Table of Contents

- Option Selling Strategy: Double Batman Strategy (Monthly Explained)

- What is the Double Batman Strategy?

- Double Batman Setup – Nifty (Monthly)

- Double Batman Setup – Bank Nifty (Monthly)

- Basic Rules & Best Practices

- Why Use the Double Batman Strategy?

- Practical Examples

- Risk, Adjustments & Exit Ideas

- FAQs

In options trading, a clear framework helps control risk and grow returns. One such non-directional framework is the Double Batman Strategy — a premium-decay, range-bound approach that works well on monthly expiries for both Nifty and Bank Nifty.

If you expect a stable market, this structure can turn time decay (Theta) into steady income. Below you’ll find the setup, rules, two worked examples, and a practical FAQ.

What is the Double Batman Strategy?

The Double Batman is a non-directional option selling strategy. You build four legs on each side (Calls and Puts) in a staggered, out-of-the-money (OTM) fashion. The payoff resembles two “bat wings,” hence the name. You sell more lots than you buy to harvest premium decay, while the buys act as hedges and distance anchors.

Double Batman Setup – Nifty (Monthly)

Expiry: Monthly

Capital Requirement: ₹5–6 Lakhs

Entry Window: 3rd or 4th week for the next month's expiry

At a Glance

- Non-directional, range-bound bias

- Relies on time decay (Theta)

- Keep funds for adjustments

| Leg | Action | Side | Qty | Placement | Notes |

|---|---|---|---|---|---|

| 1st Leg | Buy | OTM CE & OTM PE | 1 lot each | Delta ≈ 0.30 | Anchor hedges |

| 2nd Leg | Sell | OTM CE & OTM PE | 2 lots each | 200 points away from 1st leg | Premium harvest |

| 3rd Leg | Buy | OTM CE & OTM PE | 1 lot each | 200 points away from 2nd leg | Risk buffer |

| 4th Leg | Sell | OTM CE & OTM PE | 2 lots each | 200 points away from 3rd leg | Outer premium layer |

Double Batman Setup – Bank Nifty (Monthly)

Expiry: Monthly

Capital Requirement: ₹5–6 Lakhs

Entry Window: 3rd or 4th week for the next month's expiry

Key Difference

- Spacing is wider: 500 points between legs

| Leg | Action | Side | Qty | Placement | Notes |

|---|---|---|---|---|---|

| 1st Leg | Buy | OTM CE & OTM PE | 1 lot each | Delta ≈ 0.30 | Anchor hedges |

| 2nd Leg | Sell | OTM CE & OTM PE | 2 lots each | 500 points away from 1st leg | Premium harvest |

| 3rd Leg | Buy | OTM CE & OTM PE | 1 lot each | 500 points away from 2nd leg | Risk buffer |

| 4th Leg | Sell | OTM CE & OTM PE | 2 lots each | 500 points away from 3rd leg | Outer premium layer |

Basic Rules & Best Practices

- Non-directional: Prefer stable markets; avoid entries before major events (RBI policy, Budget, elections).

- Adjustment power: Keep extra funds aside to manage adverse moves.

- First week: Avoid aggressive adjustments unless the index moves > 1.0%.

- Low frequency: Fewer adjustments usually outperform over-tinkering.

Why Use the Double Batman Strategy?

- ✅ High Probability of Profit (POP): Tailored for range-bound conditions.

- ✅ Time Decay Advantage: Systematically captures premium decay.

- ✅ Clear Framework: Easy, step-wise deployment.

- ❌ Unlimited Risk: Extreme moves can hurt — monitor & hedge.

- ❌ Capital Intensive: Typical requirement is ₹5–6 lakhs.

