In a move closely watched by economists, market participants, and borrowers alike, the Reserve Bank of India (RBI) has officially RBI Cuts Repo Rate by 25 basis points, bringing it down to 6%. The latest Monetary Policy Committee (MPC) meeting, held in April 2025, also saw the policy stance shift from 'neutral' to 'accommodative', signaling a more growth-focused approach by the central bank.

Governor Sanjay Malhotra, in his first full-year policy announcement as RBI chief, emphasized the risks posed by escalating global tariff tensions and their likely negative impact on India’s net exports. Let’s dive into the key highlights, implications, and expert insights from this critical announcement.

What is the Repo Rate and Why It Matter

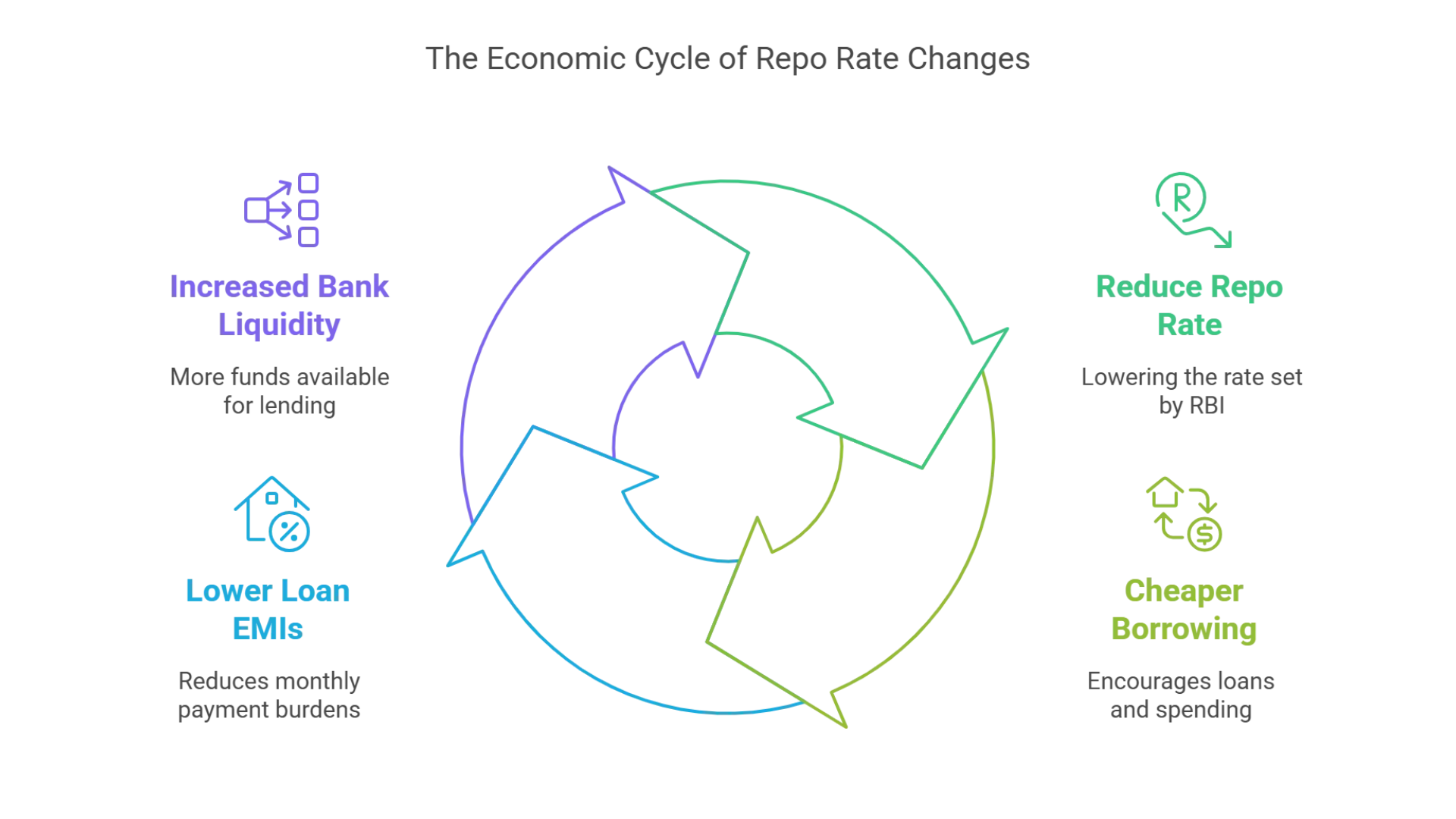

The repo rate is the interest rate at which the RBI lends money to commercial banks. When this rate is reduced:

- Borrowing becomes cheaper, encouraging consumption and investment

- Loan EMIs drop, helping borrowers save

- Banks get more liquidity, allowing more lending

This rate acts as a critical lever in managing inflation, liquidity, and economic growth.

