Table of Contents

- What Is a Long Call Option Strategy?

- When Should You Use a Long Call Strategy?

- How Does It Work?

- Real-World Example 1: Bank Nifty

- Real-World Example 2: NIFTY

- How to Exit a Long Call Trade?

- Benefits of Long Call Strategy

- Limitations of Long Call Strategy

- Profit & Loss Summary

- Strategy Summary

- Final Thoughts

What Is a Long Call Option Strategy?

A Long Call is a basic options trading strategy used when a trader expects the price of a stock or index to rise. This strategy involves buying a single call option, giving the trader the right (but not the obligation) to purchase the underlying asset at a specific price (called the strike price) before the expiry date.

The risk is limited to the premium paid for the option, while the profit potential is unlimited, making it a popular strategy among beginner and intermediate traders.

Risk: Limited to the premium paid. Reward: Unlimited.

When Should You Use a Long Call Strategy?

This strategy is ideal when you are bullish on the market or a specific stock. If you believe a stock (like Reliance, TCS, or Nifty Index) will increase in value in the short term, buying a call option can be a cost-effective way to benefit from the upside without purchasing the actual stock.

How Does It Work?

Pay a premium to buy a call option. If the stock rises above the breakeven (Strike + Premium), you profit. If it stays below strike, you lose only the premium.

- ✅ Maximum Loss: Limited to the premium paid

- ✅ Maximum Profit: Unlimited

- ✅ Breakeven Point: Strike Price + Premium

Real-World Example 1: Bank Nifty

Trade Setup:

- Current Spot: ₹56,900

- Strike Price: ₹56,800

- Premium: ₹800

- Lot Size: 35

- Breakeven Point: ₹56,800 + ₹800= ₹57,600

| Bank Nifty on Expiry (₹) | Premium Payoff (₹) | Exercise Payoff (₹) | Net Payoff (₹) |

