>>>> Angel One (₹20/Trade) Open Free Demat Account Now.

ELSS mutual fund?

What is an ELSS Mutual Fund?

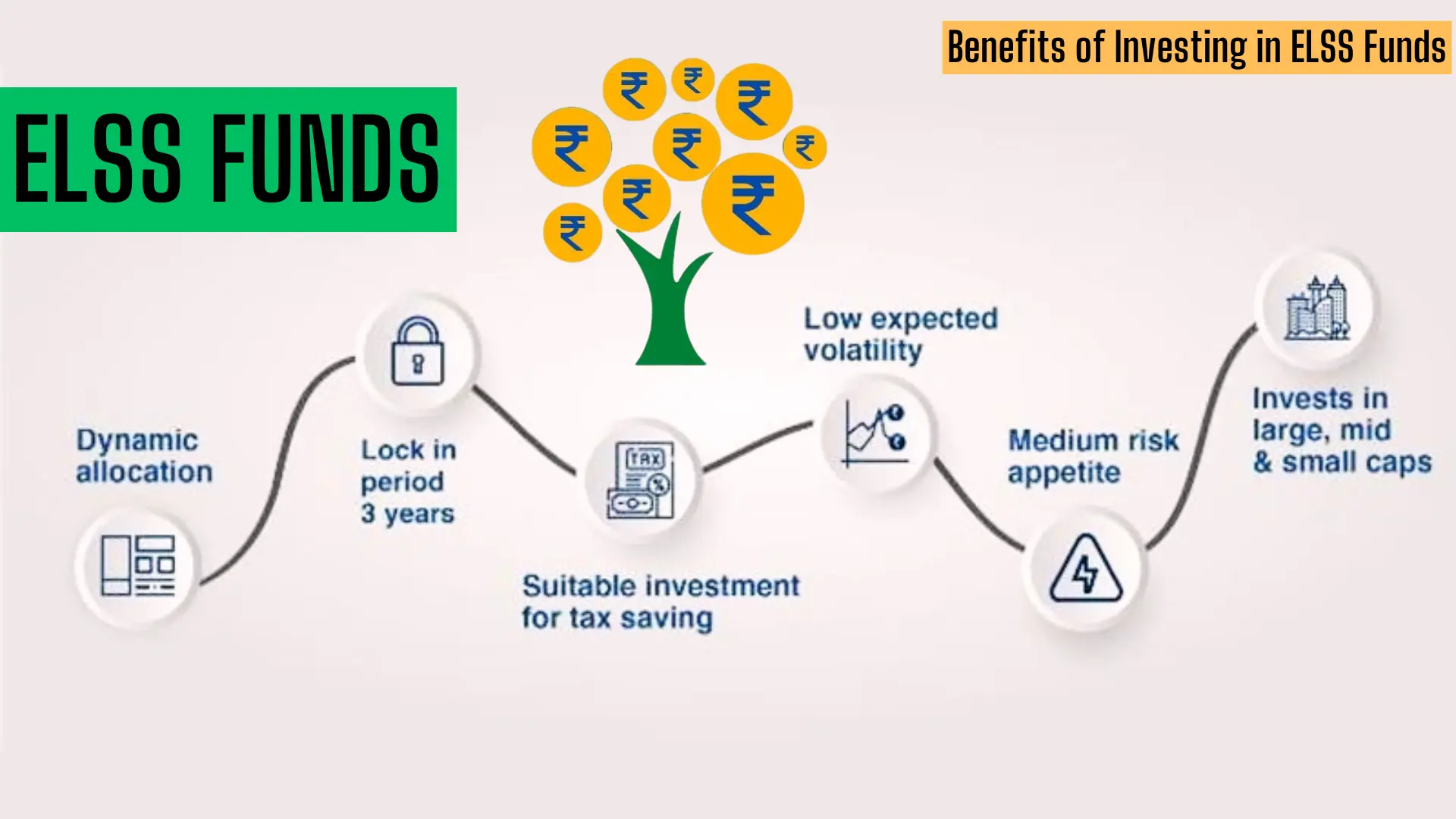

ELSS stands for Equity Linked Savings Scheme. It's a type of mutual fund that invests mostly in stocks. But here's the cool part - it also helps you save on taxes (Tax saving plan). ELSS funds have a mandatory lock-in period of three years. ELSS funds offer tax deductions of up to ₹1,50,000 per year under Section 80C of the Income Tax Act.

How to work ELSS Funds?

Think of ELSS funds as a piggy bank where you put your money, and professional investors use it to buy stocks of different companies. As these companies grow, so does your money. The best part? You don't have to know anything about the stock market to benefit from it.

What are the benefits of Investing in ELSS Funds?

Tax Benefits:

Remember when I mentioned saving on taxes? Here's how it works: you can deduct up to ₹1.5 lakhs from your taxable income, if you invest in ELSS funds. That's a pretty sweet deal for investment in a mutual fund.

Potential for High Returns:

While there's no guarantee in the world of investing, ELSS funds have the potential to give you higher returns compared to many other investment options. It's like planting a seed that could grow into a big, beautiful tree over time.

Flexibility and Convenience:

You don't need a huge amount to start investing in ELSS funds. You can begin with as little as ₹500 per month like SIP. It's like building a house brick by brick - small amounts can add up to something substantial over time.

Things to Consider Before Investing?

Lock-in Period:

ELSS funds have a lock-in period of 3 years. This means you can't take your money out before three years are up. It's like putting your money in a time capsule - you need to be patient!

Risk Factor:

Just like any investment in the stock market, ELSS funds come with some risk. The value of your investment can go up or down based on how the stock market performs. It's a bit like riding a roller coaster - there might be some ups and downs, but many find the overall journey exciting and rewarding.

Choosing the Right Fund:

Not all ELSS funds are created equal. It's important to do your homework and choose a fund that matches your goals and risk tolerance. Think of it like choosing a travel destination - you want to pick one that suits your preferences and budget.

How to Invest in ELSS Funds?

Direct vs Regular Plans:

You have two options when investing in ELSS funds: direct plans and regular plans. Direct plans usually have lower fees because you're investing directly with the fund company. Regular plans involve a middleman, which can mean higher fees but also personalized advice.

Lump Sum vs SIP:

You can invest a large amount all at once (lump sum) or set up a Systematic Investment Plan (SIP) where you invest a fixed amount regularly. SIPs are like setting up a recurring deposit - it's a great way to build the habit of investing.