Table of Contents

- Overview

- What is a Short Call?

- How the Strategy Works

- Example: Stock Option

- Example: Bank Nifty

- When to Use

- Key Metrics

- Pros and Cons

- Final Thoughts

Overview

The Short Call, also known as a Naked Call, is a bearish options trading strategy where a trader sells (writes) a call option without owning the underlying asset. This strategy is suited for experienced traders due to its unlimited risk and limited reward nature.

🔍 Strategy Snapshot

| Parameter | Details |

|---|---|

| Strategy Level | Advanced |

| Instrument Traded | Call Option |

| Position Type | Single Leg – Sell Call |

| Market Outlook | Strongly Bearish |

| Risk | Unlimited |

| Reward | Limited (Premium received) |

| Breakeven Point | Strike Price + Premium Received |

💡What is a Short Call?

A Short Call strategy involves selling a call option without owning the underlying asset. Traders use this strategy when they expect the asset price to decline or remain below the strike price till expiry.

Since the trader earns a premium upfront, their maximum profit is capped at this amount. However, if the asset price rises significantly, the potential loss is theoretically unlimited because the seller is obligated to deliver the stock at the strike price, regardless of how high the market goes.

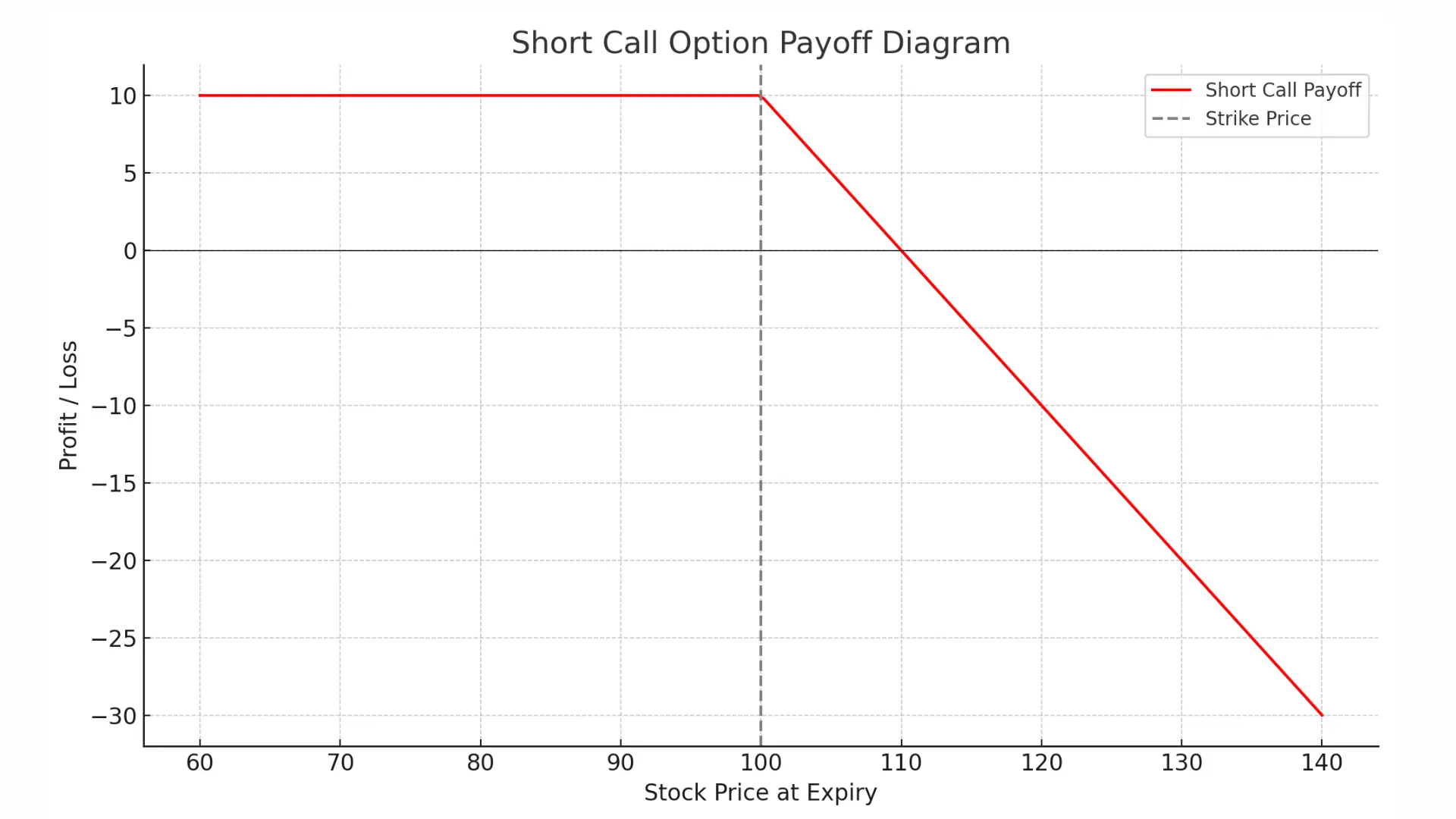

Here's the payoff graph for the Short Call (Naked Call) strategy:

- 📉 Profit is limited to the premium received (flat line to the left of the strike price).

- 📉 Loss becomes unlimited as the stock price rises beyond the strike price.

📈How the Strategy Works

Let’s break down the mechanics with an example:

📍 Scenario: NIFTY is trading at ₹25,000

You are bearish on NIFTY and believe the price will not rise above ₹25,000 by expiry. You decide to sell one NIFTY 25,000 Call Option.

- Sell 1 ATM Call Option: NIFTY25JUL25000CE

- Premium Received: ₹200

- Lot Size: 75

- Total Premium Received: ₹200 × 75 = ₹15,000

If NIFTY stays at or below ₹25,000 at expiry, the option will expire worthless, and you keep the premium of ₹15,000.

If NIFTY goes above ₹25,000, you’ll start incurring unlimited losses with every upward movement.

📊Short Call Example – Stock Option

Underlying Price: TCS ₹3400

Option Contract: July ₹3500 Call at ₹3 Premium

Lot Size: 175 Shares

You sell 1 lot of ₹3500 Call Option, and receive:

- Premium Received: ₹3 × 175 = ₹525

Let’s evaluate outcomes:

