Table of Contents

- IPO Application Cancellation & Modification

- Rules for IPO Cancellation and Modification

- 1. IPO Application Cancellation

- 2. IPO Application Modification

- 3. IPO Application Rejection Reasons

When participating in an IPO (Initial Public Offering), investors sometimes realize they want to tweak their bid or cancel their application altogether. Then we are thinking about how to do the IPO Application Modification. The IPO cancellation and modification facility is designed to help investors make these changes smoothly.

IPO Application Cancellation and Modification

After submitting an IPO bid, investors might want to adjust the bid quantity, revise the bid price to better match market demand, or even cancel their application if they reconsider their investment decision.

Thankfully, the system allows such modifications, but there are specific rules you should be aware of.

Rules for IPO Cancellation and Modification

Here’s a quick breakdown of the essential rules:

- Retail Investors: Allowed to cancel or modify their IPO applications by increasing or decreasing the bid size.

- Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs): Cannot cancel their bids. However, they can only increase the bid quantity or price; they are not allowed to lower it.

- Employee and Shareholder Categories: If the application size is less than ₹2 lakh, cancellation and modification (both increase and decrease) are permitted.

Important: Changes are allowed only while the IPO is open for subscription. After the issue closes, no modifications or cancellations are permitted.

Quick Reference Table

| Investor Category | Cancellation | Modification |

|---|---|---|

| Retail Investor | Allowed | Increase or decrease bid size |

| QIB | Not Allowed | Only increase bid size/price |

| NII | Not Allowed | Only increase bid size/price |

| Employee (≤ ₹2 lakh) | Allowed | Increase or decrease bid |

| Shareholder (≤ ₹2 lakh) | Allowed | Increase or decrease bid |

1. IPO Application Cancellation

Investors can withdraw their IPO application either online or offline. While online cancellation is quicker, offline methods are also available.

