📑 Table of Contents

- What is a Short Put Option Strategy?

- ✅ Strategy Overview

- 🔍 When to Use the Short Put Strategy?

- 📊 Real-World Example 1: Bank Nifty

- 📊 Real-World Example 2: NIFTY Options

- 📌 Key Takeaways

- 👍 Pros & 👎 Cons

- 🔚 How to Exit?

- 📌 Final Thoughts

- ❓ Frequently Asked Questions (FAQs)

📉What is a Short Put Option Strategy?

A Short Put Option strategy is a bullish trading approach where the trader sells a Put Option, expecting the underlying asset not to fall below a specific price level. The profit is limited to the premium received, while the risk is theoretically unlimited.

✅ Strategy Overview

| Strategy Type | Bullish |

|---|---|

| Instruments Used | Put Options |

| Number of Positions | Single |

| Maximum Profit | Limited to Premium Received |

| Maximum Loss | Potentially Unlimited |

| Breakeven Point | Strike Price – Premium |

🔍 When to Use the Short Put Strategy?

You can apply a Short Put strategy when:

- You are bullish to neutral on the stock/index.

- You believe the underlying will stay above a certain price.

- You want to earn income through time decay (theta).

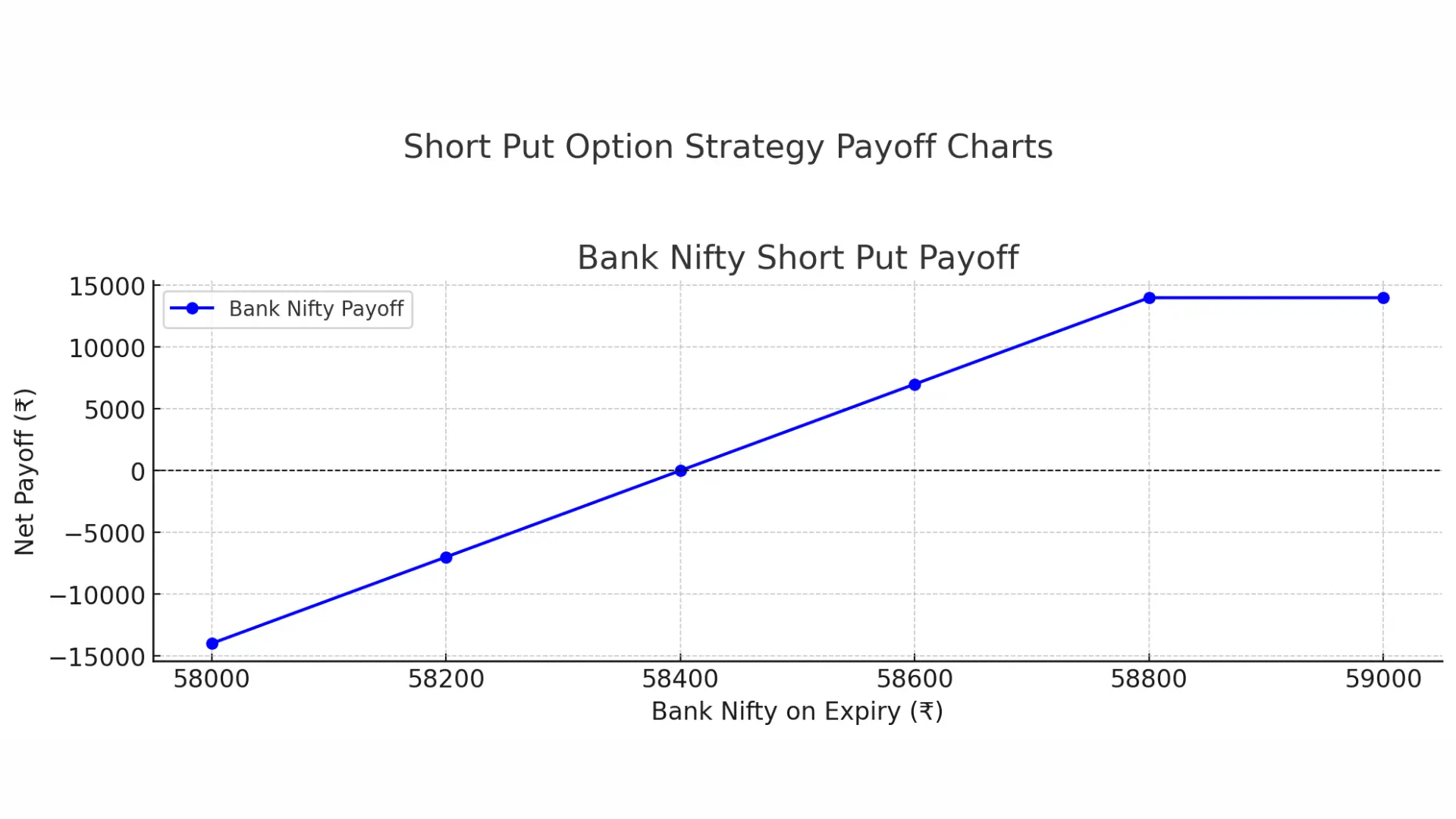

📊 Real-World Example 1: Bank Nifty

Bank Nifty Spot Price: ₹58,900

Strike Price Sold: ₹58,800

Premium Received: ₹400

Lot Size: 35

📌Break-Even Point: ₹58,800 - ₹400 = ₹58,400

