Table of Contents

IPO Pricing: A Critical Step Before the Launch

IPO pricing is one of the most critical steps before a company gets listed on the stock exchange. If the IPO is overpriced, it may discourage investor participation, while underpricing might raise doubts about the company’s potential. Hence, fair pricing ensures better investor confidence and smooth listing.

How IPO Pricing Works

IPO prices are generally determined using either the Book Building Method or the Fixed Price Method. The choice depends on the issuer's preferences and regulatory requirements. Companies that don't meet SEBI’s profitability norms must use the book-building route under the QIB (Qualified Institutional Buyers) framework.

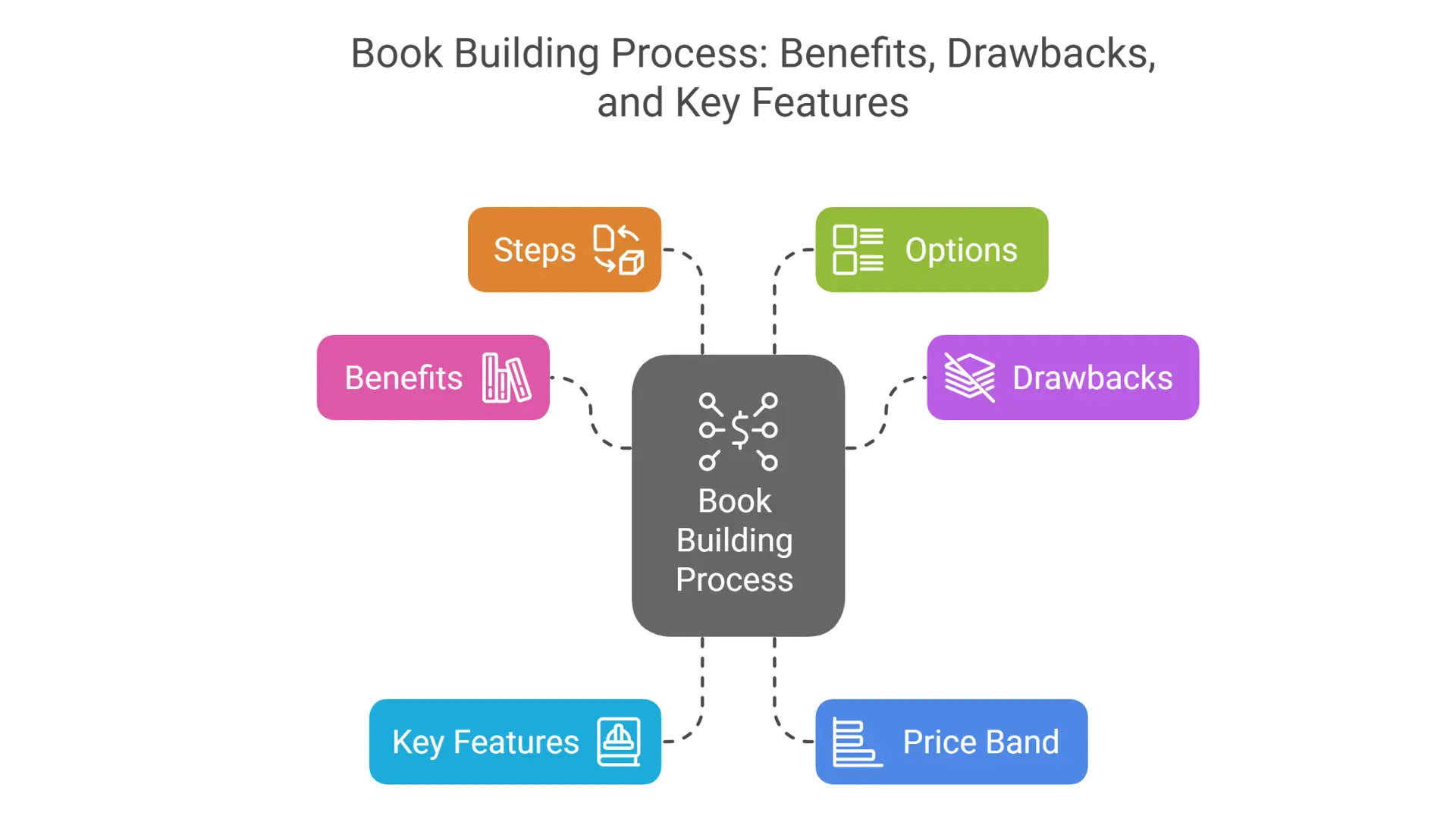

1. Book Building Method

In the book-building process, the price is not fixed initially. Instead, a price range (e.g., ₹75–₹80 per share) is announced, and investors place bids within this range. The final price is decided based on demand at different price levels after the bidding window closes.

Benefits of Book Building

- Efficient price discovery based on demand.

- Company credibility is tested through market response.

- Realistic valuation driven by investor sentiment.

Drawbacks of Book Building

- Higher costs compared to fixed-price issues.

- More time-consuming due to post-bid price finalization.

- Generally preferred for large-volume issuances.

Key Features of Book Building

- Price band must be announced at least 2 business days before the issue opens.

- The issue remains open for 3 to 7 business days (can extend by 3 more days if the price band changes).

- Fully automated bidding on NSE and BSE platforms.

Understanding the Price Band

- Includes a Floor Price (e.g., ₹75) and a Cap Price (e.g., ₹80).

- The difference between floor and cap prices must not exceed 20%.

- Retail investors may apply at any price within the band or choose the "Cut-off price".

- The Cut-off Price is finalized after the bidding ends.

Steps in the Book Building Process

- Lead managers finalize issue size and price band.

- Syndicate members are appointed for handling bids.

- Investors place bids at desired prices within the price range.

- Final issue price is determined using the weighted average method.

- Details of bids and allotments are disclosed for transparency.

Book Building Options

- 100% Book Built Offer: The entire issue is offered through book building.

