📑 Table of Contents

- What is a Long Iron Condor?

- How the Strategy is Constructed

- Payoff Diagram with Explanation

- Examples using Stock & Index Options

- Advantages

- Risks

- FAQs for Beginners

- Final Thoughts

Long Iron Condor option strategy gives you the flexibility to design strategies for different market conditions. One of the most popular range-bound strategies is the Long Iron Condor. It is designed for traders who expect low volatility in a stock or index and want to earn limited profit with limited risk.

✅ What is a Long Iron Condor?

A Long Iron Condor is a non-directional options trading strategy that profits when the underlying stock or index remains within a specific price range.

It involves four option contracts with the same expiry but different strike prices:

- Buy 1 Out-of-the-Money Put (lower strike)

- Sell 1 Put (just below current price)

- Sell 1 Call (just above current price)

- Buy 1 Out-of-the-Money Call (higher strike)

This creates a “condor-shaped” payoff graph, hence the name.

👉 It’s called a long condor because you pay a small net premium to enter the trade.

⚙️ How the Strategy Works

- Maximum profit: Earned when the stock stays between the two middle strike prices (the sold put & sold call).

- Maximum loss: Limited to the net premium paid.

- Market outlook: Best for range-bound markets with low volatility.

📊 Payoff Graph of Long Iron Condor

Profit | ______ | / \ | / \ |-------------/ \----------- | / \ | / \ |_________/ \_______ Loss K1 K2 K3 K4

