Table of Contents

🔍What is a Long Put Option Strategy?

A Long Put Option Strategy is a simple options trading strategy that profits when the underlying asset’s price falls. It involves buying a Put Option, giving the trader the right (but not the obligation) to sell the asset at a specific price (strike price) before the expiry.

This strategy is ideal for traders with a bearish outlook on the market who want to benefit from a price decline, with limited downside risk.

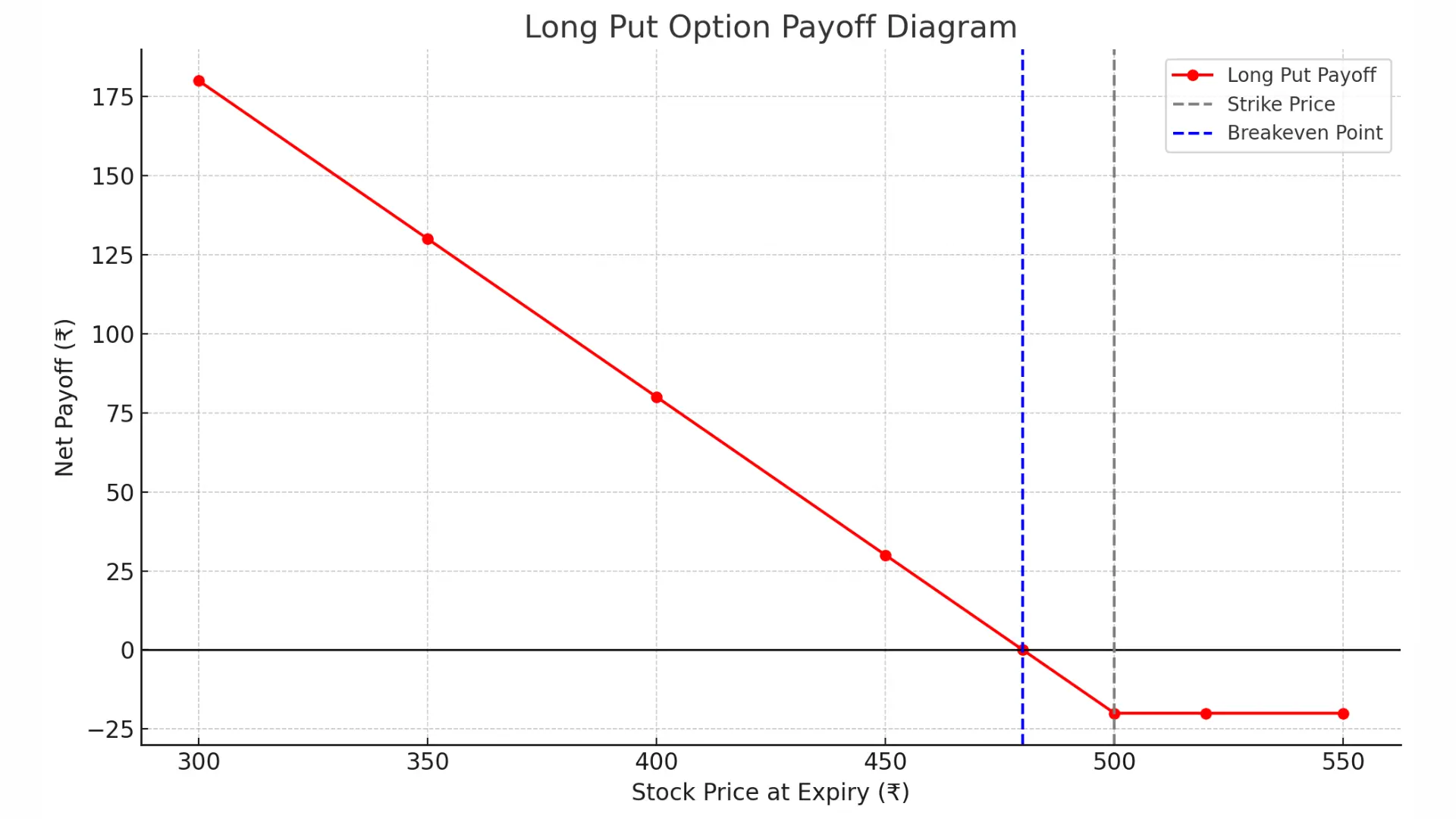

Here's the Long Put Option Payoff Graph, which shows the profit and loss (P&L) at expiry for a long put position:

