📚 Table of Contents

- What is a Long Straddle?

- Strategy Setup

- When to Use a Long Straddle?

- Real-World Examples

- Key Metrics

- Advantages

- Disadvantages

- Exit Strategy

- Final Thoughts

- FAQs

🔍 What is a Long Straddle?

The Long Straddle, also known as the Buy Straddle, is a popular neutral options trading strategy used by traders when they expect significant price movement in a stock or index but are unsure of the direction. This strategy involves purchasing one Call option and one Put option with the same strike price and expiration date on the same underlying asset.

It’s a smart choice during high-volatility events like earnings announcements, budgets, elections, or geopolitical tensions, where major price swings—up or down—are expected.

⚙️ Strategy Setup

- Instruments Used: Call + Put

- Number of Positions: 2

- Market Outlook: Neutral

- Risk Profile: Limited

- Reward Profile: Unlimited

- Breakeven Points: Two

How It Works:

Buy 1 Call Option + Buy 1 Put Option at the same strike and expiry. The total premium paid is your maximum loss. Profit becomes unlimited if price moves significantly.

🧠 When to Use a Long Straddle?

- When direction is uncertain

- When volatility is expected to rise

- During events like earnings, budget, or geopolitical developments

📊 Real-World Examples

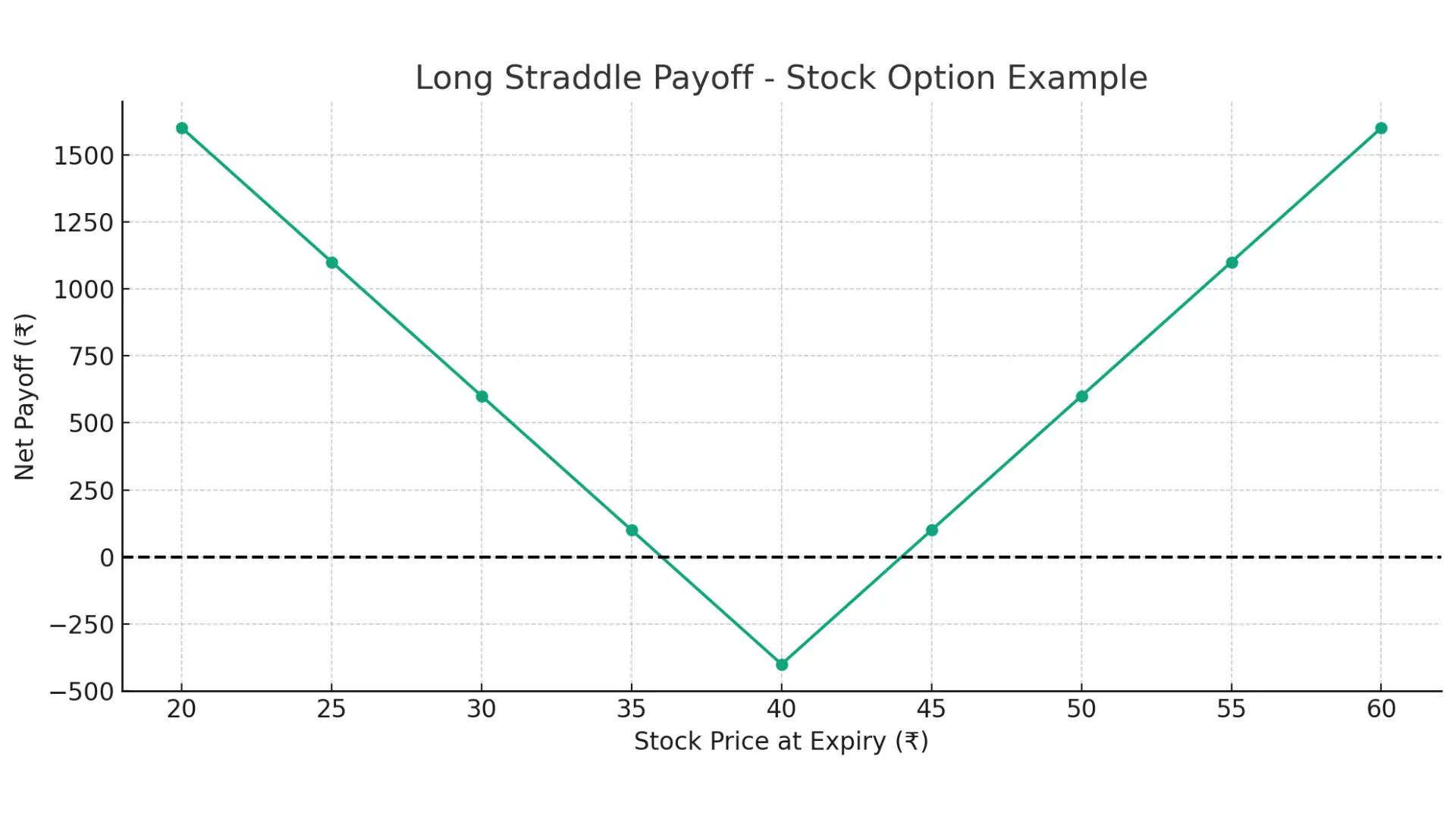

Example 1: Stock Options

- Spot Price: ₹40

- Call Premium: ₹2

- Put Premium: ₹2

- Lot Size: 100

Net Premium: ₹400

Scenario Table:

| Price | Call Payoff | Put Payoff | Net P&L |

|---|---|---|---|

| ₹40 | 0 | 0 | -₹400 |

| ₹50 | ₹1000 | 0 | ₹600 |

| ₹30 | 0 | ₹1000 | ₹600 |

Position Setup:

- Buy 1 Call = ₹2 × 100 = ₹200

- Buy 1 Put = ₹2 × 100 = ₹200

- Total Cost (Net Premium): ₹400

Scenario 1: Price stays at ₹40

- Both options expire worthless

- Total Loss = ₹400 (maximum possible loss)