- 75% Book Built Offer: 75% of the issue is offered via book building, the remaining 25% through fixed pricing.

Book Building Example

Suppose a company issues 1 million shares with a price band of ₹601–₹650. After the bidding process, the cut-off price is determined to be ₹640.

Case 1: Bidding above the cut-off price

If an investor bids at ₹645 for 10 shares and receives full allotment, ₹50 will be refunded (₹5 per share).

Case 2: Bidding below the cut-off price

All such bids are rejected and the full amount is refunded.

Case 3: Bidding at the cut-off price

Investors may get full or partial allotment depending on demand. Refunds are made for any unallotted shares.

2. Fixed Price Issue Method

Under this method, the IPO price is set in advance (e.g., ₹75). It is commonly used by SME companies due to the simplicity and smaller issue size.

Features of Fixed Price Issues

- The issue price is mentioned upfront in the prospectus.

- Minimum 50% of the offering is reserved for retail investors.

- The IPO remains open for 3–10 business days.

- 100% payment is required at the time of application.

Fixed Price IPO Process

- Lead manager is appointed and the issue price is finalized based on company fundamentals.

- Investors apply at the fixed price.

- Allotment is done based on demand and availability.

- Refunds are issued for unallotted shares.

Fixed Price IPO Example

If a company announces a fixed price of ₹186 and an investor applies for 1000 shares:

- Full Allotment: All 1000 shares are credited. No refund.

- No Allotment: Full amount refunded.

- Partial Allotment: If only 200 shares are allotted, refund issued for the remaining 800 shares.

Comparison: Book Building vs Fixed Price IPO

| Book Building IPO | Fixed Price IPO |

|---|---|

| Introduced by SEBI in 1995 for fair pricing | Traditional method used earlier |

| Price discovered after bidding closes | Price fixed before subscription begins |

| Demand visibility during bidding | Demand known only after closure |

| Cut-off pricing allowed | Only fixed price bidding allowed |

| Mostly used in Mainboard IPOs | Preferred by SME IPOs |

What is Reverse Book Building?

Reverse book-building is the opposite of the IPO process. It is used when a listed company wants to delist its shares and offers to buy them back from shareholders. Shareholders place their sell bids, and the company finalizes the exit price based on these bids, similar to demand-supply logic in book building.