Table of Contents

- Introduction

- Reasons for IPO Refund (Unblocking Funds)

- IPO Refund Timeline

- Initiation of IPO Refund Process

- Modes of Refund in IPO

- IPO Funds Not Unblocked?

- Page Glossary

- Conclusion

Introduction

When an investor applies for an IPO (Initial Public Offering), their bank account is temporarily blocked for the amount they bid, pending the outcome of the share allotment process. But what happens when an investor doesn’t receive the shares they applied for or receives only a partial allotment? That’s where the IPO fund unblocking or refund process comes into play.

In this article, we’ll break down every aspect of IPO refund and fund release, from why funds are returned, to how long it takes, and what to do if your funds are not unblocked. This guide is designed to be your one-stop resource to understand this crucial but often overlooked part of the IPO process.

What Is IPO Fund Blocking and Unblocking?

When you apply for an IPO using the ASBA (Application Supported by Blocked Amount) method, your application amount is blocked in your bank account. This means the money stays in your account but can’t be used unless the shares are not allotted to you.

After the allotment is finalized:

- If you receive shares, the corresponding amount is debited.

- If you don’t get any shares, the full amount is unblocked.

- If you get a partial allotment, the unused portion is unblocked.

This process ensures transparency and prevents unnecessary fund transfers.

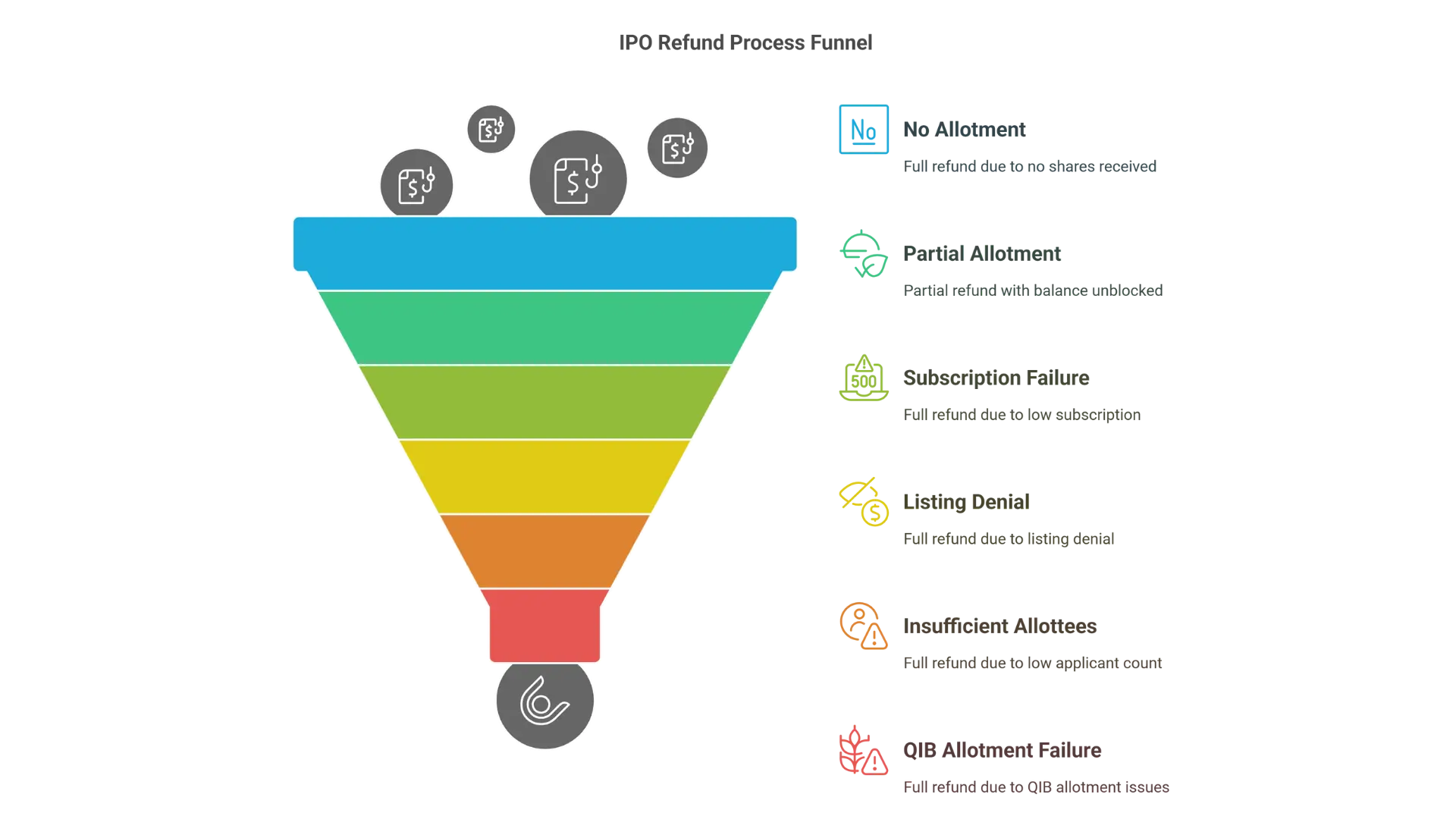

Reasons for IPO Refund (Unblocking Funds)