Practical Examples

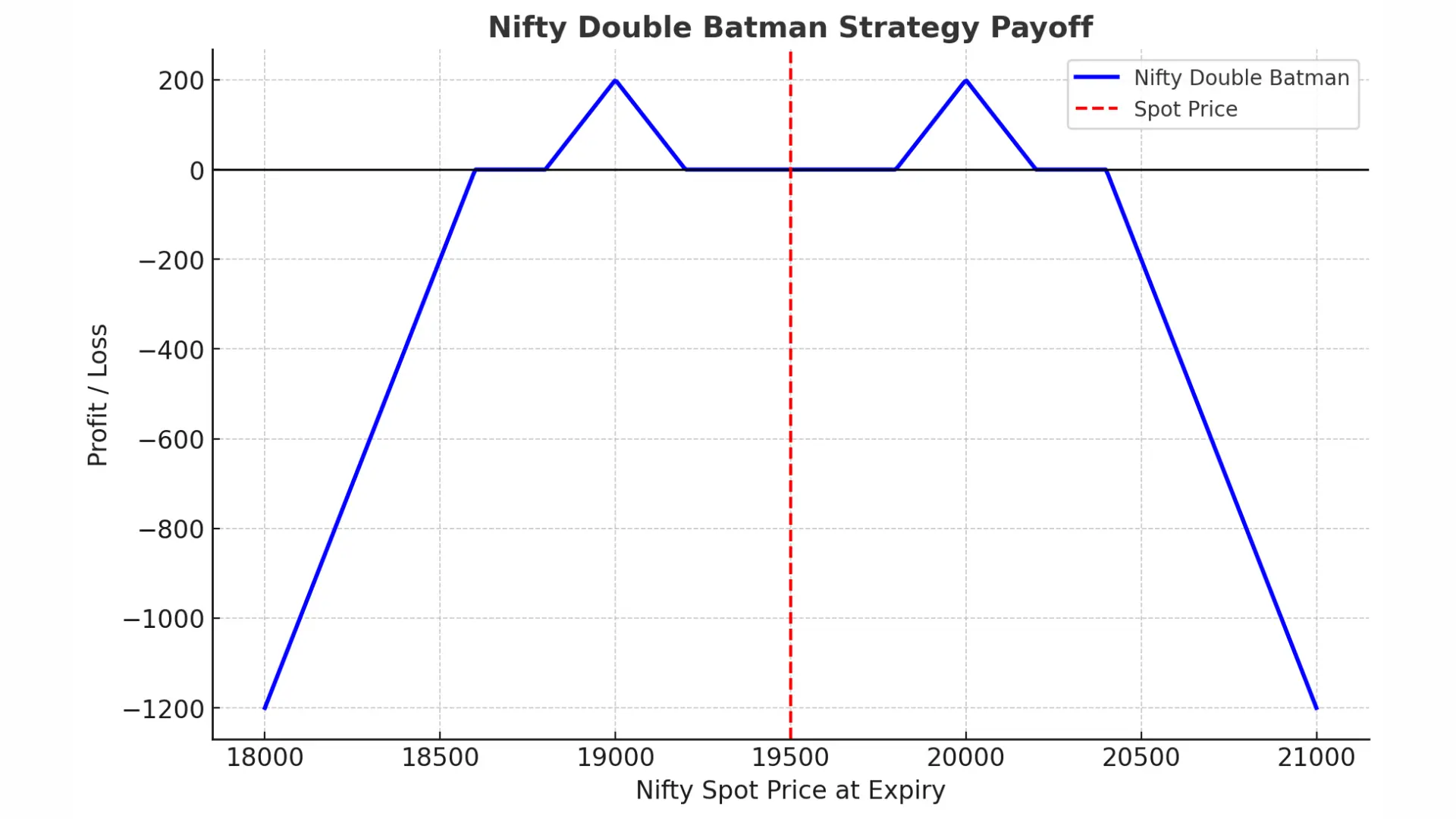

Example 1: Nifty Double Batman

Assume Nifty = 19,500 (entry during 3rd week).

- Buy 1 lot 19,800 CE & Buy 1 lot 19,200 PE (Δ ≈ 0.30)

- Sell 2 lots 20,000 CE & Sell 2 lots 19,000 PE (200 pts from 1st leg)

- Buy 1 lot 20,200 CE & Buy 1 lot 18,800 PE (200 pts from 2nd leg)

- Sell 2 lots 20,400 CE & Sell 2 lots 18,600 PE (200 pts from 3rd leg)

Outcome idea: If Nifty stays roughly within 18,800–20,200 till expiry, time decay works in your favor.

Here’s the effective payoff graph for the Nifty Double Batman Strategy 🎯.

It shows:

The profit zones (two peaks) are where the strategy works best.

The maximum loss outside the wings.

The spot price (19500) is clearly marked with a red dashed line.

