Table of Contents

- What Is IPO Allotment?

- IPO Allotment Rules

- IPO Allotment Methods

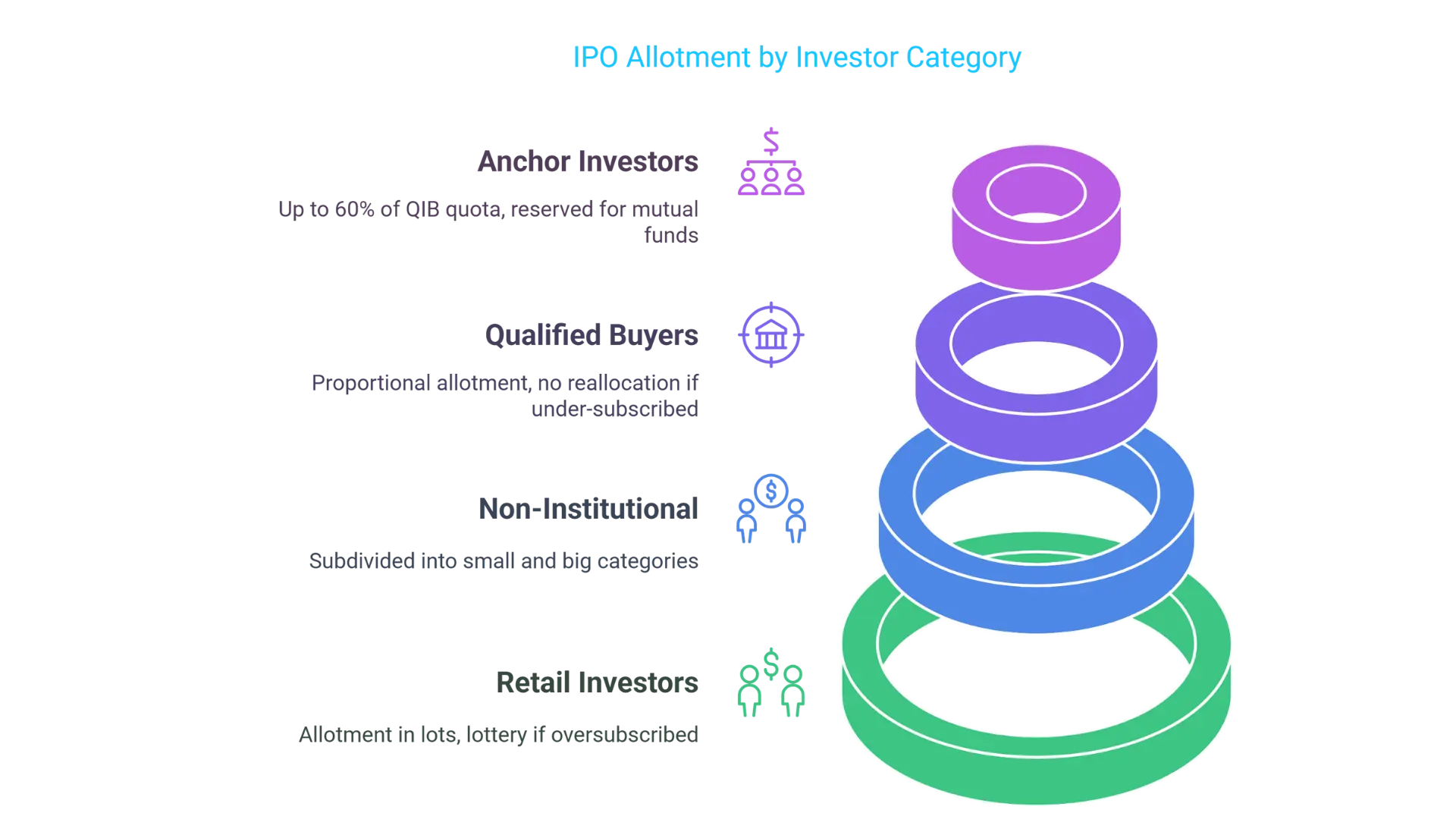

- IPO Allotment by Investor Category

- IPO Allotment Process (Step-by-Step)

- How to Check IPO Allotment Status

- IPO Allotment Probability

- Basis of Allotment (BOA)

- Real IPO Examples

IPO allotment refers to the process of distributing shares to investors who apply for an Initial Public Offering (IPO). This allocation is handled by the Registrar of the issue in coordination with the stock exchange and follows specific rules based on investor categories.

What Is IPO Allotment?

IPO allotment is the official process where shares are distributed to applicants after the IPO bidding period ends. It generally takes 3–4 working days for the registrar to announce the allotment status. Investors can check their allotment by visiting the registrar’s website using their PAN, application number, or demat details.