|---|---|---|---|

| 56,800 | -28,000 | 0 | -28,000 |

| 57,000 | -28,000 | 7,000 | -21,000 |

| 57,200 | -28,000 | 14,000 | -14,000 |

| 57,400 | -28,000 | 21,000 | +7,000 |

| 57,600 | -28,000 | 28,000 | 0 |

| 57,800 | -28,000 | 35,000 | +7,000 |

| 58,000 | -28,000 | 42,000 | +14,000 |

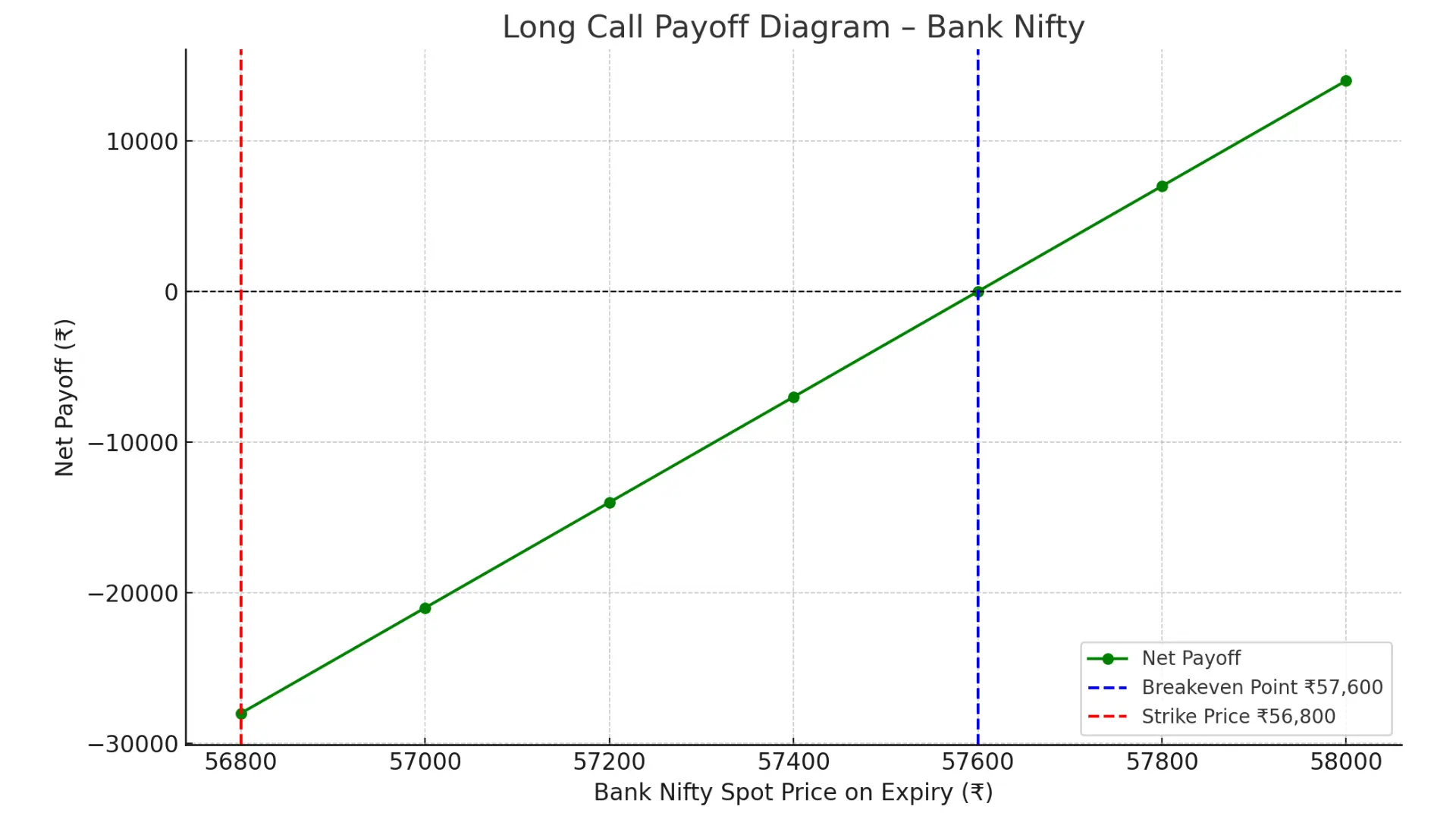

Here's the payoff graph for the Bank Nifty Long Call strategy:

- 📍 Red Line = Strike Price (₹56,800)

- 📍 Blue Line = Breakeven Point (₹57,600)

- ✅ Green Line = Net Payoff Curve

This clearly shows:

- Loss is capped at ₹28,000 (premium paid)

- Profit rises as the price moves above ₹57,600

Let me know if you want this as an image file or want to create another one for NIFTY!

Real-World Example 2: NIFTY

- Nifty Spot: ₹25,550

- Strike Price: ₹25,750

- Premium: ₹40

- Lot Size: 75

- Total Premium Cost: ₹3,000

- Breakeven: ₹25,790(25,750+40)