📈 Long Put Payoff Graph Details

- X-axis: Stock Price at Expiry (₹)

- Y-axis: Net Payoff (₹)

- Breakeven Point = Strike Price − Premium Paid

- Maximum Profit = Strike Price − Premium (when stock price drops to zero)

- Maximum Loss = Premium Paid (if the stock price ends above strike)

✅ Example Assumptions

| Parameter | Value |

|---|---|

| Strike Price | ₹500 |

| Premium Paid | ₹20 |

| Breakeven | ₹480 |

| Lot Size | 1 (for simplicity) |

🧮 Payoff Table

| Stock Price at Expiry (₹) | Intrinsic Value | Net Payoff = (Strike − Price − Premium) |

|---|---|---|

| 550 | 0 | -20 |

| 520 | 0 | -20 |

| 500 | 0 | -20 |

| 480 | 20 | 0 |

| 450 | 50 | +30 |

| 400 | 100 | +80 |

| 350 | 150 | +130 |

| 300 | 200 | +180 |

📊 Long Put Payoff Chart

I'll now generate a graph based on this data.

Here is the Long Put Option Payoff Graph:

- 🔴 Red Line: Net payoff for holding a long put.

- ⚫ X-axis: Stock Price at Expiry.

- 🔹 Blue dashed line: Breakeven point (₹480).

- ⚪ Gray dashed line: Strike price (₹500).

As seen:

- If the stock falls below ₹480, you start making a profit.

- If it stays above ₹500, your loss is limited to the premium paid (₹20).

- The lower the stock price, the higher the profit (up to the strike minus premium).

🧠Key Features

| Parameter | Details |

|---|---|

| Instruments Used | Put Options |

| Market Outlook | Bearish |

| Risk | Limited to premium paid |

| Reward | Theoretically unlimited |

| Breakeven Point | Strike Price – Premium Paid |

📊Why Use a Long Put Strategy?

The Long Put strategy allows traders to:

- Capitalize on falling prices.

- Take a bearish position with limited capital.

- Limit losses to just the premium paid.

- Avoid the unlimited risk involved in short-selling stocks.

Unlike holding a short position in equities, a long put comes with a clear, predefined risk, making it a smart alternative for risk-conscious traders.

📌When to Use Long Put Strategy

Use the Long Put strategy when:

- You expect the underlying asset to decline sharply.

- Market volatility is rising.

- You want to limit your loss to the premium.

🛠️How to Execute a Long Put Strategy

Let’s say NIFTY is currently trading at ₹25,000. You believe it will fall.

Example Setup:

| Action | Contract | Strike Price | Premium |

| Buy 1 Put | NIFTY 25JUL 25,000 PE | ₹25,000 | ₹150 |

If NIFTY falls, your Put option gains value. If NIFTY rises, the maximum you lose is the premium.