Let’s look at the major reasons why IPO funds are released back to investors:

1. No Allotment of Shares

If you do not receive any shares in the IPO, the registrar instructs your bank to release the full blocked amount. This is the most common scenario.

2. Partial Allotment

In case of partial allotment, only the required amount for allotted shares is debited, and the remaining balance is unblocked.

3. IPO Fails to Get Minimum Subscription

As per SEBI guidelines, an IPO must receive at least 90% subscription to proceed. If this threshold isn’t met, the issuer has to refund all applicants in full.

4. Listing Approval Not Granted

If the stock exchange(s) deny listing approval, the company is compelled to return the entire application money to investors.

5. Insufficient Number of Allottees

If the number of applicants eligible for allotment falls below 1,000, the IPO fails to comply with listing requirements, and all funds must be refunded.

6. Less Than 75% Allotment to QIBs (In QIB Route)

For issues via the Qualified Institutional Buyer (QIB) route, at least 75% of shares must be allotted to QIBs. If this condition isn’t fulfilled, the IPO is invalidated, and full refunds must be issued.

IPO Refund Timeline

SEBI mandates refunds to be initiated within 4 working days after issue closure. This rule applies across all reasons for refund.

| Reason for Refund | Refund Deadline |

|---|---|

| Non-Allotment of Shares | Within 4 working days of issue closure |

| IPO Receives Less Than 90% Subscription | Within 4 working days of issue closure |

| Listing Approval Denied | Within 4 working days of rejection info |

| Less than 1,000 Allottees | Within 4 working days of issue closure |

| Less Than 75% QIB Allotment in QIB Route IPO | Within 4 working days of issue closure |

Initiation of IPO Refund Process

The refund process is primarily managed by the Registrar of the IPO. They act as the link between:

- The issuing company,

- The stock exchange,

- The bank (Self-Certified Syndicate Bank or SCSB).

The Registrar ensures that allotments are finalized and funds are released appropriately.

Steps Involved in the IPO Refund Process

Here’s how the refund or unblocking process typically unfolds:

- Allotment Finalization: The registrar, in coordination with the stock exchange and lead managers, finalizes share allotment.

- Instructions to Banks: Based on the allotment result, banks are informed to release the funds.

- Lien Release by SCSB: The bank removes the block (or lien) from the investor’s bank account.

- Refund Issuance: Depending on the application method, refunds are either credited back or mandates are revoked.

Modes of Refund in IPO

The refund method depends on how you applied and your investor category.

| Application Type | Refund Method | Investor Category |

|---|---|---|

| ASBA | Unblocking of funds in the bank account | RII, NII, QIB |

| UPI | Mandate revoked via UPI app | Primarily Retail Investors |

| Electronic Transfer | Refund via NEFT, NACH, Direct Credit, or RTGS | Anchor Investors |

ASBA and UPI applicants usually don’t receive a physical refund—just a release of the blocked amount.

