Indian Stock Market Closing Levels (FY26 - First Session)

| Index | Closing Level | Change | % Change |

|---|---|---|---|

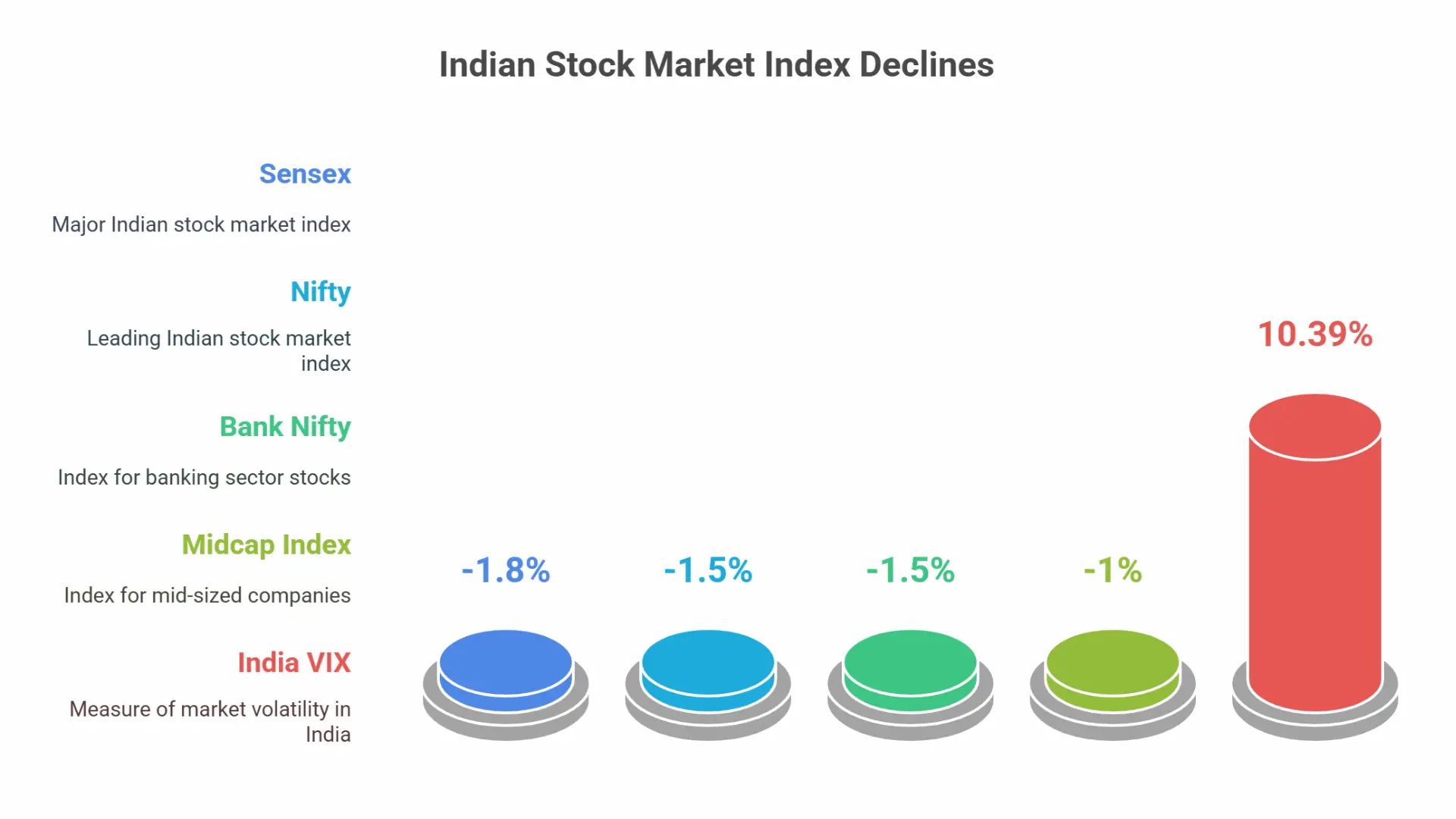

| Nifty 50 | 23,166 | -354 | -1.50% |

| Sensex | 76,025 | -1,390 | -1.80% |

| Bank Nifty | 50,828 | -737 | -1.50% |

| India VIX | 12.75 | +1.20 | +10.39% |

Indian Stock Market Sees Sharp Decline Amid Weak Global Signals

"Daily Market Update" The Indian stock market started the new financial year FY26 on a negative note, with Sensex and Nifty experiencing significant losses. Weak global cues, selling pressure, and sectoral declines led to the downturn.

Key Highlights of the Market Performance

- Sensex fell by 1,390 points (-1.8%), closing at 76,025.

- Nifty dropped by 354 points (-1.5%), settling at 23,166.

- Bank Nifty declined by 1.5%, closing at 50,828.

- Midcap Index fell by 1%, closing at 51,230.

- India VIX surged by 10.39%, indicating increased market volatility.

Sector-Wise Market Performance

IT Sector Witnesses Heavy Selling Pressure

The IT sector took a major hit following a weak Nasdaq performance in the U.S. Shares of Infosys, TCS, and Wipro faced selling pressure, with Infosys falling by 2.73% and TCS dropping by 1.53%. Midcap IT stocks also declined by up to 6%.

Banking Stocks Face Volatility

- ICICI Bank and HDFC Bank dropped 2-3%, reflecting weak banking sector trends.

- IndusInd Bank was a top gainer, rising 5%, while Punjab & Sind Bank and UCO Bank declined due to QIP-related movements.

Auto Sector Performance: Mixed Trends

- Ashok Leyland gained 3%, fueled by strong March sales figures.

- Maruti Suzuki and Mahindra & Mahindra (M&M) closed lower.

- Vodafone Idea surged 20%, following government-backed financial restructuring.

Midcap & Defense Stocks Performance

- BEL (Bharat Electronics Ltd.) dropped 3% due to lower-than-expected order growth.

- HAL (Hindustan Aeronautics Ltd.) secured big orders, closing in the green despite intraday volatility.

- Voltas fell 7%, becoming the worst-performing Midcap stock of the session.

- Coal India’s production miss kept the stock stable.

Real Estate Stocks Under Pressure

- Maharashtra real estate stocks fell due to an increase in Ready Reckoner Rates (RRR).

- HUDCO gained 4%, showing some resilience in the infrastructure segment.

Market Sentiment and Global Influence

- Weak global trends, concerns over U.S. tariff policies, and economic uncertainty added pressure to the market.

- The India VIX index jumped 10.39%, reflecting increased market fear and volatility.

Conclusion: Market Remains Under Pressure

The first trading session of FY26 highlighted a volatile start for the Indian stock market. Global uncertainties, sector-specific losses, and selling pressure impacted investor sentiment. Moving forward, traders and investors should stay cautious, keeping an eye on global markets, economic policies, and sectoral trends for better decision-making.