📘Real-World Examples

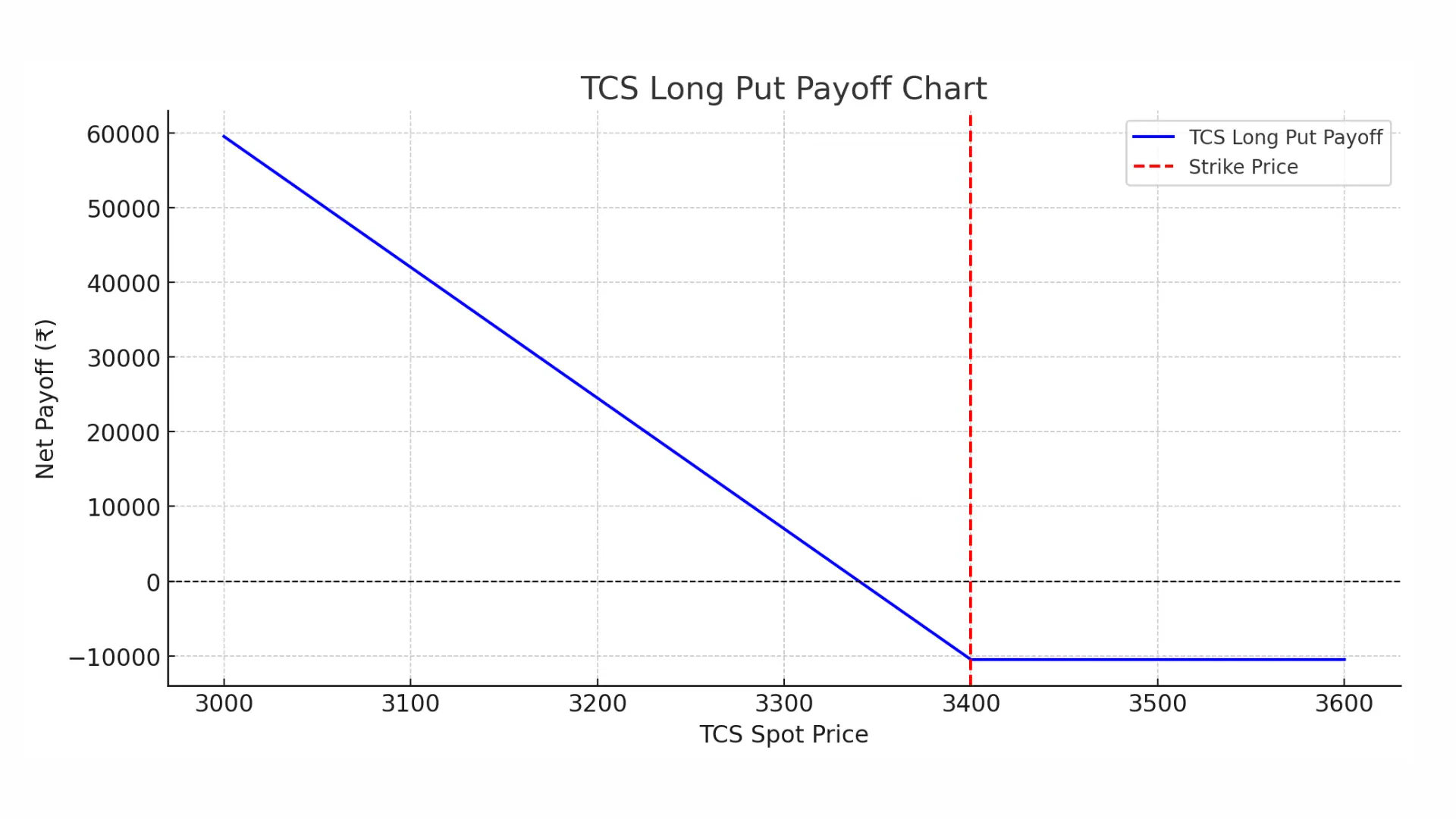

📌Example 1: TCS Stock

• Spot Price: TCS ₹3400

• Put Option Strike Price: ₹3400

• Premium: ₹60

• Lot Size: 175 shares

• Total Cost (Premium): ₹10500

Scenario A: Stock stays at ₹3400

• Option expires worthless.

• Loss = ₹10500 (maximum possible loss)

Scenario B: Stock rises to ₹3500

• Option again expires worthless.