K1 = Lower Put Buy

K2 = Put Sell

K3 = Call Sell

K4 = Higher Call Buy

📌 Examples of Long Iron Condor

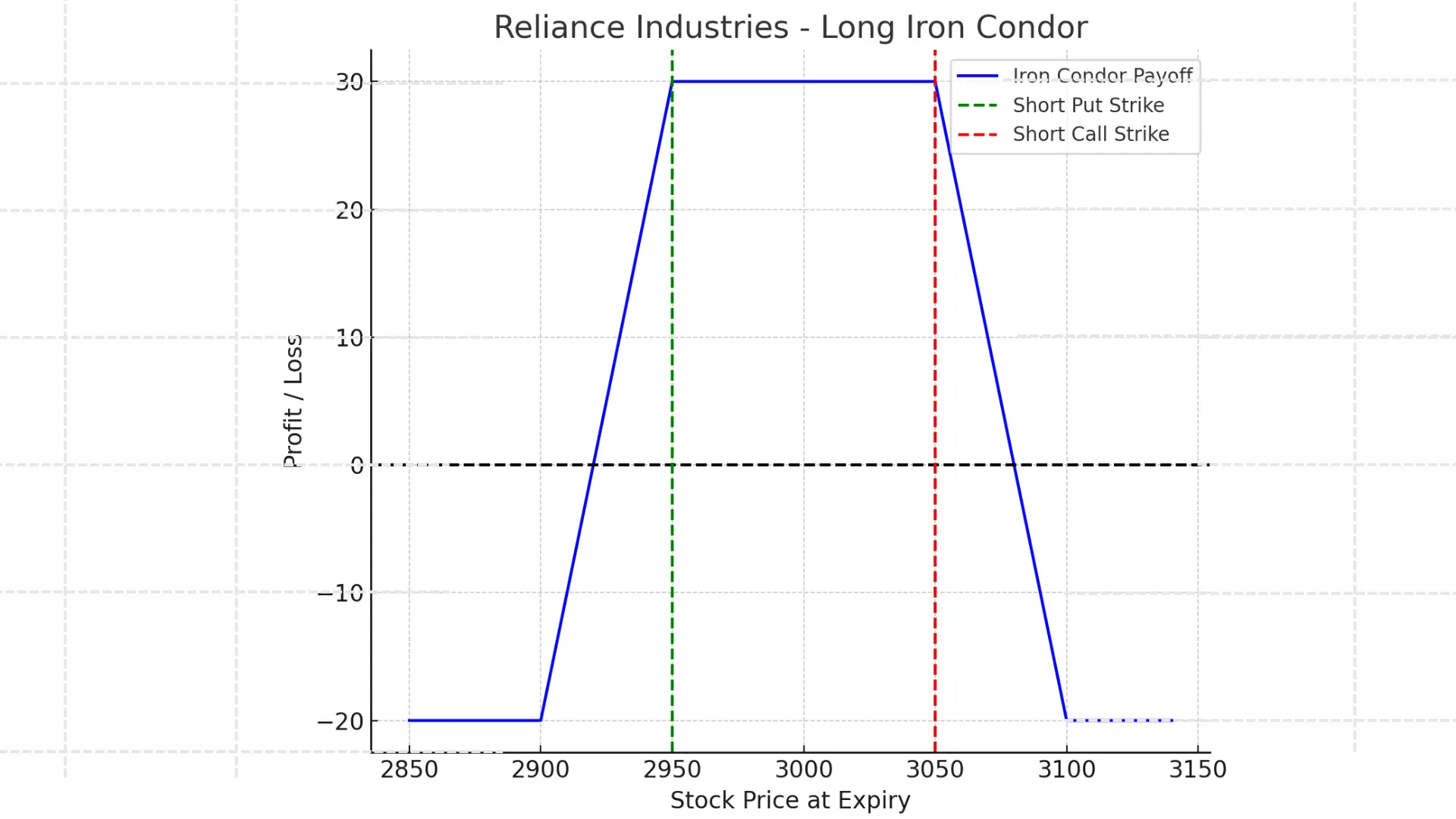

Example 1: Reliance Industries

Suppose Reliance is trading at ₹3,000. You expect it to remain between 2,950 – 3,050 till expiry.

- Buy 1 Put (Strike 2900) @ ₹10

- Sell 1 Put (Strike 2950) @ ₹25

- Sell 1 Call (Strike 3050) @ ₹25

- Buy 1 Call (Strike 3100) @ ₹10

Net Premium Paid = ₹20

Max Profit = ₹30

Max Loss = ₹20

Breakeven Points = 2930 and 3070

If Reliance stays between ₹2950 – ₹3050, you make a profit.