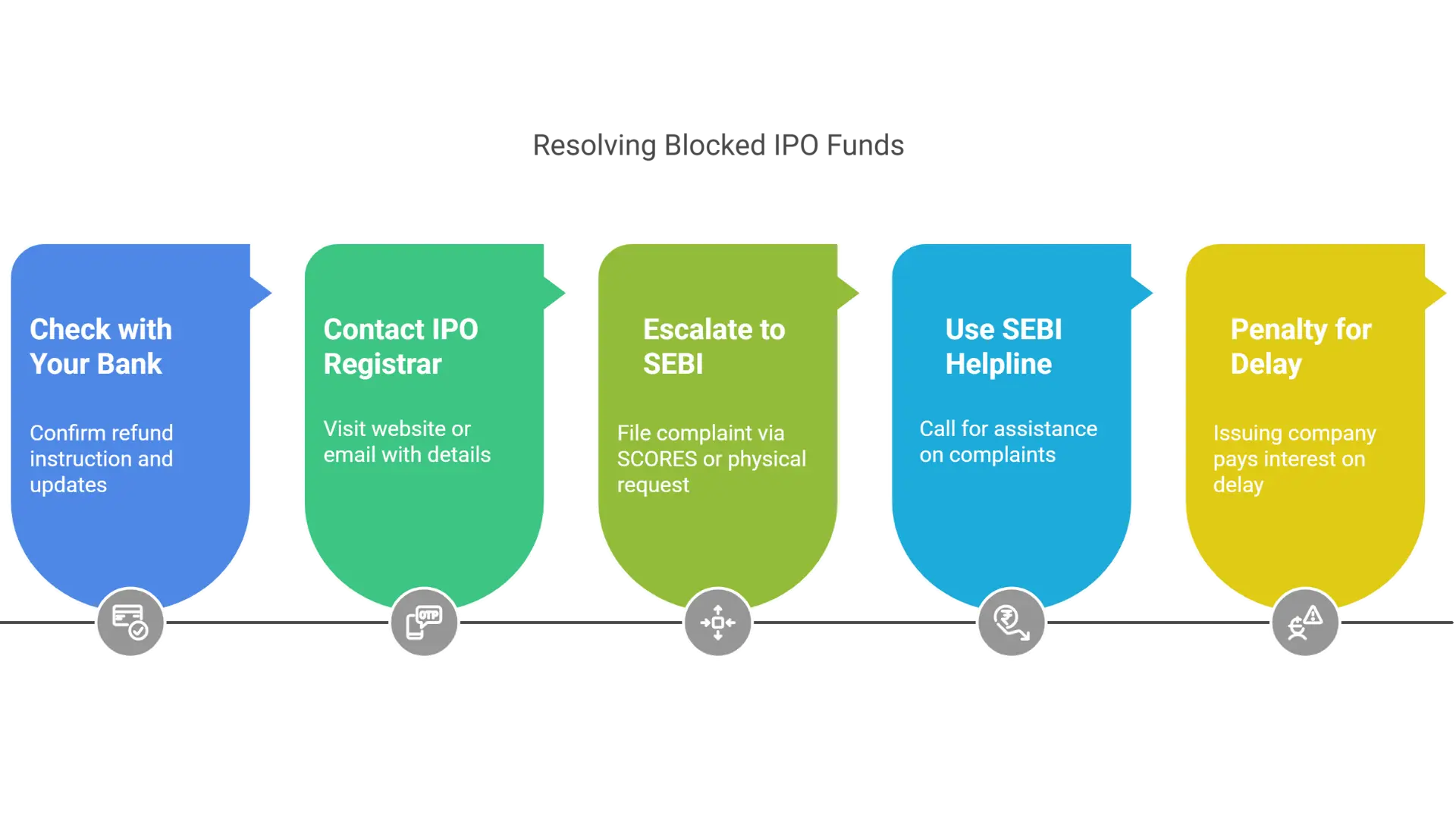

IPO Funds Not Unblocked?

Sometimes, despite following the timeline, funds remain blocked or no credit is received. If that happens:

Step-by-step solution:

Check with Your Bank First

- Confirm if the refund instruction was received.

- Check SMS/email for any updates from the bank.

Contact the IPO Registrar

- Visit their website or customer service portal.

- Send an email with your application details (PAN, DP ID, Application Number).

Escalate to SEBI

- If the registrar doesn't resolve the issue, reach out to SEBI.

- Visit the SCORES website to file a complaint or send a physical request.

SEBI Helpline

- Toll-Free Numbers: 1800 266 7575 / 1800 22 7575

- Get assistance on complaints, IPO refund status, or other investor queries.

Penalty for Delay in Refund

If the refund is delayed beyond the prescribed period, the issuing company may be liable to pay 15% interest per annum on the refund amount.

IPO Fund Unblocking: Common Terms You Should Know

Understanding these key terms can make the refund process much clearer:

NACH (National Automated Clearing House)

A platform developed by NPCI for high-volume interbank transactions such as refunds and salary credits. It improves upon older ECS systems.

NEFT (National Electronic Fund Transfer)

A widely used mode for low-value electronic bank transfers. Suitable for refunds to non-ASBA applicants.

RTGS (Real-Time Gross Settlement)

Used for high-value immediate fund transfers. Minimum transaction size is ₹2 lakhs.

Direct Credit

Funds are credited directly to the investor’s bank account via the Automated Clearing House.

ASBA

A method where IPO funds are blocked in the investor’s bank account instead of being transferred upfront.

QIB Route

A route in which Qualified Institutional Buyers must receive at least 75% of the IPO allocation. Often used when the company doesn’t meet standard profitability norms.

Conclusion

Final Thoughts: Stay Informed and Vigilant

Understanding the IPO refund and fund unblocking process is essential for any investor participating in public offers. Delays are uncommon, but they do happen. Knowing your rights and the timeline helps you stay proactive and secure your funds without stress.

If you’ve applied for an IPO and your money hasn't been unblocked or refunded, don’t panic—take the steps mentioned in this guide. And always monitor the official registrar updates and SEBI announcements related to the IPO.