• Loss = ₹10500

Scenario C: Stock falls to ₹3200

• Intrinsic Value = ₹200 × 175= ₹35,000

• Profit = ₹35,000 - ₹10500= ₹24,500

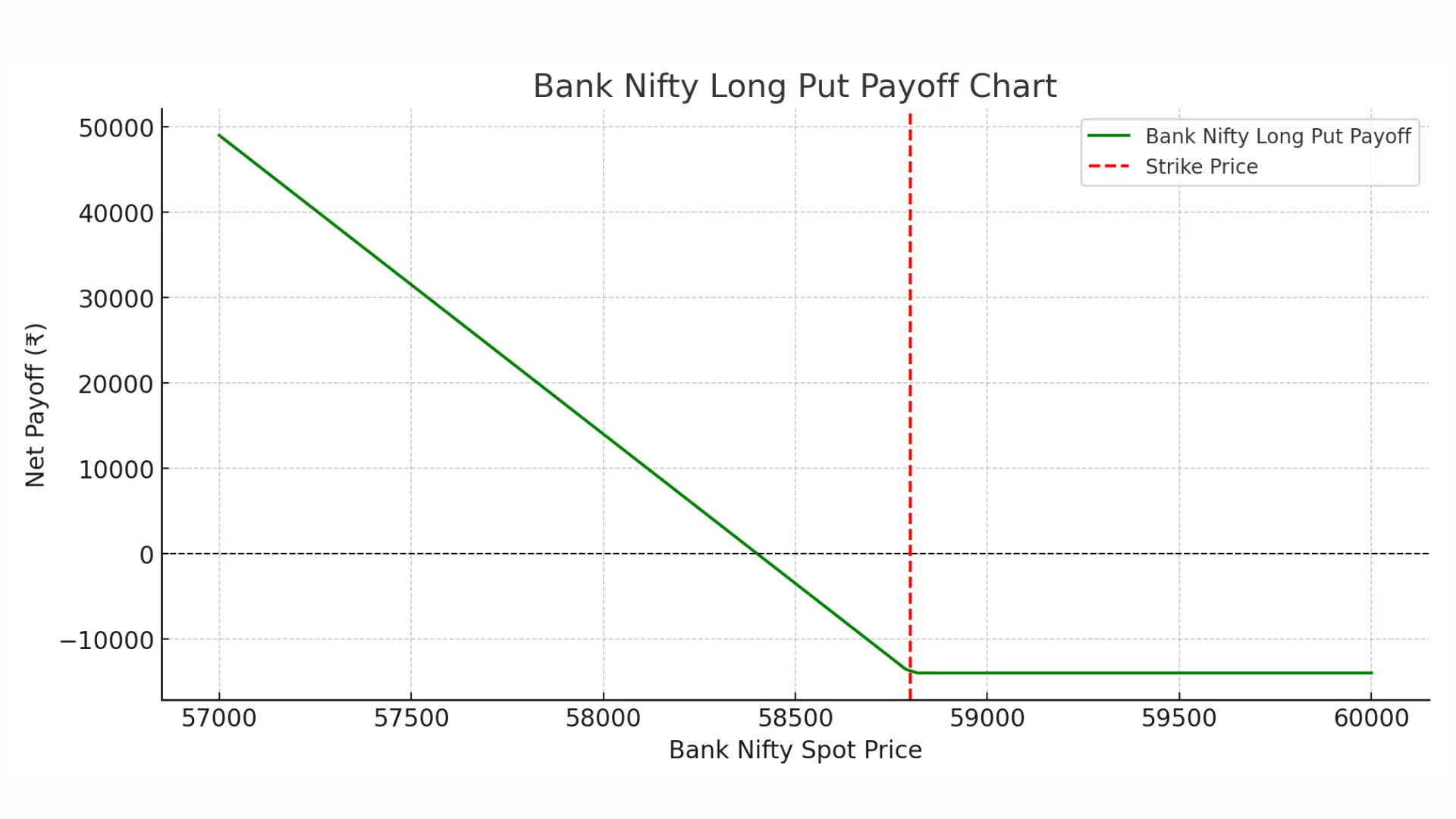

📌Example 2: Bank Nifty

- Bank Nifty Spot Price: ₹58,900

- Strike Price: ₹58,800

- Premium Paid: ₹400

- Lot Size: 35

- Total Cost: ₹14,000

- Breakeven Price: ₹58,400

| Expiry Price | Payoff (₹) | Net Profit (₹) |

| 58,000 | 28,000 | 14,000 |

| 58,200 | 21,000 | 7,000 |

| 58,400 | 14,000 | 0 |

| 58,600 | 7,000 | -7,000 |

| 58,800 | 0 | -14,000 (Max loss) |

| 59,000 | 0 | -14,000 |

📉Risk & Reward Profile

- Maximum Loss = Premium Paid

- Maximum Profit = Theoretically Unlimited (if underlying price falls to zero)

- Breakeven Point = Strike Price – Premium Paid

✅Pros and ❌Cons

✅ Pros:

- Limited, predefined risk

- High profit potential in falling markets

- No margin requirement

- Simple to execute

❌ Cons:

- 100% premium loss if the asset doesn’t move below the strike price

- Time decay works against the position

🏁How to Exit a Long Put

- Sell the Put Option before expiry to book profits or minimize losses

- Hold till expiry if expecting a strong downside

- Avoid letting OTM (out-of-the-money) puts expire worthless unnecessarily

📌Final Thoughts

The Long Put strategy is an excellent choice for traders expecting a downward move in an underlying stock or index. It's especially useful when you want to take a bearish bet while keeping your risk low and defined.

Whether you're a beginner or an experienced trader, this simple yet effective strategy can be a valuable tool in your options trading playbook.