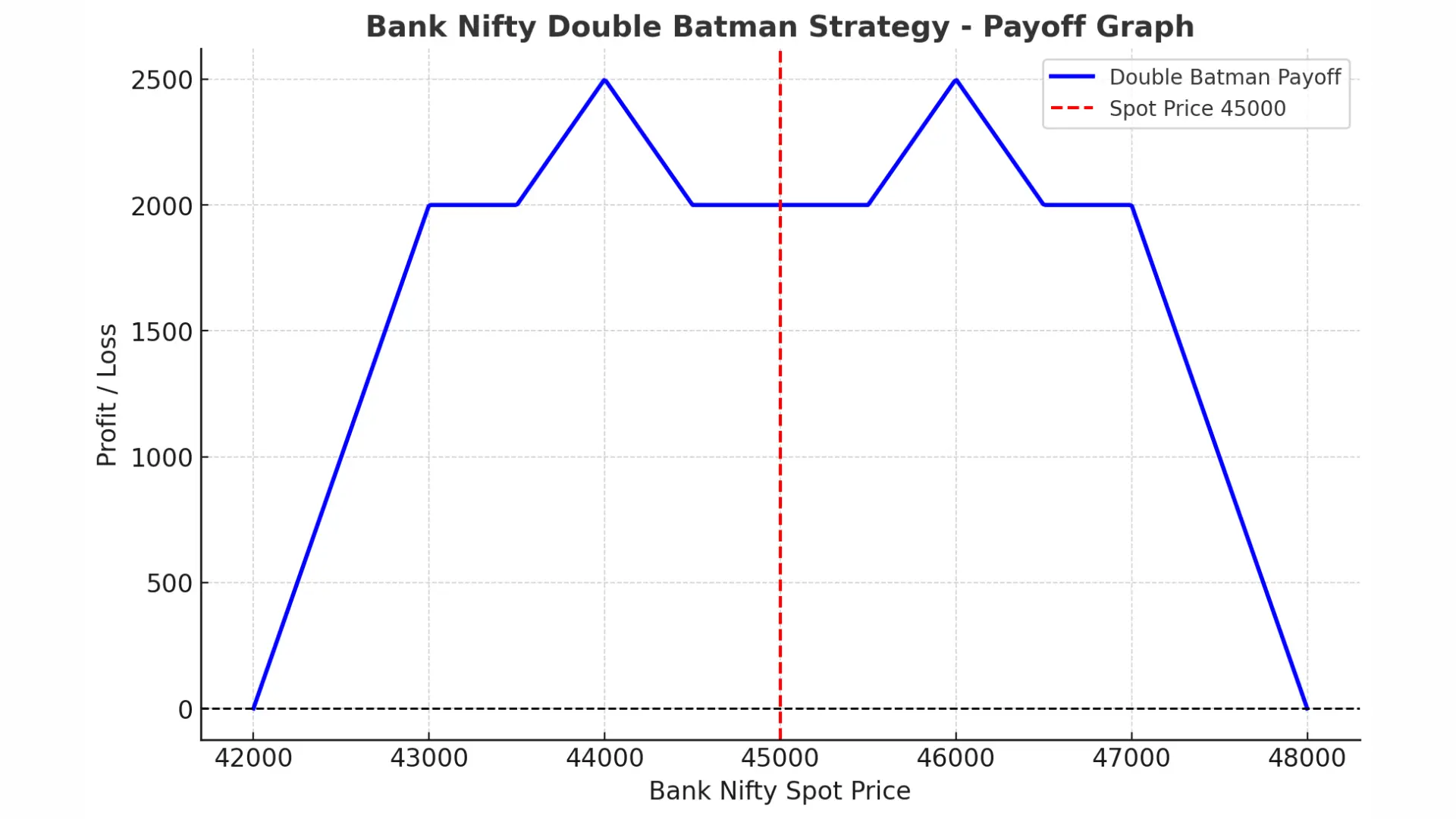

Example 2: Bank Nifty Double Batman

Assume Bank Nifty = 45,000.

- Buy 1 lot 45,500 CE & Buy 1 lot 44,500 PE (Δ ≈ 0.30)

- Sell 2 lots 46,000 CE & Sell 2 lots 44,000 PE (500 pts from 1st leg)

- Buy 1 lot 46,500 CE & Buy 1 lot 43,500 PE (500 pts from 2nd leg)

- Sell 2 lots 47,000 CE & Sell 2 lots 43,000 PE (500 pts from 3rd leg)

Outcome idea: A range around 44,000–46,500 tends to favor premium decay and stabilizes P&L.

Risk, Adjustments & Exit Ideas

- Gap Risk: Sudden gaps from news/events can expand losses. Consider protective buys or quick delta hedges (e.g., futures micro-hedge).

- Volatility Spike: Rising IV widens premiums; avoid chasing adjustments — scale in calmly or reduce exposure.

- Time-based Exit: Many sellers book profits when 60–75% of the total premium is captured or 5–7 trading days before expiry.

- P&L Guardrails: Pre-define max daily loss (e.g., 1–1.5% of capital) and total strategy loss limit.

Frequently Asked Questions

1) Is the Double Batman suitable for beginners?

It’s structured and rule-based, but because it involves multiple legs and adjustments, beginners should start small or paper trade first.

2) Why do we buy fewer lots than we sell?

Buying fewer lots acts as a distance hedge and structure anchor, while the extra short lots are the primary source of premium income.

3) What market condition suits this strategy best?

Range-bound or mildly trending markets with stable volatility. Avoid major binary events.

4) How much capital do I need?

Typical requirement is around ₹5–6 lakhs for one full structure in Nifty or Bank Nifty.

5) When should I adjust?

Only if price threatens outer short strikes or if the index moves > 1% early. Otherwise, let Theta work.

6) Do I hold to expiry?

Not necessary. Many traders exit after capturing 60–75% of the premium or before the final week to avoid gamma risk.

7) Is the risk unlimited?

Yes, naked short exposure implies theoretically unlimited risk. Discipline in sizing, hedges, and exits is essential.

8) Can I automate this?

Yes, with broker APIs for entries, spreads, alerts, and IV filters, but test thoroughly before going live.

Disclaimer: Options involve substantial risk and are not suitable for every investor. Examples are educational and not recommendations.