Scenario 2: Price rises to ₹50

- Call Value = ₹10 × 100 = ₹1,000

- Put expires worthless

- Profit = ₹1,000 - ₹400 = ₹600

Scenario 3: Price falls to ₹30

- Put Value = ₹10 × 100 = ₹1,000

- Call expires worthless

- Profit = ₹1,000 - ₹400 = ₹600

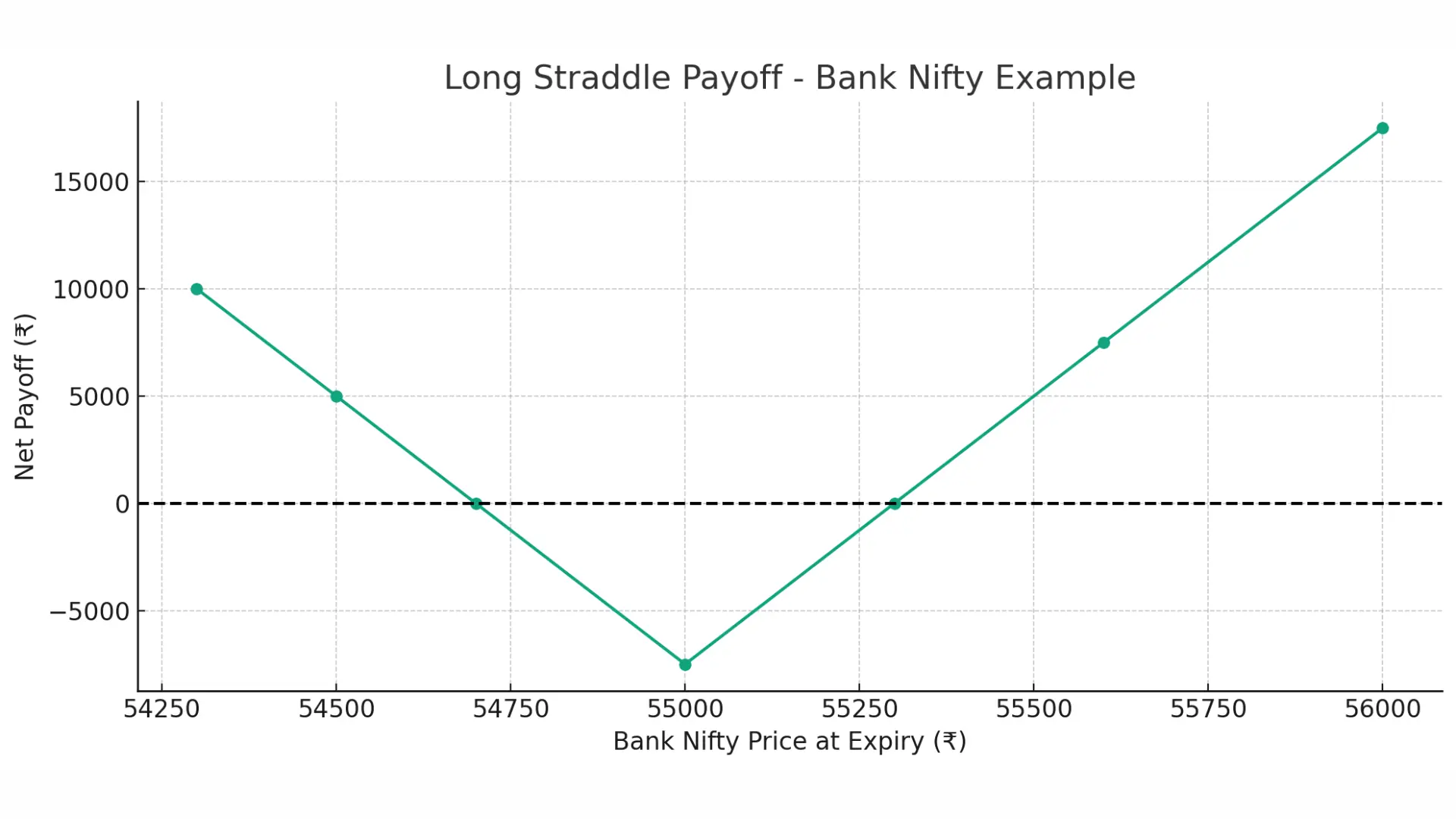

Example 2: Bank Nifty Long Straddle

- Spot Price: ₹54,900

- Strike Price: ₹55,000

- Call Premium: ₹100

- Put Premium: ₹200

- Lot Size: 25

Net Premium: ₹300 × 25 = ₹7,500

Breakevens: ₹54,700 and ₹55,300

Scenario Table:

| Closing Price | Call Payoff | Put Payoff | Net Payoff |

|---|---|---|---|

| ₹54,300 | -₹2,500 | ₹12,500 | ₹10,000 |

| ₹54,500 | -₹2,500 | ₹7,500 | ₹5,000 |

| ₹54,700 | -₹2,500 | ₹2,500 | ₹0 |

| ₹55,000 | -₹2,500 | -₹5,000 | -₹7,500 |

| ₹55,300 | ₹5,000 | -₹5,000 | ₹0 |

| ₹55,600 | ₹12,500 | -₹5,000 | ₹7,500 |

| ₹56,000 | ₹22,500 | -₹5,000 | ₹17,500 |

📈 Key Metrics of Long Straddle

- Lower Breakeven: Strike Price – Net Premium

- Upper Breakeven: Strike Price + Net Premium

- Maximum Loss: Limited to the premium paid

- Maximum Profit: Unlimited if the price moves significantly

✅ Advantages

- Best for volatile markets

- Unlimited profit potential

- Simple structure and easy to implement

⚠️ Disadvantages

- Needs large price movement to be profitable

- Time decay can eat premiums if volatility doesn't appear

🔄 Exit Strategy

Exit the Long Straddle by:

- Selling the Call Option

- Selling the Put Option

You can also exit early to book profits or cut losses.

🧾 Final Thoughts

The Long Straddle is a solid strategy when you're expecting big market moves but can’t predict the direction. With limited downside and unlimited upside, it suits traders in uncertain but high-volatility situations. Whether you're trading Nifty, Bank Nifty, or individual stocks, this strategy helps turn unpredictability into potential profit.

❓ Frequently Asked Questions (FAQs)

Q1. What is the Long Straddle strategy?

It’s an options strategy that involves buying a call and a put option with the same strike and expiry, aiming to profit from large price movements.

Q2. When should I use a Long Straddle?

Use it when you expect high volatility due to earnings, elections, policy changes, etc., but are unsure about direction.

Q3. What is the risk in a Long Straddle?

Risk is limited to the total premium paid for both options.

Q4. Can I exit the Long Straddle before expiry?

Yes. You can sell both options anytime before expiry to realize profits or limit losses.

Q5. What is the breakeven for a Long Straddle?

There are two: Strike Price ± Net Premium Paid.