RBI Cuts Repo Rate to 6% – The Decision Explained

The MPC voted unanimously to slash the repo rate from 6.25% to 6% in light of:

- Easing consumer inflation

- Global growth slowdown

- Worsening trade tensions

- Need to stimulate domestic demand

This was the second consecutive rate cut, following a similar move in February 2025. The accompanying rates were adjusted accordingly:

- Standing Deposit Facility (SDF): 5.75%

- Marginal Standing Facility (MSF) and Bank Rate: 6.25%

Key Statement from Governor Sanjay Malhotra

In a detailed address, Governor Malhotra said:

“Higher tariffs shall have a negative impact on net exports. We must act preemptively to insulate the domestic economy from external shocks.”

His comments underscore how rising global protectionism—especially new US tariff hikes—could dent India’s export-led growth and weaken external demand.

Inflation Projections – RBI Sees Comfort Ahead

A major driver behind the rate cut was the comfort in inflation projections:

Period | Previous CPI (%) | New CPI (%) |

|---|---|---|

FY26 | 4.2 | 4.0 |

Q1FY26 | 4.5 | 3.6 |

Q2FY26 | 4.0 | 3.9 |

Q3FY26 | 3.8 | 3.8 |

Q4FY26 | 4.2 | 4.4 |

With inflation projected to stay within the RBI’s target band (2-6%), the central bank has room to support growth without stoking price pressures.

GDP Growth Outlook – Slightly Trimmed But Optimistic

The RBI revised GDP growth estimates slightly lower due to global uncertainty:

Period | Previous (%) | New (%) |

|---|---|---|

FY26 | 6.7 | 6.5 |

Q1FY26 | 6.7 | 6.5 |

Q2FY26 | 7.0 | 6.7 |

Q3FY26 | 6.5 | 6.6 |

Q4FY26 | 6.5 | 6.3 |

Despite this slight dip, the RBI believes India’s growth trajectory remains resilient, thanks to:

- Improving investment sentiment

- Revival in manufacturing

- Gradual uptick in urban consumption

Tariff Wars and Global Risks – A Real Threat

Governor Malhotra didn’t mince words when he said:

“Some of the concerns of the trade frictions are coming true, unsettling the global community.”

India is feeling the heat from US tariff hikes, including a 26% reciprocal tariff on Indian goods. The fear is that higher tariffs could stifle exports, reduce foreign inflows, and hurt employment in export-heavy sectors like textiles, gems, and engineering goods.

Rate Cut Transmission – The Real Test Lies Ahead

A key challenge is whether banks will pass on the full benefit of the repo rate cut to borrowers.

“The effectiveness of the rate cut hinges on swift transmission to retail loans,” noted Pradeep Aggarwal, Chairman of Signature Global.

Historically, banks have been slow to adjust lending rates. For this policy move to be impactful, home loan, auto loan, and SME loan rates need to decline promptly.

