📑 Table of Contents

- What is a Short Call Butterfly Strategy?

- How it Works

- Example with Stock

- Example with Index

- Payoff Graph Explained

- Pros and Cons

- FAQs

- Final Thoughts

Options trading offers many strategies to profit in different market conditions. One such advanced strategy is the Short Call Butterfly Spread. It is a range-bound option strategy designed to benefit when the underlying asset shows high volatility — i.e., when you expect the stock or index to move significantly in either direction.

✅ What is a Short Call Butterfly Strategy?

The Short Call Butterfly is a bearish-to-volatile options strategy that involves three different strike prices. Unlike the Long Call Butterfly, which profits in a sideways market, the Short Call Butterfly profits from large price movements — either upward or downward.

It is created using four call option contracts:

- Sell 1 In-the-Money (ITM) Call (Lower strike)

- Buy 2 At-the-Money (ATM) Calls (Middle strike)

- Sell 1 Out-of-the-Money (OTM) Call (Higher strike)

👉 The goal is to earn when the stock/index moves far away from the middle strike price.

⚙️ How the Short Call Butterfly Works

- Max Profit: When the underlying moves significantly up or down beyond the breakeven points.

- Max Loss: Limited to the net premium paid if the stock stays around the middle strike.

- Market Outlook: Traders use this strategy when they expect high volatility but are unsure about the direction.