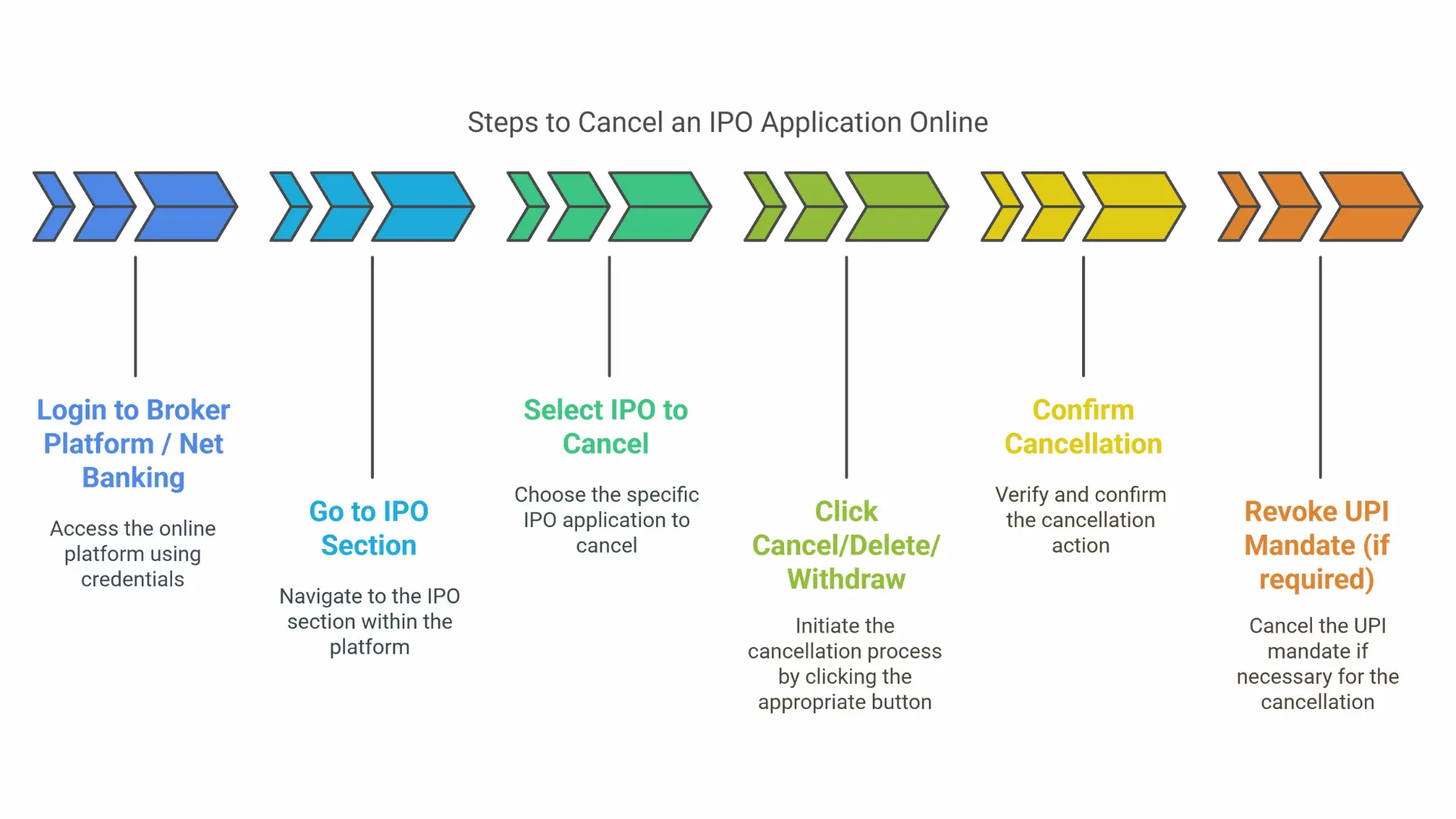

Steps for Online IPO Cancellation

- Log in to your broker platform or net banking.

- Navigate to the IPO section.

- Select the IPO application you wish to cancel.

- Click on Cancel/Delete/Withdraw.

- Confirm the cancellation request.

- Revoke the UPI mandate if necessary.

Note: If the application was made through UPI, sometimes you’ll need to manually revoke the mandate. Otherwise, the bank may release the funds automatically after the mandate expires.

Once your broker submits the cancellation request (between 10 AM and 5 PM), you will receive an email confirming the cancellation.

Tip: Always check your broker's specific timings—some may have earlier cut-off times on the last day.

Steps for Offline IPO Cancellation

1-Draft a cancellation request letter mentioning:

- Application Number

- Applicant’s Name and Details

- PAN Number

2-Sign and submit the letter to the bank or broker through whom you made the application.

IPO Cancellation Timings

- You can cancel your IPO bid anytime between 10 AM on the opening date and 5 PM on the closing date.

- However, many brokers and banks impose earlier deadlines, especially on the final day. Check their policy beforehand!

Good to Know:

There are no cancellation charges for withdrawing your IPO application, whether done online or offline.

2. IPO Application Modification

Want to adjust your IPO bid instead of cancelling it? No problem!

Retail investors can both increase or decrease their bid quantity and price. However, QIBs and NIIs are restricted to only increasing their bids.