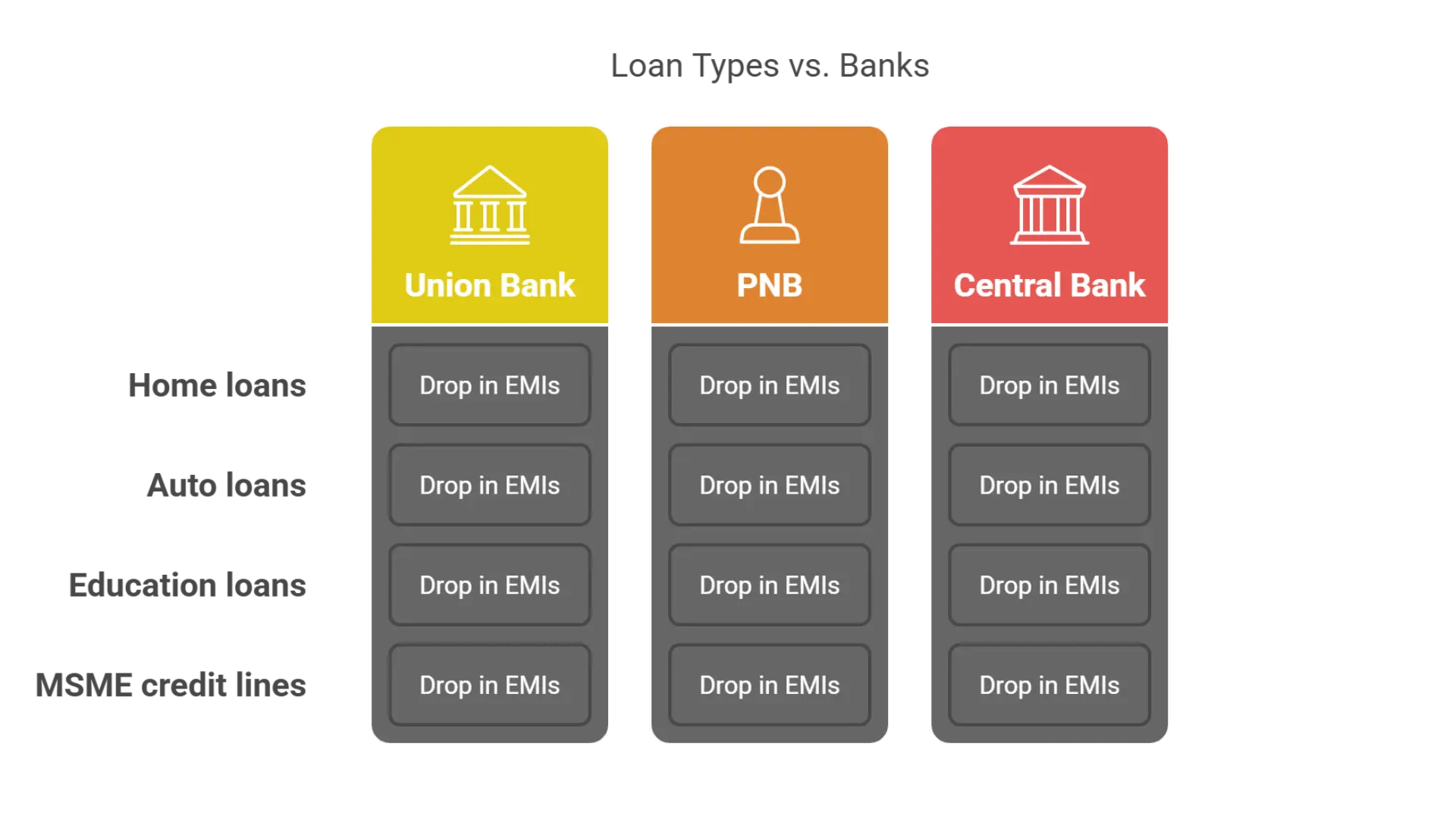

Impact on Borrowers – Relief on the Horizon

Borrowers across India can expect a drop in EMIs, especially for:

- Home loans

- Auto loans

- Education loans

- MSME credit lines

Banks like Union Bank, PNB, and Central Bank of India already offer rates near 8.1–8.15%. Analysts predict these could dip below 8% in the coming weeks.

Stock Market Reacts to Policy Decision

Despite rate cut optimism, Indian equity indices fell due to:

- Weak global cues

- Tariff uncertainty

- Weekly options expiry

As of 9:15 AM on April 9:

- Sensex dropped 442.59 points to 73,784.49

- Nifty 50 slipped 144.90 points to 22,390.95

However, with a bullish divergence forming, many believe a rally could resume soon.

Bond Yields Hit 3-Year Low – What It Means

The 10-year bond yield slipped to 6.589%, its lowest level since January 2022. This sharp fall is driven by:

- Lower inflation expectations

- Liquidity infusion by RBI

- Rate cut anticipation

For investors, this means:

- Capital gains on existing bond holdings

- Lower returns on new bond investments

- A potential shift toward equity and real estate

Gold Shines Amid Uncertainty

With the US dollar weakening and tariff worries mounting, gold prices soared:

- Spot gold touched $3,000.13 per ounce

- Gold futures climbed to $3,014.40

This indicates a risk-off sentiment, with investors moving to safe-haven assets amid geopolitical and financial uncertainty.

RBI’s Growth-Friendly Stance – A Strategic Pivot

In contrast to the hawkish posture under previous Governor Shaktikanta Das, Sanjay Malhotra has embraced a more accommodative approach:

- Over $80 billion injected into the banking system since February

- Willingness to cut rates despite global risks

- Focus on reviving demand, investment, and industrial output

This could pave the way for a sustained domestic recovery, even as external headwinds persist.

Securitisation of Stressed Assets – A Bold Reform

One of the noteworthy regulatory moves announced:

“We propose to enable securitisation of stressed assets through a market-based mechanism,” said Malhotra.

This means bad loans could now be bundled and sold, similar to how mortgage-backed securities work in the West. If implemented properly, this could:

- Free up bank capital

- Improve credit availability

- Restore financial sector confidence

Conclusion: A Delicate Balancing Act Amid Global Uncertainty

The RBI’s decision to cut the repo rate to 6% is a strategic step aimed at safeguarding India’s growth in a volatile global environment. With tariff wars escalating, export risks rising, and inflation cooling, the timing seems apt.

However, the road ahead isn’t free of challenges. The effectiveness of this policy depends largely on:

- Transmission speed by banks

- Continued macroeconomic stability

- Evolving geopolitical landscape

For now, both consumers and businesses can expect a mild boost, especially if the reduction in borrowing costs starts translating into real economic momentum.