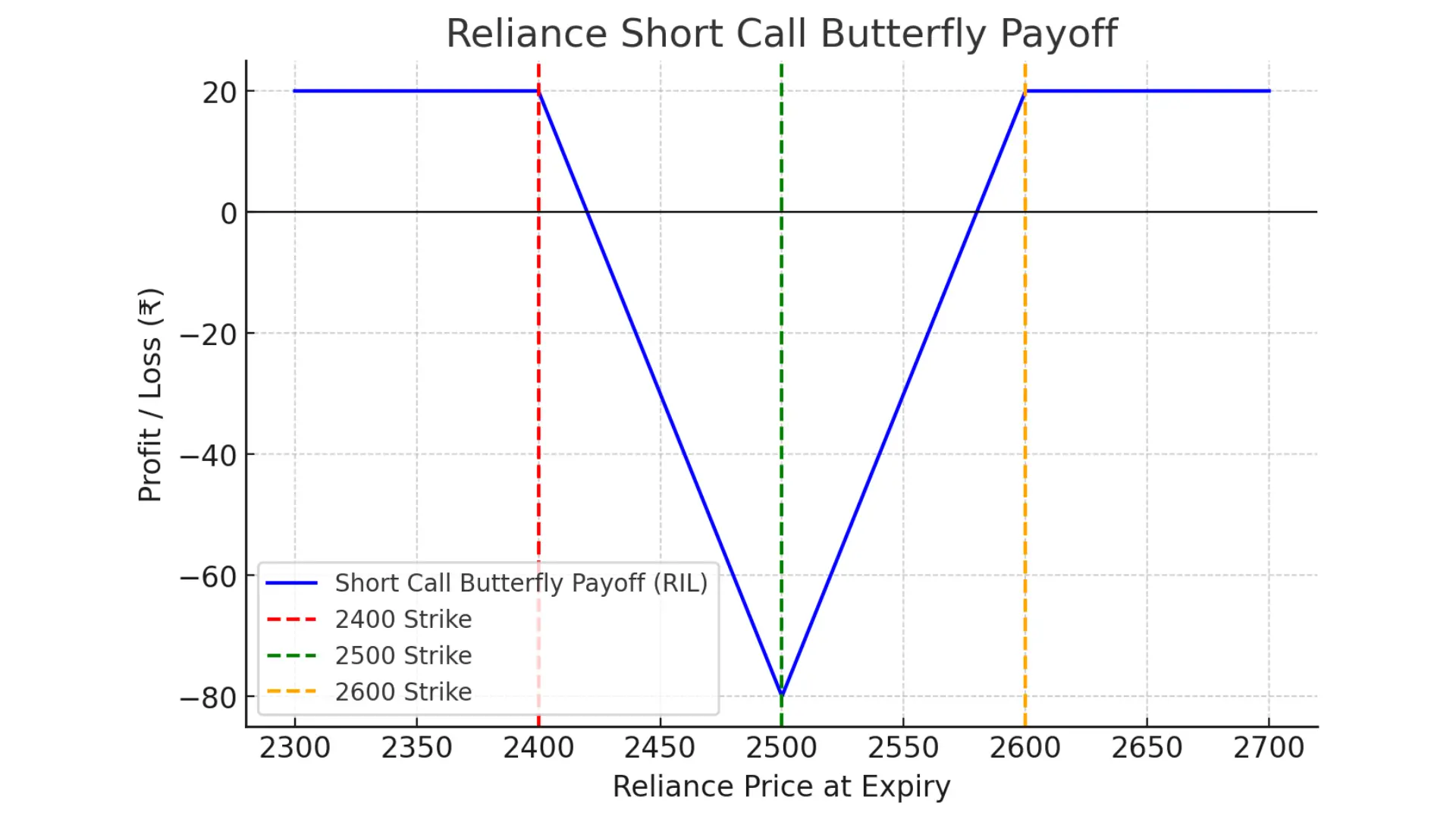

📊 Example 1: Short Call Butterfly with Stock

Let’s assume Reliance Industries (RIL) is trading at ₹2,500. You expect a big move due to the earnings announcement but are not sure if it will be up or down.

- Sell 1 ITM Call (Strike ₹2,400) – Premium = ₹160

- Buy 2 ATM Calls (Strike ₹2,500) – Premium = ₹100 each

- Sell 1 OTM Call (Strike ₹2,600) – Premium = ₹60

Net Premium Received:

(₹160 + ₹60) – (₹100 + ₹100) = ₹220 – ₹200 = ₹20 credit

Payoff Scenarios:

If Reliance moves sharply above ₹2,600 or below ₹2,400, you profit.

If it stays close to ₹2,500, you lose limited money.