If an IPO is oversubscribed, not every applicant may get shares. In contrast, if it is undersubscribed, all valid applicants receive full allotment.

IPO Allotment Rules

Here are the key rules followed during the IPO allotment process:

- Only valid applications (no errors or duplications) are considered.

- Applications must be at or above the cut-off price.

- Allotment is based on demand and reserved quotas in each investor category—Retail, Non-Institutional Investors (NII), and Qualified Institutional Buyers (QIB).

- If a category is undersubscribed (except QIB), the excess demand from other categories can be adjusted.

- The registrar publishes a "Basis of Allotment" document explaining the allotment logic.

- Shares from an undersubscribed QIB category are not reallocated to other categories.

IPO Allotment Methods

The allotment method depends on two main factors:

- The subscription level (under/oversubscribed)

- The investor category

General Scenarios:

- Undersubscribed IPO: All valid applicants get full allotment.

- Mixed subscription: Oversubscription in one category and undersubscription in another may allow adjustment, except for QIB.

- Oversubscribed IPO: Shares are allotted through a lottery system or proportionately.

IPO Allotment by Investor Category

1. Retail Individual Investors (RII)

- Retail investors are allotted shares in "lots."

- A lot contains a fixed number of shares (typically worth ₹15,000 in mainboard IPOs and up to ₹1 lakh in SME IPOs).

- Maximum allottees = Total RII shares ÷ Lot size.

Example:

If 10,00,000 shares are reserved for RII and the lot size is 50, then: Max Allottees = 10,00,000 ÷ 50 = 20,000 investors.

Allotment Scenarios for RII:

| Scenario | Allotment Rule |

|---|---|

| Under-subscribed | Full allotment to all valid applicants |

| Oversubscribed | Computerized lottery for allotment of 1 lot per successful applicant |

| Slightly oversubscribed | Minimum 1 lot per applicant, remaining shares distributed proportionately |

2. Non-Institutional Investors (NII)

NII is further split into two sub-categories:

| Sub-Category | Investment Range | Share Reservation |

|---|---|---|

| sNII (Small) | ₹2–10 lakhs | 1/3rd of NII quota |

| bNII (Big) | Above ₹10 lakhs | 2/3rd of NII quota |

- Minimum allotment = One lot as per the minimum bid value.

- Remaining shares, if any, are allotted proportionately.

- In case of under-subscription, all valid applications get full allotment.

- In SME IPOs, NII is not subdivided.

3. Qualified Institutional Buyers (QIB)

- Allotment in QIB is proportional in case of oversubscription.

- If under-subscribed, the leftover shares are not reallocated to other categories.

- Mutual Funds get up to 5% reservation within QIB.

4. Anchor Investors

Applicable in book-built IPOs:

- Up to 60% of the QIB quota can be allocated to Anchor Investors.

- One-third of this is reserved for domestic mutual funds.

| Issue Size | Anchor Investor Limits |

|---|---|

| Up to ₹10 Cr | Max 2 anchors |

| ₹10–250 Cr | 2–15 anchors (min ₹5 Cr each) |

| ₹250+ Cr | Min 5, max 15 anchors per ₹250 Cr increment |

5. Employees

- Shares are allotted on a pro-rata basis if oversubscribed.

- Employees can receive up to ₹2,00,000 in value. If under-subscribed, this limit can increase up to ₹5,00,000.

6. Shareholders

- Allotment is proportionate during oversubscription.

- Bids above ₹2,00,000 in the shareholder and another category are treated as multiple applications and rejected.

IPO Allotment Process (Step-by-Step)

- Registrar receives application data from stock exchanges.

- Invalid or duplicate applications are filtered.

- Valid bids at or above the cut-off price are grouped.

- The Basis of Allotment is finalized with the stock exchange.

- Investors are notified via SMS or email.

- Shares are credited to demat accounts, and bank accounts are debited.

IPO Allotment Date

- Typically 3–5 business days after the IPO closes.

- Investors can check allotment status online using PAN, DP ID, or application number.

How to Check IPO Allotment Status

Follow these steps:

- Visit the IPO allotment page on the registrar’s website.

- Choose the IPO.

- Enter PAN, application number, or demat details.

- Click "Submit" to see your allotment status.

IPO Allotment Probability

There’s no official IPO allotment calculator. However, the following tips can improve your chances:

- Apply for one lot using multiple family accounts (for retail).

- Monitor subscription levels before choosing a category (Retail, sNII, bNII).

- Submit bids early, preferably before 1 PM on the last day.

- Double-check all application details.

- Always authorize your UPI payment on time.

Basis of Allotment (BOA)

The Basis of Allotment is a document that provides:

- Total applications and shares per category.

- Allotment ratios and number of allottees per group.

- Detailed breakdown of allotment patterns.

