnover:

| Enterprise Type | Investment in Equipment/Plant | Annual Turnover |

|---|---|---|

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore |

🎯 Objectives of Issuing an SME IPO

- The decision to go public is often backed by strategic goals. Common objectives of an SME IPO include:

- Meeting working capital requirements.

- Expanding business operations.

- Acquiring other businesses or forming joint ventures.

- Buying new machinery or equipment.

- Debt repayment (non-promoter loans only).

- Brand visibility and media attention.

- Exit route for early investors.

- Strengthening the company’s financial foundation.

💡 Fresh Issue vs Offer for Sale (OFS)

There are two types of share offerings in an SME IPO:

1. Fresh Issue

The company issues new shares to raise capital, which is then used for business development.

2. Offer for Sale (OFS)

Existing investors sell their shares. No capital goes to the company; it goes directly to selling shareholders.

SEBI has placed a limit of 20% OFS in an SME IPO, and the selling shareholders cannot offload more than 50% of their holding.

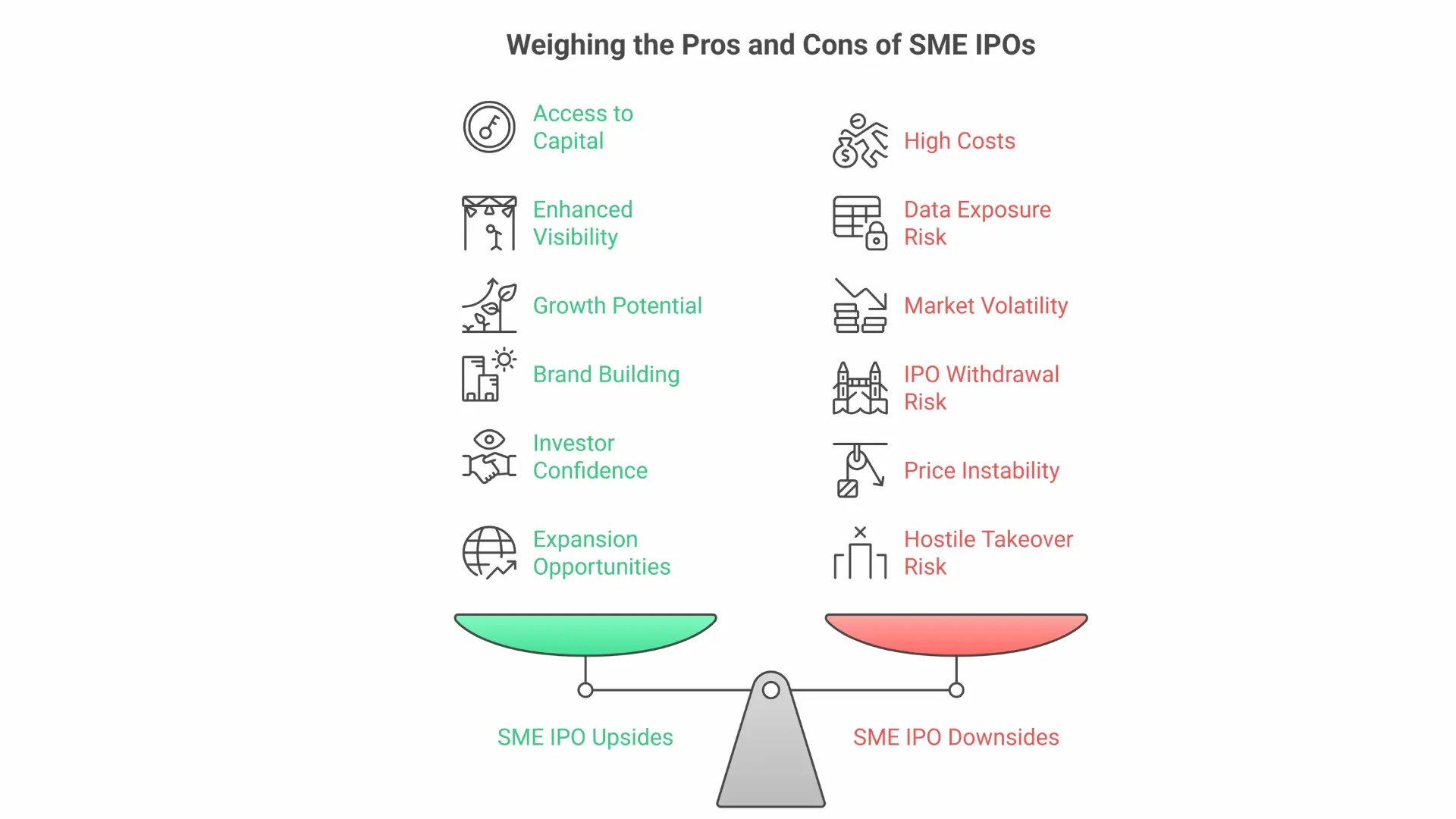

📈 Advantages of SME IPO

Listing through an SME IPO can transform a small business. Here are the key benefits:

1. Capital Without Interest

Unlike loans, IPO funds don’t require repayment or interest payments, making it a cost-effective capital-raising method.

2. Enhanced Credibility

Being listed improves brand image, investor trust, and business credibility.

3. Improved Valuation

A public listing often results in higher valuation and increased shareholder wealth.

4. Expansion Opportunities

IPO funds can be used to scale operations, hire talent, or enter new markets.

5. Liquidity for Shareholders

Existing shareholders can monetize their holdings through secondary offerings or OFS.

6. Employee Motivation

ESOPs (Employee Stock Options) help retain talent and align employee goals with company growth.

7. Better Governance

Being public demands transparency, leading to stronger governance and compliance.

8. Gateway to Mainboard Listing

SME IPOs can serve as a stepping stone to mainboard IPOs once the business grows.

⚠️ Disadvantages and Risks of SME IPO

While there are many upsides, SME IPOs also come with a few downsides:

1. High Costs

Legal, compliance, merchant banking, registrar, PR, and advertising costs can range from ₹50 lakhs to several crores.

2. Public Data Exposure

Going public means sharing sensitive financial and operational data with the world.

3. Market Volatility

Poor market performance can hurt stock prices, brand reputation, and investor sentiment.

4. Risk of IPO Withdrawal

Issues like disputes, underwriter disagreements, or non-disclosure can lead to last-minute IPO cancellations.

5. Price Instability

Retail investors often sell shortly after listing, causing price fluctuations. Some companies hire fund managers to stabilize prices.

6. Hostile Takeovers

Publicly traded shares increase the risk of a large corporate acquiring a controlling stake.

📊 SME IPO vs Mainline IPO

📉 SME IPO Limits Imposed by SEBI

To protect retail investors and maintain transparency, SEBI has introduced certain limitations:

- OFS Limit: Max 20% of total issue size.

- Promoter Lock-In: 50% released after 1 year, remaining after 2 years.

- General Corporate Cap: Max 15% or ₹10 crore (whichever is lower).

- No Loan Repayment to Promoter/Related Parties using IPO funds.

🔄 Post-Issue Capital Restructuring

To qualify for SME IPOs, companies must ensure their post-issue paid-up capital falls between ₹1 crore to ₹25 crore. This is often achieved through:

✔️ Bonus Issue Example:

- Pre-IPO paid-up capital: ₹1 lakh (10,000 shares at ₹10 FV).

- Reserves: ₹10 crore.

- Bonus shares issued: 1 crore (₹10 crore ÷ ₹10 FV).

- Post-bonus holding: 1.001 crore shares.

✔️ Public Issue:

- Fresh issue: 33.5 lakh shares (~25% public holding).

- Post-IPO total shares: 1.336 crore.

- Paid-up capital = 1.336 crore × ₹10 = ₹13.36 crore (eligible).

🧾 Real-Life Example

If a company issues shares at ₹100 (₹10 FV + ₹90 premium), only ₹10 goes to share capital; the rest builds strong reserves.

Let’s assume a company issues shares at ₹100 (₹10 FV + ₹90 premium):

- Only ₹10 goes to capital.

- ₹90 goes to Reserves & Surplus.

- The increased reserves reflect strong financial backing.

🏁 Conclusion: Is SME IPO Right for You?

If you're a small or medium business seeking growth, visibility, and long-term sustainability, an SME IPO can be a game-changer. It opens doors to affordable capital, builds trust, and places your business on a national platform.

However, it’s important to weigh the costs, compliance needs, and potential risks. Always consult financial experts and thoroughly analyze your company’s readiness before taking the leap into public markets.

SME IPOs are not just about raising funds—they’re about unlocking the full potential of your business.

Would you like a downloadable checklist or infographic on SME IPO eligibility and process? Just let me know!