✅ Scenario 1: Stock stays at ₹3499

- Option expires worthless

- Net Profit = ₹525

❌ Scenario 2: Stock rises to ₹3568

- Option ends in-the-money

- Intrinsic value = ₹68 × 175= ₹11,900

- Net Loss = ₹11,900 - ₹525= ₹11,375

✅ Scenario 3: Stock drops to ₹3300

- Option expires worthless

- Net Profit = ₹525

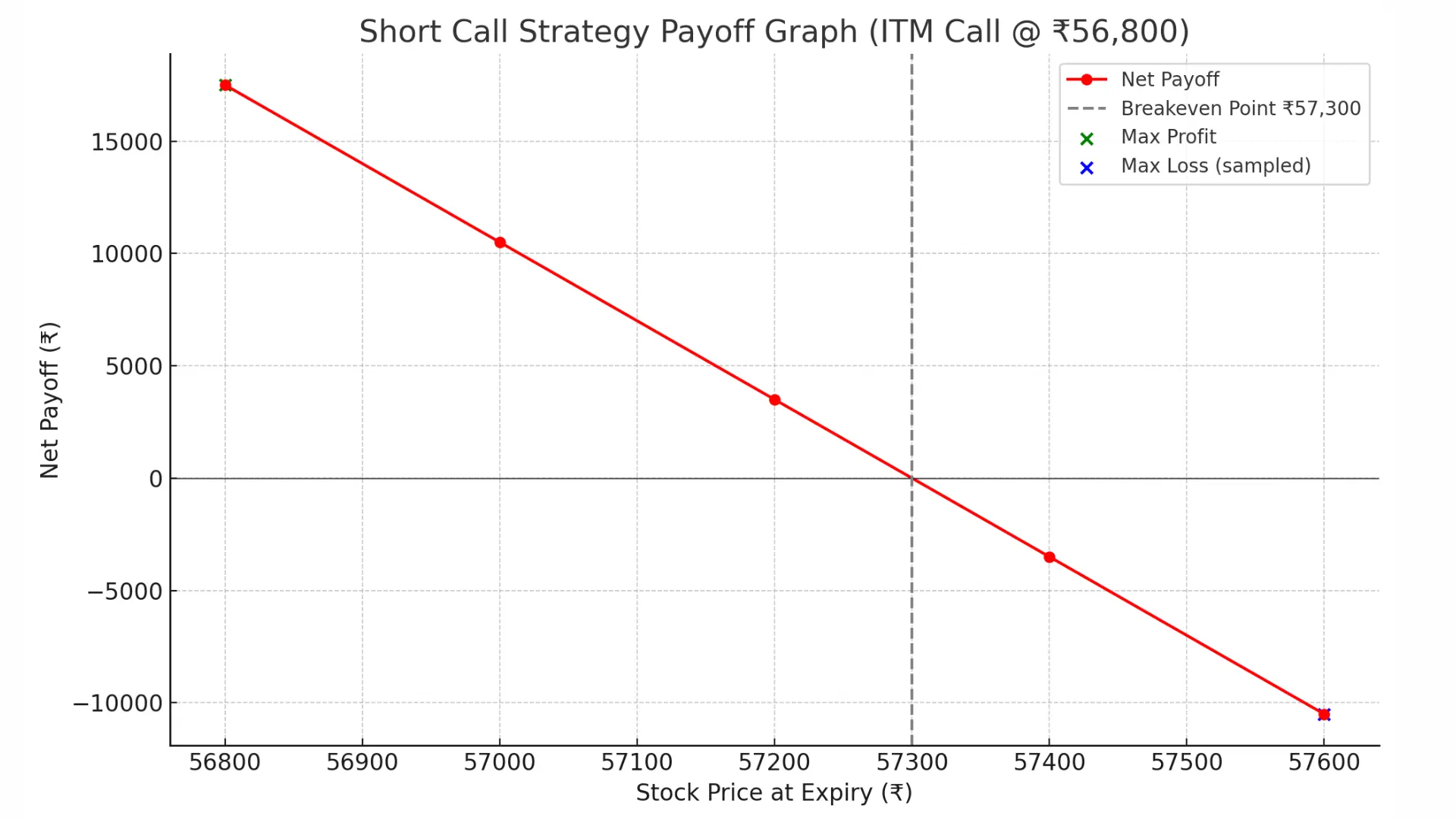

📊 Short Call Example – Bank Nifty

| Particulars | Details |

|---|---|

| Spot Price | ₹57,000 |

| Strike Price | ₹56,800 (ITM Call) |

| Premium Received | ₹500 |

| Lot Size | 35 |

| Total Premium | ₹17,500 |

| Breakeven Point | ₹56,800 + ₹500 = ₹57,300 |

Net Payoff Table

| Expiry Price | Loss from Option | Net Payoff |

|---|---|---|

| ₹56,800 | ₹0 | ₹17,500 |

| ₹57,000 | ₹7,000 | ₹10,500 |

| ₹57,200 | ₹14,000 | ₹3,500 |

| ₹57,400 | ₹21,000 | -₹3,500 |

| ₹57,600 | ₹28,000 | -₹10,500 |

Here is the payoff graph based on your data for a Short Call (ITM @ ₹56,800):

- ✅ Maximum Profit of ₹17,500 occurs when expiry is at or below ₹56,800.

- ⚠️ Breakeven Point is at ₹57,300.

- 📉 Beyond that, loss increases linearly with each rise in the Index price.

When to Use

Use the Short Call strategy when:

- You expect the stock/index price to fall or remain flat

- You are confident in a bearish or neutral market outlook

- You are an experienced trader who can manage risks actively

Key Metrics

| Criteria | Details |

|---|---|

| Maximum Profit | Premium Received |

| Achieved When | Price stays below or equal to Strike Price |

| Maximum Loss | Unlimited |

| Occurs When | Price rises above Strike + Premium |

| Breakeven Point | Strike Price + Premium Received |

Pros and Cons

✅ Pros of Short Call Strategy

- Generates income from premiums in a falling or sideways market

- Simple execution (single leg sell position)

- Useful in range-bound scenarios

❌ Cons of Short Call Strategy

- Unlimited loss potential if price moves sharply upward

- Requires constant monitoring and strict risk management

- Margin requirements can be high

- Not suitable for beginners

🧠Final Thoughts

The Short Call or Naked Call strategy can be profitable in bearish markets but comes with high risk exposure. Since there's no cap on losses, it’s essential to use stop-loss orders or hedge the position to avoid massive drawdowns. This strategy is best used by seasoned traders who are confident in their analysis and can manage volatility efficiently.