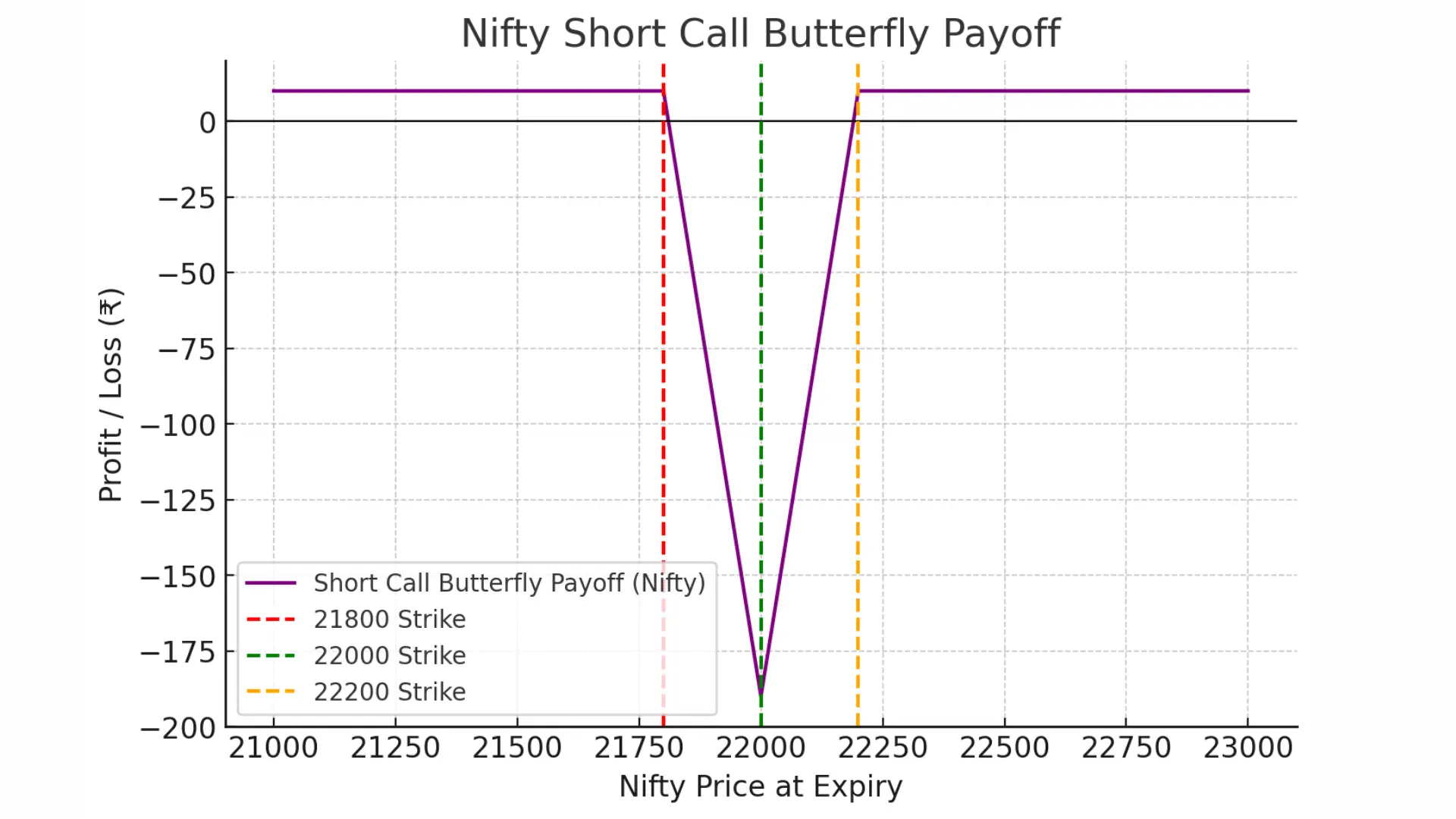

📊 Example 2: Short Call Butterfly with Index (Nifty 50)

Suppose Nifty is at 22,000 before the Union Budget. You expect a big move.

- Sell 1 ITM Call (21,800) – Premium = ₹280

- Buy 2 ATM Calls (22,000) – Premium = ₹200 each

- Sell 1 OTM Call (22,200) – Premium = ₹130

Net Premium:

(280 + 130) – (200 + 200) = 410 – 400 = ₹10 credit

Outcome:

If Nifty jumps above 22,200 or falls below 21,800 → profit.

If Nifty stays near 22,000 → loss (limited).

📉 Payoff Graph of Short Call Butterfly

The payoff graph of a Short Call Butterfly looks like an inverted “V” (concave).

👉 In simple terms:

- Flat market → Loss

- Volatile market → Profit

👍 Advantages & 👎 Disadvantages

Advantages

- Profits in high volatility situations.

- Limited risk strategy.

- Can be applied to both stocks and indices.

Disadvantages

- Losses occur if the stock/index stays near the middle strike.

- Requires experience in options pricing.

- Brokerage and margin requirements may be high.

🔎 FAQs on Short Call Butterfly

Q1. When should I use a Short Call Butterfly?

Use it when you expect large movement in stock/index (e.g., during earnings, budget, policy announcements).

Q2. Is the risk unlimited in this strategy?

No. Both profit and loss are capped.

Q3. Can I use this with weekly options?

Yes. Many traders use this on Nifty & Bank Nifty weekly options to capture volatility.

Q4. How is it different from a Long Call Butterfly?

Long Call Butterfly → Profits in sideways (low volatility).

Short Call Butterfly → Profits in high volatility (big move).

Q5. Is it good for beginners?

Not ideal. It requires an understanding of options Greeks, volatility, and strike selection.

📌 Final Thoughts

The Short Call Butterfly Strategy is a smart way to benefit from sharp market moves while keeping your risk limited. It’s best used during times of uncertainty and expected volatility, such as results, elections, or budgets.

For beginners, paper-trading this strategy before actual execution is highly recommended.