| Nifty on Expiry (₹) | Net Payoff (₹) |

|---|---|

| 25,200 | -3,000 |

| 25,500 | -3,000 |

| 25,790 | 0 |

| 25,800 | +750 |

| 25,900 | +8,250 |

| 26,000 | +15,750 |

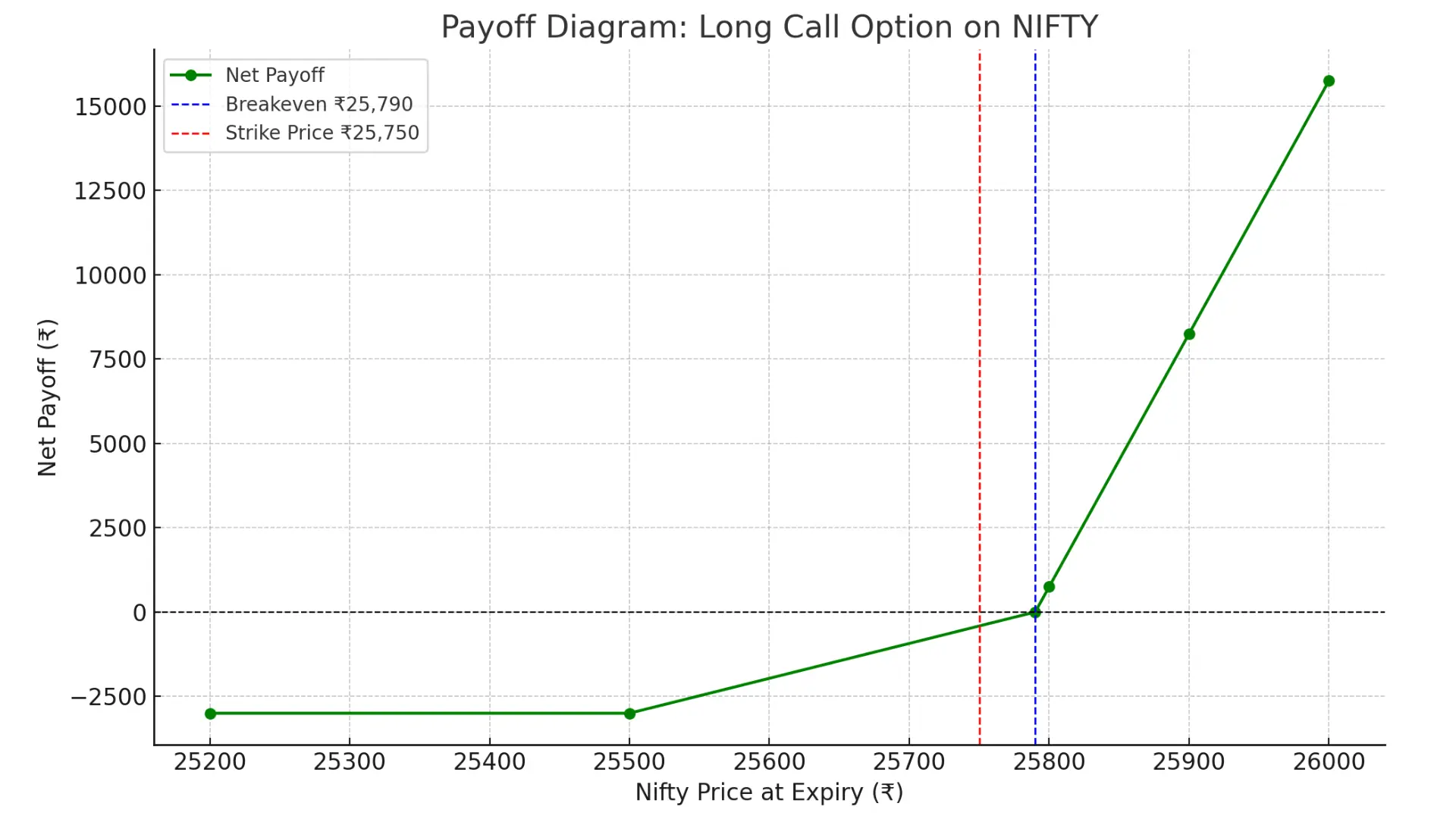

Here's the payoff diagram for the NIFTY Long Call Option strategy:

- The strike price is marked at ₹25,750 (red dashed line).

- The breakeven point is ₹25,790 (blue dashed line).

- The curve shows your net profit or loss based on Nifty’s expiry price.

How to Exit a Long Call Trade?

- Sell the Call Option before expiry if it's in profit.

- Let the Option Expire and exercise it if it's in the money.

Benefits of Long Call Strategy

- 🔒 Limited Risk: Loss is capped at the premium paid.

- 💰 High Reward: Unlimited profit potential on upside.

- 💸 Capital Efficient: Cheaper than buying the underlying stock.

Limitations of Long Call Strategy

- ⏳ Time Decay: Options lose value with time.

- 💸 Premium Loss: Entire premium is lost if price doesn’t rise.

Profit & Loss Summary

| Scenario | Outcome |

|---|---|

| Underlying closes above breakeven | Profit (Unlimited) |

| Underlying closes below strike | Loss = Premium Paid |

Strategy Summary

| Feature | Details |

|---|---|

| 📈 Market View | Bullish |

| 🔐 Risk | Limited to premium paid |

| 💰 Reward | Unlimited |

| 🎯 Breakeven | Strike Price + Premium |

| 🏁 Max Profit | When price rises well above strike |

| ⚠️ Max Loss | Premium paid only |

Final Thoughts

The Long Call Option strategy is a powerful yet simple way to profit from a bullish view while capping losses. It's a great entry-level strategy during earnings or high-volatility events.

❓ Frequently Asked Questions (FAQ)

Q: What is a Long Call option strategy?

A: It is a bullish options trading strategy where a trader buys a call option, limiting loss to the premium paid and gaining from price rises.

Q: When should I use a Long Call?

A: When you're bullish on a stock or index and expect its price to rise before the option's expiry.

Q: What is the risk in a Long Call strategy?

A: The maximum risk is limited to the premium you pay to buy the call option.