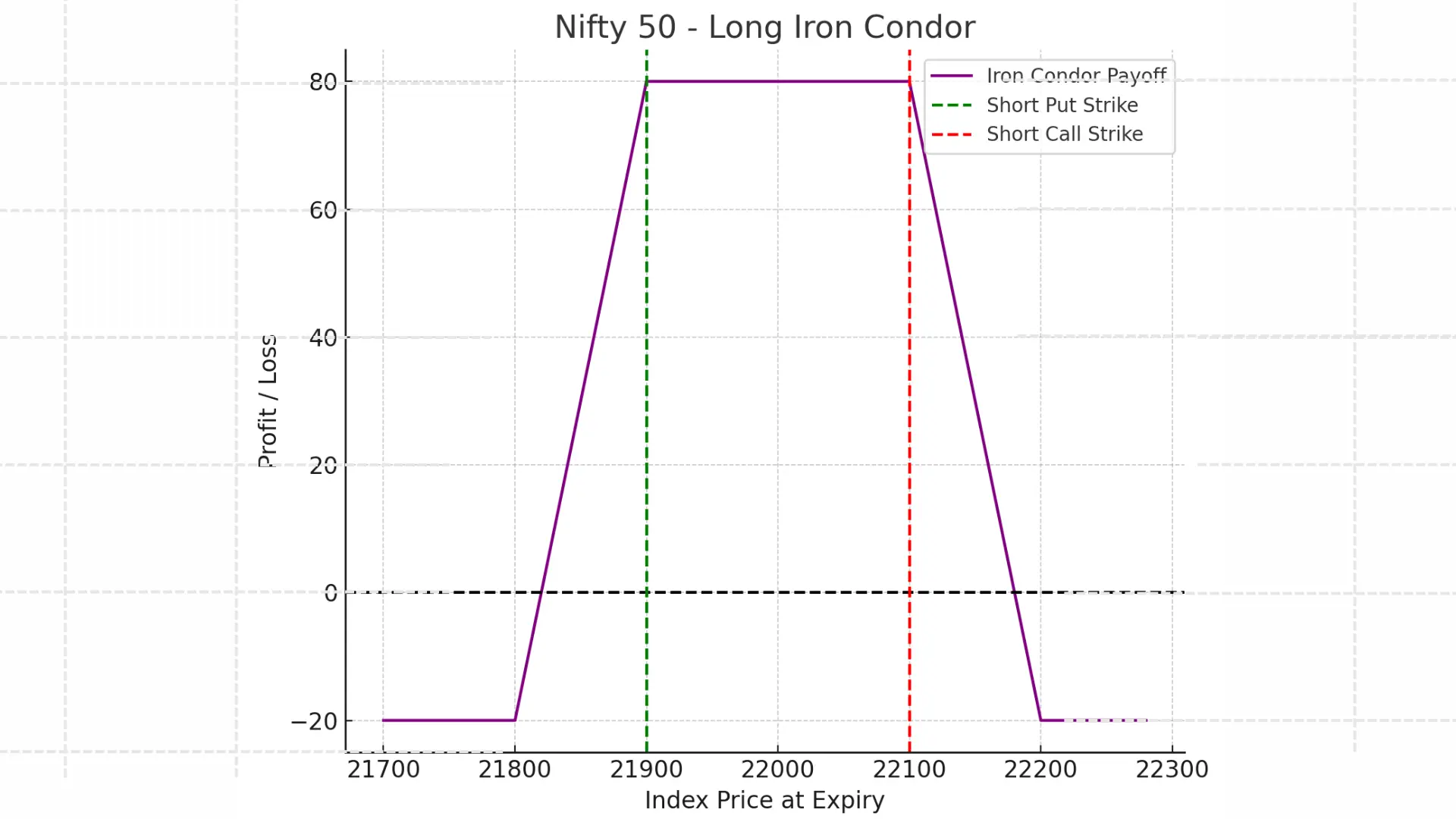

Example 2: Nifty 50 Index

Nifty is at 22,000. You expect no big move till expiry.

- Buy 1 Put (21,800) @ ₹30

- Sell 1 Put (21,900) @ ₹70

- Sell 1 Call (22,100) @ ₹70

- Buy 1 Call (22,200) @ ₹30

Net Premium Paid = ₹40

Max Profit = ₹60

Max Loss = ₹40

Breakeven = 21,860 and 22,140

This is ideal for traders betting on a sideways market.

⭐ Advantages of Long Iron Condor

- Limited risk and limited reward

- Works well in low volatility environments

- Profitable even if the stock/index moves slightly within the middle range

- Higher probability of profit compared to directional strategies

⚠️ Risks & Limitations

- Profit is capped (cannot earn unlimited gains)

- Loss occurs if the stock moves sharply outside the expected range

- Time decay (Theta) benefits sellers but hurts if the market moves out of range

- Requires careful strike selection and timing

❓ FAQs on Long Iron Condor

Q1. Is Long Iron Condor good for beginners?

Yes, it’s beginner-friendly since risk is limited and payoff is easy to understand.

Q2. When should I use this strategy?

When you expect low volatility and believe the stock/index will stay within a range.

Q3. Can I exit before expiry?

Yes, you can square off anytime before expiry if profit is achieved early.

Q4. What is the difference between a Long Iron Condor and a Short Iron Condor?

Long = Net debit, profits in low volatility. Short = Net credit, profits in high volatility.

Q5. Is a margin required for this trade?

Yes, brokers may block margin, but since both calls and puts are bought & sold, the margin requirement is usually lower than for naked positions.

🏁 Final Thoughts

The Long Iron Condor is a safe and systematic strategy for sideways markets. While profits are capped, the strategy provides peace of mind with limited risk. Traders who want a steady income from options with low volatility often rely on this strategy.

If you’re trading stocks like Reliance, Infosys, or indices like Nifty 50 or Bank Nifty, a Long Iron Condor can help you generate consistent returns when you don’t expect big moves.