🔽 Payoff Table

| Bank Nifty on Expiry | Premium Received | Loss/Gain on Option | Net Payoff |

|---|---|---|---|

| ₹58,000 | ₹14,000 | -₹28,000 | -₹14,000 |

| ₹58,200 | ₹14,000 | -₹21,000 | -₹7,000 |

| ₹58,400 | ₹14,000 | -₹14,000 | ₹0 |

| ₹58,600 | ₹14,000 | -₹7,000 | ₹7,000 |

| ₹58,800 | ₹14,000 | ₹0 | ₹14,000 |

| ₹59,000 | ₹14,000 | ₹0 | ₹14,000 |

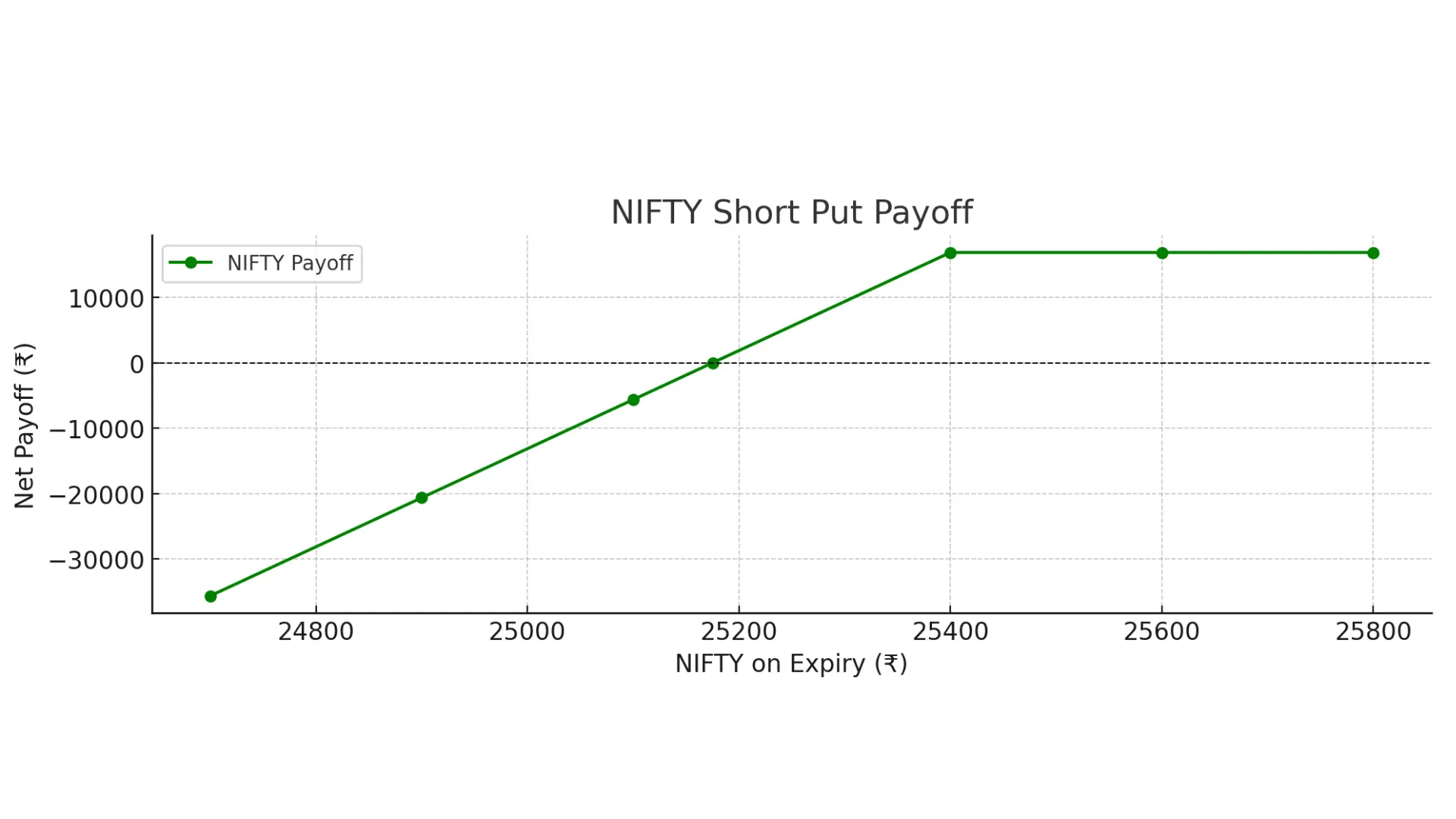

📊 Real-World Example 2: NIFTY Options

NIFTY Spot Price: ₹25,500

Strike Price Sold: ₹25,400

Premium Received: ₹225

Lot Size: 75

Premium Total: ₹16,875

📌Break-Even Point: ₹25,400 – ₹225 = ₹25,175

| NIFTY on Expiry | Net Payoff (₹) |

|---|---|

| ₹24,700 | -₹35,625 |

| ₹24,900 | -₹20,625 |

| ₹25,100 | -₹5,625 |

| ₹25,175 | ₹0 |

| ₹25,400 | ₹16,875 |

| ₹25,600 | ₹16,875 |

| ₹25,800 | ₹16,875 |

Note: Maximum gain is capped at the premium received: ₹16,875

📌 Key Takeaways

🎯 Actions

- Sell a Put Option at a strike price below the current spot price.

- Collect the premium upfront, which becomes your max profit.

📈 Market View

- Use this when expecting the price to remain stable or rise slightly.

⚠️ Risk Profile

- Unlimited Loss Potential if the price falls sharply.

- You are obliged to buy the asset at the strike price, even if the market value is much lower.

💰 Reward Profile

- Limited to Premium Received

- Profitable if the option expires worthless (i.e., underlying stays above strike).

👍 Pros & 👎 Cons

👍Pros

- Generates income from time decay (theta).

- Simple execution, no spreads required.

- Effective in sideways/bullish markets.

👎Cons

- Unlimited loss if the price falls sharply.

- High margin requirement.

- Requires active monitoring.

🔚 How to Exit?

- Buy back the Put Option to book profit or cut loss.

- Or let it expire worthless if the price stays above the strike.

📌 Final Thoughts

The Short Put Option Strategy is ideal for earning steady premiums in stable or rising markets. However, due to unlimited risk, it's best suited for experienced traders with a solid risk management system.

❓ Frequently Asked Questions (FAQs)

Q1. What is a Short Put Option Strategy?

A strategy where you sell a Put Option to earn the premium when expecting the asset to stay above a certain level.

Q2. Is a Short Put strategy risky?

Yes, it involves unlimited risk if the asset price drops below the strike significantly.

Q3. When should I use a Short Put?

When you're confident the price will stay above a certain level, bullish or neutral market view.

Q4. What’s the maximum profit?

Limited to the premium you received when selling the option.

Q5. Can I exit early?

Yes, by buying back the Put Option before expiry.