Table of Contents

- Issuer Company

- Stock Exchanges

- SEBI – The Market Regulator

- Merchant Bankers (Lead Managers)

- Bankers to the Issue

- Self-Certified Syndicate Banks (SCSBs)

- Registrar to the Issue (RTI)

- IPO Underwriters

- Market Makers

- Depositories (NSDL & CDSL)

- Conclusion

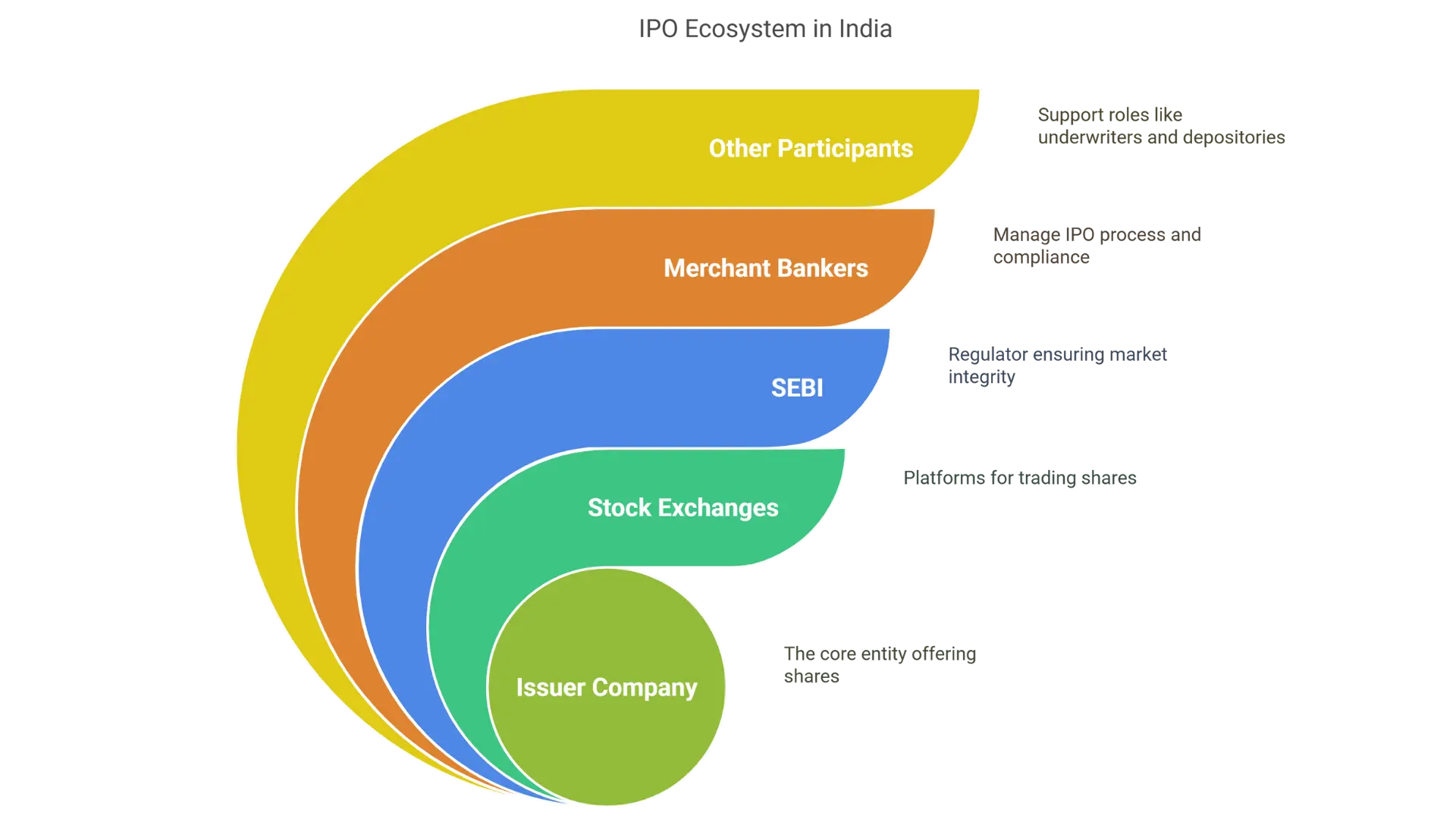

When a company goes public via an Initial Public Offering (IPO), several intermediaries collaborate to ensure the process is smooth, compliant, and transparent. These intermediaries connect the issuing company with investors and provide vital support throughout the IPO lifecycle.

1. Issuer Company

The issuer is the company offering shares to the public for the first time. Issuers raise capital by selling new or existing shares.

Types of issuers:

- Mainboard Companies – Established, large businesses

- SMEs – Small and Medium Enterprises

- Startups – Early-stage companies with growth potential

2. Stock Exchanges

Stock exchanges such as BSE and NSE provide the platform for trading shares. They are regulated by the Securities and Exchange Board of India (SEBI). Investors must trade through SEBI-registered brokers.

3. SEBI – The Market Regulator

SEBI regulates the securities market in India and ensures investor protection.

- Companies raising over ₹50 lakh must submit their Draft Red Herring Prospectus (DRHP) for approval.

- SEBI ensures disclosure compliance but does not evaluate the project’s financial soundness.

4. Merchant Bankers (Lead Managers)

Merchant bankers manage the entire IPO process. Also known as Lead Managers or Book Running Lead Managers (BRLMs), they are SEBI-registered financial institutions.

Pre-Issue Roles:

- Due diligence and eligibility verification

- Preparing and filing DRHP and RHP

- Marketing and roadshows

Post-Issue Roles:

- Handling allotment and refunds

- Publishing post-issue reports

- Managing escrow accounts

5. Bankers to the Issue

These banks manage IPO-related financial transactions. Responsibilities include:

- Handling Escrow, Allotment, and Refund accounts

- Executing fund transfers as instructed

- Providing bank statements and handling refund complaints

6. Self-Certified Syndicate Banks (SCSBs)

SCSBs are banks authorized by SEBI to offer ASBA (Application Supported by Blocked Amount) services. They:

- Accept and process IPO applications

- Block funds in applicant accounts

- Coordinate with brokers, registrars, and depositories

7. Registrar to the Issue (RTI)

The registrar assists in share allotment and maintains investor records. Their key functions include:

- Validating IPO applications

- Allotment processing

- Refund initiation

- Maintaining post-listing shareholder data

8. IPO Underwriters

Underwriters guarantee the sale of a specified portion of shares and step in to purchase unsold shares in case of under-subscription.

In SME IPOs, underwriting is mandatory. In mainboard IPOs, it is optional.

Duties:

- Entering into underwriting agreements

- Promoting the IPO

- Advising on share pricing

9. Market Makers

Market makers ensure liquidity by offering buy and sell quotes for the stock. They are essential for SME IPOs due to lower trading volumes.

Responsibilities:

- Providing 2-way quotes for 75% of trading hours

- Maintaining inventory

- Supporting price discovery and reporting irregularities

10. Depositories (NSDL & CDSL)

Depositories hold IPO shares in electronic form. The company signs a tripartite agreement with both NSDL and CDSL along with the Registrar.

- Dematerializing shares

- Crediting allotted shares to investors' demat accounts

- Facilitating post-listing trading and settlements

Conclusion

Each IPO intermediary plays a specific and crucial role in taking a company public. Their combined efforts ensure regulatory compliance, investor transparency, and smooth market entry for the issuing company. Understanding their functions empowers both companies and investors in the IPO journey.