Example: DAM Capital Advisors IPO

| Category | Shares Offered | Value (₹ Cr) | Percentage |

|---|---|---|---|

| Anchor | 88,86,268 | 251.48 | 29.93% |

| QIB | 59,24,182 | 167.65 | 19.95% |

| NII | 44,43,135 | 125.74 | 14.96% |

| Retail | 1,03,67,315 | 293.40 | 34.92% |

| Employee | 70,000 | 1.98 | 0.24% |

| Total | 2,96,90,900 | 840.25 | 100% |

Got it!

You’ve shared a very detailed explanation about RII and NII IPO allotment mechanisms, with examples from DAM Capital Advisors IPOs.

Real IPO Examples

1. RII (Retail Individual Investors) Allotment Rules

General Rule:

- Each RII investor is allotted at least one lot (subject to availability of shares and the number of RII applicants).

- If the number of RII applicants is less than the available lots → Pro-rata basis allotment.

- If the number of RII applicants exceeds available lots → Lottery + Pro-rata mechanism.

Example: Sah Polymers Limited IPO

Total shares for RII: 1,020,000

Lot size: 230 shares

Maximum number of RII Allottees:

1,020,000230=4434\frac{1,020,000}{230} = 4434 investors

Total applications received: 138,971

Hence, oversubscription happened → Allotment via Pro-rata + Lottery.

How the allotment was distributed across categories:

| Sr. No. | Lot Applied (Shares) | Applications | % of Total | Allottees | Shares Allotted |

|---|---|---|---|---|---|

| 1 | 230 | 127,218 | 91.54% | 4060 | 933,800 |

| 2 | 460 | 6600 | 4.75% | 211 | 48,530 |

| 3 | 690 | 1780 | 1.28% | 57 | 13,110 |

- After allotting the minimum shares, 180 shares remained.

- These were distributed randomly among 374 applicants who applied between 460 and 2990 shares.

Important Points:

- Rounding adjustments are often made.

- The registrar and exchanges have final discretion.

- Mainboard IPOs follow this complex system.

- SME IPOs (e.g., Crayons Advertising) use a simpler lottery method — usually, only one category exists.

SME IPO Example: Crayons Advertising Ltd

- Minimum/Maximum RII Lot Size: 2000 shares

- Shares reserved for RII: 2,138,000

- Max possible RII allottees:

2,138,0002,000=1069\frac{2,138,000}{2,000} = 1069 - Applications received: 178,602

Thus, only 1069 applicants were selected via computerized lottery, each getting 2000 shares.

2. NII (Non-Institutional Investors) Allotment Rules

General Rule:

- Each NII investor must get at least one lot (as defined).

- After that, the remaining shares are distributed on a pro-rata basis.

- NII is often split into Small NII (sNII) and Big NII (bNII) in Mainboard IPOs. SME IPOs usually have no separation.

Example: Sah Polymers Limited IPO (Small NII)

- Minimum NII Lot Size: 3220 shares (value ~ ₹209,300)

- Shares reserved for sNII: 510,000

- Potential maximum allottees:

510,0003220=158\frac{510,000}{3220} = 158 - Applications received: 4578

Thus, oversubscribed → Allotment via Pro-rata + Lottery.

How the allotment was distributed across categories:

| Sr. No. | Lot Applied (Shares) | Applications | % of Total | Allottees | Shares Allotted |

|---|---|---|---|---|---|

| 1 | 3220 | 4318 | 94.32% | 149 | 479,780 |

| 2 | 3450 | 77 | 1.68% | 3 | 10,071 |

| 3 | 3680 | 35 | 0.76% | 1 | 3357 |

- Any very small categories with a low application % might not get any allotment.

- Leftover shares (7 shares) were randomly distributed among 9 applicants.

SME IPO Example: Crayons Advertising Ltd (NII)

- Shares reserved for NII: 918,000

- The allotment is done proportionally and rounded to the nearest multiple of 2,000 shares (lot size).

Sample calculations:

| Lot Applied (Shares) | % of Total Applications | Shares Allotted (rounded) | Allottees (Shares ÷ 2000) |

|---|---|---|---|

| 4000 | 6.43% | 60,000 | 30 |

| 6000 | 1.45% | 14,000 | 7 |

| 8000 | 0.92% | 8,000 | 4 |

Key Notes:

- Rounding differences may happen.

- SME IPO allotment for NII is simpler compared to Mainboard IPOs.

- Always subject to the registrar and exchange discretion.

Conclusion

✅ Mainboard IPOs (e.g., Sah Polymers) allot RII and NII using a mix of lottery + pro-rata.

✅ SME IPOs (e.g., Crayons Advertising) allot through simple lottery or proportional allotment, with only one application category for each type of investor.