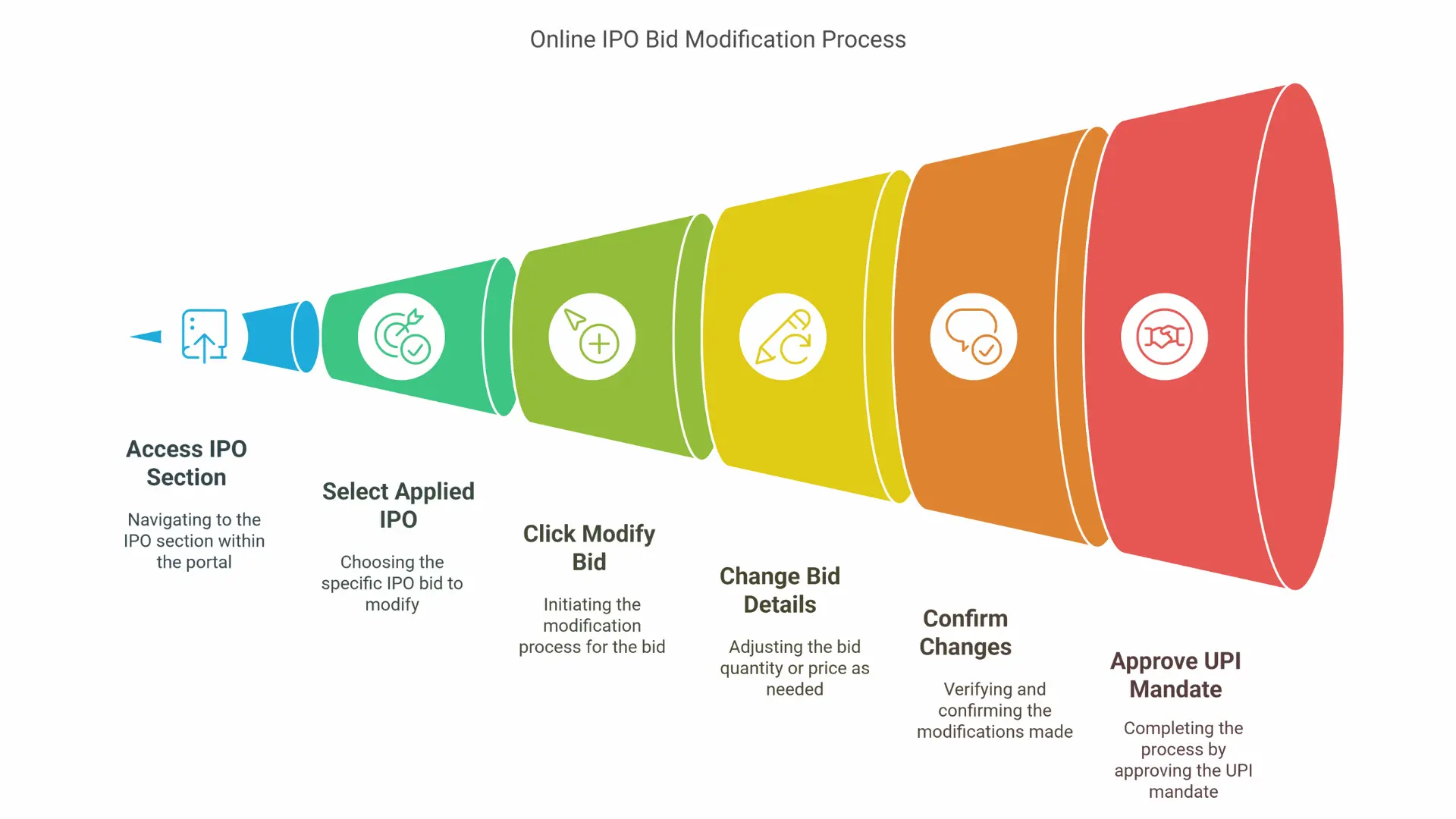

Steps for Online IPO Modification

- Log in to your broker's platform or net banking account.

- Navigate to the IPO section.

- Select the IPO application you wish to modify.

- Click on Modify Bid.

- Change the bid quantity or bid price as needed.

- Confirm the changes.

- Approve the revised UPI mandate if applicable.

UPI Users: If you revise the bid upward, the additional amount gets blocked. If you revise downward, excess funds are usually released after the allotment process.

Steps for Offline IPO Modification

- Download or collect the IPO Modification/Revision Form.

- Fill in your details: Name, Address, Contact Information, PAN, and DP details.

- Mention the old bid details and the revised bid details.

- Sign the form.

- Submit it to the broker/bank where you originally placed the IPO order.

IPO Modification Form

You can download the IPO Revision Form from the NSE or BSE websites . NSE even offers pre-filled forms for ease of use.

This form requires:

- Personal information

- Original bid details

- Revised bid details

- ASBA Account Number or UPI ID

- Signature

Need a sample? Visit the exchange website for an example modification form. Click Here

3. IPO Application Rejection Reasons

It’s critical to fill your IPO form accurately. Otherwise, your application might be rejected. Here are common mistakes:

- The applicant is not eligible under the company’s IPO terms or the Indian Contract Act 1872.

- Bidding outside the specified price band.

- Incorrect ASBA account number, UPI ID, or UPI handle.

- Application through another person’s bank account.

- Wrong PAN or Demat Account details.

- Mismatch in the applicant's name across the bank, PAN, and DP account.

- The bid amount is lower than the minimum application size.

- Duplicate applications with the same PAN in the same category.

- Cut-off bidding by NIIs or QIBs (only allowed for retail investors).

- Insufficient bank funds.

- Errors by brokers, banks, or exchanges.

Note: If your application is rejected but the IPO amount is blocked, the funds are typically released after the UPI mandate expiry or upon allotment finalization.

Page Glossary

UPI Handle: A UPI handle is the unique virtual payment address linked to your bank or payment app (like @paytm for Paytm, @oksbi for SBI UPI apps).

DP ID: DP ID is the unique Depository Participant Identification number assigned by NSDL or CDSL to your demat account intermediary (like banks or brokers).